- The Opening Print

- Posts

- Mike Walz Warns "All Options Are On The Table"

Mike Walz Warns "All Options Are On The Table"

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

It’s Not Over Until It’s Over

U.S. and Iranian officials clashed at a UN Security Council emergency meeting yesterday over Iran's deadly crackdown on protests that killed at least 2,637 amid economic collapse, where Ambassador Mike Waltz warned "all options are on the table" despite Trump's de-escalation signals.

“Colleagues, let me be clear: President Trump is a man of action, not endless talk like we see at the United Nations,” Mike Waltz, U.S. ambassador to the U.N., said in a statement. “He has made it clear that all options are on the table to stop the slaughter. And no one should know that better than the leadership of the Iranian regime.”

Our Lean

In addition to the January expiration and this morning's economic reports, there are four Fed speakers. Like earlier leans this week, I don’t doubt the ES and NQ can rally, but I also expect a lot of two-way price action. I’m just not sure that they will hold, and Mike Waltz's warning is going to add to the market anxiety as we head into the three-day MLK Day holiday on Monday.

Our lean: I don’t think it's worth going out on a limb, and I’ll say it again: trade less and pick your spots better. Sorry I can't add to this...

Guest Posts:

|

Get instant access to our partners’ real-time market data and insights not available anywhere else. Here is last night's Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

Founder's Note:

Futures are 20bps higher with no major data on deck for today.

The SPX is indicated to open at 6,950 - which is right in the center of the ~14-day prevailing range.

Our Risk Pivot remains at 6,890, and we want to remain long while SPX is above that level, eyeing the 7k area as resistance into FOMC.

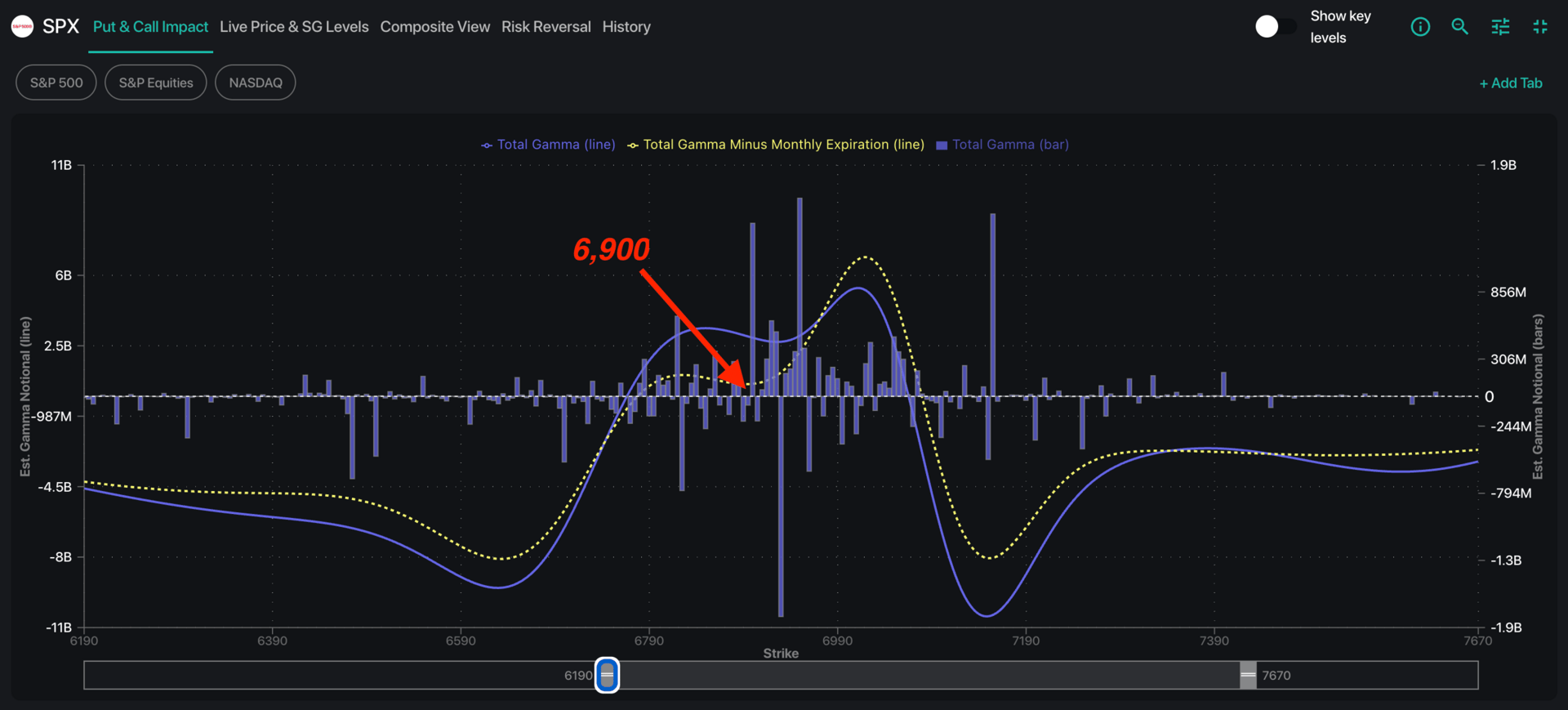

Today is Jan OPEX, with VIX Exp on Wed. With SPX at ATH, and realized vol ~8%, the OPEX edge would be in looking for SPX vol in increase, with some light mean reversion in SPX prices. However, for the SPX this expiration seems to not matter much, as SPX GEX shifts quite lightly (yellow = GEX after expiration vs purple = current GEX). Simply stated this OPEX does not seem to loosen up SPX GEX today all that much, nor shift it to a negative downside stance. Additionally, we are heading into a 3-day weekend with MLK on Monday. This incentivizes traders to sell short dated options, in order to collect extra perceived decay. Given that, if any equity weakness was to arrive, we'd anticipate it as a "next week thing" vs today.

As we've covered, upside here is tough as traders have sold calls into previous 7k attempts, and vol is likely to be sticky, which removes vanna as an upside surprise. It's likely stocks need the catalysts of FOMC & earnings to push higher.

Single stocks are likely to lose a lot of ITM deltas from calls that have built up in value over the last year. We think OPEX could therefore bring some net selling in single stocks - but we hesitate to expect much until/unless the SPX Risk Pivot is broken (<6,890). If that level is broken, we do not think material vol selling will occur with FOMC on Wed 1/28. Further, on the single stock side, eyes are set to earnings which pick up in earnest next Wednesday (1/28).

Single stock vol is also going to be sticky for the next week due to earnings. You can see this in Compass, which measures 1-month DTE. Many top names having IV ranks that are in the 30-50% area, and they are also crowded in that bullishly positioned lower right quadrant. A move lower in stocks can shift these names towards puts (left on Compass), but vols are not likely to sink until post-ER. So, again, we base case read this as throttling upside, and if downside were to appear it could be ramped up a bit given this vol position. In summary, continue to favor long until SPX <6,890 - as that risk off level likely means single stocks are going to correct, too (i.e. correlation spike).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

Market Recap

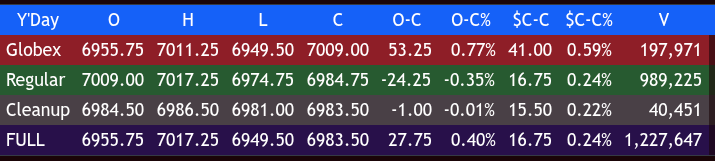

After Wednesday’s late-day push and a wayward headline, the ES traded up to 7011.25 at 9:29 and opened Thursday’s regular session at 7009.00. After the open, the ES hit 7009.75, sold off down to 6994.50, rallied up to 7010.25, sold off down to a new low at 6992.25, and then rallied up to a new high at 7014.75 at 11:20.

It did a sideways-to-up back-and-fill move, traded 7007.50, then traded up to a 7017.25 double top at 12:05. It pulled back to 7004.25, rallied to a lower high at 7015.25 at 1:35, sold off down to 6989.50 at 2:30, traded 6999.75, and then sold off down to a new RTH low. It rallied up to 6992.50, sold back off down to 6974.75 at 3:22, made a higher low, rallied 10 points up to 6984.75, and traded 6967.75 as the 3:50 cash imbalance showed $2.3 billion to sell.

It popped up and traded 6984.75 on the 4:00 cash close. After 4:00, the ES rallied up to 6986.50, traded 6981.00, flatlined, and settled at 6983.50, up 17.25 points or 0.25%.

The NQ closed at 25,707.00, up 76 points or +0.30%, the YM settled at 49,643.00, up 287 points or +0.58%, and the RTY settled at 2,689.40, up 23.30 points or +0.87% on the day.

In the end, I think the $3.4 billion MOC was the tell. In terms of the ES and NQ's overall tone, they were firm until the late-day selloff and the $2.4 billion front-run sell imbalance.

In terms of the ES's overall trade, volume was steady but not higher than Wednesday’s, at 1.234 million contracts traded.

Rotation Junction

There has been a mammoth rotation into the RTY (Russell 2000). After the RTY fell from 12/26 to 12/31 (a four-session decline), the index has rallied 8 out of the last 10 sessions, with the two down days only being down -0.27% and -0.06%. The index gained 198.90 points or +7.88% on the winning days for a total gain of 190.4 points or +7.55%. When I pull these stats, I am not using AI or pulling from any existing stories—I use Barchart's 'price history'.

Meanwhile, the YM (Dow Jones Futures) has closed higher in 7 out of the last 10 sessions for a gain of +2,238 points, with the down days accounting for 935 points of losses. The total net gain has been 1,303 points or +2.69%.

I do not need to include the ES or NQ in this equation, because over the same time frame, the ES is up 1.88% and the NQ is up only 1.6%.

Now, this is where I asked GROK why the Russell is outperforming the other three indices:

The Great Rotation into the Russell 2000 (RTY) in early 2026 involves investors shifting from overvalued mega-cap tech to undervalued small caps, driving RTY's ~6–7% YTD outperformance over the S&P 500, Nasdaq, and Dow (up ~2–3%). Key reasons include:

Lower Interest Rates: Fed’s easing cycle (rate at 3.50%–3.75%) aids small caps’ high debt sensitivity, enabling cheaper refinancing and growth.

Economic Stabilization: Soft landing with cooling inflation and resilient spending boosts cyclical sectors (40% of RTY), plus recovery signs like housing gains.

Broader Earnings Growth: Small caps eye 80%+ EPS expansion through 2026 (vs. 31% for S&P), diversifying beyond maturing tech/AI dominance.

Additional drivers: Cheap valuations (18x P/E vs. 31x for S&P), high short interest for squeezes, 10-session outperformance streak, and focus on profitable small caps.

Risks include inflation or delayed cuts; potential for a multi-year cycle if conditions hold.

What's your take on this, @MrTopStep?

My answer was that RTY is cheaper or undervalued compared to the other indices—and GROK agreed.

MiM

Market-On-Close Recap

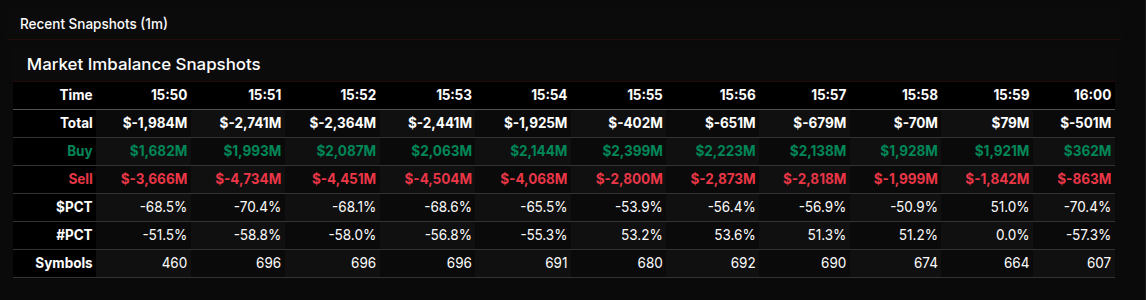

The Market-on-Close auction opened with a heavy sell-side imbalance and remained under pressure throughout the final ten minutes, despite brief attempts at stabilization. At 15:50 ET, total market imbalance registered near –$2.0B and quickly deteriorated, with sell programs firmly in control through 15:54. While buy interest gradually increased into 15:55–15:58, the improvement proved rotational rather than structural, and the session ultimately resolved with a renewed sell skew into the close.

By 16:00 ET, the aggregate imbalance finished at approximately –$501M, but that figure masked the broader pressure seen earlier, when sell flow peaked well above –$4.0B. The late-session improvement reflected position squaring and selective dip-buying rather than a wholesale reversal of flow.

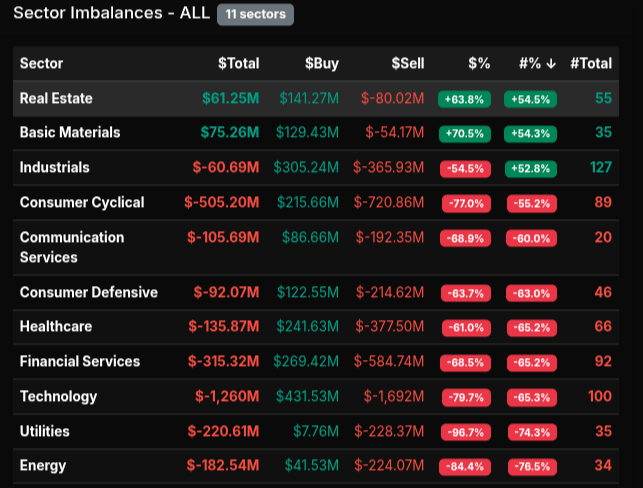

Sector-level data confirmed broad-based selling. Technology was the dominant driver, posting a deeply negative imbalance with a dollar lean near –80%, signaling institutional-scale selling rather than rotation. Consumer Cyclical, Energy, Utilities, and Financial Services also showed strong sell leans, many exceeding –70%, reinforcing the defensive tone into the close. Healthcare and Communication Services followed a similar pattern, contributing to the index-level pressure.

On the buy side, Real Estate and Basic Materials stood out as notable exceptions, each posting buy leans greater than +66%. These readings suggest targeted accumulation rather than index-related flow, with capital selectively rotating into smaller, less crowded areas of the market.

Single-stock imbalances were concentrated in large-cap leaders. Technology bellwethers such as NVDA, AAPL, MSFT, and AVGO featured prominently on the sell side, while selective buying emerged in names like WFC, UBER, AMD, and META. However, most symbol-level activity leaned rotational, clustering near ±50%, consistent with end-of-day rebalancing.

Index summaries reinforced the bearish bias. NASDAQ closed with the heaviest lean near –83%, followed by the S&P 500 at roughly –72% and NYSE near –62%. Overall, the MOC reflected persistent institutional selling, only partially offset by late-session rotation, leaving a clear risk-off tone into the close.

BTS Trading Levels - (Premium Only)

ES Levels

The bull/bear line for the ES is at 6982.50. This is the key pivot for today. Holding above this level keeps the bias constructive, while acceptance below shifts control back to sellers.

ES is currently trading around 6994.75 in the Globex session, slightly above the bull/bear line. As long as price holds above 6982.50, upside targets remain in play, with first resistance at 7017.25, followed by 7030.50, which is the upper intraday range target. A sustained push above 7030.50 would open the door toward 7075.50.

If ES fails to hold 6982.50, look for downside pressure to test 6955.75, then 6949.50. A clean break below these levels would target 6934.50, the lower intraday range target. Further weakness below 6934.50 could extend toward 6920.00 and potentially 6889.50.

Overall, the short-term bias is balanced to slightly bullish above 6982.50, but expect two-way trade. Directional conviction improves only with acceptance above 7030.50 or below 6934.50.

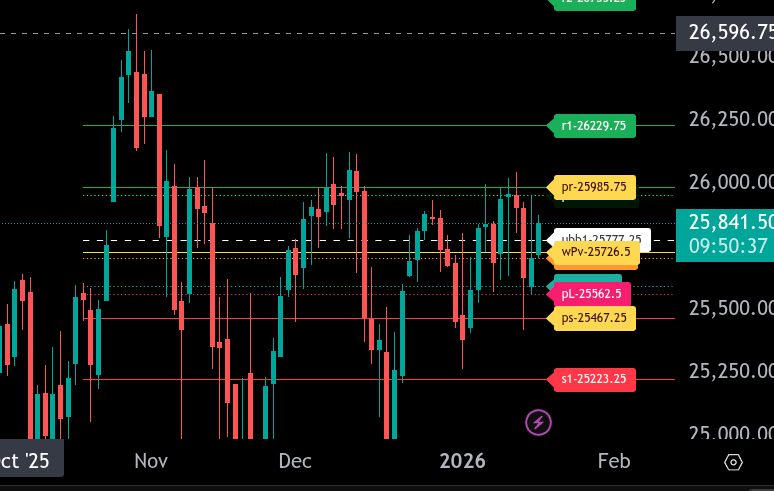

NQ Levels

The bull/bear line for the NQ is at 25,726.50. This is the key pivot for today. Holding above this level keeps the tone constructive, while acceptance below shifts control back to sellers.

NQ is currently trading around 25,840.75 in the Globex session, well above the bull/bear line. As long as price holds above 25,726.50, upside continuation remains possible. Initial resistance is at 25,952.75, followed by 25,985.75, which marks the upper intraday range target. Strength through 25,985.75 would put 26,229.75 in play as a higher resistance zone.

Failure to hold 25,726.50 would signal downside risk, with support first at 25,705.75, then 25,593.00. A break below these levels would target 25,562.50, followed by 25,467.25, the lower intraday range target. Continued weakness below 25,467.25 opens the door toward 25,223.25.

Overall, NQ remains bullish above 25,726.50, but given recent volatility, expect two-way trade. Directional confidence improves with acceptance above 25,985.75 or below 25,467.25.

Technical Edge

Fair Values for January 16, 2026

SP: 35.9

NQ: 152.53

Dow: 189.26

Daily Breadth Data 📊

For Thursday, January 15, 2026

NYSE Breadth: 57% Upside Volume

Nasdaq Breadth: 47% Upside Volume

Total Breadth: 50% Upside Volume

NYSE Advance/Decline: 68% Advance

Nasdaq Advance/Decline: 56% Advance

Total Advance/Decline: 60% Advance

NYSE New Highs/New Lows: 256 / 28

Nasdaq New Highs/New Lows: 447 / 110

NYSE TRIN: 1.67

Nasdaq TRIN: 1.43

Weekly Breadth Data 📈

Week Ending Friday, January 9, 2026

NYSE Breadth: 59% Upside Volume

Nasdaq Breadth: 58% Upside Volume

Total Breadth: 58% Upside Volume

NYSE Advance/Decline: 74% Advance

Nasdaq Advance/Decline: 72% Advance

Total Advance/Decline: 72% Advance

NYSE New Highs/New Lows: 414 / 89

Nasdaq New Highs/New Lows: 701 / 246

NYSE TRIN: 1.90

Nasdaq TRIN: 1.81

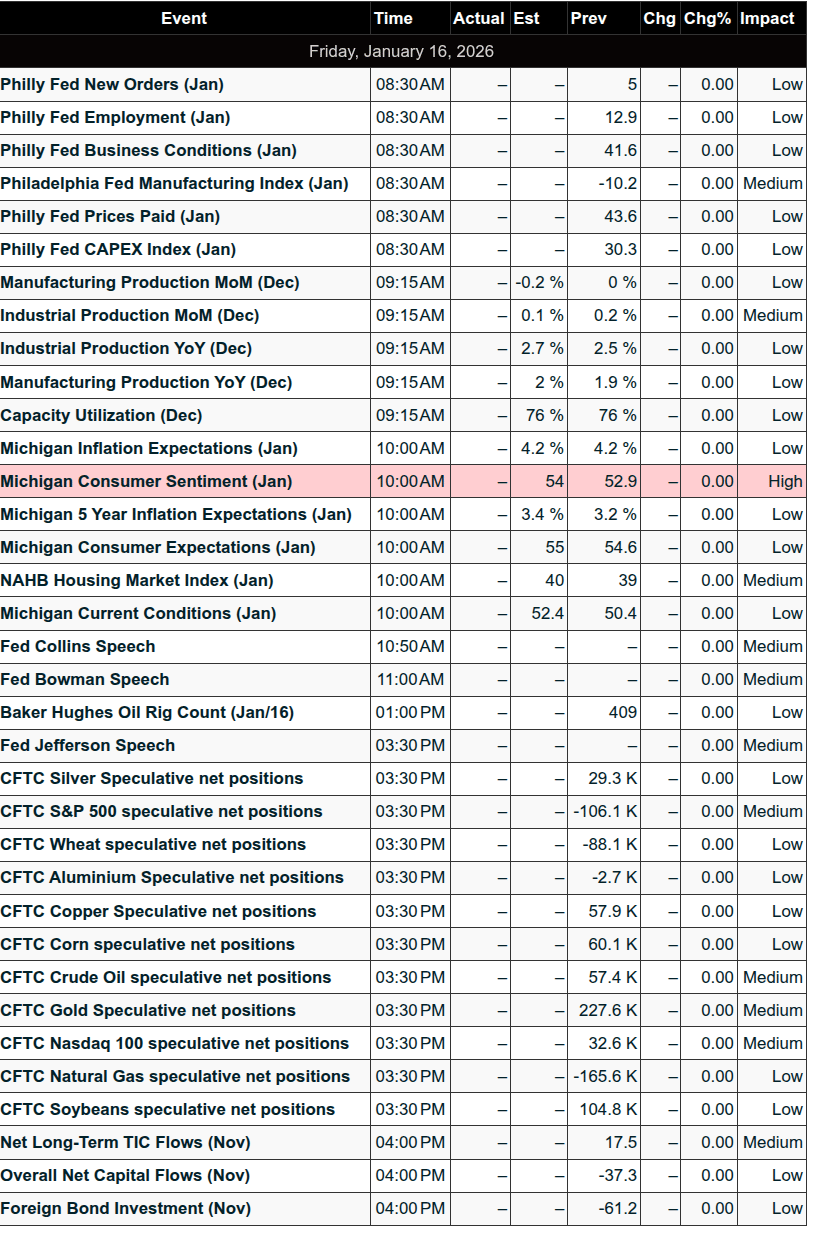

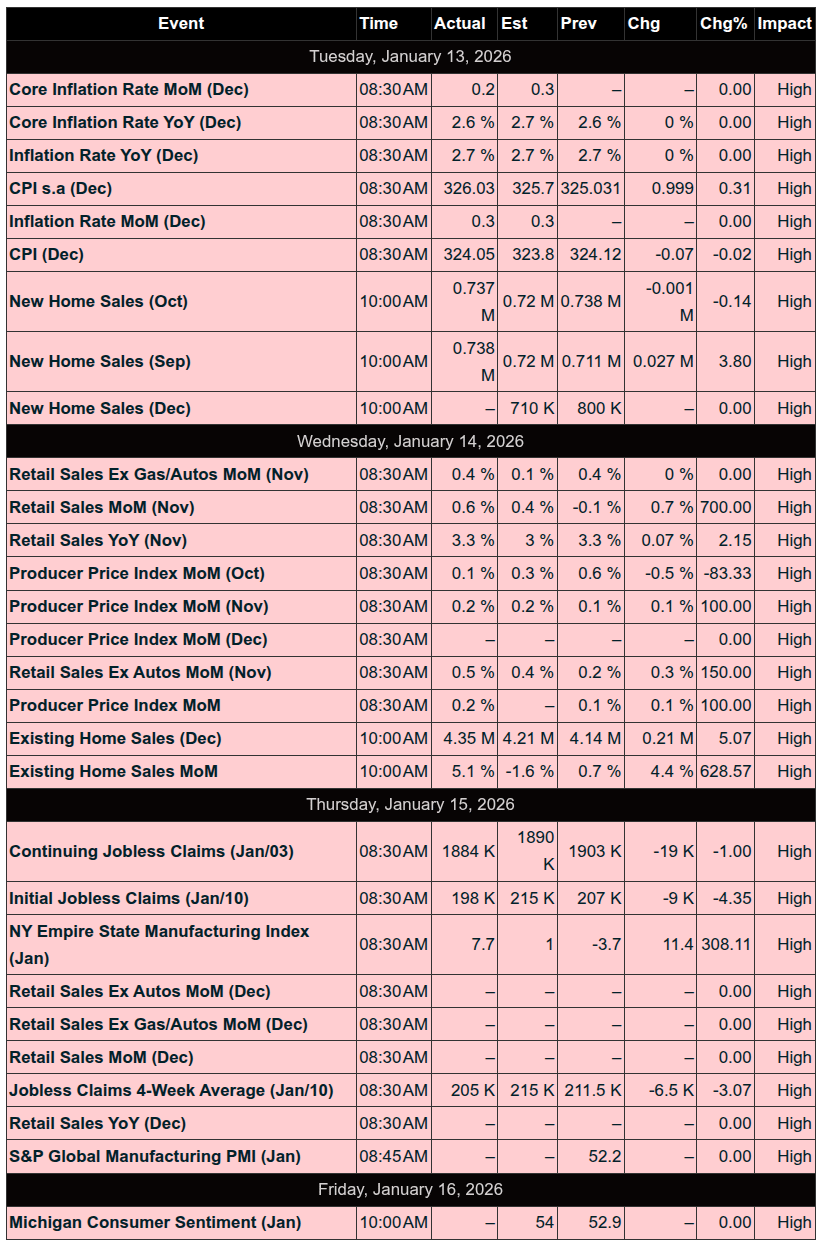

Calendars

Economic Calendar Today

This Week’s High Importance

S&P 500 Earnings:

Upcoming:

Recent:

Trading Room News:

Polaris Trading Group Summary - For Thursday, January 15, 2026

Yesterday was a strong and educational session in the PTG trading room, led by PTGDavid, with key market targets achieved and several valuable insights shared.

Market Overview & Key Moves

NQ & ES Targets Hit Early:

PTGDavid highlighted a “monster mover overnight” in NQ, with the 3-day rally target of 25906 fulfilled early.

ES also fulfilled its initial 3-day cycle target of 6970, continuing to extend beyond the prior session’s range.

Cycle Day 2 (CD2) Behavior:

The day developed as a textbook Cycle Day 2, characterised by balancing and consolidation, not reversal.

PTGDavid reinforced that the healthiest behavior in CD2 is digestion and preparation for continuation—“a pause that refreshes.”

Additional Upside Target Hit:

Late morning, David posted new upside targets: 7015.50, 7020, 7025.

By 12:03 PM, 7015.50 was tagged, fulfilling another precision-level move.

D-Level Reaction:

In the afternoon, price responded significantly to a Daily D-Level, with David calling it a “BIG response.”

Cycle Day 2 Range High target zone was fulfilled, completing the strategic roadmap laid out earlier.

Education & Lessons Learned

Late-Day Trading Rule Reinforced:

A $2.3B MOC (Market On Close) sell imbalance caused a sharp late-day selloff.

David reiterated a core PTG rule: Avoid late-day trading. His advice? “Just say NO!”

Members praised this discipline, noting that late-day moves are often driven by large institutional activity or front-running behavior.

Market Mechanics Discussion:

A lively exchange took place around market makers, liquidity sweeps, and MBOs (Market By Order).

Maxim, a new member, asked insightful questions about adding to winners, footprint charts, and market-making strategies, sparking deeper discussion.

Takeaways

Plan your trades early and stick to the roadmap.

Respect CD2 rhythms – consolidation is not weakness; it's structure.

Avoid chasing late-day moves – let institutions play their games without your money at risk.

Lean on the community – whether it’s tech help or trade setups, the PTG room thrives on collaboration.

DTG Room Preview – Friday, January 16, 2026

Macro Focus: Markets are driven by the AI trade and corporate earnings amid geopolitical tensions (Greenland, Iran) and concerns over Fed independence as a legal battle unfolds between the Trump administration and Fed Chair Powell. Despite headlines, Fed speakers remain committed to holding rates steady. FedWatch shows a 95% probability of no rate change at the January meeting.

Global Trade: A breakthrough in Canada-China relations – China to cut tariffs on Canadian canola; Canada drops tariffs on 49,000 Chinese EVs. This signals China's intent to rebuild strategic trade ties, possibly at the cost of Canada's alignment with the U.S.

China Capital Flows: China’s $1.2T export surplus in 2026 is funding private purchases of foreign securities ($535B into U.S. and European markets), increasing exposure to FX risk as state reserves dwindle.

Market Technicals:

ES Consolidation: Still corkscrewing between converging inside trendlines. Key levels: Resistance at 7045/48; Support at 6912/17. Watch for a breakout move.

Volatility: Moderate and stable. 5-day ADR up to 69 points. No whale bias overnight due to low volume.

10Y Treasury: Weekly range compression (<10bps for 5 weeks) is making traders cautious. Historic patterns suggest potential for a breakout, possibly lower.

Earnings Watch: Premarket reports from MTB, RF, STT, PNC, and WIT.

Data & Fed Speak:

9:15am ET – Capacity Utilization & Industrial Production

10:00am ET – NAHB Housing Index

11:00am ET – Bowman

3:30pm ET – Jefferson

Reminder: U.S. stock markets are closed Monday for MLK Day. Trading resumes Tuesday, January 20.

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!!

Follow @MrTopStep on Twitter and please share if you find our work valuable!