- The Opening Print

- Posts

- Rate-Cut Dreams Meet Reality — Chop City, Population: You

Rate-Cut Dreams Meet Reality — Chop City, Population: You

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

The ES traded up to 6953.75 after the Trump/Xi meeting. Trump said at the end of the meeting: "We have not too many major stumbling blocks," speaking of a formal trade agreement. "We have a deal. Now, every year, we'll renegotiate the deal. But I think the deal will go on for a long time. Long beyond the year, we'll negotiate at the end of a year."

Trump said the 20% tariffs on China related to fentanyl were being reduced to 10%, bringing the total amount of duties imposed on Chinese imports from 57% to 47%. Part of the agreement eased restrictions on rare earth and included an agreement on fentanyl and the purchase of U.S. grains.

After the meeting, the ES and NQ fell.

Market Recap

Some people don’t trade on Fed days, and some do.

The people that don’t have probably lost, and the people that do probably lost too. Why? Because Fed decision day is known for volatile trading and losses.

The ES traded 6942.00 on Wednesday's regular session open, sold off down to 6936.00, and then rallied up to a 6952.00 double top and high for the day.

Early on, the NQ acted firmer than the ES, but as the ES started the slow grind lower, the NQ started to fall apart.

Doing a play-by-play today just won’t work—there were just too many dips and rips to keep track of.

After 10:15, the ES traded down to 6939.25 at 10:12, made a lower high 6946.25 at 10:39, then sold off down to 6930.00 at 12:03. It rallied back up to 6942.50 at 12:45, pulled back to 6937.25, revisited 6942.50, and dropped down to the 6930.25 level.

It traded up to 6942.00 at 2:00, dropped down to 6927.50, rallied up to 6942.00 at 2:33—and that’s when this headline hit the tape:

POWELL: RATE CUT IN DECEMBER IS 'FAR FROM' FOREGONE CONCLUSION

And that’s when Powell started talking. The ES fell 59.50 points down to 6882.25 at 2:39, rallied up to 6923 at 2:54, sold off down to 6894.75 at 3:36, then traded up to 6927.25.

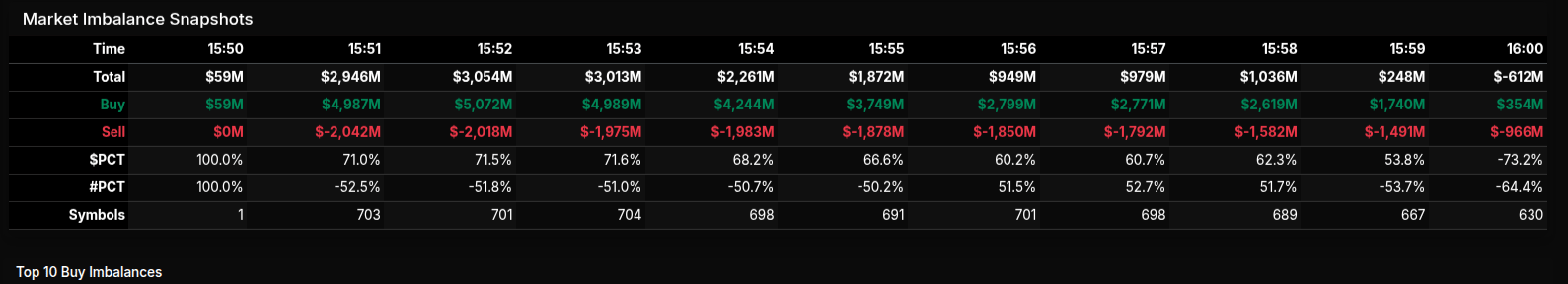

It traded 6916.50 as the 3:50 imbalance showed $3 billion to buy and rallied up to 6946.75 on the 4:00 cash close.

#META #MSFT #GOOG

GOOG reported first and surpassed Wall St expectations. MSFT came second and beat revenue and earnings per share (EPS) estimates for its first fiscal quarter. Azure cloud revenue grew 40% year-over-year.

Then META bombed out, reporting revenue that beat expectations—but net income and diluted EPS were significantly impacted by a one-time, non-cash tax charge of nearly $16 billion. The company attributed the tax charge to the "One Big Beautiful Bill Act."

I really can't tell you what was what after that. The ES sold off down to 6905, rallied back up to the 6929.50 level, and settled at 6922.75, down 3 points or -0.04%, breaking a 4-day winning streak.

The NQ settled at 26,252.50, up 99 points or +0.38% on the day and up 5 days in a row for a total gain of 1,223.75 points or 4.80%.

In the end, the ES and NQ started doing a weird chop. They would both go bid and then downtick right away. That’s when I posted this:

IMPRO Dboy (10:13:20 AM): I think there is a lot of risk. It was a shift in the price action.

In terms of the ES and NQ’s overall tone, they both took a hit but made a nice late recovery. In terms of the ES’s overall trade, volume was high: 1.46 million contracts traded.

On Tap

9:55 — Fed Vice Chair for Supervision Michelle Bowman speaks

4:00 — After the Bell: AAPL and AMZN

MiM

The 3:50 PM Market-on-Close (MOC) imbalance showed a broad-based $2.95B to buy, signaling strong institutional demand into the bell. The buy pressure was driven primarily by the Nasdaq ($2.73B buy) and S&P 500 ($2.84B buy), while the NYSE lagged with a smaller $431M buy. The overall lean of +71% confirmed a clear directional bias rather than rotation, with Nasdaq leading the flow at +87% buy vs. +61% weighted direction, a hallmark of aggressive accumulation.

From 15:50 to 16:00, the total imbalance climbed sharply from just $59M to $3.05B, peaking near 15:52 before gradually fading into the close as paired-off volume increased. The decline into the bell was mechanical, typical of order matching, not sentiment reversal. Technology names dominated participation, accounting for more than half of total imbalance value.

Sector breakdowns underscored the tech leadership:

Technology saw a massive $2.34B total imbalance with +90% buy lean, reflecting sustained demand across semiconductors and software.

Communication Services followed with +74.6%, driven by GOOG and META.

Industrials and Consumer Cyclicals posted moderate positive leans (+63% and +70%), while Real Estate and Utilities were hit hard with heavy sells (−72.5% and −74.9%).

Among symbols, NVIDIA (NVDA) led the board with a $1.37B paired imbalance and $555M to buy, followed by Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA)—collectively representing over $1.5B in net buy interest. On the sell side, Regeneron (REGN), Texas Instruments (TXN), and Oracle (ORCL) showed concentrated liquidation, hinting at rotation out of biotech and legacy semiconductor names.

Overall, today’s MOC reflected a wholesale tech-sector buy program, with institutional flows overwhelmingly favoring semiconductors and AI-linked large caps. The lean metrics above +70% across NASDAQ and S&P sectors confirm conviction buying rather than passive rotation.

Guest Posts:

Technical Edge

Fair Values for October 23, 2025

S&P: 30.55

NQ: 135.59

Dow: 149.26

Daily Breadth Data 📊

For Wednesday, October 29, 2025

• NYSE Breadth: 33% Upside Volume

• Nasdaq Breadth: 42% Upside Volume

• Total Breadth: 41% Upside Volume

• NYSE Advance/Decline: 29% Advance

• Nasdaq Advance/Decline: 31% Advance

• Total Advance/Decline: 30% Advance

• NYSE New Highs/New Lows: 152 / 110

• Nasdaq New Highs/New Lows: 332 / 175

• NYSE TRIN: 0.67

• Nasdaq TRIN: 0.60

Weekly Breadth Data 📈

For the Week Ending Friday, October 24, 2025

• NYSE Breadth: 57% Upside Volume

• Nasdaq Breadth: 57% Upside Volume

• Total Breadth: 57% Upside Volume

• NYSE Advance/Decline: 74% Advance

• Nasdaq Advance/Decline: 67% Advance

• Total Advance/Decline: 73% Advance

• NYSE New Highs/New Lows: 229 / 66

• Nasdaq New Highs/New Lows: 595 / 257

• NYSE TRIN: 2.12

• Nasdaq TRIN: 1.52

S&P 500/NQ 100 BTS Trading Levels (Premium Only)

Calendars

Economic Calendar Today

This Week’s High Importance

Earnings:

Released

Trading Room News:

PTG Room Summary – Wednesday, October 29, 2025 (FOMC Day)

Overview of the Day:

Today’s trading session was driven by anticipation of the FOMC rate decision and featured disciplined execution across both CL and ES. PTGDavid provided solid leadership with structure-focused guidance. Several traders, including Manny, Bosier, and Slatitude39, shared quality setups and trade management insights. The day demonstrated strong alignment between PTG methodology and market behavior, particularly around VWAP, gap fills, and the Daily Money Boxes.

Positive Trades and Setups:

CL OPR Long Trade

David initiated a long in CL early in the session, hitting TGT1 quickly and eventually all targets. The trade was managed with scaling and a trailing stop, reflecting a clean execution of the OPR strategy.

ES Lean Long Above VWAP

David called a bullish lean above VWAP, which offered intraday opportunities for upside continuation. This setup guided several traders, including Roy and Manny, through trades in alignment with structure.

Manny’s Early Scalps

Manny executed a morning trade, trimming into strength and exiting flat with a solid gain of about 7 points. He highlighted the importance of banking early profits during high-risk macro days like FOMC.

Bosier’s Short and Re-entry Strategy

Bosier traded multiple short attempts with good structure. He scaled in, took partial profits around the 35 level, and used order control (OCOs) to manage risk. YM and RTY alignment helped him stay confident in the trade.

Gap Fill Called in Advance

David called for a gap fill around 10:39 AM. This scenario played out perfectly post-FOMC announcement, reinforcing the power of structured planning and patience.

Slatitude39’s Range Target Trade

Slatitude entered long at 84 using the PTG Daily Range Target Calculator and took +18 points. He credited the tool for helping identify high-probability setups and shared plans to deepen his study of the PTG indicators.

Lessons and Insights:

Backup and Platform Stability

Bruce and Manny emphasized the need for daily backups in NinjaTrader. Loss of strategy data created unnecessary stress. It's a reminder to protect your trading environment as much as your capital.

Discipline Over Impulse

The room discussed handling trades with moving average reversals and re-entries. The value of structured, rules-based re-engagement was emphasized.

Using Delta and Order Flow

Manny offered a precise order flow read, identifying lack of follow-through on an upside probe. His exit was timely and underscored how delta divergence can be a strong signal to reduce or exit.

FOMC Reaction Requires Patience

The Fed announced a 25bps cut, signaled the end of balance sheet reduction, and noted one dissent for a 50bps cut. The initial market reaction was muted, reinforcing the importance of waiting for Powell’s press conference before acting on headline news.

Educational Momentum

Slatitude's success using the Range Target Calculator inspired others to revisit PTG tools. He plans to begin charting levels daily, signaling commitment to a deeper, structured trading approach.

FOMC Recap:

Fed cut rates by 25bps

Balance sheet runoff to end Dec 1

One dissenter favored a 50bps cut

Powell later clarified that a December cut is "far from a foregone conclusion"

Market reacted slowly at first but eventually completed the gap fill as forecast earlier by David.

End-of-Day Wrap:

ES moved cleanly from the upper to lower D-Level Money Box

Market digested Powell’s comments and stabilized into the close

Focus turned to after-hours tech earnings from Microsoft, Meta, and Google

A $3 billion MOC buy imbalance was noted late in the day, adding upward pressure

Key Takeaways:

PTG structure continues to provide reliable intraday targets and ranges

Proper trade management (especially on Fed days) is crucial to protect gains

Delta and order flow reads remain essential tools for confirmation or early exits

Members using PTG tools, like the Daily Range Calculator, are finding success when they follow levels and stay disciplined

A solid session overall. The room maintained strong situational awareness and composure throughout a news-heavy day.

DTG Room Preview – Thursday, October 23, 2025

Morning Market Brief – Oct 30, 2025

The Fed cut interest rates by 25bps as expected, but internal division emerged: one governor pushed for a 50bps cut, while another dissented in favor of holding steady. With limited data due to the government shutdown, Fed Chair Powell cited disagreement about December’s path. Markets are processing this alongside mixed Big Tech earnings and modest progress from the Trump-Xi meeting, including U.S. tariff cuts and renewed Chinese soybean purchases.

In trade, Trump announced deals with South Korea and Japan, but tensions rose with Canada over a controversial ad, prompting threats of additional tariffs. The Senate voted to end Trump’s 50% Brazil tariff, and U.S.-India talks aim to cut theirs from 50% to ~15%. The Supreme Court is set to review Trump’s reciprocal tariffs, which could result in major policy reversals and refunds.

Geopolitically, Trump said the U.S. will resume nuclear weapons testing after Russia showcased new nuclear capabilities, despite initial plans to push a disarmament treaty with China.

Earnings movers: Alphabet surged ~6%, while Meta and Microsoft slid ~8% and ~4%, respectively. Amazon and Apple report after the bell. Premarket earnings are heavy with names like LLY, MA, MRK, BMY, and CI.

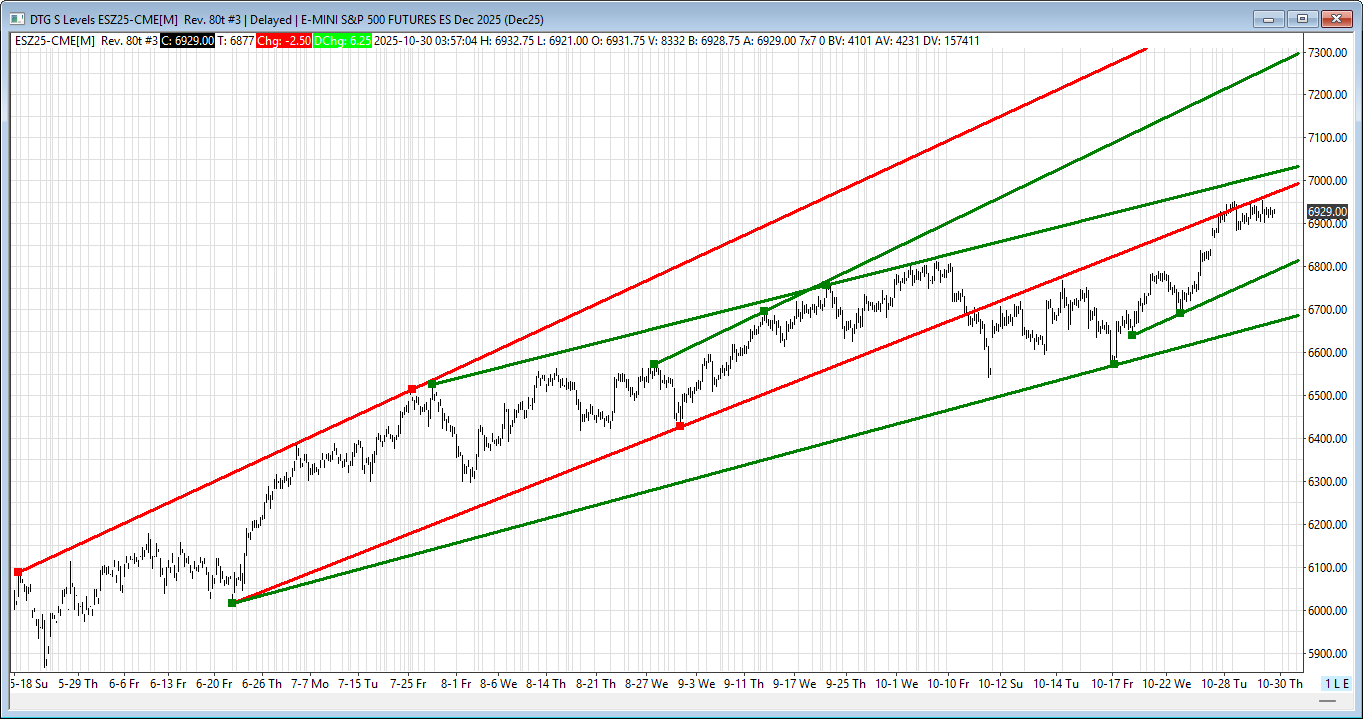

Despite recent Fed-driven spikes, volatility is compressing; the ES 5-day ADR fell to 67.25. Technical levels in focus:

Resistance: 6973/78, 7024/29, 7308/13

Support: 6807/12, 6684/89

Bearish bias holds amid light overnight whale volume.