- The Opening Print

- Posts

- The Tale of Two Cities, S&P 500 U-Turn

The Tale of Two Cities, S&P 500 U-Turn

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

I do my very best not to change the “lean”. If I call it right, it sets the tone for my trading for the day. As we all know, I like trading the gaps, but Friday's gap sharply lower gave the ES its high on the open, and yesterday’s big gap-up-and-go was not what I was looking for. I knew the risks going into it. I started writing about end-of-July weakness and warned about July month-end and early August weakness the week before the declines.

Most of last week’s weakness started on Monday when the ES closed down -0.04%, then fell -0.26% on Tuesday, -0.37% on Wednesday, -0.34% on Thursday, and down -1.69% Friday — or down -2.66% on the week. It was a pretty negative week and down hard on Friday, but ended with $2.6 billion to buy.

The last time the S&P closed down several days in a row was April 12–17, 2024, as part of the five-day losing streak ending April 18, 2024, which lost 2.8% and then rallied 3.85% over the next five sessions. The point being — after a five-day sell-off, the ES rallied 3.85% over the next five sessions.

After falling 1.8% on Friday, August, the S&P rallied 1.5% after losing 1.69% on August 1. The NQ closed down 2.06%, then gained 2%, and another $2.445 billion to buy on yesterday’s close.

It really looked like there was going to be more of a pullback, but a bleak economic background got energized by hopes the Fed will cut rates this year, as traders continue to deal with Trump's ever-shifting headlines. Traders are also pressing through Q2 earnings season. So far, the S&P has reported about two-thirds of its 500 companies. According to FactSet, over 80% reported better-than-expected earnings per share, including some of the tech heavyweights: META, GOOG, and MSFT.

In the end, it’s been a tale of two cities — a big down day Friday and almost a full recovery yesterday. I wasn’t looking for it, but even the PitBull said the charts are “nuts.” In terms of the ES and NQ’s overall tone, the move back up with little to no pullbacks was stunning. In terms of the ES’s overall trade, volume was almost 700k contracts, low compared to Friday’s volume of 1.29 million contracts traded.

On Tap

This morning, we have two economic reports: the U.S. trade deficit at 8:30 ET and the S&P PMI at 9:45.

Pfizer (PFE) will release its Q2 2025 earnings before the market opens today. Caterpillar (CAT) is set to announce its Q2 2025 financial results at 6:30 a.m. EDT. Duke Energy (DUK) will post its Q2 2025 financial results at 7:00 a.m. EDT. Eaton Corporation (ETN) will announce its Q2 2025 earnings before the opening of the New York Stock Exchange. Finally, Advanced Micro Devices (AMD) will report its Q2 2025 earnings after the market closes today.

MiM and Daily Recap

ES Futures Recap for August 4, 2025

Intraday Recap

The overnight Globex session saw a steady climb into early Monday, beginning with an initial high of 6290.25 at 23:40 before dipping to a higher low of 6279.75 at 00:20. A modest bounce followed, pushing ES to 6293.00 at 02:00, but a selloff into 02:30 dropped the market to a lower low of 6279.25. From there, bulls regained control with a strong push to 6310.00 by 05:40, marking the Globex high. However, the session retraced into the 07:00 hour with a dip to 6294.50 ahead of the cash open.

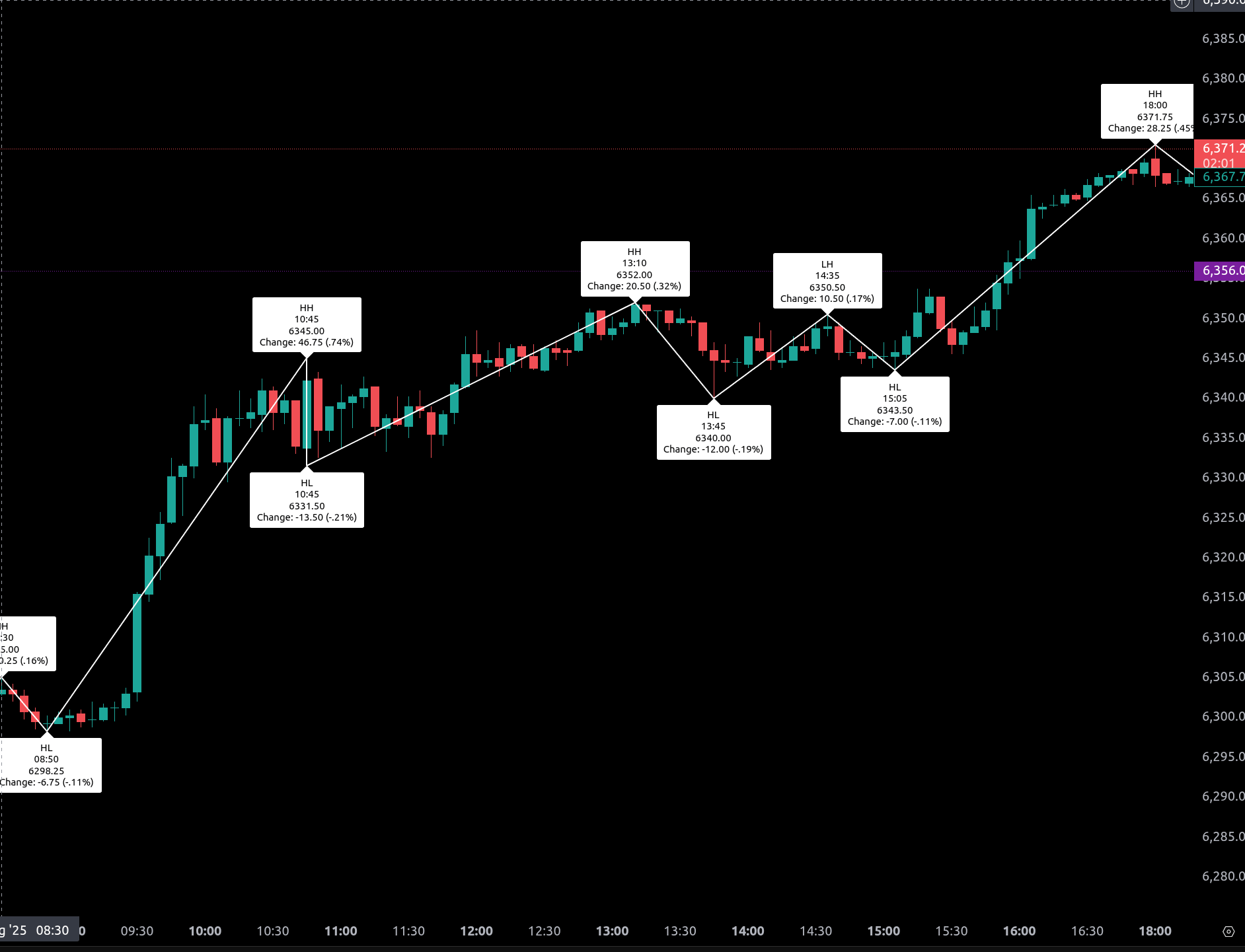

The regular session opened at 6303.25 and immediately began a strong morning rally that lifted ES to 6345.00 by 10:45, a 46.75-point move off the low. A pullback to 6331.50 followed before bulls resumed control into the midday stretch, lifting the market to 6352.00 at 13:10. After a minor retracement to 6340.00 at 13:45, price advanced again to 6350.50 at 14:35 before briefly dipping to 6343.50 at 15:05.

The final afternoon leg saw a strong late-session push to 6357 by 16:00, the cash session high and close. The regular session ended at 6357.00, up 53.75 points or +0.85% from the open, while the full session gained 112.50 points (+1.80%) from the prior close, settling at 6369.50 by 17:00.

From the prior day’s close of 6257.00, ES gained 46.00 points during Globex, and another 53.75 during the regular session, with a final cleanup-session lift of 12.25 points into the 17:00 close. Volume was solid, with 1.23 million contracts traded across all sessions.

Market Tone & Notable Factors

Monday’s tone was bullish throughout, driven by early Globex strength, steady intraday higher lows, and a closing drive that extended gains into the end of the session. The cash market notably respected early support at 6298.25, which helped fuel a confidence-driven advance.

MOC (Market-On-Close) imbalance data showed a $2.445B net buy, with the dollar imbalance skewing 69.7% to the buy side. While the symbol imbalance finished at 55.0% and didn’t breach the 66% threshold, the $ value clearly indicated strong institutional interest into the bell. That supported the closing rally from 15:05 into 16:00.

The session ended on a strong note with price closing near the highs, suggesting bullish momentum may carry into Tuesday’s trade, barring any overnight macro surprises.

Technical Edge

Fair Values for August 5, 2025:

SP: 26.94

NQ: 116.38

Dow: 119.68

Daily Market Recap 📊

For Monday, August 4, 2025

NYSE Breadth: 80% Upside Volume

Nasdaq Breadth: 79% Upside Volume

Total Breadth: 79% Upside Volume

NYSE Advance/Decline: 81% Advance

Nasdaq Advance/Decline: 75% Advance

Total Advance/Decline: 78% Advance

NYSE New Highs/New Lows: 73 / 33

Nasdaq New Highs/New Lows: 115 / 95

NYSE TRIN: 1.04

Nasdaq TRIN: 0.80

Weekly Breadth Data 📈

For Week Ending Friday, August 1, 2025

NYSE Breadth: 32% Upside Volume

Nasdaq Breadth: 37% Upside Volume

Total Breadth: 35% Upside Volume

NYSE Advance/Decline: 31% Advance

Nasdaq Advance/Decline: 22% Advance

Total Advance/Decline: 25% Advance

NYSE New Highs/New Lows: 217 / 133

Nasdaq New Highs/New Lows: 438 / 322

NYSE TRIN: 0.95

Nasdaq TRIN: 0.46

I’ll keep the format consistent from here on. Let me know when you're ready for tomorrow’s data.

Ask ChatGPT

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, August 4, 2025

General Theme:

Strong bullish bias from the open, driven by overnight buying and confirmed by price action throughout the day. The session provided clear setups early, and the market fulfilled key statistical targets into the close, aligning well with the PTG playbook.

Market Structure and Strategy

Early lean favored long setups, with Globex buyers holding strong.

PTGDavid called out an Open Range Breakout Long in ES and NQ, which played out effectively.

Buyers consistently bought dips, supporting the trend throughout the session.

Price action was in alignment with bullish expectations and 3-Day Cycle behavior.

Key Trade Setups and Executions

The Open Range Breakout strategy was the primary structured opportunity and executed well.

Later in the day, PTGDavid identified the 30-handle area as a potential dip-buy zone, reinforcing the continuation bias.

Afternoon focus shifted to reclaiming the CD1 low, a statistical setup with over 91% historical fulfillment.

Both NQ and ES fulfilled the CD1 reclaim targets, with ES achieving it just before the close.

A strong Market-On-Close (MOC) Buy Imbalance ($2.3B) supported the final push.

Lessons and Discussions

Emphasis on "Staying Aligned" with market direction to avoid unnecessary losses.

Manny highlighted the importance of mental discipline—specifically, resisting the urge to countertrade after missing a move.

Room members discussed automation and how programmed trades often exhibit cleaner, more disciplined behavior than discretionary ones.

PTGDavid and others stressed the principle of “less is more” and the value of one good trade over frequent participation.

Statistical Context and Closing Action

PTGDavid tracked the 3-Day Cycle reclaim closely, using historical stats to guide decision-making.

NQ completed its reclaim in the afternoon; ES followed with a strong late-session rally.

The CD1 reclaim confirmed the statistical edge and validated the bullish game plan.

Market closed strong, aligned with expectations and closing imbalances.

Takeaway

The session rewarded alignment with the trend, patience, and execution of well-defined setups.

Mental discipline and statistical awareness were key factors in navigating the day successfully.

Discovery Trading Group Room Preview – Tuesday, August 5, 2025

Morning Market Summary – August 5, 2025

Market Focus: Corporate earnings remain the key driver.

Earnings Highlight: Palantir (PLTR) jumped after hours, topping $1B in quarterly revenue and beating expectations.

Monday Recap: Stocks rebounded from Friday’s drop, which was triggered by:

Weak jobs report

New tariffs

Inflation signals

Firing of the BLS commissioner

Geopolitical Tensions:

Trump threatens India with steep tariffs over Russian oil purchases.

China pushed back on similar U.S. pressure—labeling oil demands a roadblock in trade talks.

Tariffs on Canada raised to 35%; other nations face 10–40% rates.

Mexico granted a 90-day tariff reprieve.

Exemptions: Goods en route before Thursday, aid items (food, clothing, medicine).

New 40% tariffs on transshipped goods.

Earnings (Premarket): ADM, BP, CAT, MPC, PFE, DUK, YUM, ZTS, and more.

Earnings (After Hours): AMD, RIVN, AMGN, SMCI, SNAP, TOST, SU, MOS.

Economic Calendar:

8:30 AM ET – Trade Balance

9:45 AM ET – S&P Global Services PMI

10:00 AM ET – ISM Services PMI

Volatility: Elevated. ES 5-day average daily range at 95.75 points.

ES Levels:

Resistance: 6527/32, 6566/71

Support: 6266/71, 6198/03, 5733/38

Whale Bias: None — overnight volume mixed.