- The Opening Print

- Posts

- Patterns Make the World Go Round

Patterns Make the World Go Round

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Over the years, I have named so many patterns that I can't remember them all. There are definitely certain patterns that exist in the S&P futures that have to be part of your trading toolbox. I know your charts may not show what I'm talking about, but many of these patterns are staring you in the face. They are not hard to see—in fact, you see them all the time.

The pattern I’m going to talk about was part of a very profitable trading methodology called “momentum trading,” and it has not worked in over 25 years. I’m sure you’ve heard me say that the ES usually rallies when it closes weak. Well, that’s exactly what it did after Tuesday’s weak close—it rallied on Globex up to 6302.00.

Many moons ago, I remember a time when you could sell a “break” (sell into weakness), but as time went by and I started doing the UBS S&P program trading, I noticed that when I was doing sell programs late in the day and the SPU closed weak, it always rallied the next day or on Globex. This also coincided with some of the big macro hedge funds that used the desk to sell late in the day and near the lows. The futures could not have looked worse. All day, the ES was higher, then it sold off, closed on the lows of the day—and then rallied.

I think in the early days of algorithmic trading, there was a component geared to buying when everyone was selling and selling when everyone was buying.

I base a lot of how I trade on different daily patterns I’ve picked up over time. Some of the patterns are in the MrTopStep Trading Rules 101. Some don’t work anymore, but some do. The new rule today is called the “Double Pump.”

nq slow walking IMPRO : Dboy : (9:34:13 AM): One of the patterns I look at on selling the gap-ups is what I call the double pump. You sell the gap, it sells off, and then does another push up that fails.

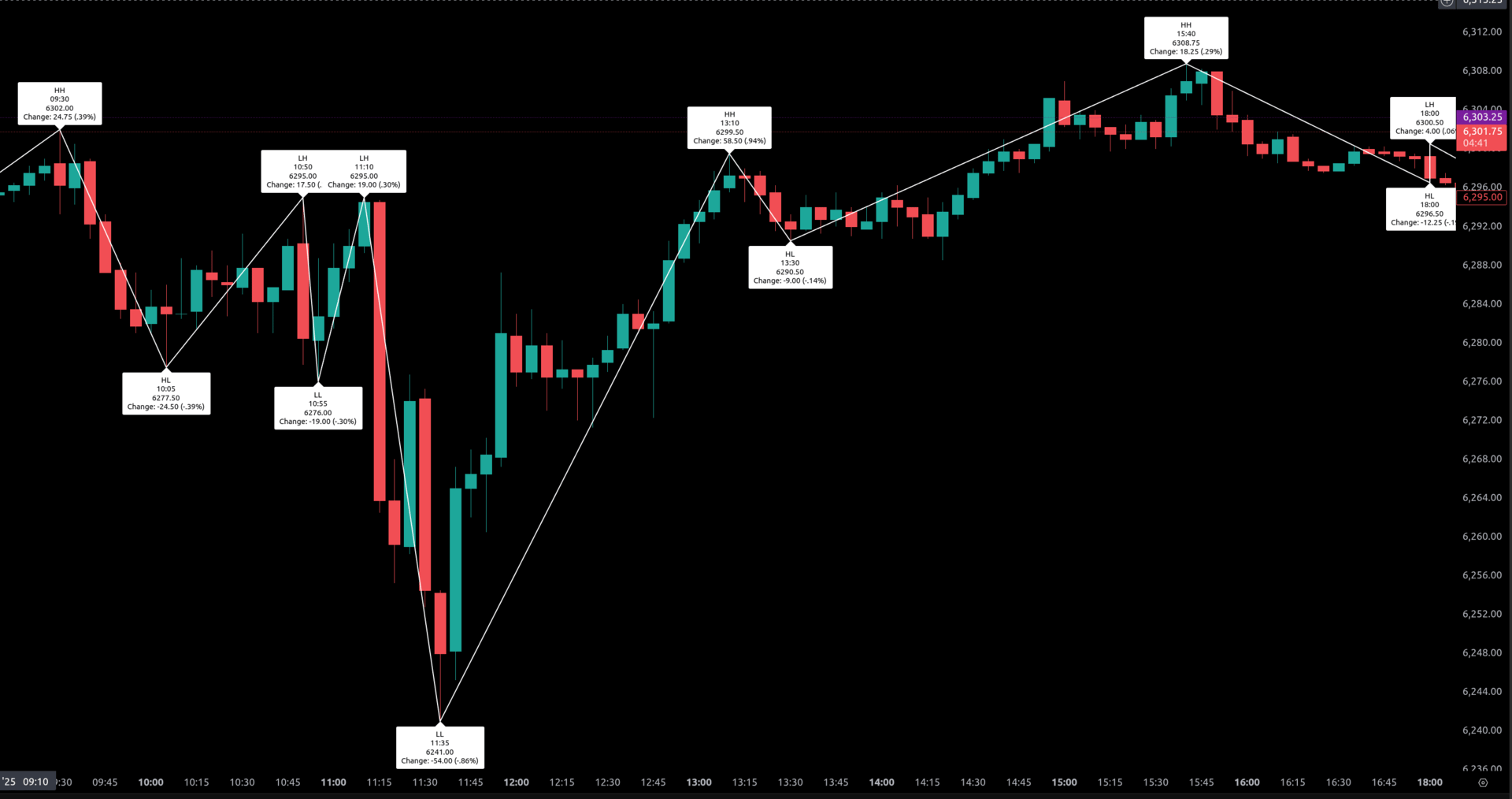

After the 9:30 open, the ES sold off right away, did the double pump back up to the 6296 area, dropped all the way down to 6241, and then rallied all the way back up to 6308.75 late in the day.

Insanity at its Best:

(10:50:20): Trump asked GOP lawmakers if he should fire Fed Chair Jerome Powell, sources said.

(11:17:05 AM): BREAKING: White House official: Trump is likely to fire Powell soon.

(11:33:14 AM): Trump has drafted a letter to fire the Fed Chair – NYT.

(11:36:40): Trump: “Highly unlikely I will fire Federal Reserve Chair Jerome Powell.”

I remember when I was asked to speak at the University of Chicago in front of 200 finance students. True story. I was chosen by a guy who went to UoC and knew me from the floor. It was just after Globex went online in 1992. Everyone in the auditorium looked like a young brainiac. They were studying how to write trading codes for algos and automated trading programs.

I was the only floor guy there out of 15 speakers. When they introduced me and I walked up to the podium, the crowd could see my red CME trading jacket with my DBOY badge, trading cards, and orders hanging out of my pockets—and the crowd started cheering and clapping their hands. Everyone in the room thought the floor was done.

TT, CQG, Schwab, ABN—I can’t remember all the old companies, but they were all there pushing their trading platforms and clearing services. When I got up to the podium, I introduced myself, adjusted the mic, and thanked everyone. Then I said:

“The Man vs Machine is not over,” and that’s when it started getting louder and then a guy in the front row who was pushing his platform (I think it was Charles Schwab) said, “Your days are over, the floors are finished.” I got quiet, then I looked at him and said, “Schwab has people on the trading floor, right?” He responded, “Yes, we do.” I asked him why if he thinks the floor is ‘over’ and he said to back up the platform if it goes down. The room completely blew up. Then he asked me how many years I thought I had left on the floor, five? I said 25, and everyone in the room was laughing and shaking their heads. I explained that at the end of the day, it’s the customer’s choice, but no way could the platform beat calling a desk on the floor and getting a quote on a 4-way spread vs using an options platform to enter all those symbols.

Our Lean

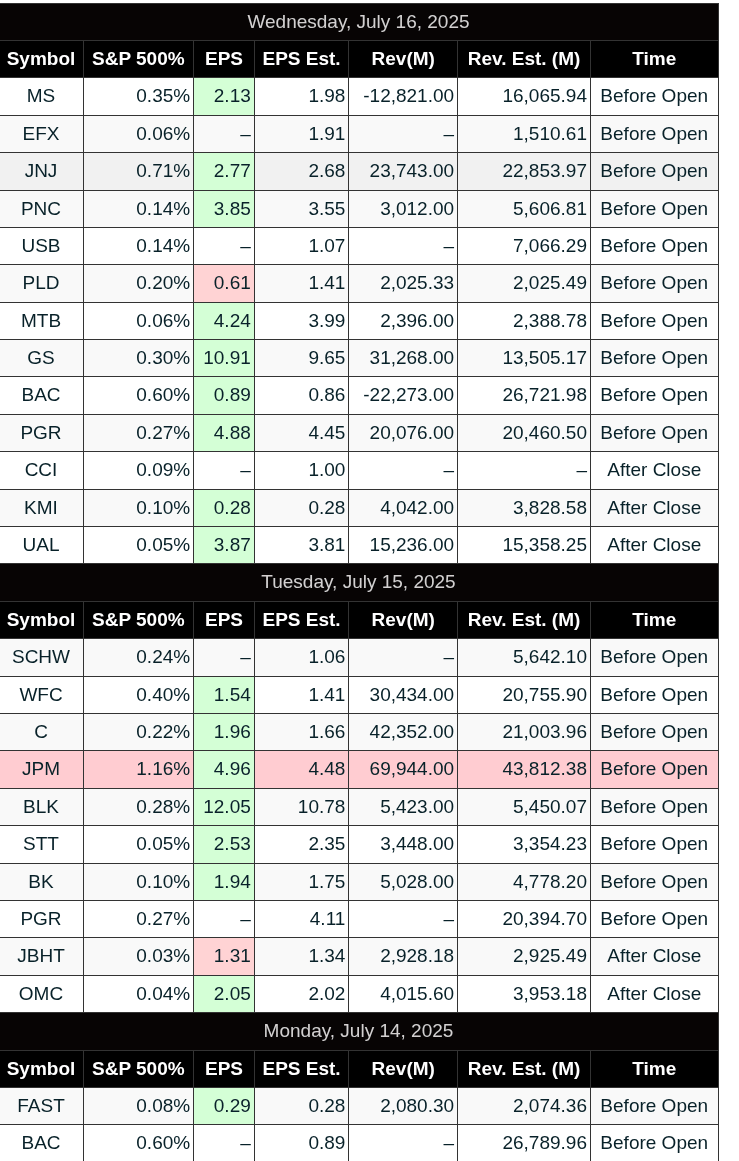

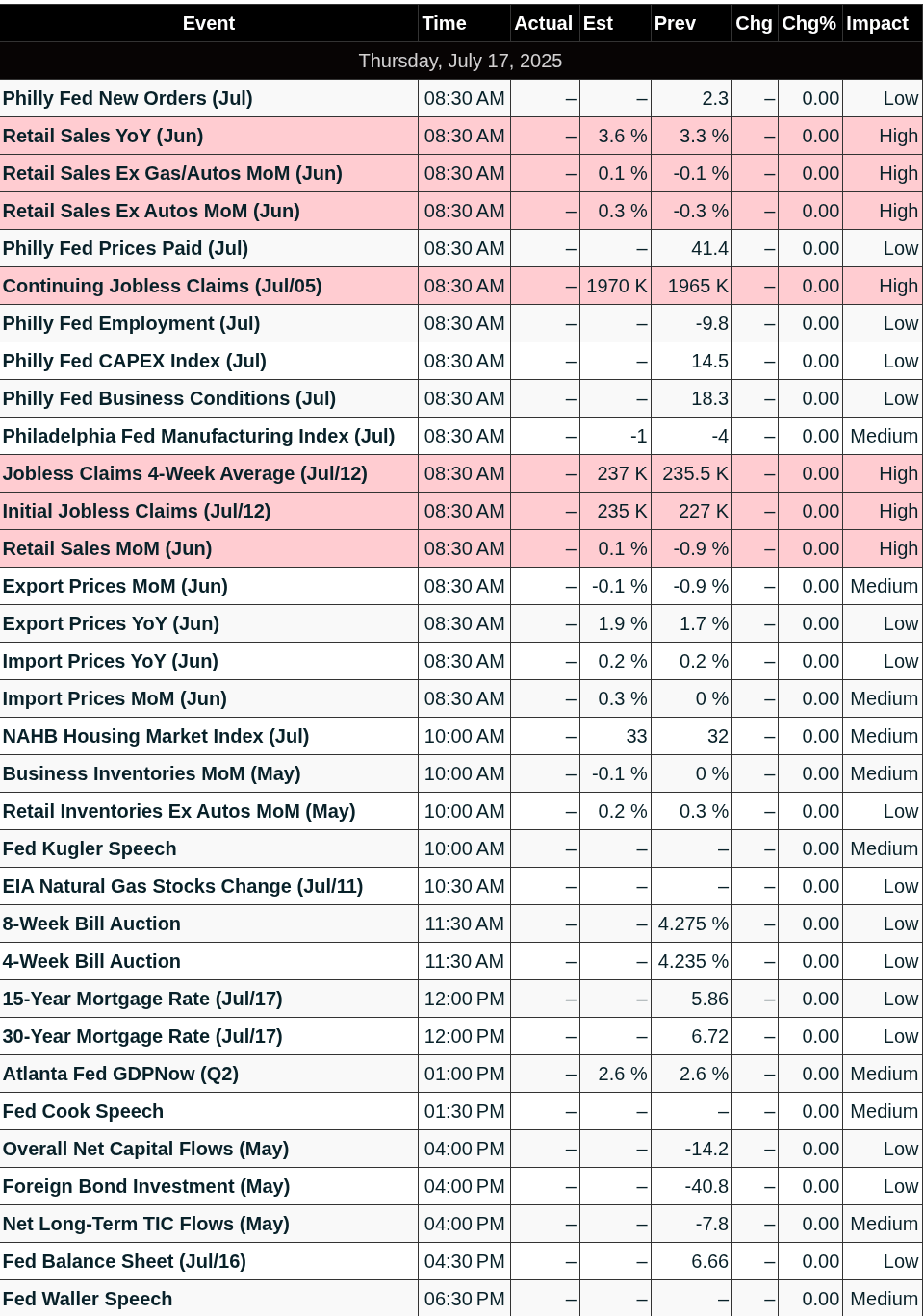

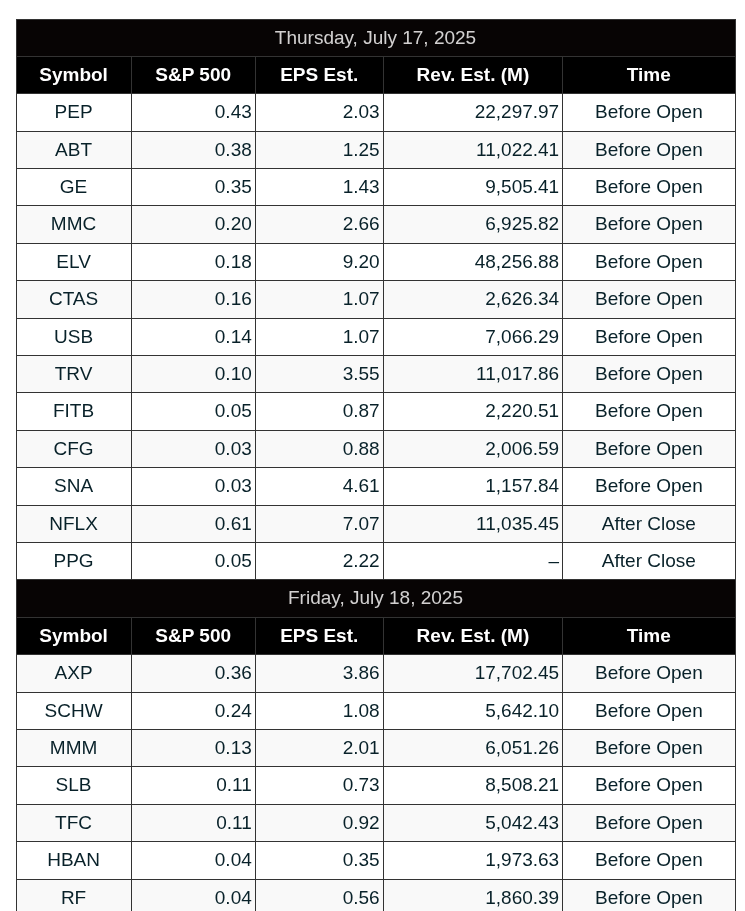

There are seven economic reports and four Fed speakers. Before the bell: Taiwan Semiconductor Manufacturing, Abbott Laboratories, PepsiCo, E, U.S. Bancorp, Travelers, and Fifth Third Bancorp. Netflix reports after the bell.

I don’t get it or understand it, but traders are pricing in more than a 50% chance of a September Fed rate cut.

Our lean: I think this is going to be another day of two-way trading. While the ES did recover from the plunge, the rallies have been failing at the 6300–6320 area. On the downside, the 6240 level is in play. My gut says we are going back up, but I am concerned about how the futures act after they rally.

MiM and Daily Recap

Intraday Recap:

Wednesday's ES session began with modest strength in the Globex hours and traded in a narrow range until hitting a low at 3:10 AM of 6257.75. From there, prices rose consistently into the open, putting in the Globex high of 6300.50 at the open. However, sellers quickly stepped in, driving ES to 6277.50 by 10:05 AM and extending the decline to 6276.00 at 10:55 AM. This early morning weakness erased 24.50 points (-0.39%) from the overnight high.

The market rebounded sharply from the 10:55 AM low, staging a rally that peaked at 6255.00 by 11:10 AM. However, the bounce was short-lived as sellers pushed the index to a new low of 6241.00 by 11:35 AM, the session’s deepest pullback and the ultimate intraday low.

From there, sentiment shifted bullishly. A steady climb began just before noon and extended into the early afternoon, culminating in a powerful rally to 6299.50 at 1:10 PM. This 58.5-point surge (+0.94%) off the morning low helped flip the tone for the rest of the day. A minor pullback to 6290.50 at 1:30 PM (-9.00 points) found support, and the market resumed climbing.

A second rally wave crested at the session high of 6308.75 at 3:04 PM, representing an 18.25-point push from the 1:30 PM pivot. However, late-day trading turned choppy, with the ES dropping to 6296.50 at 4:00 PM, followed by another minor bounce to 6300.50. The regular session closed at 6302.75, up 4.25 points (+0.07%) from its open and 20.50 points (+0.33%) from the prior day’s settlement.

Volume was strong, with the regular session posting 1.21 million contracts and the full session totaling 1.41 million. The full session closed at 6299.00, marking a 25.25-point gain (+0.40%) open to close or 20.50 (0.33%) cash close to close.

Market Tone & Notable Factors:

The day unfolded with early downside pressure but resolved into a resilient, bullish tone led by strong midday buying. The cash session’s narrow +0.07% open-to-close gain masked the strength beneath the surface as bulls defended key supports and propelled ES to a higher high late in the day.

Despite bullish price action, the Market-on-Close (MOC) imbalance painted a different picture. The final imbalance showed -$2.1B to sell, with only 60% of symbols leaning sell.

That said, sellers failed to break any meaningful downside levels after the 11:35 AM low, and the continued strength into the cleanup session suggests buyers retained control despite the soft MOC tone. Cleanup trading ended modestly lower at 6299.00, down 4.00 points from the 4:00 PM close.

Overall, Wednesday’s action was marked by a strong midday reversal and solid upward continuation, reinforcing a bullish bias heading into Thursday’s session.

Guest Posts:

Dan @ GTC Traders

The Problem with the Global Macro “Hook”

Many trading services thrive on the chaos of global macro events … CPI surprises. Fed pivots, and geopolitical flare-ups. Hooking you with “urgent” newsletters or podcasts that imply your portfolio’s survival depends on their next hot take. Why? They want you tethered to their commentary, subscribing forever for the next big macro insight. We reject that model. Our goal is to free you from dependency, showing you how robust programs can trade through market noise without straying from their calibrated variances. At GTC Traders, we’ve built our reputation on clarity and discipline, not on flashy promises or sensational narratives.

Don’t get us wrong: we comment on global macro events when they impact markets. We’ve watched CPI prints move indices, central bank decisions shift yields ripple through supply chains. But here’s where we differ: we are not going to pretend that Global Macro is the key to pulling trade triggers. Our programs at GTC Traders … whether Equity Fixed Income, Long-Short Valuation, or Short-Term Trading … are designed to be resilient. They’ve weathered every economic storm of the last several years without needing tweaks or adjusted signals. From the 2022 inflationary spike through the Tariff announcements … our systems stayed within their statistical bounds, delivering consistent results.

So why do we pay attention to global macro at all? It’s not about chasing headlines or predicting the next black-swan event (which is impossible by the way). Instead, it’s about situational awareness. A clear-eyed view of the market landscape. Global macro events subtly shift the inputs to our models. For instance, during our “Bubble” series, we highlighted how upside volatility in month-over-month returns has slowly drifted higher. That’s not a signal to overhaul our programs; it’s a prompt to research how these dynamics interact with our existing models. If intra-month downside volatility compression has been creeping higher over time, do we layer in one of an already existent robust short programs to balance it? If a tariff expansion announcement hits the day after a trade signal instead of four days before, how does that affect outcomes? Would the program still hold within its variance?

These questions aren’t about reacting to every macro blip with a trade. They’re about understanding how the environment evolves and ensuring our systems remain anti-fragile; such that they are not curve-fit. Our programs are built to handle chaos, not add to it. A properly constructed system doesn’t need daily macro updates to function. It thrives because it’s designed to absorb shocks and despite them. Not because it’s chasing the latest narrative.

The “hook” of macro-driven services is seductive but flawed. They sell the idea that you need their proprietary lens to navigate markets, keeping you dependent on their next call. That’s not a program; it’s a marketing ploy. We want traders to develop their own process, and empower them to understand trading. Not trust me, or anyone else as ‘the pundit’ or ‘guru’. Our models … Quantitatively rigorous, diversified across strategies … don’t rely on macro forecasts to generate edge. They’re built on statistical frameworks, like the Markov state processes we’ve discussed, that focus on current market conditions. They don’t speculate about the past or try to predict the future.

Consider the 2021 supply chain crunch. While others fixated on predicting when port congestion would ease, we focused on how our programs performed through the volatility. The answer? They held steady, because they’re designed to adapt to shifting regimes, not to bet on specific outcomes. When tariffs sparked front-loading in shipping, we didn’t chase the surge; we studied how it altered volatility patterns and confirmed our models stayed within bounds.

Global macro matters, but not as a crystal ball. It’s a lens for understanding the terrain, not a trigger for trades. Our research into macro effects? Whether it’s yield curve shifts or commodity spikes … helps us refine our awareness, not rewrite our playbook. We don’t claim to have a secret sauce for modeling global economics. Economic modeling is fiendishly complex, and anyone promising you a perfect macro edge is likely selling a story, not a strategy.

Our advice? Focus on what you can control. Build or follow programs that are robust, diversified, and grounded in data, not headlines. At GTC Traders, we’re not here to hook you with macro drama. We’re here to help you trade through it, with systems that stand firm no matter the noise.

Until next time, stay safe ... and trade well.

Technical Edge

Fair Values for July 17, 2025

S&P: 39.3

NQ: 166.19

Dow: 210.9

Daily Breadth Data 📊

For Wednesday, July 16, 2025

• NYSE Breadth: 61% Upside Volume

• Nasdaq Breadth: 76% Upside Volume

• Total Breadth: 74% Upside Volume

• NYSE Advance/Decline: 60% Advance

• Nasdaq Advance/Decline: 67% Advance

• Total Advance/Decline: 64% Advance

• NYSE New Highs/New Lows: 48 / 40

• Nasdaq New Highs/New Lows: 128 / 74

• NYSE TRIN: 0.88

• Nasdaq TRIN: 0.58

Weekly Breadth Data 📈

For the Week Ending Friday, July 11, 2025

• NYSE Breadth: 50% Upside Volume

• Nasdaq Breadth: 61% Upside Volume

• Total Breadth: 57% Upside Volume

• NYSE Advance/Decline: 45% Advance

• Nasdaq Advance/Decline: 45% Advance

• Total Advance/Decline: 45% Advance

• NYSE New Highs/New Lows: 264 / 35

• Nasdaq New Highs/New Lows: 453 / 157

• NYSE TRIN: 0.81

• Nasdaq TRIN: 0.51

S&P 500/NQ 100 BTS Trading Levels (Premium Only)

Trading Room News:

Polaris Trading Group Summary: Wednesday, July 16, 2025

Wednesday’s trading session in the PTG room unfolded with textbook structure, emotional discipline, and valuable lessons—especially for newer members.

Market Context & Strategy

Early Bias: The day began with a bullish lean, based on a reclaim of the 6275 Line in the Sand (LIS) and a bull stacker shift pre-RTH.

First Target Zone: 6290–6295 was identified as the initial upside target, with 6300 as a critical resistance level.

Bearish Flip: Upon rejection of 6300 and a bear stacker shift, bias shifted bearish, targeting 6290–6295 first, then 6250–6245.

Highlighted Trades & Moves

@NQ OPR Short hit TGT1 early in the session, aligning with David’s CD2 (Cycle Day 2) expectation of balancing/consolidation.

The break below 6275 was a key bear signal, and the room successfully navigated to the 6245 target, with David calling it a “direct missile hit” into the lower strike zone.

A textbook bounce off the Money Box (MB) mid-session provided a strong recovery trade—well-identified by Roy and later confirmed by David.

Later in the day, bulls made an effort to reclaim the Opening Range Midpoint, culminating in a new high on the day—a strong shift back to the upside.

Lessons & Insights

Patience in Consolidation: David emphasized "sitting on hands" during low-structure consolidation—a key lesson for managing risk on CD2.

Emotional Discipline: PeterN (new member) was coached on avoiding chase entries, with guidance on waiting for first pullbacks and structural setups.

Volatility Management: TTBs (Trump Tweet Bombs) created sudden volatility. David reminded the room: “No trades on TTBs—wait for sore setup.”

Cycle Awareness: The group discussed 3-Day Cycle structure, with David reaffirming its value for anticipating balancing moves.

Indicator Use: Good discussion around A4, A7, A10 zones, ATR7 bounce points, and custom PTG DMI configurations added technical clarity.

Community Highlights

Welcome PeterN: The room warmly welcomed Peter as a new 3-month member. His active questions sparked insightful discussions.

Multiple members shared experiences and support, reinforcing the collaborative culture PTG fosters.

End-of-Day Notes

The MOC imbalance ballooned to $1.6B sell, but the price action showed resilience, with a late-day rally to new highs.

David humorously summed up the wild news flow: “Wednesday is TTB day—fuk everyone over.” Despite the chaos, structure prevailed.

Final Takeaway:

Yesterday was a masterclass in adapting to shifting market structure, with early bullish setups, a mid-day selloff to key targets, and a strong recovery. Members were reminded of the power of discipline, structure, and patience in navigating even the most volatile days.

Calendars

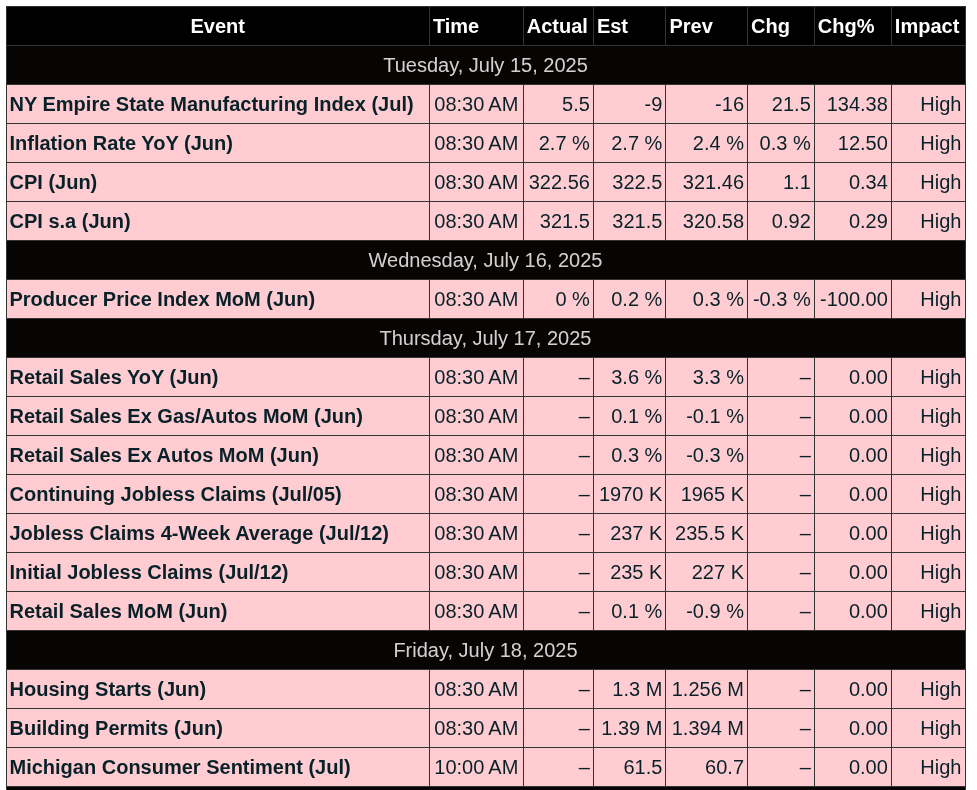

Economic Calendar Today

This Week’s High Importance

Earnings:

Released