- The Opening Print

- Posts

- Mutual Fund Monday

Mutual Fund Monday

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

You know my saying, “everything is moving” — well, it really is.

On Friday, the ES broke through 6400.00 and made a late-day high at 6425.00, up 2.6% over the last five sessions. The NQ gained 4% for the week, trading up to another new all-time high at 23,845.00.

Gold, believe it or not, traded up to $3,534.10 and has closed higher 5 out of the last 6 days, now up 28% YTD. Crude futures sold off down to $62.77 for their third weekly loss, while natural gas, which traded up to $5.210 in late March, has since dropped to $2.900.

I don’t look at the grains every day, but corn, wheat, and beans have sold off sharply. Meanwhile, cattle prices, which made a low in September last year just above $170.00, traded above $232.00, while milk prices have been falling.

The 30-year bonds chart is holding at the low end of the 5-year range around the 114.00 level, not far off the May lows, and the dollar, which traded up to 99.33 in May, made a 96.38 low and closed at 98.009 on Friday.

In my 38 years in the markets, I have never seen anything like this. Since the 2008 credit crisis low, the ES has rallied 5,703.50 points or 855.25%. Since the Covid-19 pandemic, the ES has rallied 2,191 points or +190.80%. If you had your wits about you and stepped in during these declines, you were paid handsomely.

Track Records

I wasn’t around when Marty “The PitBull” Schwartz started his career, but after getting to know him, it all made sense. He’s a math genius who went to Amherst, an expert tape reader who used to study hundreds of charts a night. He also had something I think is essential for making big money — big balls — and no problem taking on mammoth size.

One hundred percent of the money he made came from his own decisions. No help from guys with better seats or outside info. He was smart, driven, and always said, “If you want to make the money, you have to do the work.”

I remember visiting him in New York at his Park Avenue apartment. He took me to his war room (trading office), with walls covered in trophies and plaques from his trading accomplishments. It was around the time he started entering the United States Investing Championship, founded by Norman Zadeh. He won the contest in 1984, achieving an average return of 210% (non-annualized) in nine of the four-month-long US Trading Championships he entered. His return was 781% in a year-long contest.

Marty did it the hard way — 15-hour days, never giving up. But I’ve seen people without his skill set somehow make more money.

As we move forward, I think anyone making money the “old-fashioned” way — front-running — should go to jail. But I doubt that will happen to former Speaker of the House Nancy Pelosi and her husband. In 2012, the government passed the STOCK Act, requiring members of Congress to disclose stock trades worth over $1,000 within 30–45 days to deter insider trading.

Nancy Pelosi Inc.

I saw plenty of questionable behavior on the trading floor. If there was a way to steal money, there was no shortage of people willing to do it. That applies to big banks like JPMorgan and billion-dollar hedge funds, too. If they could gain an edge, they would take it.

They get more information and trading flow than most, yet Nancy Pelosi’s account finished 2024 up 54%. Her returns were just under Light Street Capital’s 59.4% and just above Discovery Capital Management’s 52%.

This isn’t about politics — it’s about right and wrong, fair and unfair. Here’s a link to a Reuters article: Hedge funds score double-digit returns in 2024.

I get it, her husband Paul runs Financial Leasing Services, a San Francisco–based real estate, venture capital, and consulting firm, and he’s connected to a lot of tech and AI firms in Silicon Valley. But I don’t think his information is coming from there — though that’s the story.

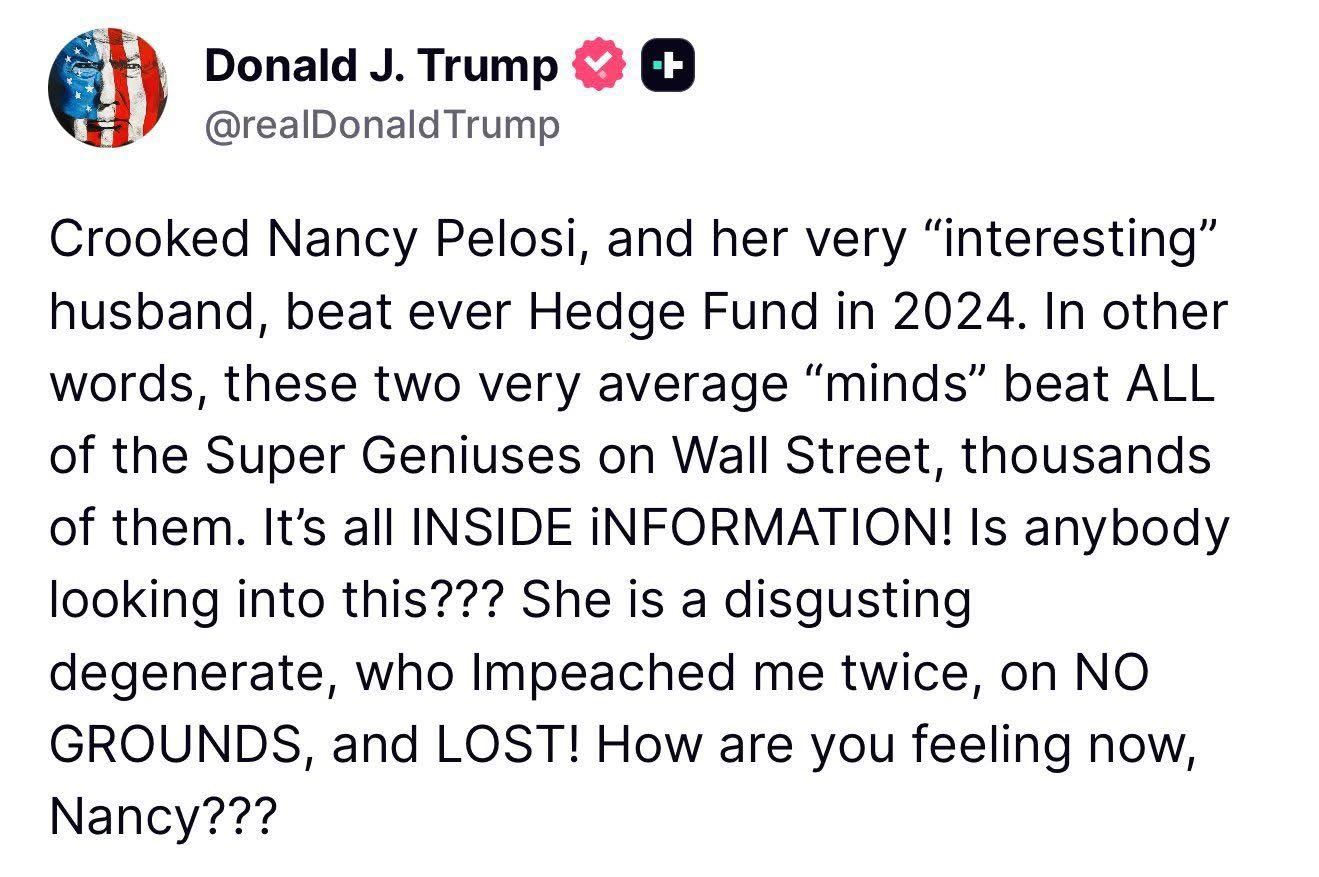

I started writing this Saturday and didn’t know Trump was going to blast Nancy on Truth Social, calling her a “disgusting degenerate” and alleging she and her husband made a fortune off “inside information.”

Like I said, it doesn’t matter who it is or what side of the aisle they’re on — if this were you or me, we’d be prosecuted. Shouldn’t Nancy be held to the same standard?

MiM and Daily Recap

Overnight Globex trade opened Thursday evening at 6372.50 and initially trended higher, marking a lower high at 6382.75 at 18:20. Sellers pushed prices back down to a higher low at 6373.75 by 20:00, a 9.00-point (-1.14%) retreat. Momentum shifted upward into the evening session, reaching a higher high at 6387.50 at 20:30, a 13.75-point (+0.22%) gain. After that, prices reversed lower, setting a new overnight low at 6369.25 at 01:50, down 18.25 points (-0.29%). The market recovered steadily into the morning, peaking at 6389.75 at 07:50 for a 20.50-point (+0.32%) rally, before pulling back to 6376.25 at 08:20 ahead of the regular session open.

The regular cash session opened at 6383.00 and quickly advanced to an early high of 6413.00 at 10:30, up 36.00 points (+0.56%). A selloff followed, reaching 6390.50 by 11:40, a 22.50-point (-0.35%) drop. Buyers regained control, lifting prices to 6416.00 at 12:15 (+25.50, +0.40%), before another dip to 6403.50 at 13:00 (-12.50, -0.19%). A third leg higher printed 6419.00 at 14:00 (+15.50, +0.24%), followed by a shallow pullback to 6411.50 at 14:25 (-7.50, -0.12%). Afternoon trading saw a lower high at 6419.00 at 15:20 before sellers took the tape to 6402.75 at 15:50, down 16.25 points (-0.25%). Into the close, a late rally carried ES to 6425.75 at 16:30 (+23.00, +0.36%) before settling the regular session at 6414.00, up 31.00 points (+0.49%) from the open and 46.50 points (+0.73%) from the prior close.

The Cleanup session extended gains slightly, finishing at 6425.25, adding 11.50 points (+0.18%) from the regular close and securing the full-session close at 6425.25, a net gain of 52.75 points (+0.83%) on the day.

Market tone was broadly constructive throughout Friday’s trade, with buyers stepping in consistently after each pullback. The overnight session showed balanced two-way trade, but the cash market established a clear intraday uptrend despite multiple mid-session retracements. Volume reached 964,452 contracts in regular hours and 1,132,185 for the full session, reflecting solid participation.

The Market-on-Close imbalance data showed a $284M buy-side imbalance at 15:51, with 53.4% of dollar flow favoring buyers. However, the symbol percentage was -53.4%, indicating more symbols were on the sell side. This mixed MOC profile did not exert a significant directional push into the final minutes, as prices held firm above the day’s midpoint.

Overall, the day closed strongly, with ES notching its highest levels in the afternoon and maintaining gains into settlement. The session’s structure suggests underlying bullish sentiment, with the market well-positioned for potential continuation if buyers defend support levels in the next session.

Technical Edge

Fair Values for August 11, 2025:

SP: 22.09

NQ: 98.62

Dow: 86.57

Daily Breadth Data 📊

For Friday, August 8

• NYSE Breadth: 49.81% Upside Volume

• Nasdaq Breadth: 60.55% Upside Volume

• Total Breadth: 59.37% Upside Volume

• NYSE Advance/Decline: 53.23% Advance

• Nasdaq Advance/Decline: 51.14% Advance

• Total Advance/Decline: 51.92% Advance

• NYSE New Highs/New Lows: 96 / 61

• Nasdaq New Highs/New Lows: 178 / 122

• NYSE TRIN: 1.19

• Nasdaq TRIN: 0.71

Weekly Breadth Data 📈

For Week Ending August 8

• NYSE Breadth: 54.54% Upside Volume

• Nasdaq Breadth: 60.09% Upside Volume

• Total Breadth: 57.95% Upside Volume

• NYSE Advance/Decline: 65.79% Advance

• Nasdaq Advance/Decline: 57.29% Advance

• Total Advance/Decline: 60.45% Advance

• NYSE New Highs/New Lows: 233 / 130

• Nasdaq New Highs/New Lows: 385 / 324

• NYSE TRIN: 1.60

• Nasdaq TRIN: 0.91

Calendars

Today’s Economic Calendar

This Week’s Important Economic Events

Today’s Earnings

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, August 8, 2025

The session opened with a neutral overnight tone and early focus on the bull scenario from the DTS briefing — sustained bids above 6375 targeting the 6390–6395 zone. That target was met right out of the gate, with longs authorized until a bearish structure emerged.

Key trades included:

NQ Open Range Long – Target 1 hit early, then all targets fully met by mid-morning.

CL Open Range Short – Target 1 reached, but stop trail brought it back to near break-even.

A10 scale-and-trail provided further upside participation.

Retest of the 6400 level was pivotal — a potential break lower was flagged, but buyers defended 6398 for a time.

PeterN shared success using 13/34/89 EMA stacker strategy from prior PTG content to stay out of losing shorts — a solid example of applying lessons learned. Manny also highlighted SPX/ES GEX levels (6370 & 6395) that lined up well with market reactions.

By late morning, David called it a “Capital Preservation Day” as the best trades were in the books, shifting focus to defending gains. The 6390–6395 zone was backtested, with a “line in the sand” at 6375. Large GEX levels reinforced expectations for strong buy responses, and David noted a PKB long trigger if 6395 was reclaimed.

Highlights & Lessons:

Early targets were precise and actionable, rewarding those who followed the DTS plan.

EMA stacking method proved valuable in keeping traders aligned with the trend.

Recognizing when the “best trades are behind us” is as important as taking the early entries.

GEX awareness added another layer of confluence to intraday decision-making.

It was a morning of measured, strategic execution with an emphasis on locking in wins and preserving capital into the afternoon.