- The Opening Print

- Posts

- MOC/MIM Imbalance Sparks Push Into the Close

MOC/MIM Imbalance Sparks Push Into the Close

Follow @MrTopStep on Twitter and please share if you find our work valuable!

FREE Two-Week Offer for the Opening Print Premium. Open up the Lean and other premium features for the next Two Weeks!

Our View

The ES rallied up to 6523.50 on Globex at 3:33 a.m. and sold off down to 6507.00 after the U.S. Bureau of Labor Statistics showed that U.S. employers added only 911,000 jobs over the last 12 months ending in March, much lower than previously estimated.

I wrote about the possibility of slower trading and lower volume and posted this in the MTS chat early in the day:

IMPRO : Dboy : (9:24:01 AM): smaller ranges and volume the words for the day

IMPRO : Dboy : (9:42:22 AM): I say we end up with a 25 pt range

At 12:43, the ES day high was 6515.00 and the low was 6488.75, a 26.25-point range.

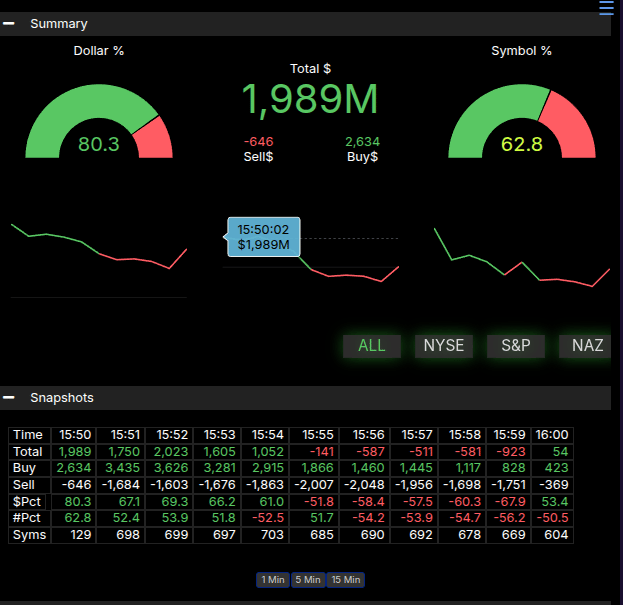

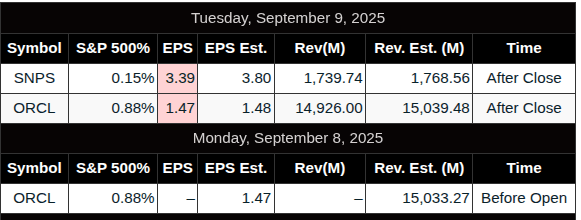

After the low, the ES back-and-filled in a 4 to 6-point range, drifted back up to 6519.25 at 3:27, pulled back to the 6514.00 area at 3:42, and started to go bid as the 3:50 imbalance showed $2 billion to buy. It shot up to 6526.25, traded 6521.00 on the 4:00 cash close, down-ticked slightly, and then took off to the upside as Oracle jumped 25% after reporting, when the CEO said its AI-fueled cloud revenue is set to soar to $144 billion by 2030.

In the end, the tape still favors higher prices.

In terms of the ES and NQ’s overall trade, it fell in line with yesterday's lean: selling the early rallies and buying the pullbacks. In terms of the ES’s overall trade, volume was lower (as it should be) at 1.137 million contracts traded.

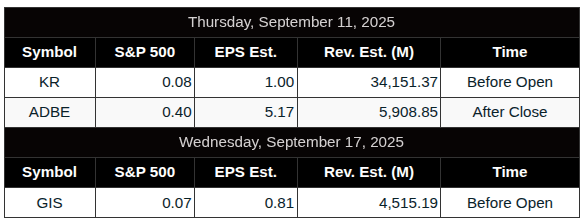

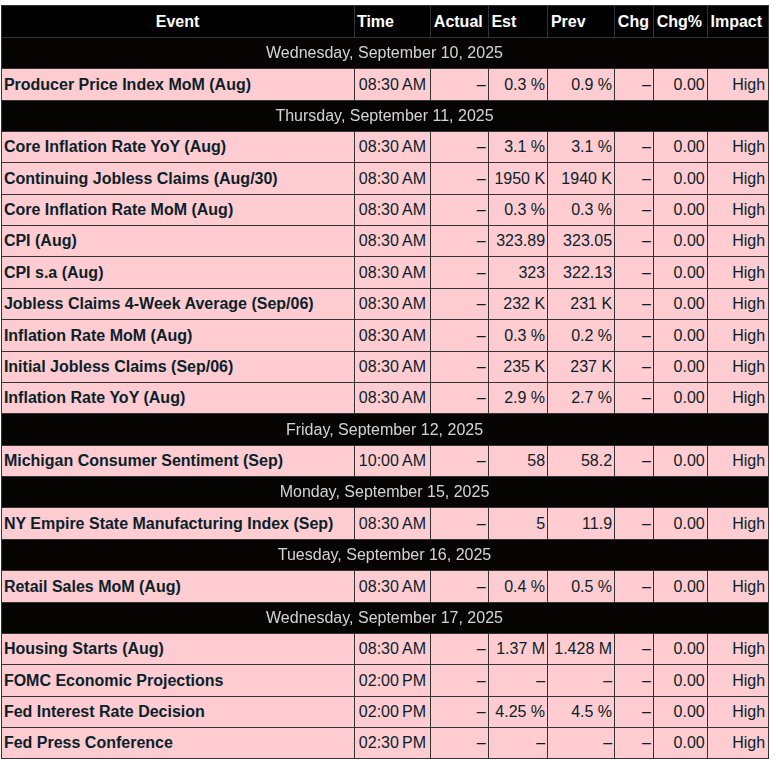

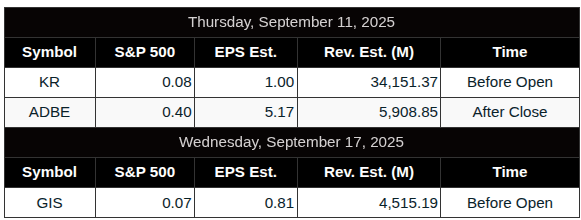

Today's economic and earnings calendar includes Kroger (KR) and Adobe (ADBE) reporting earnings, Producer Price Index at 8:30, Wholesale Inventories at 10:00, and no Fed speak.

Goldman Sachs August CPI Review:

We expect a 0.36% increase in August core CPI (vs. +0.3% consensus),

corresponding to a year-over-year rate of 3.13% (vs. +3.1% consensus). We expect a 0.37% increase in headline CPI (vs. +0.3% consensus), reflecting higher food (+0.35%) and energy (+0.6%) prices. Our forecast is consistent with a 0.29% increase in core PCE in August.

We highlight four key component-level trends we expect to see in this month’s report. First, we expect increases in used car prices (+1.2%), reflecting an increase in auction prices, and new car prices (+0.2%), reflecting a decline in dealer incentives. Second, we expect a 0.4% increase in the car insurance category based on premiums in our online dataset. Third, we forecast a 3% increase in airfares in August, reflecting a boost from seasonal distortions and an increase in underlying airfares based on our equity analysts’ tracking of online price data. Fourth, we have penciled in upward pressure from tariffs on categories that are particularly exposed, such as communication, household furnishings, and recreation, worth +0.14pp on core inflation.

Over the next few months, we expect tariffs to continue to boost monthly

inflation and forecast monthly core CPI inflation around 0.3%. Aside from tariff effects, we expect underlying trend inflation to fall further, reflecting shrinking contributions from the housing rental and labor markets. We expect year-over-year core CPI inflation of +3.1% and core PCE inflation of +3.2% in December 2025 (or +2.3% for both measures excluding the effects of tariffs).

Our View

What does all this come down to? Higher inflation — but less than analyst expectations?

It all just seems so out of whack when you consider today’s CPI, PPI on Thursday, Consumer Sentiment, Week Two Friday options expiration next week, the Fed’s two-day meeting on Tuesday and Wednesday, the September Triple Witching on the 19th, the historically weak second half of September, and the end-of-quarter rebalance.

It’s a total overload.

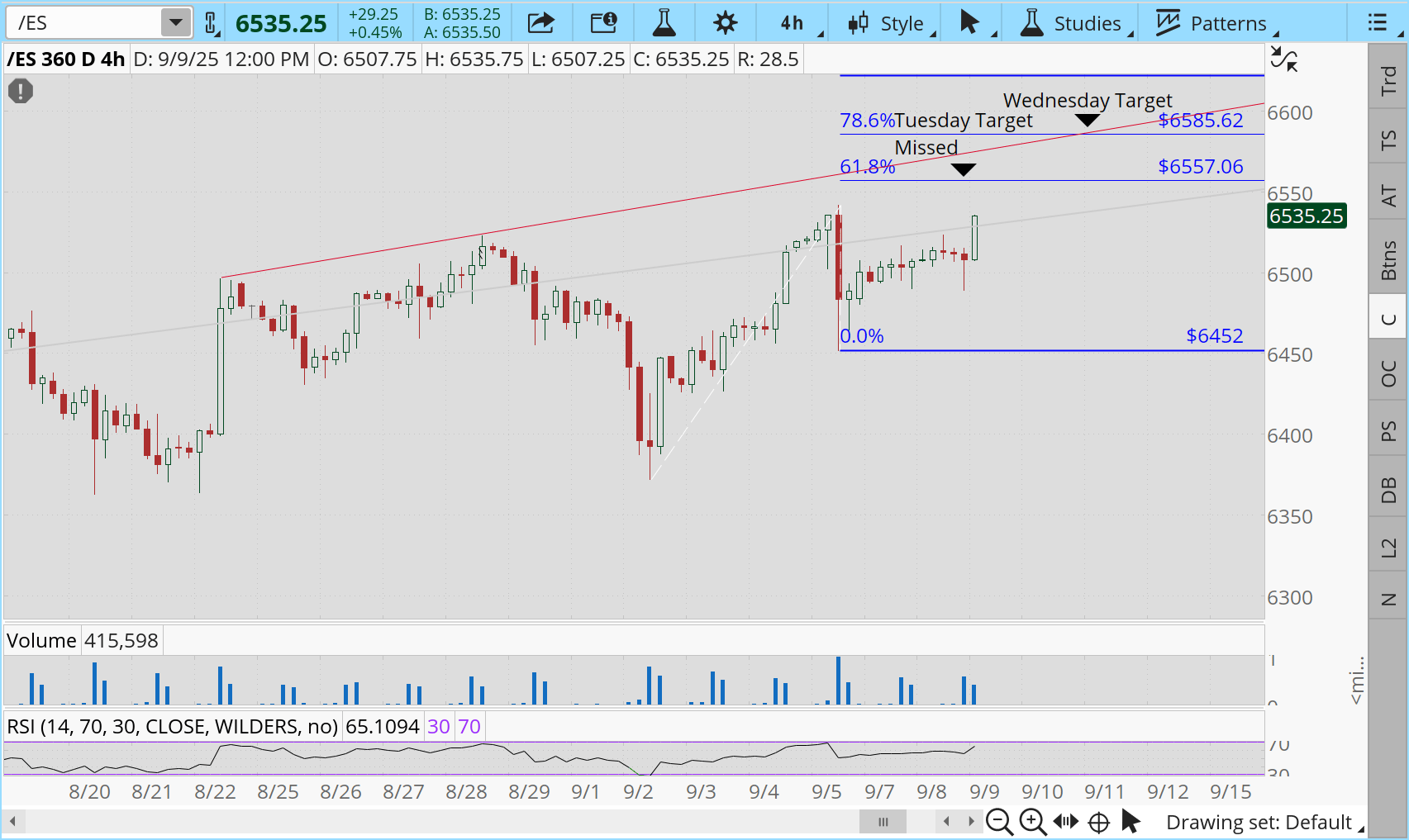

The ES, NQ, and YM all closed at new record highs and still look higher. Trader JB's chart (above) shows the same thing.

While a September rate cut is a lock, the next three days of inflation reports could change the course of future rate cuts and bring in slower economic growth — and even stagflation.

Our Lean — Danny’s Trade (Premium only)

Guest Posts — Polaris Trading Group

Prior Session was Cycle Day 2: This cycle day saw normal rhythmic oscillations as price rotated with stunning precision between the upper and lower target zones outlined in the prior DTS Briefing 9/9/25.

Market on Close (MOC) $2 Billion Buy Imbalance added the closing fuel today, which may spill-over into Wednesday’s session.

Lots of fantastic PTG Member interaction happening in the Live Trading Room daily. Be sure to check out the Daily RECAP.

Range was 47 handles on 1.113M contracts exchanged.

Click on this link: Trading Room RECAP 9.9.25

…Transition from Cycle Day 2 to Cycle Day 3

Transition into Cycle Day 3: The current rally has fulfilled the initial cycle target (6526.88) having closed near the prior high of day, as bullish momentum may spill-over into today’s session.

PPI is slated for release @ 8:30, which will give traders a “first-look” inflation read-through for the all-important CPI print on Thursday. We preview the PPI below:

Here’s the consensus estimate for the U.S. Producer Price Index (PPI) scheduled for release on September 10, 2025 (for August data):

Headline PPI (month-over-month): +0.3%

Core PPI (excluding food and energy, month-over-month): +0.3% Calculated Risk

Additionally, broader financial platforms provide corroborating data:

A recent preview from TerraBullMarkets offers a slightly more detailed breakdown:

Headline PPI MoM: Cons: 0.3%; Forecast: 0.4%

Core PPI MoM: Cons: 0.3%; Forecast: 0.4% Terrabull Markets

What It Means

If the reports align with the +0.3% projections, it suggests moderate but manageable inflation at the wholesale level, likely reinforcing expectations that the Federal Reserve could proceed with an interest rate cut in September, especially given weakening labor signals in other data ReutersAppleton Partners, Inc..

However, if the PPI comes in closer to the 0.4% “forecast” bounds as per TerraBullMarkets, that could indicate slightly stronger wholesale inflation, potentially giving the Fed a reason to delay or moderate any easing decision InvestopediaTerrabull

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 6520+-, initially targets 6535 – 6540 zone.

Bear Scenario: Price sustains an offer below 6520+-, initially targets 6505 – 6495 zone.

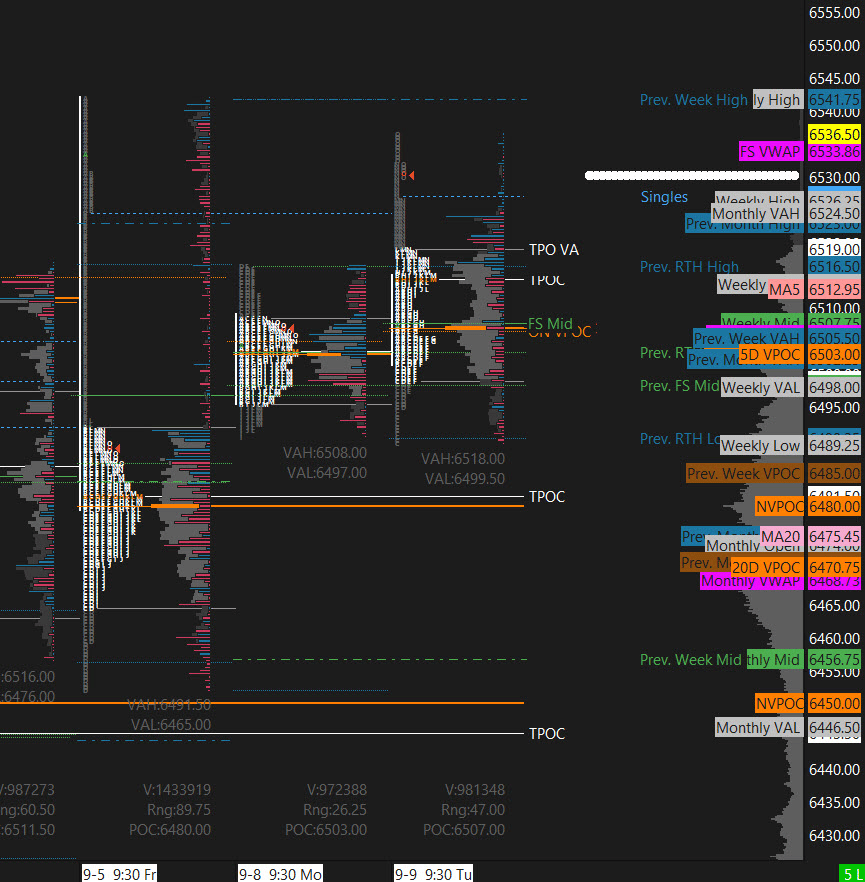

PVA High Edge = 6518 PVA Low Edge = 6500 Prior POC = 6507

PVA High Edge = 6428 PVA Low Edge = 6390 Prior POC = 6425

ESU

Thanks for reading, PTGDavid

MiM and Daily Recap

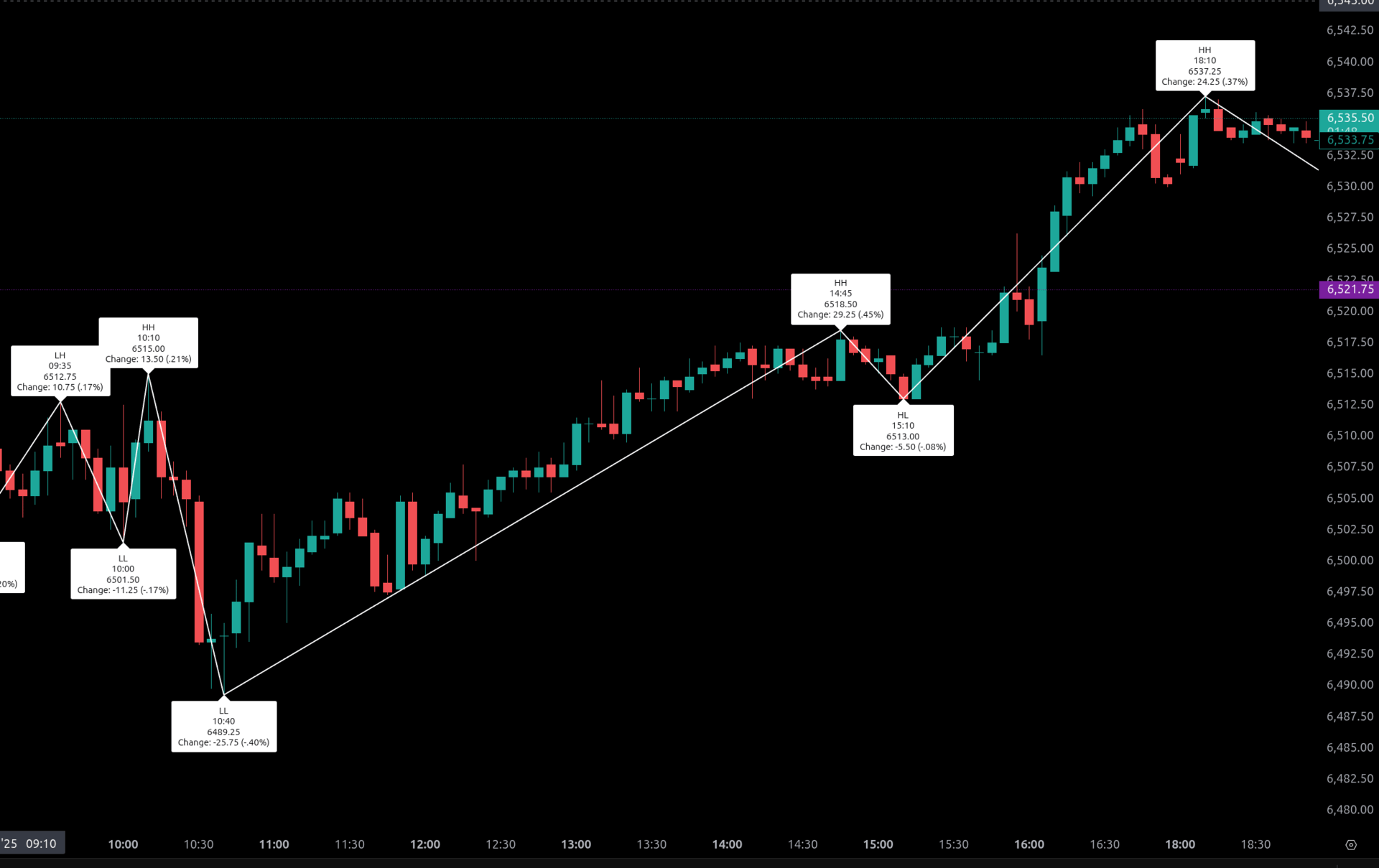

The September 9 session in the S&P 500 futures unfolded with steady overnight trade before turning into a firm recovery during regular hours, ultimately closing higher on the day.

Overnight action began at 6507.75 with a measured advance into the evening high of 6514.25 at 7:00 PM, followed by steady selling that carried prices down to 6504.00 at 9:40 PM. A recovery attempt lifted the contract to 6515.50 by 11:30 PM, but sellers reemerged after midnight. The ES pressed lower, reaching 6508.25 at 1:20 AM. From there, the tone softened once more, with lower highs appearing at 6515.25 at 5:10 AM and 6515.50 at 6:10 AM, and finally, the session low of 6507.00 printed at 7:10 AM. Globex settled modestly weaker, closing at 6507.25, down 0.50 points (-0.01%) from the prior day.

The cash session opened at 6507.25 and initially extended higher, reaching 6515.00 at 10:10 AM. Sellers then gained traction, dragging the ES down to the regular-session low of 6489.25 at 10:40 AM. That marked the inflection point of the day, as buyers stepped in with steady conviction. A broad-based rally unfolded through midday, carrying futures back to 6518.50 at 2:45 PM. After a brief dip to 6513.00 at 3:10 PM, another late push drove the ES to the regular-session high of 6526.25 at 3:50 pm. The contract settled at 6521.00, up 13.75 points (+0.21%) on the day, a gain of 14.00 points or +0.22% from the prior cash close.

Cleanup trade added modestly to the upside, closing at 6530.25, bringing the full-session net to +22.50 points (+0.35%) with total volume of 1.11 million contracts.

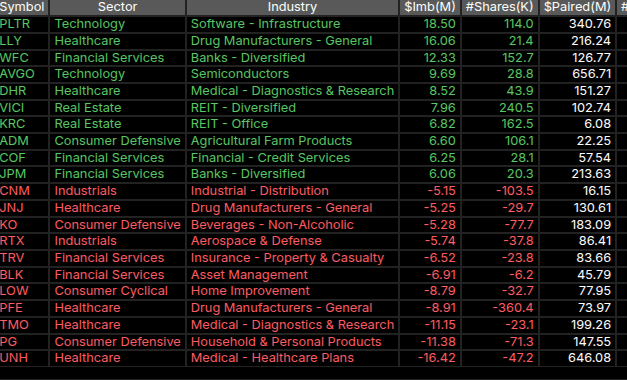

Market tone leaned constructive. After early weakness, the afternoon rally revealed strong dip-buying interest, particularly into the close. The Market-on-Close imbalance monitor showed a $1.99 billion buy imbalance at 3:50 PM, with 80.3% of notional skewed to the buy side and 62.8% of symbols favoring buyers. This notable imbalance supported the late-session push into the day’s highs. Sector flows showed heavy buy imbalances in technology (PLTR, AVGO) and financials (WFC, JPM), while notable sell pressure came from healthcare names such as UNH and PFE.

In summary, the September 9 ES session was marked by a choppy Globex, a morning test lower, and a determined recovery that built into the afternoon. The strong buy imbalance into the bell reinforced bullish sentiment, allowing the market to finish firmly above its open and prior close. Traders will look ahead to see if the momentum can sustain into Wednesday’s session.

Technical Edge

Fair Values for September 10, 2025:

SP: 6.15

NQ: 27.78

Dow: 36.12

Daily Market Recap 📊

For Tuesday, September 9, 2025

• NYSE Breadth: 45% Upside Volume

• Nasdaq Breadth: 63% Upside Volume

• Total Breadth: 61% Upside Volume

• NYSE Advance/Decline: 39% Advance

• Nasdaq Advance/Decline: 47% Advance

• Total Advance/Decline: 44% Advance

• NYSE New Highs/New Lows: 119 / 22

• Nasdaq New Highs/New Lows: 256 / 74

• NYSE TRIN: 0.65

• Nasdaq TRIN: 0.50

Weekly Market 📈

For the week ending Friday, September 5, 2025

• NYSE Breadth: 52% Upside Volume

• Nasdaq Breadth: 58% Upside Volume

• Total Breadth: 55% Upside Volume

• NYSE Advance/Decline: 60% Advance

• Nasdaq Advance/Decline: 51% Advance

• Total Advance/Decline: 54% Advance

• NYSE New Highs/New Lows: 274 / 49

• Nasdaq New Highs/New Lows: 442 / 264

• NYSE TRIN: 1.35

• Nasdaq TRIN: 0.76

ES & NQ Futures trading levels (Premium only)

Calendars

Economic

Today

Important Upcoming / Recent

Earnings

Upcoming

Recent

Trading Room Summaries

Polaris Trading Group Summary - Tuesday, September 9, 2025

Overview:

Cycle Day 2 played out with textbook precision as price action respected the expected levels and zones laid out in the DTS briefing. Both bull and bear scenarios triggered and fulfilled, offering multiple clean trade opportunities. The session featured excellent teamwork, tight discipline, and solid trade execution—especially during the volatile mid-morning payroll revision event. The day ended on a high note with a final push into the highs, capping a rewarding day.

Key Highlights:

Morning Prep & Market Context

LIS (Line in the Sand): 6505

Overnight price hit the initial target zone (6520–6523).

Market expected to waffle ahead of inflation clarity with the Fed meeting on Sep 17 approaching.

Target Rate Probabilities: 89.4% for 4.00–4.25%.

Look Below & Reclaim 6500

6485 Controlled Support Buy

6480 Sunday Open Low Reclaim (High-Significance)

Look Below & Fail into Reclaim of 6490

Key Lesson from Manny: "The only 'perfect' trade is the one executed perfectly according to your rules. Everything else is gambling."

Notable Trades & Wins

Early Action:

Manny scored +3 points at 6508 early in the session.

Bosier executed a well-managed short campaign, scaling in and out tactically around key levels like 6505, 6499, and 6491.5, earning him the “Kewpie Award” for the day.

Major Catalyst: Payrolls Revision

At 10:00 AM, the market reacted sharply to the -911,000 jobs revision—the largest on record.

David quickly highlighted both bull and bear targets being hit post-news, underscoring how well the DTS levels held up.

Fade Opportunity

Manny executed a clean +5 pt short from 6501, noting that good shorts should "work FAST or risk should be cut."

Execution Discipline & Education

Strong emphasis throughout the day on:

Following trade plans

Adhering to rules

Discussing mental game like whether to walk away from trades in progress.

Manny’s morning streaming experiment helped him stay hyper-focused and rule-bound.

Chart types like tick and Renko were discussed as valuable tools, especially in trending environments.

Closing Session Action

2B MOC Buy Imbalance ($2B) sparked a strong late-day push.

Price tagged and pushed past the prior HOD into the close.

Discount Longs triggered around 3:17 PM, with David holding positions into the bell.

Lessons & Takeaways

Stick to your rules. The difference between gambling and trading is discipline.

Prepare your levels and scenarios in advance—both directions played out exactly as forecasted.

Be mentally agile. Several traders, like John B, sat out when no setups aligned with their strategy—a great example of trading maturity.

Adapt your tools. Use what fits the market conditions: tick charts, Renko, etc.

Looking Ahead:

PPI data drops today – Expect volatility.

FED decision looms next week.

"Beautiful display of levels/zones responding per DTS Briefing for Cycle Day 2." – PTGDavid

Discovery Trading Group Room Preview – Wednesday, September 10, 2025

Macro Focus:

Fed in Focus: Markets are pricing in a rate cut next week following weaker labor data. Tomorrow’s PPI and Thursday’s CPI will be critical.

Jobs Revision: BLS revised down job growth by 911K for the year ending March 2025—much larger than expected, intensifying Fed cut expectations.

PPI Data (8:30am ET): Key inflation readout today. A hot print could complicate rate cut bets. Wholesale and oil inventories follow later.

Market Moves:

Gold: Continues to rally, up 2.5% in two days, hitting new record highs on rate cut bets.

Oracle (ORCL): Soared 28% premarket on AI cloud growth guidance. FY25 cloud rev est. at $20B, targeting $144B by 2030.

Apple (AAPL): New iPhone 17, Air model, and heart-rate AirPods failed to wow; stock dipped 1.5%.

Volatility: ES 5-day ADR down to 54.75; volatility muted ahead of PPI. Whale bias bullish on light overnight volume.

Politics & Policy:

Trump Tariffs: SCOTUS to hear a case on Trump-era tariffs. Trump signed an EO exempting gold, uranium, tungsten from global tariffs.

Geopolitics: Trump signals willingness to mirror EU tariffs on China or India to pressure Russia; new sanctions on Russian oil discussed.

Postal Traffic: UN agency says U.S. international mail volume dropped 80% after de minimis exemption ended.

Housing:

Zillow: U.S. housing market value hit $55T (+$20T since 2020), but gains uneven. Northeast demand outpaces supply; CA, FL, TX lost billions in 2025.

ES Technical Levels:

Trend: Still within short- and intermediate-term uptrend, nearing ATHs.

Key TL Resistance: 6727/32, 6750/55

Key TL Support: 6443/48, 6401/06

Earnings Watch: Light day. Chewy (CHWY) reports premarket.