- The Opening Print

- Posts

- Tariff Turmoil, Tech Triumph: Markets Whipsaw on Trump and Powell

Tariff Turmoil, Tech Triumph: Markets Whipsaw on Trump and Powell

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Yesterday's trade had a little bit for everyone—sell-off, rally, and then another sell-off, or something like that. With all the economic and earnings reports, plus the Fed, we knew there would be an uptick in volatility.

The ES made a high at 6429.75 and then sold off 63 points down to 6366.75 after Powell spoke. I've been around a long time and have seen a lot of things, but never the likes of this president.

Trump hits India and Brazil with high tariffs – NBC News

Trump says U.S. will impose 25% tariffs on India – NPR

Trump says he thinks the US will have a very fair deal on trade with China – Reuters

President Donald J. Trump Takes Action to Address the Threat to National Security from Imports of Copper – The White House

President Donald J. Trump Addresses Threats to the United States from the Government of Brazil – The White House

Trump misusing tariffs to punish Brazil – referencing Reuters coverage of sanctions linked to Brazil's political unrest

Breaking: Korea reaches Trade Deal with US/TRUMP! More winning! – The Wall Street Journal

Donald Trump Announces Pre-Deadline Trade Pact with South Korea – Newsweek

Trump 2.0 tariff tracker – Trade Compliance Resource Hub

Wyden Urges Colleagues to Rein in Trump's Catastrophic Trade War – Senate Finance Committee

Trump implements additional 40% tariff on Brazil

Trump imposes universal 50% tariffs on imports of semi-finished copper products

Trump imposes universal 50% tariffs on imports of copper-intensive derivative products

It was a sell-the-news event, but I thought there was a big disconnect between the drop and the META and MSFT earnings after the close. Whenever you see the crowd go from long into the rally and then short into the decline late in the day, there's always a chance of a late rally.

Here are a few of my posts as we went down to the lows:

IMPRO : Dboy : (3:02:41 PM) : everyone short now going into the earnings

IMPRO : Dboy : (3:11:32 PM) : e going back to 6400

IMPRO : Dboy : (3:13:26 PM) : going to blast out of here

IMPRO : Dboy : (3:14:00 PM) : fill in the blank ... run the sell stops now run the ???

IMPRO : Dboy : (4:03:14 PM) : flat 16.00

IMPRO : Dboy : (4:03:18 PM) : done

IMPRO : Dboy : (4:03:28 PM) : ha ha

IMPRO : Dboy : (4:03:35 PM) : love it

IMPRO : Dboy : (4:04:07 PM) : u had to know the F job was coming

IMPRO : Dboy : (4:04:17 PM) : no one rides for free

IMPRO : Dboy : (4:05:19 PM) : especially the shorts

The ES started to short cover, pushing it up to the 6392 level just before META and Microsoft reported robust earnings. That helped push the ES all the way up to a new high at 6435.25.

In the end, it was a good old-fashioned drop and pop. In terms of the ES and NQ's overall tone, they didn’t look great on the lows, but they looked terrific at the late highs. In terms of the ES's overall trade, volume was low for the size of the trading range at 1.235 million contracts traded.

MiM and Daily Recap

ES Recap for Tuesday, July 30, 2025

Intraday Recap

Globex session opened at 6404, and buyers stepped in and slowly pushed the contract to a high of 6416.75 at 2:15 AM. After a couple of 10-point swings up and down by 8 AM, getting ready for premarket setup for the cash open, the ES was trading right around its Globex open price. The regular session opened at 6412.00 and quickly found resistance at 6414.50 by 9:45 AM before dipping to an early low of 6405.25. A rebound lifted the ES to 6421 at 10:30 AM, marking the morning session's high. However, the rally failed to hold as prices reversed sharply, tagging a fresh low of 6402.25 by 11:15 AM.

A midday grind higher took ES back to 6419.75 by 12:21 PM before a brief dip to 6414.75 at 12:39 PM. Another lower high printed at 6419.25 at 1:00 PM, and back-to-back selloffs followed. The first leg dropped ES to 6413.50 at 1:30 PM, and a second leg extended the decline to 6412.50 by 2:00 PM and the Fed announcement.

That set up a powerful downside flush into 3:06 PM, where the session low of 6366.75 printed, representing a 45-point drop from the morning high. A sharp short-covering bounce followed into the final hour as earnings were released, with prices ramping up to 6435.25 at 4:12 PM, a massive 68.5 point swing from the 3:06 low. The ES settled at 6425.50 in the 5:00 PM cleanup session.

On the day, the cash session fell 14.50 points, or -0.23%, closing at 6397.50. From the prior day’s cash close, ES was down 8.50 points (-0.13%). Globex added 8.00 points (+0.12%), while the full session rose 21.50 points (+0.34%).

Market Tone & Notable Factors

The overall tone was two-sided with sharp intraday swings but leaned bearish through the middle of the session before a late rebound. Volume was solid with over 1.23 million contracts traded, led by 1.02 million during the regular hours.

Buyers attempted multiple pushes throughout the day, but each move failed to break away until the final-hour rally. That recovery was not enough to lift the session into the green, and the market remained net down from the previous day’s cash close.

The Market-on-Close (MOC) imbalance showed a strong -$2.05B to sell, with 71.4% of dollar flow and 60% of symbols leaning negative. This notable sell-side imbalance contributed to the mid-afternoon weakness and limited the recovery into the 4:00 PM cash close.

Despite the late-day rally, sellers maintained control on the close, and the heavy imbalance signals caution going into Wednesday's trade.

Technical Edge

Fair Values for July 31, 2025

S&P: 31.47

NQ: 134.3

Dow: 155.75

Daily Breadth Data 📊

For Wednesday, July 30, 2025

NYSE Breadth: 27% Upside Volume

Nasdaq Breadth: 41% Upside Volume

Total Breadth: 40% Upside Volume

NYSE Advance/Decline: 31% Advance

Nasdaq Advance/Decline: 33% Advance

Total Advance/Decline: 32% Advance

NYSE New Highs/New Lows: 77 / 42

Nasdaq New Highs/New Lows: 143 / 114

NYSE TRIN: 1.16

Nasdaq TRIN: 0.70

Weekly Breadth Data 📈

For the Week Ending Friday, July 25, 2025

NYSE Breadth: 58% Upside Volume

Nasdaq Breadth: 65% Upside Volume

Total Breadth: 63% Upside Volume

NYSE Advance/Decline: 66% Advance

Nasdaq Advance/Decline: 61% Advance

Total Advance/Decline: 63% Advance

NYSE New Highs/New Lows: 273 / 62

Nasdaq New Highs/New Lows: 609 / 157

NYSE TRIN: 1.40

Nasdaq TRIN: 0.83

S&P 500/NQ 100 BTS Trading Levels (Premium Only)

Calendars

Economic Calendar Today

This Week’s High Importance

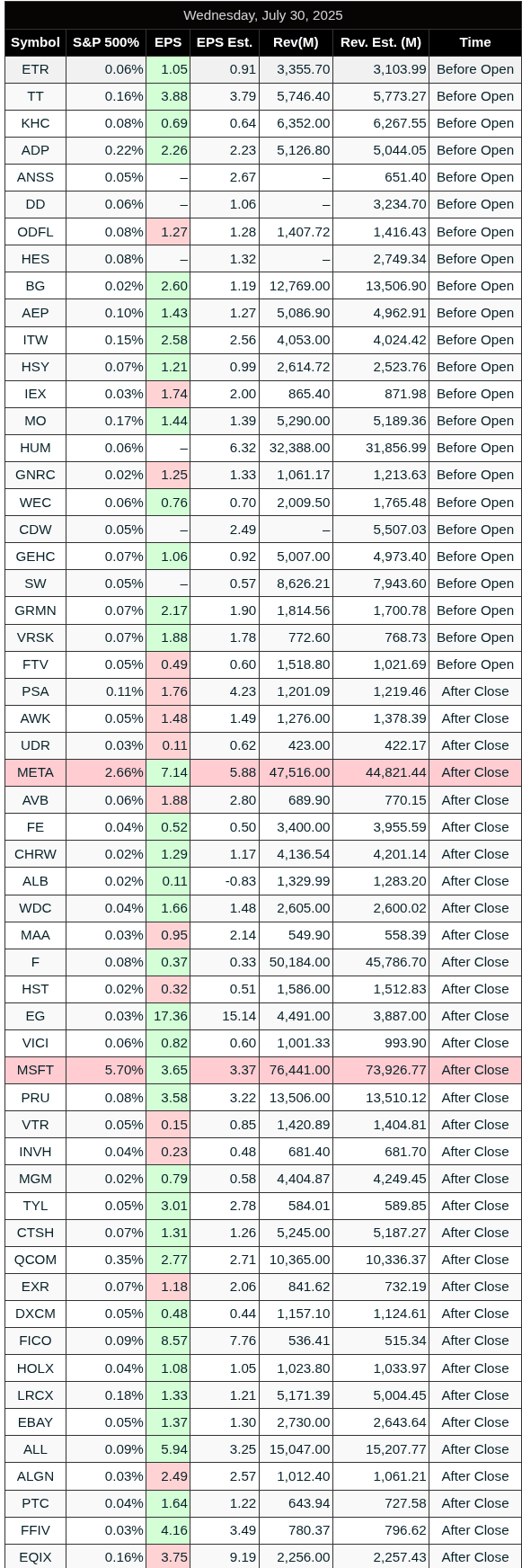

Earnings:

Released

Trading Room News:

Polaris Trading Group Summary: Wednesday, July 30, 2025 (FED Day)

Morning Session – Calm Before the Storm

The session opened with tight overnight action and an early "neutral lean" from David as traders waited for the FOMC.

David emphasized patience with little momentum present and advised against overtrading into the midday chop.

The room focused on key structure: open range consolidation, prior value levels, and the key 6405 LIS (Line in the Sand).

A shift to a long lean was noted mid-morning as price began to show strength above consolidation.

Target 1 from the @NQ Open Range Long strategy was fulfilled.

Market failed to sustain above 6420 resistance, indicating lack of interest at higher prices pre-FOMC.

FED Announcement and Reaction

The Fed held rates steady at 4.5%, as expected—no surprise.

Initial bullish move post-announcement pushed price up to 6425–6429.75, hitting David’s Bull Scenario target from the DTS Briefing.

Price reversed sharply after the Q&A began, triggering the Bear Scenario and fulfilling multiple downside targets including 6385 and 6380.

The market reached as low as 6367, hitting the Cycle Day 3 Violation Target—an advanced level from David's cycle subscribers.

Post-FED Commentary and Trade Review

David reiterated that deep violation levels like 6367 offer strong reward-to-risk reversal potential.

Room discussion covered how volatility post-FED can be difficult, but levels held up with precision on both long and short sides.

David noted this was a "both ends" day, with traders able to take advantage of each side by following structure and discipline.

Lessons and Key Takeaways

Trade lightly into FOMC releases and avoid the noise during the press conference.

Respect for structure—especially LIS at 6405—helped keep traders on the right side of the tape.

Targets from the DTS Briefing were fulfilled precisely, showcasing the value of preparation and scenario planning.

The Cycle Day 3 level (6367) provided a textbook downside completion and lesson in how market structure cycles work.

David emphasized that market depth like this cannot be navigated by emotion—discipline and tools are key.

Fulfilled Targets

@NQ Open Range Long Target 1

Bull Scenario Target: 6425–6430 (hit 29.75)

Bear Scenario Targets: 6385, 6380, 6389

Cycle Day 3 Violation Target: 6367

A strong trading day for those who stayed patient, respected key levels, and followed the game plan.

DTG Room Preview – Thursday, July 31, 2025

Fed & Macro:

Fed held rates steady post-strong GDP; no commitment for September.

Chair Powell emphasized Fed policy is independent of government financing needs.

Key economic data at 8:30 AM ET: Core PCE, Employment Cost Index, Personal Income/Spending. Chicago PMI at 10:00 AM.

Earnings Highlights:

Microsoft (MSFT) & Meta (META) crushed earnings on AI strength, pushing S&P/Nasdaq futures to new highs.

Ford (F) beat on earnings/revenue, reinstated guidance, but stock fell on projected $2B tariff hit.

Major premarket earnings: AbbVie (ABBV), Mastercard (MA), Comcast (CMCSA), Bristol Myers (BMY), CVS Health (CVS), among others.

Post-close reports: Amazon (AMZN), Apple (AAPL), Roku (ROKU), Coinbase (COIN), Reddit (RDDT), and more.

Trade & Tariffs:

Trump announced tariff deals:

Pakistan: Will lower import tariffs, open oil development to U.S. companies.

South Korea: 15% tariffs, $350B U.S. investments in shipbuilding, chips, batteries; $100B U.S. energy purchase.

Market Technicals:

ES rebounded above short-term uptrend top (6443/46) post-MSFT/META.

Key resistance: 6500 (psych level), 6519/22 (channel top).

Key support: 6443/46, 6207/12, 6160/65.

Whale volume skew bullish pre-8:30 data; 5-day ADR rose slightly to 44 points.