- The Opening Print

- Posts

- S&P 500: The Higher It Goes, The Lower The Volume

S&P 500: The Higher It Goes, The Lower The Volume

Follow @MrTopStep on Twitter and please share if you find our work valuable!

FREE Two Week Offer for the Opening Print Premium. Open up the Lean and other premium features for the next Two Weeks!

Our View

After an over 20% rally in the S&P, one of the most influential bankers in the world is sending warning signals about the health of the US stock markets.

The ES opened at 5971.00, made a low at 5950.75, and stayed in a 20-point trading range until hen it broke down to the 5927 level just after 3:00. I posted this in the chat:

IMPRO : Dboy : (3:31:52 PM): I think ES trades 5960

ES traded up to 5953 at 3:41, then up to 5961 after the 3:50 imbalance came out at $1.3 billion to sell.

The higher the ES and NQ go, the lower the volumes fall. Yesterday's total volume was just over 1 million contracts traded.

Out of the Magnificent 7 stocks, only TSLA stood out after Musk commented that he would significantly cut back on his political spending and that he expected to remain head of Tesla five years from now.

Gold futures rose $51.00, settling at $3,284.60, and the U.S. Dollar Index (DXY) closed at 100.36, down 0.07% from the previous close of 100.43. Bitcoin had a slow day, down 0.38%.

IMPRO : BTS : (9:30:02 AM): ES1 Globex Closed @ 5962.00 H:5993.50 L:5955.25 O:5980.00 O₂C: -18.00 (-0.30%) C₂C: -19.25 (-0.32%)

IMPRO : BTS : (9:30:04 AM): Cash Open @ 5962.00, -19.25 (-0.32%) from yesterday’s cash close.

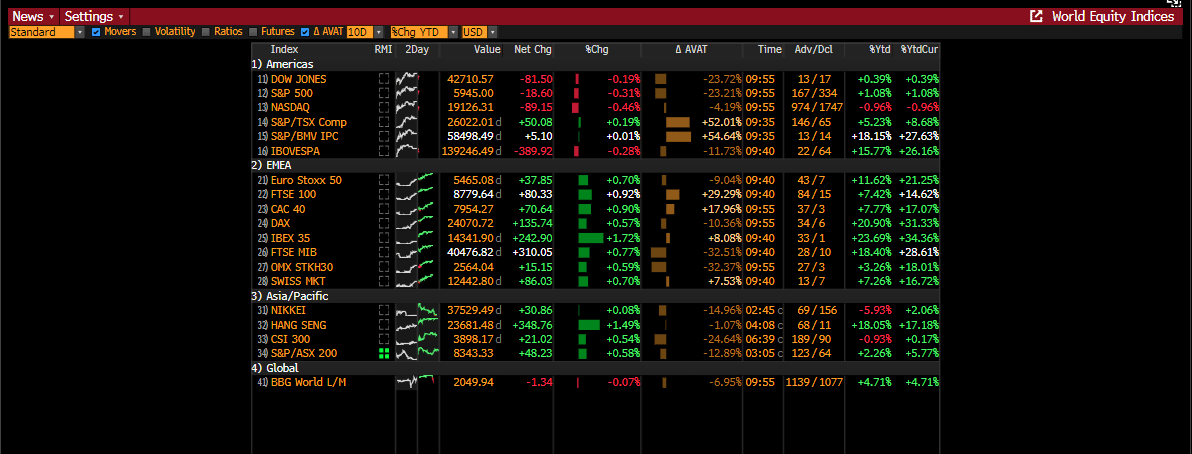

As we all know, there has been a record amount of money moving out of the US to Europe. One of the traders in the MTS chat posted this: "Check out the rest-of-world outperformance YTD — and currency-adjusted is even more."

Some of these European markets are not only outperforming the ES, they are killing it. The IBX is up almost 24%, the DAX is up 20%, the FTSE is up 18%, and the Hang Seng is up 18%. That is a big spread when you consider the ES is up 1% and the NQ is down about 1% YTD.