- The Opening Print

- Posts

- Tech Euphoria or Bubble 2.0? Market Momentum Faces Reality Check

Tech Euphoria or Bubble 2.0? Market Momentum Faces Reality Check

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

HSI -1.09%

CAC +0.21%

DAX -0.32%

FTSE -0.20%

VIX -2.99% @14.93

ES

Open: 6405.00

High: 6431.00

Low: 6401.00

3:50 Imbalance: -830M

4:00 Cash Close: 6425.75

5:00 Settlement: 6428.25

Total Volume: Record Low 773k

I used to post the foreign market net changes all the time, but I always felt the S&P was the world’s leading index. While it’s still the largest individual country index in the world, year-to-date there has been a record $46 billion rotated out of the U.S. stock market into European equities. UBS estimates that over the next five years, another $1.4 trillion will move from the U.S. to Europe. I’m not saying people don’t look at foreign markets, but times have changed.

The ES pulled back on Globex as the European indices weakened slightly and traded down to 6401.00. It doesn't really matter what we think — what matters is the current price action, which has been very distinct: small pullbacks followed by higher prices. Like I always say, I’m not here to fight City Hall. If the S&P is going up, I want to go along for the ride. But I’m starting to wonder how much longer the ride lasts before it starts to peter out.

I was probably saying this last year, but this looks like the lead-up to the 2000 Tech Bubble. In fact, by some measures, the concentration of tech and related industries in U.S. equity markets now exceeds the previous record of 33% set in March 2000. Eight of the top ten companies by market capitalization are tech or communications giants. The tech sector is experiencing extremely high valuations, with some analysts noting similarities to valuation levels seen before the 2000 crash. The forward price-to-earnings ratio of the S&P 500 has approached 2000-era levels (around 24x), topping out at about 23x in 2021 and earlier this year.

There's a clear technology transfer happening. In the 1990s, it was all about the internet. Today, it’s about artificial intelligence growth excitement. But the one big difference is: back then, many companies had no balance sheets, whereas today, these are mega-cap companies with massive balance sheets.

Some experts believe the current tech boom, driven by AI, is more extreme than the late 1990s.

During the Dot-com Bubble, the Nasdaq peaked at 5,048.62 on March 10, 2000, and dropped a whopping 78%, or $5 trillion in market capitalization, bottoming at 1,114 by October 2002. Currently, there are no $5 trillion companies, but NVDA is the closest at $4.24 trillion, Microsoft at $3.78 trillion, and in third place, Apple comes in at around $3.2 trillion.

Tariff Rally

The S&P 500 futures ($ES) three-day drop following President Trump's "Liberation Day" tariff announcement was one of the worst sell-offs since World War II. But after the S&P made its low on April 7th, the ES has closed higher in 59 of the last 72 sessions — up 59 / down 13. That is an incredible run, and it doesn’t look like it’s over.

Meme Stocks

Meme stocks are the new craze:

$OPEN up 170% in 5 days

$GPRP up 65% in a week

$KSS was up 50% in a week

$DNUT rose 325% in a week

Other names bubbling up include Vicor, 1-800-Flowers, Campbell’s, Polaris, Wendy’s, Novavax ($NVAX), Rocket Companies ($RKT), and even larger ones like Tesla ($TSLA) and Shopify ($SHOP) getting meme treatment. It's all being pushed by social media platforms like Reddit’s WallStreetBets, Stocktwits, and X, fueling explosive rallies in heavily shorted names through hype, options trading, and short squeezes. Volumes have jumped as much as 80% to 1,590% in $DNUT's case. $OPEN went from an average daily volume of 319 million shares (from July 1 to July 20) to 1.9 billion on July 22. This is where all the action has moved to.

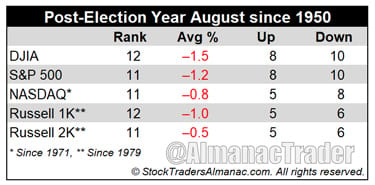

Agriculture and farming made August a great stock market month in the first half of the Twentieth Century. It was the best DJIA month from 1901 to 1951. (See page 42 of the 2025 Almanac comparing the seasonal patterns of DJIA before and after 1950.) Now it is the worst DJIA and Russell 2000 and second worst S&P 500, NASDAQ, and Russell 1000 month over the last 37 years, 1988-2024 with average performance ranging from +0.1% by NASDAQ to a –0.8% loss by DJIA. In 2022, DJIA, S&P 500, NASDAQ, and Russell 1000 all declined over 4% in August and in 2023 they declined 1.8% or more.

In post-election years, August’s rankings are little changed, but performance has been negative across the board. August is the worst month in post-election years for DJIA and Russell 1000 and the second worst for S&P 500, NASDAQ and Russell 2000. Average declines in post-election year Augusts range from –0.5% by Russell 2000 to –1.5% by DJIA. Each index has also seen more declining post-election year Augusts than positive.

Guest Post - SpotGamma:

Get instant access to our partners’ real-time market data and insights not available anywhere else. Here is last night's Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

Animal Spirits Roar as Market Catalysts Loom

This week delivered a fascinating mix of meme stock chaos, trade deal optimism, and mega tech earnings keeping traders on their toes despite unusually calm waters for the broader market.

The S&P 500 ultimately gained ground, closing at all-time-highs, just below the pivotal SPX 6,400 gamma strike.

Call option volumes exploded this week alongside broader speculative trading activity, with calls accounting for 61% of total options volume over the past month. This marks the highest reading since December 2024.

The elevated call-to-put ratio reflects the market's overwhelming bullish positioning and helps explain why volatility has been so persistently suppressed. The VIX collapsed below 15, its lowest level since early February, as trade deal optimism and low-volume summer conditions combined to create an environment of extremely subdued volatility.

The ultimate question remains: Can this low-vol, bullish environment persist through peak earnings season, or are we setting up for the kind of reset that catches everyone leaning the same direction?

Tesla's Gamma Fortress: When Earnings Misses Don't Matter

While Tesla bears scratched their heads wondering why TSLA wouldn't collapse further on its double earnings miss, the answer lay in the mechanical options-driven forces hidden beneath the surface.

Tesla's positioning showed $300 as both the Key Gamma Strike and Put Wall where dealers held concentrated long puts, creating automatic buying pressure. When TSLA gapped down 5% the session following earnings, it found immediate support exactly at the $300 level – just as anticipated.

The upside roadmap was equally clear. Above $300, gamma tailwinds supported upside momentum. At $325, diminishing dealer buying pressure provided a natural profit-taking zone. This setup offered both a defined-risk entry and logical exit target, capturing TSLA's full ~$24 bounce between Thursday and Friday.

MiM and Daily Recap

Intraday Recap: Friday, July 25, 2025

The S&P 500 futures (ESU25) began Friday's trade with mixed overnight action. The overnight Globex opened at 6406.75 and staged a steady climb, reaching 6421.25 at 23:15. That 22-point rally marked the overnight high before sellers stepped back in. A prolonged decline took hold into the earlyning, dragging ES down to 6401.00 by 04:15, erasing the entire up leg.

A bounce emerged from that pre-market low, lifting ES to 6410.00 at 06:45, but it turned out to be a lower high. Another push lower followed, with a minor rally to 6410.25 at 08:30, but price fell again to 6402.00 at 09:00. The regular session opened shortly after at 6405.00, and the early action held near that area.

Momentum gradually improved through mid-morning, building from the 09:05 low. A climb to 6410.25 at 08:35 gained traction, extending to 6416.00 by 10:45 before pulling back to 6410.50 at 10:55. That 5.5-point retracement set the stage for a steady trend higher into the afternoon.

By 14:45, ES reached a new high at 6430.50, a 20-point move off the late morning low. A shallow dip to 6427.00 at 14:55 was quickly bought, leading to another push up to 6431.00 at 15:20, the session high. However, a wave of late selling knocked prices down to 6421.25 at 15:55 before the session stabilized.

The cash close at 16:00 came in at 6425.75, up 20.75 points (+0.32%) from the regular session open and up 24.00 points or +0.37% from Thursday's 6401.75 settlement. The full session volume was light, reaching only 773,328 contracts, with 611,797 traded during regular hours.

Market Tone & Notable Factors

Friday’s tone was moderately bullish, supported by constructive pullbacks and higher lows through the day. Despite the early Globex fade, the regular session established upward momentum after absorbing pre-market weakness. Traders found confidence in the morning stability and sustained upward drive.

Buyers were willing to step in on minor dips, and the afton drift higher suggested steady demand. The late-day high at 15:20 quickly reversed, influenced by imbalances into the close.

Market-on-Close (MOC) data showed a sharp -$1.706B sell imbalance at 15:55. This was accompanied by a 67% dollar-weighted sell side, meeting the strong sell threshold, though the symbol imbalance at -50.6% did not meet the extreme threshold. The sharp drop from 6431.00 to 6421.25 in the final minutes reflected this MOC pressure.

In summary, the ES held firm ground with a modest gain and closed the week near highs, though the closing imbalance capped the upside. Traders will likely look to Monday for confirmation of strength or signs of exhaustion after this week's upward bias.

Technical Edge

Fair Values for July 28, 2025:

SP: 32.48

NQ: 136.68

Dow: 168.64

Daily Breadth Data 📊

For Friday, July 25

• NYSE Breadth: 59%ide Volume

• Nasdaq Breadth: 68% Upside Volume

• Total Breadth: 67% Upside Volume

• NYSE Advance/Decline: 61% Advance

• Nasdaq Advance/Decline: 51% Advance

• Total Advance/Decline: 52% Advance

• NYSE New Highs/New Lows: 98 / 15

• Nasdaq New Highs/New Lows: 221 / 73

• NYSE TRIN: 1.03

• Nasdaq TRIN: 0.46

Weekly Breadth Data 📈

For Week Ending July 25

• NYSE Breadth: 58% Upside Volume

• Nasdaq Breadth: 65% Upside Volume

• Total Breadth: 62% Upside Volume

• NYSE Advance/Decline: 66% Advance

• Nasdaq Advance/Decline: 61% Advance

• Total Advance/Decline: 57% Advance

• NYSE New Highs/New Lows: 273 / 62

• Nasdaq New Highs/New Lows: 609 / 157

• NYSE TRIN: 1.40

• Nasdaq TRIN: 0.83

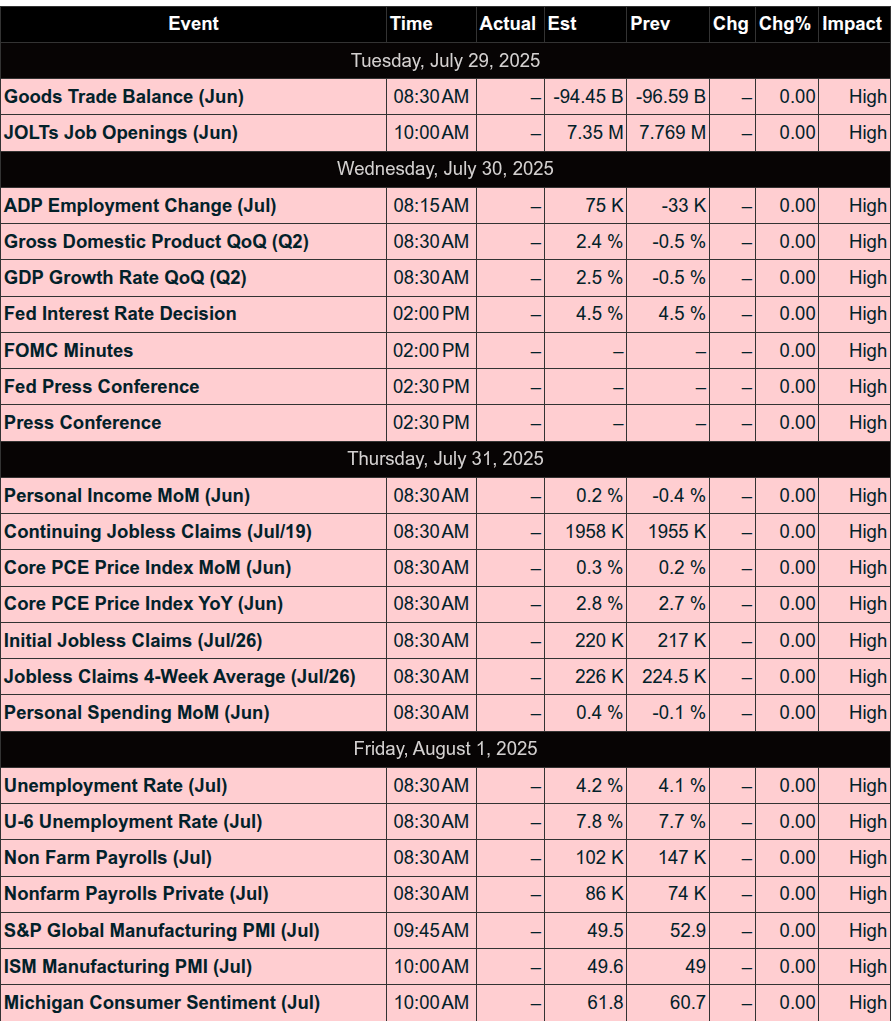

Calendars

Today’s Economic Calendar

This Week’s Important Economic Events

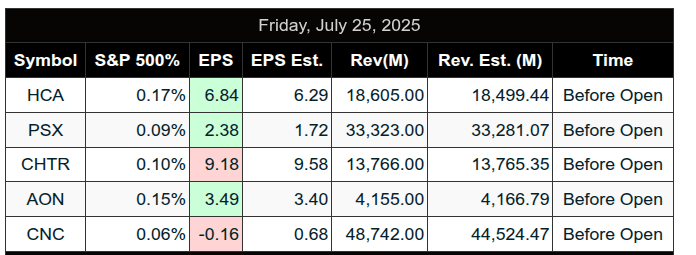

Today’s Earnings

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, July 25, 2025

Overview:

Friday was marked as Capital Preservation Day, with a strong educational focus and cautious trading in a tight-range environment. Despite low volatility, several valuable setups and lessons emerged.

Key Trades & Market Action

Overnight D-level target at 6420 was fulfilled, aligning with the trade plan

@CL Open Range Short was the standout:

Target 1 hit early in session

Target 2 followed with stop moved to breakeven

All targets fulfilled by midday

@NQ Open Range Short was stopped out for -1R

@ES Open Range Long was attempted during the tight range but yielded limited action

A midday demo long trade reached two scales with stop moved to breakeven

Lessons and Highlights

New acronym shared: ITE = If Then Else, guiding structured trade planning

Avoid trading in the middle of CCI during ranges – confirmed by David

Best range-bound entries discussed:

Break and retest of levels

Confirmation through stacked MAs, volume ratios, and thrust behavior

ATR10 and trend filter techniques discussed to refine entry timing

Tight ranges often lead to expansion – emphasized need for patience and edge-based setups

Member Contributions and Insights

Ram, John B, Roy_, and others actively contributed trade observations and educational prompts

John B shared use of the trender filter (13 EMA vs. 34 EMA) to stay out of weak setups

Multiple members appreciated the educational depth of the morning session

Market Context and Structure

ES was range-bound between 6400–6410 for much of the session

Failed to gain traction above 6415

Total ES volume was 749,000 contracts, reflecting summer Friday pace

Closing Notes

David wrapped the session early afternoon due to storms

Members signed off expressing appreciation for the session’s value and clarity