- The Opening Print

- Posts

- Uncertainty Abounds

Uncertainty Abounds

Follow @MrTopStep on Twitter and please share if you find our work valuable!

FREE Two-Week Offer for the Opening Print Premium. Open up the Lean and other premium features for the next Two Weeks!

Our View

The Crowd Gets Fooled Again: How the Media Slants the Picture

It’s not surprising that chipmakers and data storage companies led the broader market higher yesterday. It was mid-to-late November when all the AI bubble talk started. In early November, Bulletin of the Atomic Scientists warned of the economic aftermath if the AI boom crashes. Then, on November 9th and 10th, Oaktree Capital and The Atlantic published stories questioning whether we’re in a bubble and raising concerns about ominous, interconnected financing risks.

On November 12th, Reuters ran a story titled "Market drop tied directly to reignited AI bubble fears” and on November 15th and 17th, MIT Technology Review and Harvard Gazette published deep dives like "What even is the AI bubble?". This was followed on November 18th when Google’s CEO highlighted “elements of irrationality” in the trillion-dollar AI investment boom. On November 19th, The American Prospect claimed, "The AI Bubble Is Bigger Than You Think."

The dive actually started on 10/29 and 10/30 and ended on 11/21 when the ES made its low at 6593.00. From the 12/18 low at 6771.50 to yesterday’s high at 6963.50, the ES has rallied 192 points. Yes, there have been other sell-offs — like the 4-day decline from 12/12 to 12/27 and another 4-day decline from 12/26 to 12/31 — but the NQ has since rallied 370.50 points.

I admit that there was no AI bubble. Part of the reason is that, unlike the 2000 tech bubble, today’s top tech/AI companies have enormous balance sheets. The other reason is that the current bull market is in its fourth year and remains relatively young by historical standards, having surged by over 90% since its inception on October 12, 2022. It is currently tracking along the historical average duration of approximately 1,000 days.

I can’t predict the future, nor can I rule out some big declines in 2026 — but the bottom line is, if you bought and held, you'd be in a much better position.

Breaking

Over the past several hours, dozens of U.S. Air Force aerial refueling tankers and heavy military transport aircraft, C-5 and C-17 types, have departed from the United States and from an American airbase in the United Kingdom, heading toward the Middle East. According to various sources, the United States is preparing strikes against Iran, and the ongoing movement reflects the transfer of forces to the region.

Our View

In addition to Friday’s jobs report, the second week of options expiration, and the breaking headline above, the United States Supreme Court is also expected to rule on a case about the legality of President Donald Trump’s tariffs. At risk are refunds of over $133.5 billion.

IEEPA-Based Tariffs

Country/Cat | Fiscal 2026 | Fiscal 2025 | Total Since Feb 2025 |

|---|---|---|---|

China and Hong Kong (fentanyl) | $7.74 | $30.13 | $37.87 |

Mexico (fentanyl) | $0.92 | $5.56 | $6.48 |

Canada (fentanyl) | $0.47 | $1.95 | $2.42 |

'Reciprocal' (all countries, all goods) | $27.38 | $54.36 | $81.74 |

Brazil (punitive) | $0.61 | $0.36 | $0.97 |

India (punitive) | $1.58 | $0.41 | $1.99 |

Japan (post-trade deal tariffs) | $1.66 | $0.37 | $2.03 |

TOTAL | $40.36 | $93.14 | $133.50 |

As I said above, I can’t predict the future — but this court ruling could rock the markets, and the headline above isn’t great news either.

Our Lean — Danny’s Trade (Premium only)

Market Recap

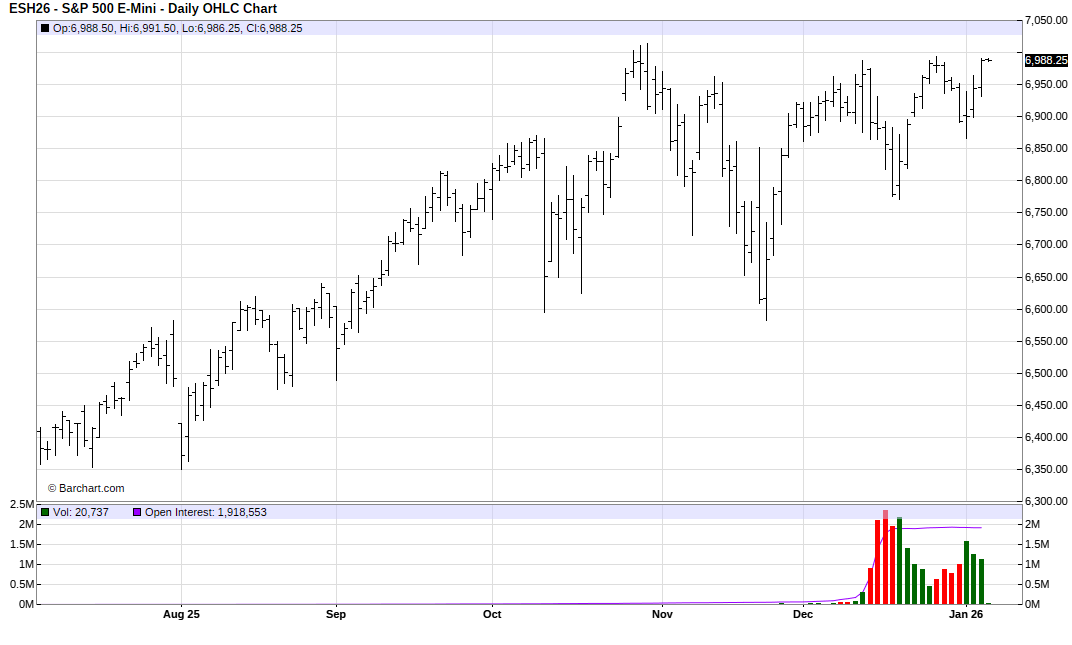

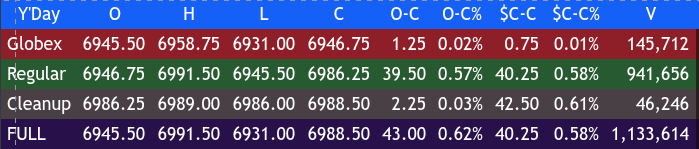

The ES traded down to 6931.00 on Globex and opened Tuesday's regular session at 6946.75, unchanged on the day. After the open, the ES traded 6945.25 at 9:40, then rallied up to 6977.25. It pulled back to 6950.25 at 11:05, rallied to a lower high at 6962.75 at 11:20, then pulled back again to a higher low at 6953.50 at 11:40.

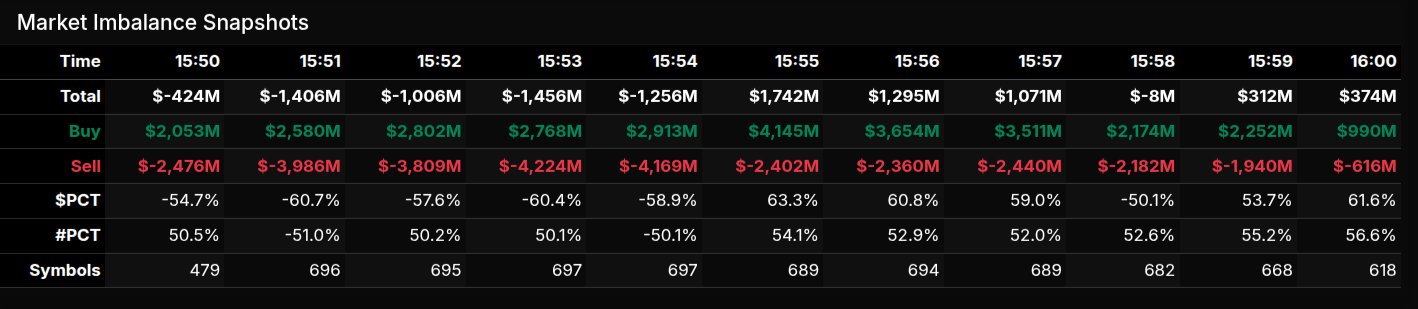

From there, the ES rallied to a new high at 6979.00 at 12:35, dipped to 6973.50 at 1:05, then pushed to a new high at 6990.00 at 3:20. It pulled back to 6987.25 at 3:30, traded back up to 6991.25 at 3:40, and traded 6988.75 as the 3:50 cash imbalance showed -, It then traded 6991.75 and 6986.25 into the 4:00 cash close.

After 4:00, the ES flatlined and settled at 6988.50, up 44.75 points or +0.64%. The NQ settled at 25,831.25, up 253 points or +0.99%. The YM made another new all-time high at 49,762.00 and settled at 49,748.00, up 520 points or +1.06%, and is on its way to YM 50,000.

In the end, the markets powered higher like I thought they would. In terms of the ES and NQ's overall tone, they were firm all day. As for the ES's overall trade, volume was low at 1.134 million contracts traded.

On Tap

8:30 am: ADP Employment

10:00 am: ISM Services Index and Factory Orders

4:10 pm: Fed Vice Chair for Supervision Michelle Bowman speaks

Guest Posts

MiM

MOC Recap

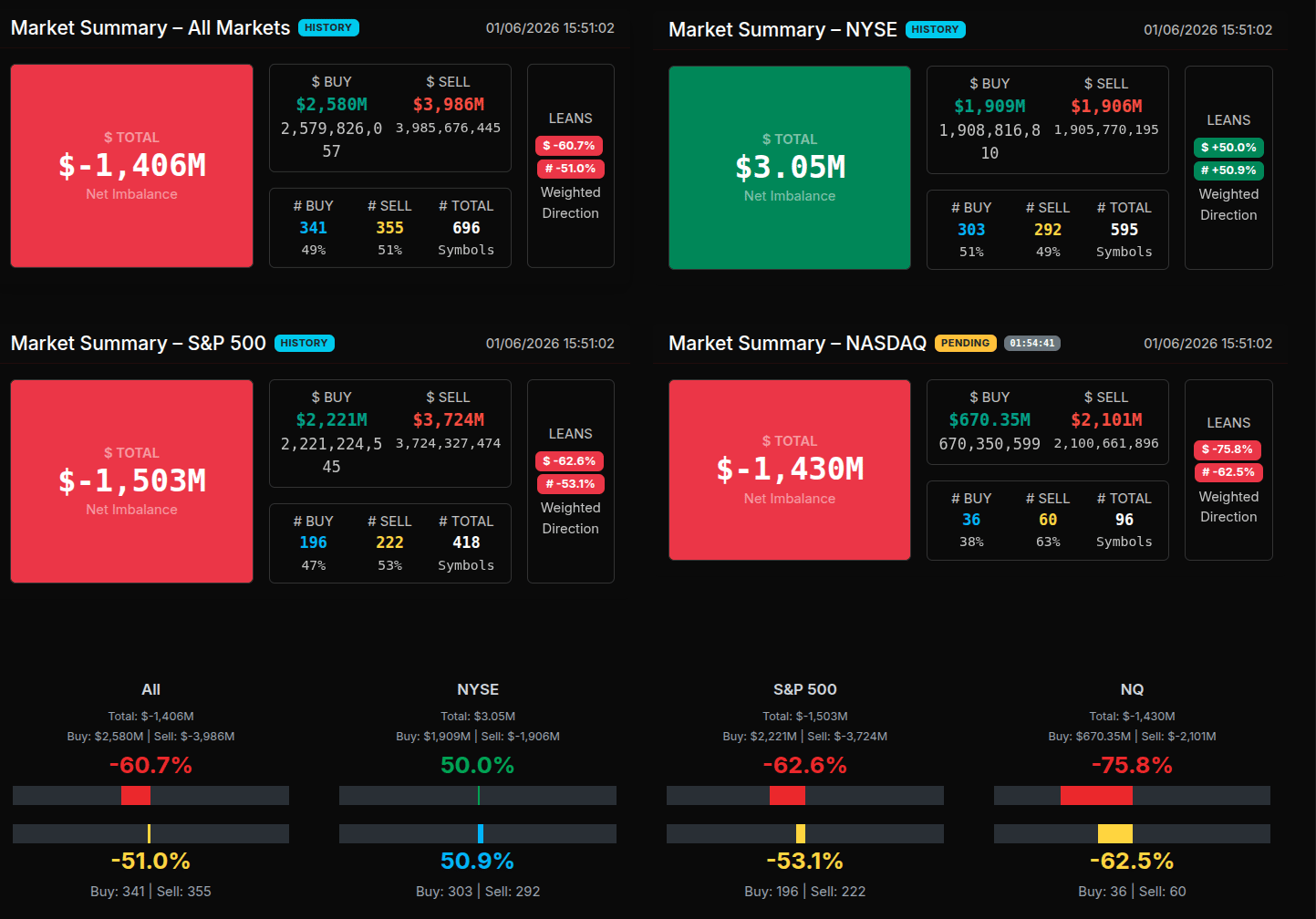

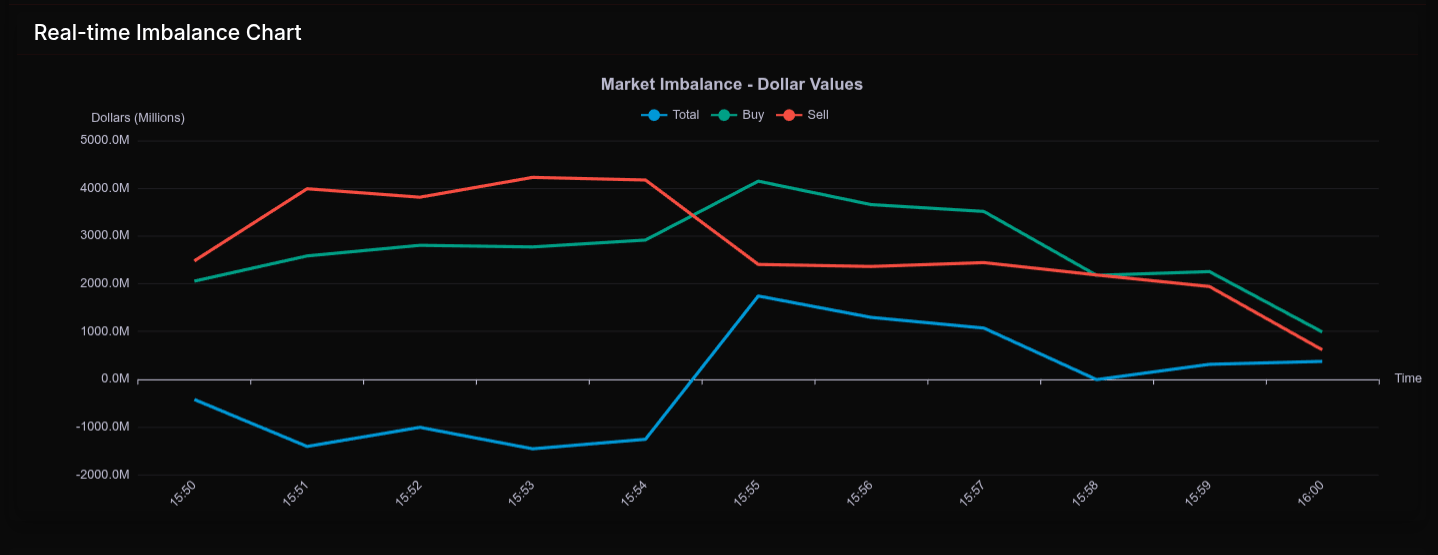

The market-on-close auction opened with a clear sell-side bias and stayed pressured through much of the 3:50–3:54 window before flipping sharply into buy dominance at 3:55. Early prints showed total imbalances widening from roughly -$424M at 3:50 to as much as -$1.45B by 3:53, with sell dollars consistently outweighing buys and percentage leans holding near -60%, signaling broad-based liquidation rather than simple rotation.

That tone shifted decisively at 3:55. Buy imbalances surged above $4.1B while sell pressure collapsed toward -$2.4B, flipping the net to +$1.74B and pushing percentage leans above +63%. This late reversal carried through 3:56 and 3:57, though the magnitude steadily faded into the close, finishing with a modest +$374M net imbalance at 4:00.

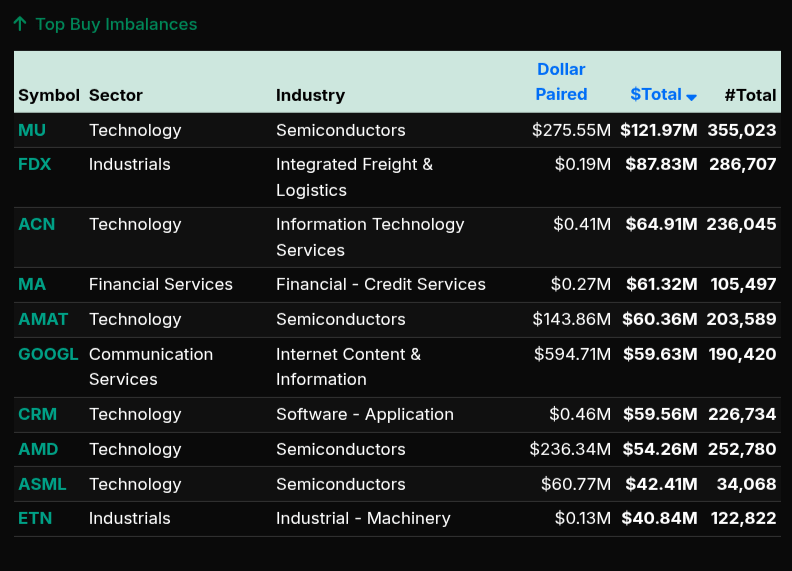

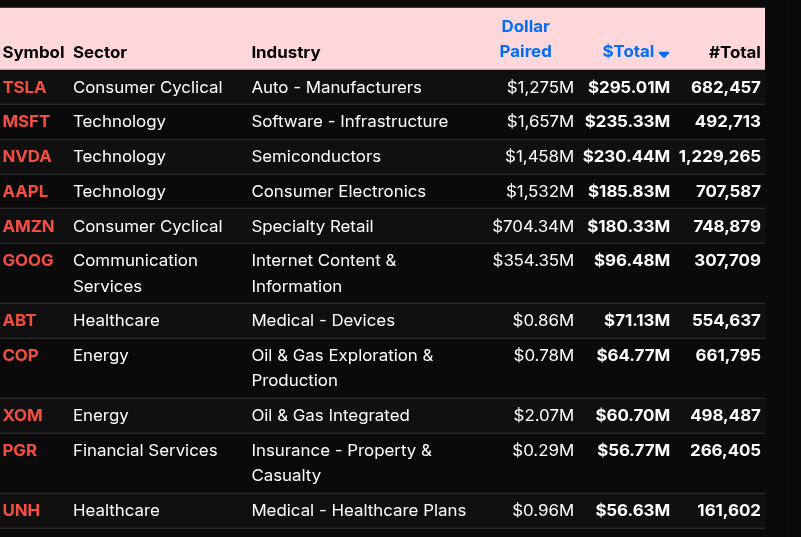

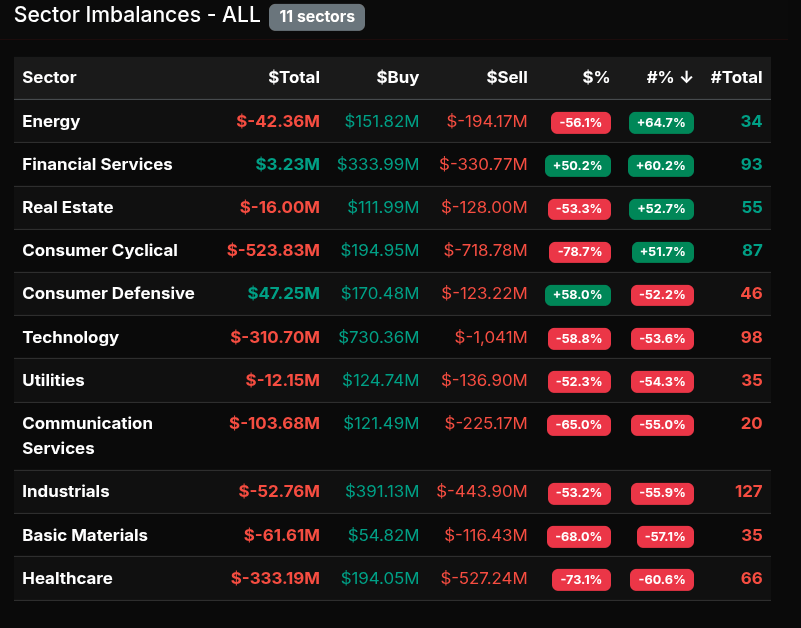

Sector data reinforces the early liquidation narrative. Consumer Cyclical (-78.7%), Healthcare (-73.1%), Basic Materials (-68.0%), Communication Services (-65.0%), and Technology (-58.8%) all registered strong sell leans. These readings, many well beyond the -66% threshold, point to wholesale selling rather than internal sector reshuffling. Industrials and Real Estate also leaned decisively lower, keeping pressure broad. Financial Services stood out as one of the few areas with a positive tilt, finishing +50.2%, while Consumer Defensive posted a +58.0% lean, reflecting late defensive demand.

On the single-name level, activity was concentrated in megacap leadership. TSLA, MSFT, NVDA, AAPL, and AMZN dominated dollar flow, underscoring that large-cap liquidity was the primary driver of the auction. Despite the heavy sector-level selling, top buy imbalances clustered in Technology and Industrials late, with MU, AMAT, AMD, and ASML highlighting targeted dip-buying in semiconductors rather than a full-sector reversal.

Index summaries capture the split tape. NYSE closed with a small positive net and a +50% lean, while the S&P 500 (-62.6%) and Nasdaq (-75.8%) finished with pronounced sell-side pressure. Overall, the session evolved from a broad sell imbalance into a late buy program, but the dominance of negative sector leans suggests the close was more about offsetting exposure than a clean risk-on rotation.

Technical Edge

Fair Values for January 7, 2026:

SP: 41.29

NQ: 177.61

Dow: 239.46

Daily Market Recap 📊

For Tuesday, January 6, 2026

• NYSE Breadth: 69% Upside Volume

• Nasdaq Breadth: 59% Upside Volume

• Total Breadth: 60% Upside Volume

• NYSE Advance/Decline: 65% Advance

• Nasdaq Advance/Decline: 62% Advance

• Total Advance/Decline: 63% Advance

• NYSE New Highs/New Lows: 227 / 39

• Nasdaq New Highs/New Lows: 379 / 53

• NYSE TRIN: 0.82

• Nasdaq TRIN: 1.09

Weekly Market 📈

For the week ending Friday, January 2, 2026

• NYSE Breadth: 47% Upside Volume

• Nasdaq Breadth: 52% Upside Volume

• Total Breadth: 50% Upside Volume

• NYSE Advance/Decline: 43% Advance

• Nasdaq Advance/Decline: 38% Advance

• Total Advance/Decline: 40% Advance

• NYSE New Highs/New Lows: 136 / 86

• Nasdaq New Highs/New Lows: 225 / 521

• NYSE TRIN: 0.84

• Nasdaq TRIN: 0.56

ES & NQ Futures trading levels (Premium only)

Calendars

Economic

Today

Important Upcoming / Recent

Earnings - SP500

Upcoming

Recent

NONE

Trading Room Summaries

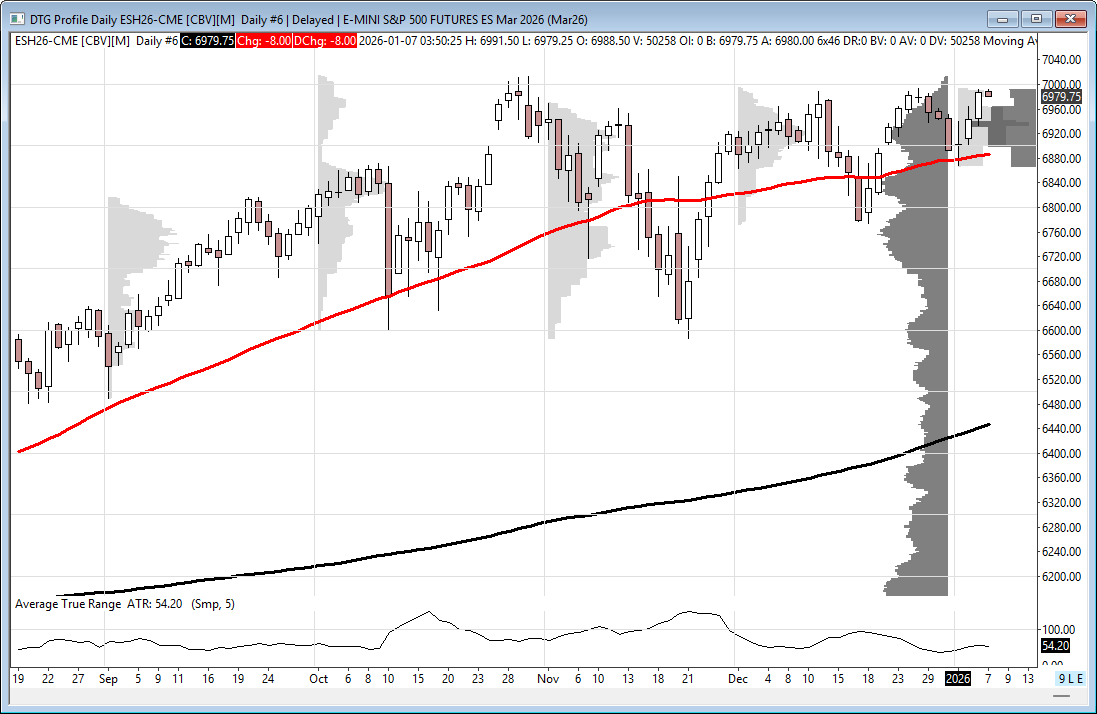

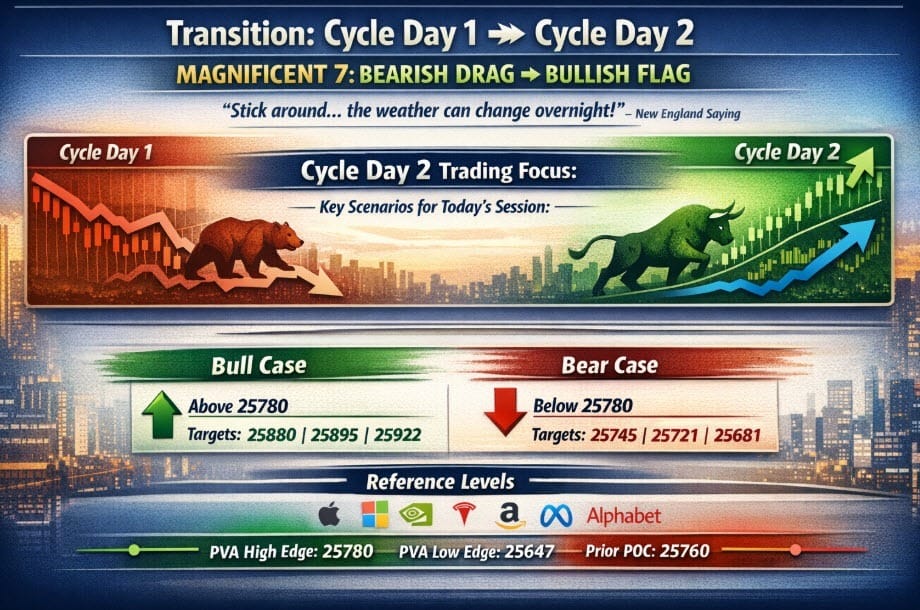

Polaris Trading Group Summary - Tuesday, January 6, 2026

Tuesday’s trading session in the PTG room, led by David Dube (PTGDavid), unfolded as a strong Cycle Day 1 rally, with several key targets from the Daily Trade Strategy (DTS) fulfilled early and continued momentum carrying through the afternoon. The room saw solid engagement, focused trade execution, and clear alignment with the pre-market game plan.

Market Action & Trade Highlights

Morning Session:

The market opened strong, and both ES and NQ met early target zones:

The ES upper target zone of 6960–6965 was fulfilled shortly after the open.

The NQ also hit its initial target at 25655.

These early moves confirmed the strength of the DTS briefing, which had laid out these levels in advance.

A Crude Oil (CL) Opening Range (OR) trade was also noted by members as a particularly nice setup, contributing to the early session’s positive tone.

PTGDavid shared updated charts and screenshots for CL, NQ, and ES DLMB levels to guide intraday positioning.

Midday & Technical Issues:

There were some technical audio issues due to overlap with the PIT room, but these were quickly addressed by David and Marlin.

Members confirmed that streaming and audio improved after adjustments.

Chat also included discussion of key levels and strategic resets, with some traders, like John B, waiting for a deeper pullback and ATR alignment before re-entering long.

Afternoon Session:

David returned for the "2 PM Shake n Bake", and the bulls maintained strong control.

Around 2:13 PM, the Upper Money Box Target at 6988 was tagged on the ES—another predefined level achieved, reflecting excellent follow-through on the day's directional bias.

The day ended with a report of a $1.4 billion MOC sell imbalance, but it had limited impact on the strong bullish momentum into the close.

PTGDavid confirmed it was a “solid continuation rally”, closing out a high-quality session.

Lessons & Takeaways

Pre-market planning worked: The DTS briefing effectively identified actionable levels, and the room stayed in sync with the directional bias.

Discipline paid off: Traders who waited for confirmed pullbacks and ATR alignment (as emphasized by David and others) were able to reset with confidence.

CL and NQ setups were strong: The CL Opening Range and NQ DLMB trades were standouts.

Team communication helped quickly resolve tech issues, and the group remained focused and cohesive.

Key Wins

ES and NQ early targets fulfilled

CL Opening Range trade highlighted as a success

Upper Money Box Target 6988 on ES tagged

Strong Cycle Day 1 rally played according to plan

Summary: Tuesday was a textbook example of PTG’s strategy in action—well-defined levels, early target fulfillment, and disciplined trend participation. Members stayed engaged and aligned, making the most of a clearly bullish Cycle Day 1.

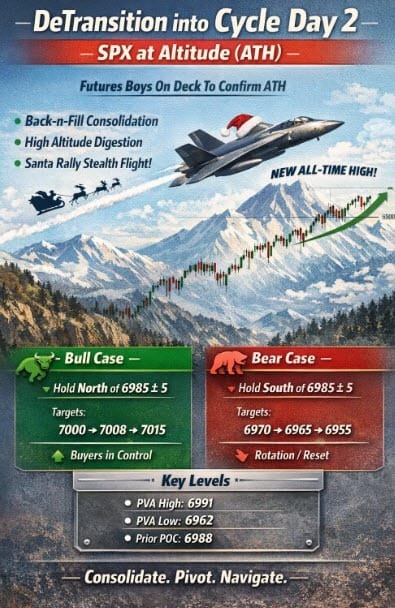

Discovery Trading Group Room Preview – Wednesday, January 7, 2026

Equity Markets & Macro

• U.S. stocks continue pushing higher, with the S&P 500 near new record territory (~7000) as traders shrug off geopolitical tension and await key labor market data this morning.

• Overnight futures are steady ahead of ADP Employment, ISM Services PMI, and JOLTS Job Openings, all seen as precursors to Friday’s December jobs report and potential signs of labor market cooling that could influence future Fed rate cuts.Economic Data

• S&P Global Services PMI slowed to its weakest in eight months, indicating softer service sector activity.

• Market focus this morning: ADP Nonfarm Payrolls, ISM Services, JOLTS, plus delayed Factory Orders and weekly Crude Inventories.

• Expected volatility could rise depending on today’s data outcomes.Geopolitical / Energy

• President Trump announced that Venezuela will relinquish 30–50 million barrels of sanctioned, high‑quality oil, directing proceeds (up to ~$2.8B) to benefit both the U.S. and Venezuela—an effort seen as increasing U.S. influence over Venezuelan production.

– The move pressured WTI crude prices lower (~−2.4%), with U.S. Gulf Coast refineries able to process Venezuelan heavy/sour crude.

• Separate reports indicate the administration is urging Venezuela to prioritize U.S. partnerships and reduce ties with China, Russia, Iran, and Cuba.

• Japan–China tensions escalated, with Japan imposing new export bans on strategic technologies, further stressing the geopolitical backdrop.Corporate Earnings

• Just Reported: Constellation Brands (STZ), Jefferies (JEF).

• Today After Close: Acuity (AYI), RPM International (RPM), TD SYNNEX (SNX).Volatility & Positioning

• Intraday volatility is moderating, but traders remain alert: ES 5‑day ATR ~55 points.

• Whale bias into the ADP print is short, on lighter overnight volume.Technical Levels (ES)

• Uptrend channel support: 6863/68s

• Channel resistance: 7117/22s

• 50‑day MA: 6886

• Potential resistances: 7117/22s, 7542/47s

• Potential supports: 6863/68s, 6581/76s, 6295/90s