- The Opening Print

- Posts

- Strong Markets, Sticky Inflation, and a PitBull Eye on 6936

Strong Markets, Sticky Inflation, and a PitBull Eye on 6936

Follow @MrTopStep on Twitter and please share if you find our work valuable!

FREE Two-Week Offer for the Opening Print Premium. Open up the Lean and other premium features for the next Two Weeks!

Our View

Like I said in the MrTopStep chat, I have never seen a slower year-end trade. The PitBull said the algos made so much money this year that they went on vacation. I think a lot of the slower trade was due to families taking off the week before Christmas and the week after.

Some 2025 end-of-year Tech / AI tidbits from the Wall Street Journal:

The S&P 500 gained 17% in 2025, contributing to its seventh-best three-year run on record, despite earlier market turbulence.

Broadcom and the Magnificent Seven now comprise 40% of the S&P 500’s market capitalization, more than double the 15% commanded by the index’s eight biggest names a decade ago.

JPMorgan Chase economists note an unprecedented acceleration in business spending alongside a material softening in job growth.

Chip designer Nvidia’s 40% climb this year lags behind Broadcom’s 51% advance and farther still from Alphabet’s 66% rally.

Advanced Micro Devices posted a 78% run-up. Palantir skyrocketed 139%. Micron Technology posted a stratospheric 248% increase.

Our View

Despite the late December weakness, the S&P is up 38% from its low, and the Nasdaq is up a whopping 54%. It's very hard to argue against the strength of the markets, and according to the CME’s Fed funds futures, the markets are pricing in two more rate cuts by the end of 2026.

That all said, the year didn't go without some big jumps in volatility — which I expect even more of in 2026.

Our Lean — Danny’s Trade (Premium only)

Market Recap

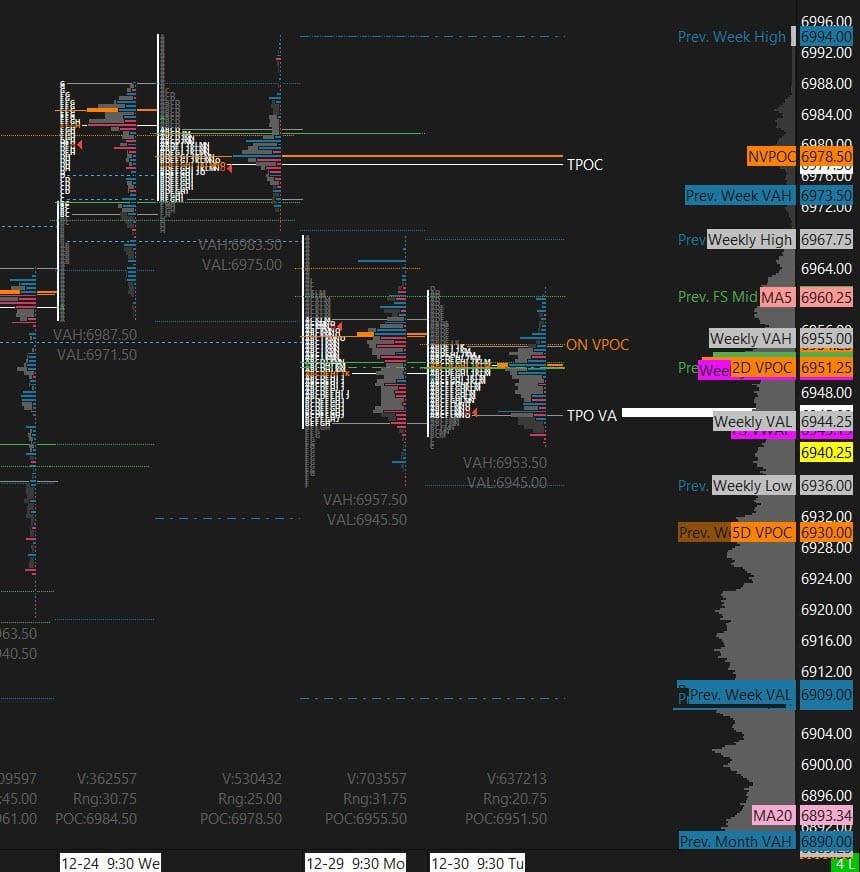

The ES made a 6943.75 low on Globex and opened Tuesday’s regular session at 6950.00, traded up to 6954.00, dropped 10 points down to 6944.00 at 9:45, and then rallied up to 6961 after the Chicago PMI number rose to 43.5 vs the 40 estimate.

After the pop, the ES sold off down to 5940.50 at 10:40, rallied up to a new high by 2 ticks at 5961.50 at 11:20, then sold off down to a higher low at 69343.50 at 12:15. It traded up to the 6952 area at 12:30 and then back-and-filled just above the VWAP at 6950.75, down to the 6947 area, until 3:05 when the ES sold off down to 6944.75 at 3:10, with only 590k contracts traded.

I seriously have never seen a lower volume, more lethargic trade — even at the end of the year.

After the small drop, the ES rallied back up to 6953.00 at 3:40 and traded 6949.75 as the 3:50 cash imbalance showed $650 million to buy, flipped to $1.4 billion to sell, sold off down to 6942.50, and traded 6945.25 on the 4:00 cash close.

After a small bounce, the ES traded down to 6942.00 and settled at 6945.50, down 4.25 points or -0.06%. The NQ settled at 25,676.00, down 34 points or -0.13% on the day — both down three sessions in a row.

In the end, it was another day of low-volume chop. Monday's rotation was buy ES / sell NQ, and yesterday it was the exact opposite — buy NQ / sell ES. In terms of the ES’s overall tone, it acted weak. In terms of the ES’s overall trade, volume was low at 883k contracts traded.

Guest Posts

S&P 500 (ES)

Prior Session was Cycle Day 3: Cycle Day Context: Year-End Drift Mode Activated

Quiet trading wrapped itself in a holiday blanket today as markets continued their low-volume, low-ambition stroll toward the final bell of 2025.

Overnight action was narrow, intraday participation was selective, and conviction was… optional. ES and SPX hovered near record highs, but without catalysts, follow-through remained elusive. In other words: Textbook Range Day Rhythm.

For greater detail of how this day unfolded, click on the Trading Room RECAP 12.30.25 link.

…Transition from Cycle Day 3 to Cycle Day 1

Transition into Cycle Day 1: 🎄 Final Trading Session 2025 — Cleared for Hope (Standby) 🎄

Santa’s at the end of the runway…

Engines humming.

Lights blazing.

Visibility? Let’s call it festive fog. 🎅🌫️

Persistent selling has made the final preflight a little… bumpy. Every attempt to throttle up has been met with cautious hands trimming risk, squaring books, and muttering the most powerful phrase of late December:

“Just get me to the close.”

And yet — not so fast.

The Setup

Yes, Santa is struggling to lift off through the haze of year-end selling.

Yes, the tape has been stubborn.

But beneath the surface, something very seasonal is stirring…

✨ Window dressing. ✨

That subtle, polite, last-minute urge for portfolios to look presentable when the calendar flips. Nobody wants to explain why they faded the year’s winners on December 31st.

What This Session Really Is

This isn’t about chasing momentum.

This is about appearance, positioning, and optics.

A little buying here

A little smoothing there

A gentle nudge so charts don’t look… awkward at the family dinner

Santa doesn’t need a miracle.

He just needs a hole in the clouds.

The Mood

🎶 Sleigh bells, not sirens

🎄 Hope, not heroics

📊 Participation, not persuasion

If the fog lifts — even briefly — Santa finally gets that short runway pop.

Not a moonshot.

Just enough altitude to wave goodbye to 2025 with dignity.

Closing Thought

This is the market equivalent of straightening your tie before the photo.

No rush.

No panic.

Just a calm, composed finish that says:

“We showed up. We managed risk. We’ll do it again next year.”

Santa’s still rolling.

The lights are still on.

And sometimes… that’s all it takes.

🎄 Happy New Year — see you in 2026. ✈️📈

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 6945+-, initially targets 6960 – 6965 zone.

Bear Scenario: Price sustains an offer below 6945+-, initially targets 6930 – 6925 zone.

PVA High Edge = 6953 PVA Low Edge = 66945 Prior POC = 6951

ESH

Thanks for reading, PTGDavid

MiM

MOC Recap

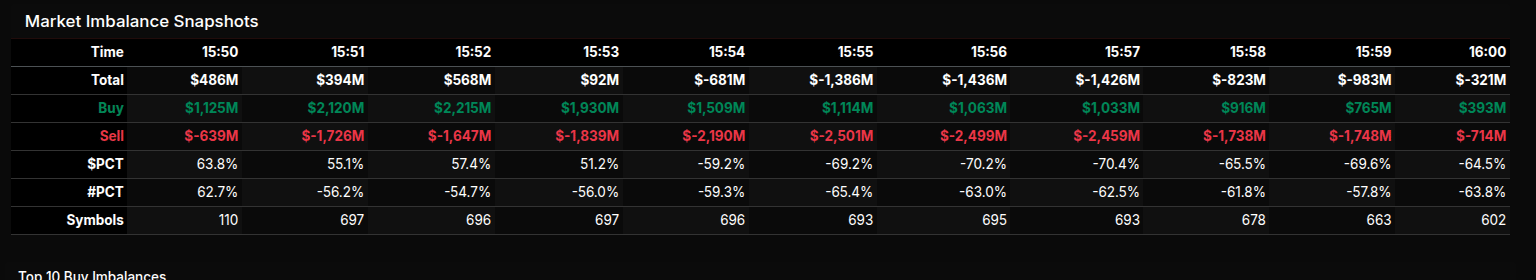

The market-on-close auction opened with a brief bid imbalance before quickly transitioning into a dominant sell program as the final ten minutes unfolded. Early snapshots around 15:50–15:52 showed net buying, but the character of the auction shifted decisively after 15:53, when sell pressure overwhelmed incoming buy orders. From that point forward, the imbalance trended sharply negative, with net sell values accelerating into the close and only modest relief in the final minute.

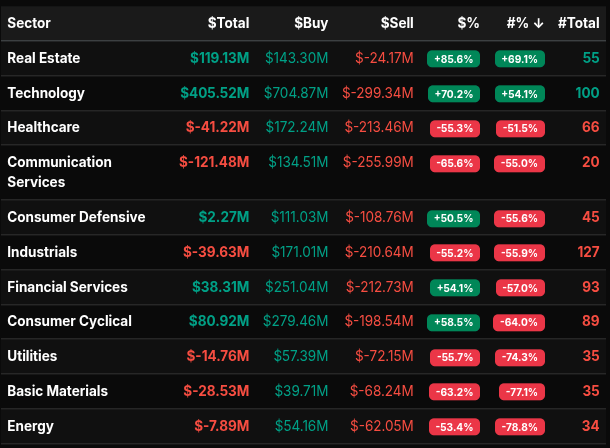

Sector flows highlighted clear divergences between rotation and wholesale liquidation. Real Estate and Technology were the standout buy-side sectors. Real Estate posted a strong +85.6% dollar lean, and Technology followed with a +70.2% lean, signaling institutional accumulation rather than light rotation. Financial Services also leaned positive at +54.1%, though closer to the rotational threshold. In contrast, Communication Services (-65.6%), Healthcare (-55.3%), Industrials (-55.2%), Utilities (-55.7%), and Basic Materials (-63.2%) showed broad-based selling pressure, with several sectors approaching or exceeding the -66% threshold that defines wholesale distribution.

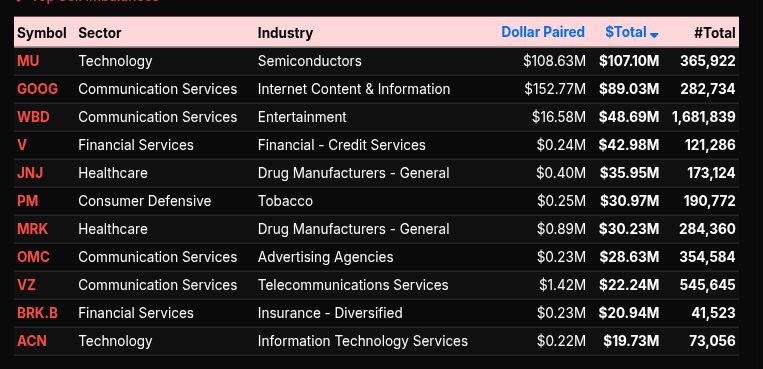

On a symbol level, buying interest clustered heavily in large-cap growth and index heavyweights. NVDA, TSLA, AVGO, AAPL, AMZN, and META all appeared on the buy side with substantial paired dollar volume, reinforcing the Technology and Consumer Cyclical inflows. Semiconductor names were particularly active, suggesting portfolio rebalancing into liquid leaders. On the sell side, Communication Services names such as GOOGL, WBD, OMC, and VZ featured prominently, aligning with the sector-level weakness.

The imbalance timeline confirmed the transition. Buy percentages hovered near rotational levels (~50–55%) early, then collapsed toward -70% as sell programs dominated between 15:54 and 15:58. These readings indicate more than simple rotation; they reflect coordinated sell-side execution into the close.

Technical Edge

Fair Values for December 31, 2025:

SP: 46.79

NQ: 199.87

Dow: 263.66

Daily Market Recap 📊

For Tuesday, December 30, 2025

NYSE Breadth: 49% Upside Volume

Nasdaq Breadth: 54% Upside Volume

Total Breadth: 53% Upside Volume

NYSE Advance/Decline: 48% Advance

Nasdaq Advance/Decline: 38% Advance

Total Advance/Decline: 41% Advance

NYSE New Highs/New Lows: 48 / 22

Nasdaq New Highs/New Lows: 88 / 250

NYSE TRIN: 0.78

Nasdaq TRIN: 0.51

Weekly Market 📈

For the week ending Friday, December 26, 2025

NYSE Breadth: 58% Upside Volume

Nasdaq Breadth: 50% Upside Volume

Total Breadth: 53% Upside Volume

NYSE Advance/Decline: 59% Advance

Nasdaq Advance/Decline: 52% Advance

Total Advance/Decline: 55% Advance

NYSE New Highs/New Lows: 232 / 82

Nasdaq New Highs/New Lows: 350 / 413

NYSE TRIN: 1.00

Nasdaq TRIN: 1.05

ES & NQ Futures trading levels (Premium only)

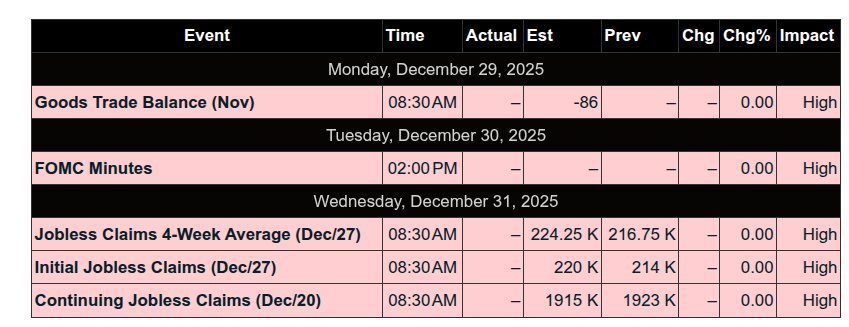

Calendars

Economic

Today

Important Upcoming / Recent

Earnings - SP500

Upcoming

NONE

Recent

NONE

Trading Room Summaries

Polaris Trading Group Summary - Tuesday, December 30, 2025

Tuesday’s session reflected the typical quiet and low-volume tone seen in the final trading days of the year. With no major economic catalysts on the calendar and most of 2025’s gains already priced in, the market drifted within tight ranges. While the FOMC minutes release at 2PM was noted, it was not expected to move the market significantly, and ultimately had little effect. External conditions also played a role, as strong winds and regional power outages were reported in the Northeast, though these did not notably disrupt the trading room or flow of activity. Overall, the day carried a muted, end-of-year feel with limited directional conviction.

Key Market Behavior:

Range Day confirmed: Markets moved within a narrow band, with clear support and resistance levels at the range extremes.

Bulls maintained control through midday but did not press to break the range.

Afternoon session showed no edge, and traders were cautioned not to overtrade into the close.

Highlighted Trades & Tactics:

Mean Reversion Strategy was the theme of the day.

PTGDavid emphasized Dynamic DLMB levels (Dynamic Day-Level Market Boundaries) as critical for locating trades at range extremes.

"Clustering" of levels—areas with multiple swing points—was used as a high-probability reaction zone.

Trade entries at these levels were advised with possible add-ons upon confirmation.

Bosier:

Active early with an ES short at 49 and exited flat at 53.

Took a bid in CL (Crude) at .36, looking for long potential.

Anticipated institutional position-lightening into year-end.

PeterN:

Asked insightful questions on ATR bounce levels and chart discrepancies (realized he was using MES vs ES).

Learned a helpful Sierra Chart feature to sync studies between MES and ES (from DanV).

Lessons & Takeaways:

Know Your Instrument: Mismatched charts (MES vs ES) can lead to confusion. Always double-check chart symbols and data feeds.

Preparation is Key: PTGDavid stressed the importance of taking and marking measurements to be ready for entries, especially on days lacking directional momentum.

Adapt Strategy to Market Type: Range days call for mean-reversion tactics, not trend-following. Patience and recognition of environment are essential.

Discipline Pays: PTGDavid cautioned against overtrading during a choppy afternoon, reinforcing the principle of trading only when there's an edge.

Overall Room Performance:

A text:disciplined and educational session with successful setups found by applying Dynamic DLMB levels and mean reversion techniques. Room members engaged actively with solid questions, peer assistance, and shared learning moments. The day closed with a modest MOC buy imbalance and textbook range-bound behavior.

Looking ahead, traders are prepped for 2026 with sharp tools and sharper minds.

Discovery Trading Group Room Preview – Wednesday, December 31, 2025

Fed Outlook: December FOMC minutes reveal a divided Fed; rate cuts remain data-dependent. Market odds show 85% chance of no rate change in January.

Metals in Focus: Gold and silver rebound fades overnight; platinum and copper near highs on AI-driven reshoring. Scottsdale Mint CEO calls it a “metals war” as industrial silver demand surges. China to begin silver export restrictions Jan 1.

Tesla (TSLA): Pre-announced Q4 deliveries at 422,850 units, 15% YoY decline. Misses Bloomberg estimate (445K). Shares -1% amid tax credit expiration.

Leadership Change: Warren Buffett steps down today; Greg Abel takes over as CEO of Berkshire Hathaway tomorrow.

Economic Calendar: Key data today – Unemployment Claims (8:30am ET), Crude Oil Inventories (10:30am ET).

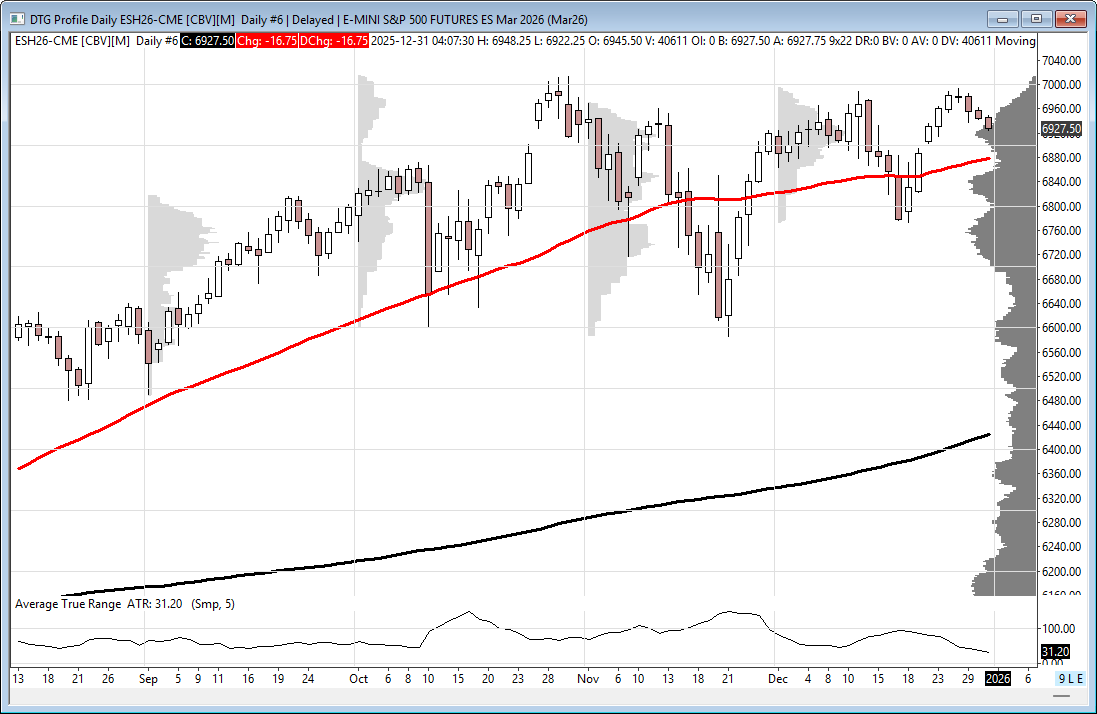

Market Volatility: ES 5-day ADR drops to 36 pts; expect muted action into New Year’s holiday. No significant overnight whale volume.

ES Technical Levels:

Resistance: 7087/92, 7508/13

Support: 6830/35, 6650/45, 6328/23

ES trending toward mid-channel; 50-day MA (6877.75) as soft support.