- The Opening Print

- Posts

- Santa’s Late This Year — But He’s Still Coming With Stops at 6897

Santa’s Late This Year — But He’s Still Coming With Stops at 6897

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Even though the ES and NQ had big rallies on Friday, volume was uncharacteristically low. I think there are a lot of reasons for the drop, but two in particular stand out: inclement weather in the East and the holidays. According to AAA, over 122 million Americans are expected to travel for the 2025 Christmas and New Year's holidays (Dec. 20 – Jan. 1), setting a new record. Most (around 109.5M) will be driving, while 8M will fly, and 4.9M will use other transport like buses, trains, or cruises — marking a 2.2% rise from last year.

The weekends before Christmas and New Year's, as well as the day after Christmas (Dec. 26), are expected to be particularly busy on the roads. In contrast, Christmas Eve/Day and New Year’s Day should be quieter. Most schools are closed the week before Christmas and the week after. I personally have seen a big jump in snowbirds and vacationers in Delray Beach.

Let’s face it, there have been several drops since the April lows, but I think the AI bubble talk shook a lot of folks out of positions.

Our Lean

Market Recap

Despite the slightly negative December Quad Witching expiration stats, the record $6.7 trillion expiration powered the ES and NQ just before and after the regular session open.

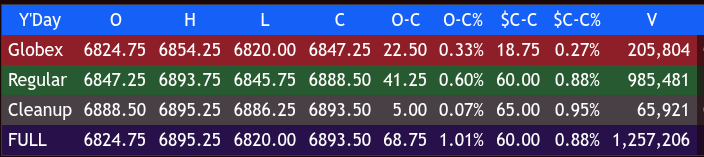

The ES made a Globex high at 6854.25 and opened the regular session at 6847.25. It rallied to 6878.50 at 10:00, then pulled back to 6866.75, rallied up to a new high at 6884.00, and traded back down to 6868.00 at 11:00. From there, it rallied 20 points to a new high of 6888.50, pulled back to 6876.00 at 11:45, traded up to another new high at 6893.25 at 12:25, pulled back to 6885.50, then rallied to another new high at 6893.75 at 1:15.

It pulled back again to 6884.00 at 1:45, drifted up to a lower high at 6892.75 at 2:45, then drifted back down to 6885.50 at 3:30. It dropped to 6879.25 at 3:40 and traded 6883.25 as the 3:50 imbalance showed $1.4 billion to sell and the NQ $1.6 billion to buy. The ES sold off down to 6880.50 and traded 6888.50 on the 4:00 cash close.

After 4:00, the ES traded up to a new high at 6895.25 and settled at 6893.50, up 65 points or +0.95%, up two sessions in a row for a total gain of 108.75 points.

In the end, I think the day's trade was a foregone conclusion. The combination of the big buy expiration and rebalancing made for a very stable, all-day buy program.

In terms of the ES and NQ's overall tone, every pullback was bought. In terms of the ES's overall trade, volume was low at 1.271 million contracts traded. The NQ settled at 25,574.75, up 313.00 points or +1.24%, also up two sessions in a row for a total gain of 676 points.

There was a lot of talk that Thursday's CPI was fudged — that the government shutdown delays in data collection meant the Bureau of Labor Statistics (BLS) couldn't gather all standard October/early November data, relying on estimates. More data was collected during the latter part of November, which included significant holiday discounts (Black Friday), pushing some prices down more than usual.

New York Fed President John Williams said Thursday's November inflation report was likely distorted by technical factors, echoing a chorus of economists and confirming the central bank will be eager for further data ahead of its late January policy meeting.

The report said annual inflation stood at 2.7%. In an interview on CNBC Friday morning, Williams said hurdles caused by the government shutdown may have pushed that rate down by roughly a tenth of a percentage point.

Before its next meeting, the Fed will get a look at December inflation data. With those figures, "I think we'll get a better reading of how big that distortion—how big the effect was," Williams said.

After the Fed's three straight rate cuts to end 2025, there is no rush to bring rates lower again, given that inflation remains above the Fed's 2% target, Williams said. Monetary policy is well-positioned, he added, echoing comments he made earlier this week. “I don’t personally have a sense of urgency to act further on monetary policy right now,” Williams said.

Holiday Trading Hours (CME)

Wed 24 Dec 2025 – Fri 26 Dec 2025

Product | Wed 24 Dec | Thu 25 Dec | Fri 26 Dec |

|---|---|---|---|

Interest Rates | 12:15 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Equities | 12:15 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Energy | 12:45 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Grains | 07:45 paused → 08:00 preopen → 08:30 open → 12:05 closed | — | 06:00 preopen → 08:30 open → 13:20 paused → 13:30 closed → 14:30 pcp → 16:00 closed |

FX | 12:45 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Metals | 12:45 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Livestock | 08:00 preopen → 08:30 open → 12:15 closed | — | 08:00 preopen → 08:30 open → 13:05 closed → 14:30 pcp → 16:00 closed |

Dairy | 12:00 closed | — | 16:00 preopen / 17:00 open / 13:55 closed |

Cryptocurrencies | 12:45 closed | — | 16:00 preopen / 17:00 open / 16:00 closed |

Lumber | 06:00 preopen → 09:00 open → 12:05 closed | — | 06:00 preopen → 09:00 open → 15:05 closed |

The Week Ahead

MONDAY, DEC. 22

None scheduled

TUESDAY, DEC. 23

8:30 am — GDP (delayed report), Q3: 3.2% vs. 3.8%

8:30 am — Durable-goods orders (delayed report), Oct.: -1.1% vs. 0.5%

8:30 am — Durable-goods minus transportation, Oct.: — vs. 0.6%

9:15 am — Industrial production, Oct.: 0.1% vs. 0.1%

9:15 am — Capacity utilization, Oct.: 75.9% vs. 75.9%

9:15 am — Industrial production, Nov.: 0.1% vs. NA

9:15 am — Capacity utilization, Nov.: 76.0% vs. NA

10:00 am — Consumer confidence, Dec.: 91.7 vs. 88.7

WEDNESDAY, DEC. 24

8:30 am — Initial jobless claims, Dec. 20: 225,000 vs. 224,000

THURSDAY, DEC. 25

None scheduled (Christmas holiday)

FRIDAY, DEC. 26

None scheduled

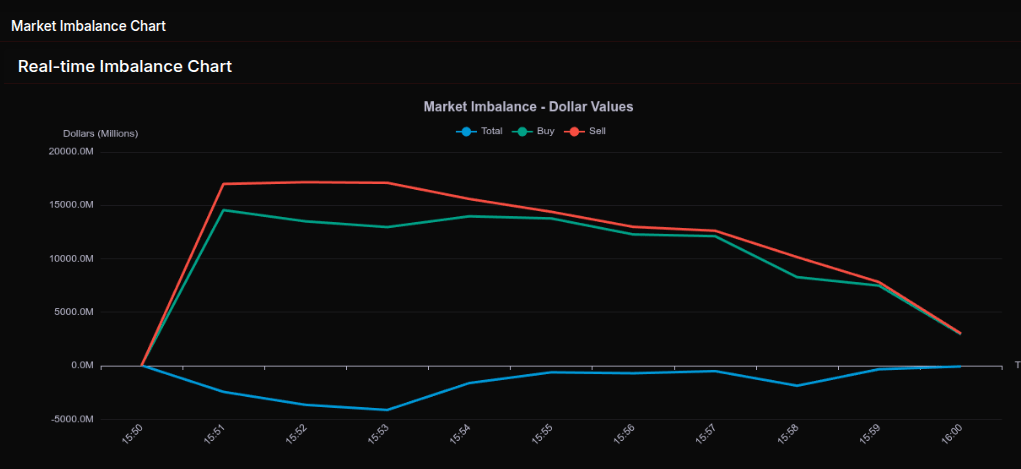

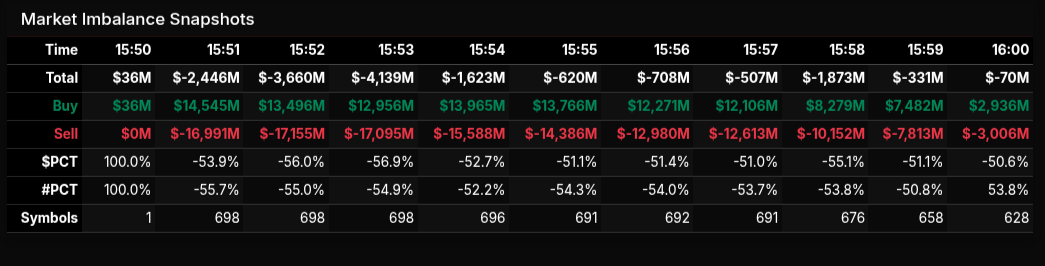

MiM

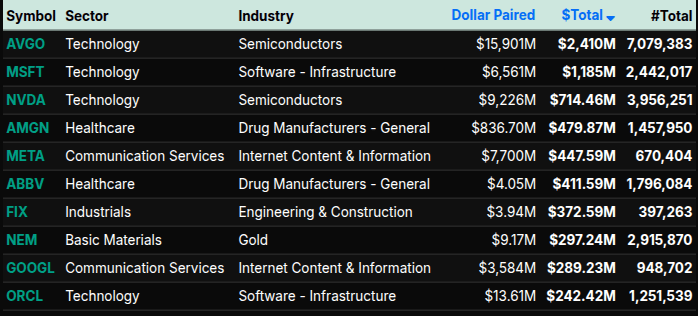

The Market-on-Close auction effectively began at 15:51, when participation expanded sharply and the true imbalance battle took shape. From that point forward, the session was less about a one-directional sell program and more about a prolonged, structured struggle between buyers and sellers. This was a triple-witching close, and the flows reflected positioning, hedging, and score-settling rather than panic or capitulation.

Between 15:51 and 15:53, total imbalance deepened as both buy and sell dollars surged in tandem. Buy interest consistently remained strong, holding above $12B for much of the window, while sell programs tracked closely alongside it. The net negative readings were driven not by disappearing demand, but by persistent, slightly heavier sell pressure layered on top of active buying. Symbol counts stayed elevated for nearly 700 names, confirming that this was broad participation tied to expiration mechanics.

As the auction progressed toward 15:55, the imbalance stabilized. Dollar flows on both sides compressed, but neither side fully disengaged. Percentage leans hovered near the -50% area, a key tell that this was rotational and mechanical rather than a wholesale liquidation. Buyers continued to absorb supply, particularly in higher-quality and index-heavy names, preventing the imbalance from accelerating further negative.

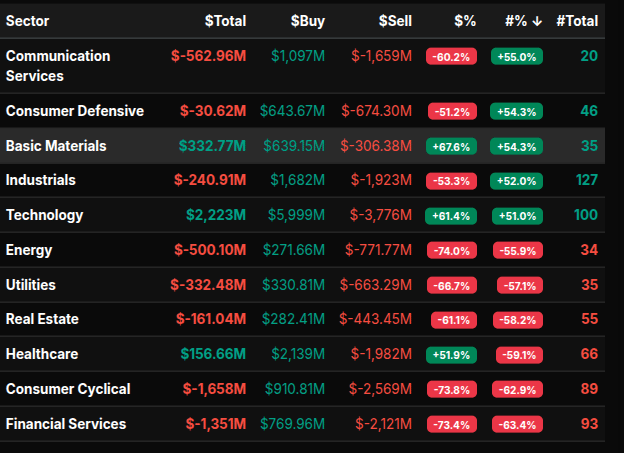

Sector behavior reinforced the two-sided nature of the close. Technology attracted consistent buy interest, led by large-cap semiconductors and software, while Healthcare and Basic Materials also saw selective accumulation. At the same time, Consumer Cyclical, Financials, Energy, and Industrials carried heavier sell imbalances, reflecting expiration-related adjustments and prior positioning being unwound.

Into the final minutes, selling pressure eased, but buyers did not press for control. The auction closed with a modestly negative net imbalance, masking the reality that both sides were highly active throughout. In the context of triple witching, this was a balanced, contested close—less about direction, and more about settling accounts before the books rolled forward.

Technical Edge

Fair Values for December 22, 2025

SP: 51.82

NQ: 224.9

Dow: 313.36

Daily Breadth Data 📊

For Friday, December 19, 2025

• NYSE Breadth: 53% Upside Volume

• Nasdaq Breadth: 70% Upside Volume

• Total Breadth: 66% Upside Volume

• NYSE Advance/Decline: 52% Advance

• Nasdaq Advance/Decline: 60% Advance

• Total Advance/Decline: 57% Advance

• NYSE New Highs/New Lows: 106 / 38

• Nasdaq New Highs/New Lows: 125 / 199

• NYSE TRIN: 0.77

• Nasdaq TRIN: 0.63

Weekly Breadth Data 📈

For Week Ending December 19, 2025

• NYSE Breadth: 48% Upside Volume

• Nasdaq Breadth: 51% Upside Volume

• Total Breadth: 50% Upside Volume

• NYSE Advance/Decline: 43% Advance

• Nasdaq Advance/Decline: 39% Advance

• Total Advance/Decline: 40% Advance

• NYSE New Highs/New Lows: 233 / 98

• Nasdaq New Highs/New Lows: 352 / 554

• NYSE TRIN: 0.81

• Nasdaq TRIN: 0.59

Calendars

Today’s Economic Calendar

This Week’s Important Economic Events

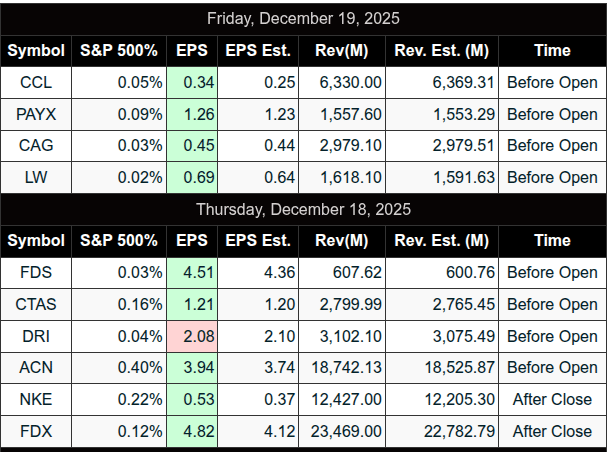

Upcoming Earnings

NONE

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, December 19, 2025

This session was packed with potential volatility, falling on a Triple Witching day and coinciding with a massive options expiration (~$2.3T in SPX and ETF deltas expiring). David provided insights from SpotGamma, noting that morning expirations could reduce negative gamma, potentially dampening volatility into the latter half of the day. However, the market gave us fireworks early.

Key Trades & Performance Highlights:

Set-Up #1 (Support Buy 6831–6835 ES):

Manny nailed this from the pre-market plan.

+5 pts early, followed by +10, and ultimately +50 pts as the market surged.

This setup was the trade of the day, providing multiple scale opportunities. An excellent example of respecting the plan and letting winners run.

Several members, including Bruce F and Manny, stayed in the trade or managed it masterfully as it ripped higher.

Target Zones Met:

Initial ES upside target zone 6845–6860 was quickly fulfilled.

Three-Day Cycle Objective at 6871.18 hit right on the money — David noted “anything more is gravy.”

NQ target zone also fulfilled early in the session.

Market Structure & Order Flow Lessons:

Price action respected levels beautifully, reinforcing the value of pre-market prep and delta/order flow confirmations.

P-type profile formed midday, as noted by Manny, suggesting short-covering and a potential bullish continuation bias.

Into the close, a $1.4B MOC sell imbalance was noted, but the market held its bid, finishing strong — an encouraging sign heading into the “Santa Claus Rally” next week.

Disruptions & Risk Management Wisdom:

High winds and flooding in David’s area caused multiple connectivity issues.

David made the prudent call to shut down his live account, emphasizing “control what I can control” — a solid risk management takeaway.

Members kept the room lively and productive even during David’s absences — a testament to the community’s maturity and preparation.

Key Lessons & Takeaways:

Trade Planning Pays: Set-up #1 was textbook — a reminder that quality zones + confirmation lead to high-R:R opportunities.

Stay Flexible: On triple witching days, volatility can surprise in either direction — today was a strong upside move with early momentum.

Risk Management First: David’s example of sidelining his live account due to external risks reinforces the discipline required for longevity.

Community Engagement Matters: Despite wild weather and a partially remote lead, the room stayed positive, focused, and profitable.

Looking Ahead:

Markets held strength into the close, setting up nicely for the Santa Claus Rally next week.

Traders are encouraged to rest, review, and return Monday ready for potential year-end opportunities.

DTG Room Preview – Monday, December 22, 2025

Markets enter Christmas week with all major U.S. indexes trading within 3% of all-time highs. U.S. equity markets close early Wednesday (Dec 24, 1:15pm ET) and remain shut Thursday for Christmas. Friday reopens normally, but expect light volumes—likely to stay thin into New Year's week. Many global markets will be closed on Friday.

Key this week: Conference Board consumer confidence (Tuesday). Recent UoM sentiment data rose modestly MoM but remains 28% below December 2024. Housing continues to grind higher, though 2025 may close with the weakest home sales in 25 years.

BOA notes consumer spending is dominated by higher-income households, while ~25% of U.S. homes face financial stress. The "K-shaped economy" narrative persists.

Santa Rally? Maybe. Analysts cite a dovish Fed, soft labor data, and cooling inflation supporting equities—but valuation concerns cap upside.

Gold and Silver surged to record highs, driven by rate cut bets and rising geopolitical risks. Both are on track for their best year since 1979. Tensions rise with U.S. sanctions on Venezuela and Ukraine’s attack on a Russian shadow fleet tanker.

Volatility remains steady but may contract in this shortened week. ES 5-day average range is down to 85 points.

Technicals (ES):

Cleared short-term downtrend channel top (6791/86s) – bullish

Closed above 50-day MA (6854.25) – bullish

Key Resistance: 7070/75s, 7478/83s

Key Support: 6805/10s, 6702/97s, 6351/46s

No major economic data today. No overnight whale bias.