- The Opening Print

- Posts

- The S&P 500 Train Keeps A Rollin

The S&P 500 Train Keeps A Rollin

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

What's the old song? Train Keeps A-Rollin' All Night Long? Well, despite a laundry list of economic problems, the government shutdown, skyrocketing geopolitical risk, and tariff problems, the S&P and Nasdaq keep going higher.

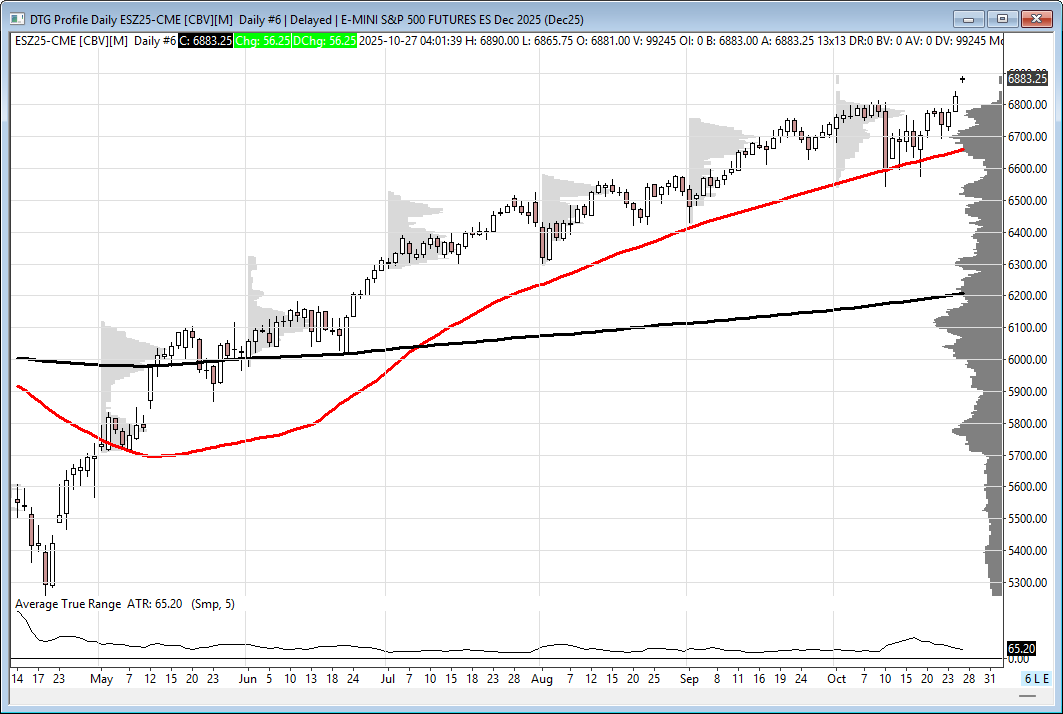

The active front-month ESZ25:CME S&P future made an April 7 tariff low at 4932.00 and traded up to 6990.00 on Globex Sunday night — a 2,058-point or +41.73% move from its low. The (NQZ25:CME) Nasdaq future made its low on April 7 at 16,873.00, and Sunday night's Globex high at 27,768.25 marking a rally of 10,895.25 or 64.60%. The Dow futures (YMZ25) made a low on April 7 at 37,351.00 and traded up to 47,775 on Globex, rallying 10,424 points for a gain of 27.91%.

At 7:25 ET Friday morning, the ES made a Globex high at 6798.75 and was trading around the 6794 area when the 8:30 ET CPI number was released. The ES ripped through the stops I talked about in the LEAN, through the 6812.25 contract high, and traded up to 6835.25.

It pulled back to 6810.00, made a series of higher lows that pushed the ES up to 6835.75 at 10:06, made two higher lows at 6817.50 and 6815.50 at 10:55, traded up to 6841.25 going into 11:30, pulled back to a 6828.50 double bottom at 12:45, rallied up to 6841.00 at 1:48, back-and-filled for the next forty-five minutes, traded 6833.50, and traded back up to 6841.00 at 3:12.

The ES traded 6840.75 at 3:25, sold off down to 6831.00 at 3:48, traded 6833.15 as the 3:50 cash imbalance showed $1.9B to sell and traded 6827.25 on the 4:00 cash close. The ES settled at 6827.00, up 52 points or +0.77%, or up 90 points in the last two sessions.

The NQ settled at 25,209.25, up 255.25 points or +1.01% on the day or up 470 points. The YM traded up to 47,500 the first time on Friday, closing up 2.5% for the week. The ES and NQ composite logged their second straight weekly gains, with the S&P 500 up 16%, and the NQ up 20.68% YTD.

In terms of the ES's overall tone, it's been follow the leader the last two days — the NQ. In terms of the ES's overall trade, volume was lower at 1.2 million contracts traded.

On Tap for the Final Week of October

10/27 Monday

Start of APEC Economic Leaders Week 2025 in South Korea

10/28 Tuesday

96th Anniversary of the 1929 CRASH (-23% Oct 28 & 29)

Day 1 Fed Two-Day Meeting

10/29 Wednesday

2:00 — Day 2 FOMC Interest Rate Decision

2:30 — Fed Chair Powell press conference

4:00 — After the Bell: MSFT, GOOGL, META

Trump/Xi meeting will take place late Wednesday evening

10/30 Thursday

9:55 — Fed Vice Chair for Supervision Michelle Bowman speaks

4:00 — After the Bell: AAPL and AMZN

10/31 Friday

Halloween and the last trading day of October

9:30 — Dallas Fed President Lorie Logan welcoming remarks

12:00 — Cleveland Fed President Hammack and Atlanta Fed President Bostic speak

Our View

While there is going to be an uptick in geopolitics this week, there are also some big-weight names reporting earnings on Wednesday and Thursday: MSFT, GOOGL, META (Wednesday), AAPL, and AMZN (Thursday), representing 25% of the S&P 500's weighting.

When you throw in the new all-time highs and the headline exposure, this could end up being another volatile week.

The only thing I have to say is that the on-again, off-again Trump/Xi meeting doesn't mean they are going to kiss or hold hands. China does not want to supply rare earth to its largest competitor and military enemy. I know U.S. Treasury Secretary Scott Bessent and his Chinese counterpart have held multiple rounds of talks to establish a framework for the leaders' discussion, but I don't think there will be any win-win deal.

Below are two posts from X. The first post from @PeterMallouk shows what happens when you don't sell into declines. The other, from @KobeissiLetter, shows how much the "Spooky Month of October's" monthly gain was.

The only thing I can say — DON’T FIGHT THE FED!!!!

@PeterMallouk · Oct 13

The S&P 500 has returned an average of 11% per year since 1950 and has done so despite an average intra-year drawdown of 14%, and often drawdowns that are much worse. The lesson? Volatility doesn’t equal a permanent financial loss unless you sell.

@KobeissiLetter · 3h

Just alone, the S&P 500 has now added +$3 TRILLION since its October 10th low after President Trump's 100% China tariff was announced. This is the most profitable market of all time.

MiM and Daily Recap

Intraday Recap

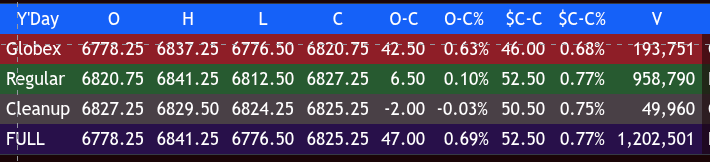

The ESZ25 futures traded modestly higher in Friday's session, extending the multi-month rally despite a heavy sell imbalance at the close. The full session closed at 6825.25, up 47.00 points or +0.69% on the day, marking a $C–C gain of +52.50 points or +0.77% from the prior close.

Overnight Globex trade began with a steady climb off the Friday open. The ES pushed to an early high of 6787.00 at 22:10 before retracing modestly to 6781.75 by 22:40. Renewed buying lifted the futures to a higher high at 6798.25 at 02:20, followed by a small dip to 6789 at 03:20 and then a lower low at 6784.00 around 04:10. A pre-dawn rally lifted prices through 6789.50 at 05:40 and into the session peak of 6837.25 at 08:30, a 53.25-point advance (+0.78%) from the early overnight low. The 8:30 gains were the result of an in-line expectation met on the PCI numbers. Globex volume reached 193,751 contracts with the session closing at 6820.75, up 46 points (-0.68%) from the prior settlement.

The regular session opened at 6820.75 and traded a clean zigzag through midday. The first push topped at 6835.50 at 10:05 (lower high), then backed off to 6817.25 at 10:30 (higher low). A second attempt stalled at 6833.00 at 10:40, and sellers pressed to a deeper pullback at 11:15 around 6811.50. From that base, buyers ripped to the morning high of 6841.25 by 11:20, then failed to extend on a retest into 12:20 (another lower high near 6841.25). Momentum flipped lower into a midday shakeout that tagged 6828.25 at 12:40, the intraday trough for the regular session.

From there, the tape ground higher in a steady, low-volatility crawl, but never broke out. The afternoon rally maxed at 6841.00 at 15:10 — a fractional lower high versus the 11:20 print — and then rolled. Into the closing rotation, the ES put in a lower high at 6833.00 around 15:55, then dumped quickly to a fresh late-day low near 6823.75 before bouncing to settle the regular session at 6827.25. Total day volume was 958,790 contracts.

The Cleanup session added little directional change, opening at 6827.25, peaking briefly at 6829.50, and closing flat at 6825.25 on light volume (49,960). Across all sessions, total volume reached just over 1.2 million contracts.

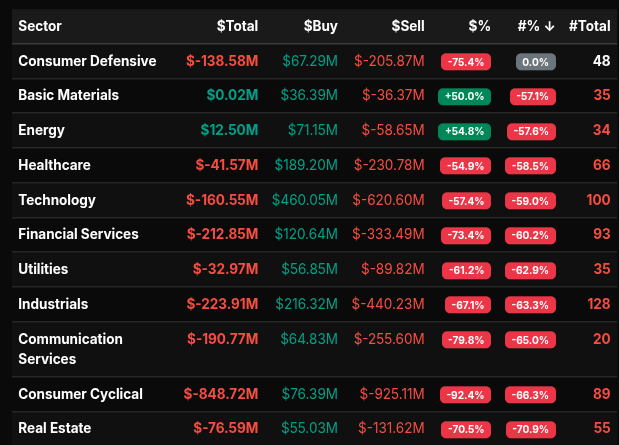

Market tone was mixed: constructive into late morning, then two-way and ultimately heavy into the close as repeated failures at 6841 capped advances. The Market-on-Close data showed a strong dollar sell imbalance at –$1.914B with weighted direction at –61.3%. The right‑meter symbol mix (39% buy / 61% sell) did not breach the ±66% “notable” threshold, but the dollars were clearly one-sided, especially in NQ (–75.6%) and S&P 500 (–72.0%). Sector flows skewed defensive: the heaviest outflows were Consumer Cyclical (–$848.7M), Industrials (–$223.9M), and Financials (–$212.8M), while Energy (+$12.5M) and Basic Materials (+$0.02M) were marginal positives.

Despite the closing sell imbalance, the ES managed to hold gains on the day. The overall tone remains cautiously bullish, with traders eyeing follow-through above 6840 for potential continuation, while 6810–6815 remains near-term support. With volatility compressing and imbalances heavy to the sell side, short-term participants appear to be rotating capital defensively ahead of key economic releases later in the week.

MIM

Technical Edge

Fair Values for October 27, 2025:

SP: 32.31

NQ: 139.65

Dow: 163.97

Daily Breadth Data 📊

For Friday, October 24, 2025

NYSE Breadth: 63% Upside Volume

Nasdaq Breadth: 63% Upside Volume

Total Breadth: 63% Upside Volume

NYSE Advance/Decline: 63% Advance

Nasdaq Advance/Decline: 69% Advance

Total Advance/Decline: 67% Advance

NYSE New Highs/New Lows: 139 / 16

Nasdaq New Highs/New Lows: 362 / 64

NYSE TRIN: 0.83

Nasdaq TRIN: 1.29

Weekly Breadth Data 📈

For Week Ending October 24, 2025

NYSE Breadth: 57% Upside Volume

Nasdaq Breadth: 57% Upside Volume

Total Breadth: 57% Upside Volume

NYSE Advance/Decline: 74% Advance

Nasdaq Advance/Decline: 67% Advance

Total Advance/Decline: 70% Advance

NYSE New Highs/New Lows: 229 / 66

Nasdaq New Highs/New Lows: 595 / 257

NYSE TRIN: 2.12

Nasdaq TRIN: 1.52

Calendars

Today’s Economic Calendar

This Week’s Important Economic Events

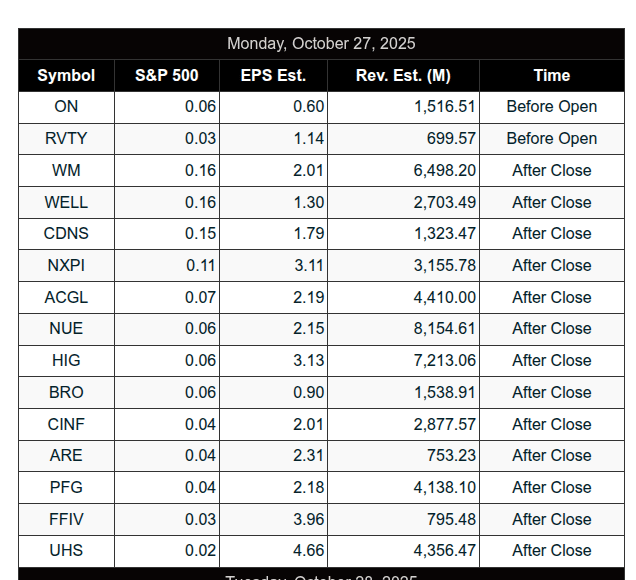

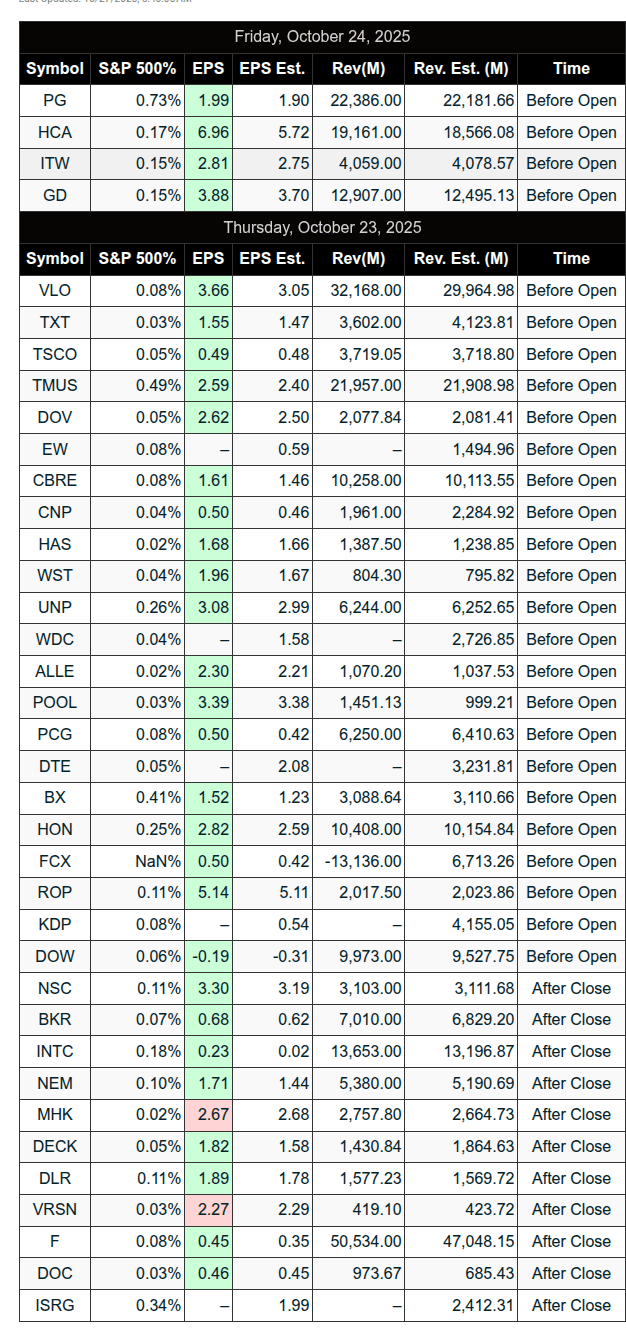

Today’s Earnings

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, October 24, 2025

Friday was a day defined by early opportunity, a CPI-driven move, and a market that ultimately became Trap City. The room was proactive, with Manny laying out a detailed premarket plan, and PTGDavid emphasizing flexibility and capital preservation as the market shifted throughout the day.

Premarket Prep & Trade Plans (Manny)

Manny shared an in-depth multi-level trade plan before the open, with precise entries, order flow triggers, and targets around key ES levels (6760, 6771, 6785, 6800-6810). His plans emphasized:

Liquidity sweeps, iceberg reloads, and positive delta flips as triggers

Focus on support reclaims and continuation longs

Monitoring GEX, vanna, and volatility structure

Key Level of Note:

6785 ES: Strong confluence, supported by technicals and order flow structure. Alerts were set, and Manny was targeting this zone as a potential high-conviction entry.

Lesson Learned: Premarket planning with specific conditions gives structure and confidence, especially on high-impact days like CPI.

CPI Release & Market Reaction

CPI came in slightly hot (3% YoY vs. 3.1% forecast), triggering a swift upside move.

3-day cycle target hit early, with David noting an upside range target of 6840.88 shortly after the data dropped.

Market sentiment leaned bullish as traders added bets on more Fed rate cuts.

Positive Trade Outcome: Those who executed Manny’s 6785 support reclaim or 6800 continuation plan likely caught the CPI-driven thrust toward ATHs.

Midday Volatility: "Trap City" Emerges

While early trades paid off, the market rhythm became wonky and erratic midday.

David observed that the action was all about M&M’s pushing to extremes—a day of "FAFO" (Figure Around, Find Out).

Emphasis shifted to VWAP dynamics:

Holding VWAP = Buy the dip bias

Breaking VWAP = Potential lean shift

Lesson Learned: Even in trending environments, rhythm changes fast—being nimble and recognizing when to sit out is key.

End of Day Sentiment: Capital Preservation & Risk-Off

David declared it a “Capital Preservation Day” by early afternoon, a clear cue that conditions had degraded.

Many in the room, including Tom Bear and Bruce, expressed caution about holding risk into the weekend at ATHs.

Room closed with a note on discipline: “Did I act because of rules, or out of fear?”

Takeaways & Lessons

Early Planning = Early Profits: Manny’s structured entries around 6785 and 6800 offered strong reward:risk setups.

News-Driven Days Require Agility: CPI opened the window for profits, but trap setups required quick adaptation.

Know When to Back Off: Recognizing the transition into "Trap City" and shifting focus to capital preservation was a pro move.

DTG Room Preview – Monday, October 27, 2025

Market Overview:

US futures surged over the weekend, fueled by optimism surrounding a likely Fed rate cut (96.7% probability per CME FedWatch), Big Tech earnings, and Thursday's high-stakes Trump-Xi summit—their first meeting since Trump’s first term. All three major US indexes hit all-time highs Friday.Trade Talks:

Progress was reported in US-China trade negotiations. Treasury Sec. Scott Bessent described a “very substantial framework” with deferrals on China’s rare-earth controls, substantial US soybean purchases, and initial cooperation on fentanyl chemical flows. A final deal on TikTok has reportedly been reached, pending leader approval. Tariff threats from Trump appear shelved for now.Commodities & Volatility:

Oil is up on improving trade sentiment, while gold falls. S&P 500 volatility continues to compress—5-day ADR down to 70.50 points. Today’s session likely to see muted intraday volatility after the morning's gap higher.Key Earnings:

This week features major earnings from Apple, Microsoft, Alphabet, Amazon, and Meta. Today’s premarket earnings include RVTY; post-market highlights include NUE, NXPI, HIG, WM, and others.Technical Levels – ES (S&P Futures):

Resistance: 6919/24, 6994/99, 7231/36

Support: 6742/47, 6642/47

ES trades near the top third of its short-term uptrend channel, with prior channel support at 6919/24 now acting as resistance.

Other Notes:

No significant whale activity overnight.

The economic calendar remains sparse due to the government shutdown.