- The Opening Print

- Posts

- Markets Shrug Off Shutdown — “Up, Up, and Away” Again

Markets Shrug Off Shutdown — “Up, Up, and Away” Again

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

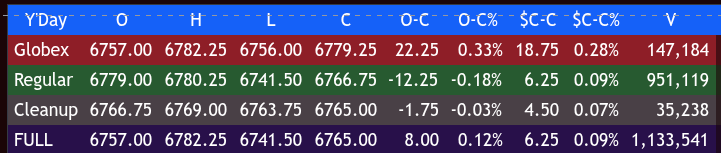

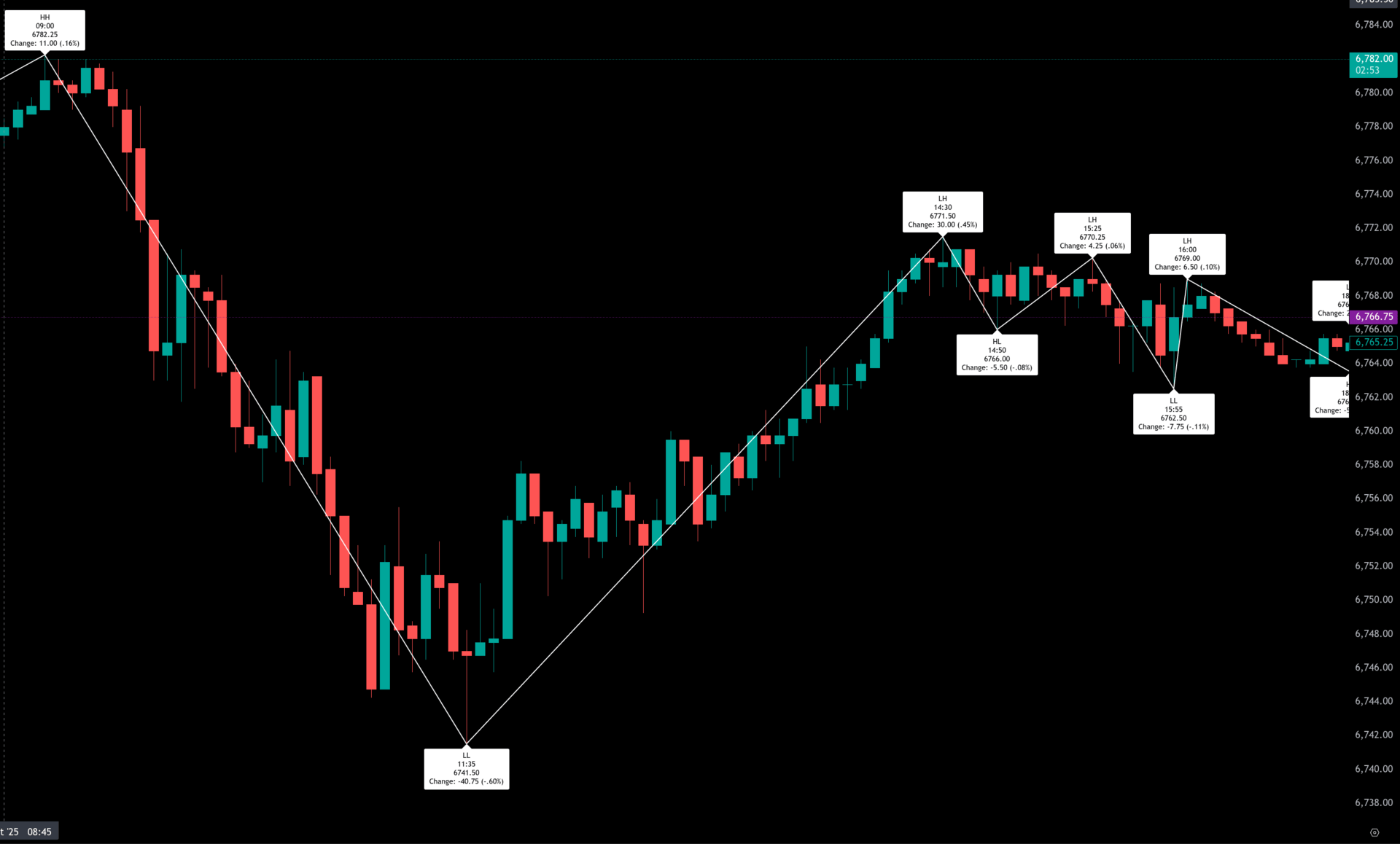

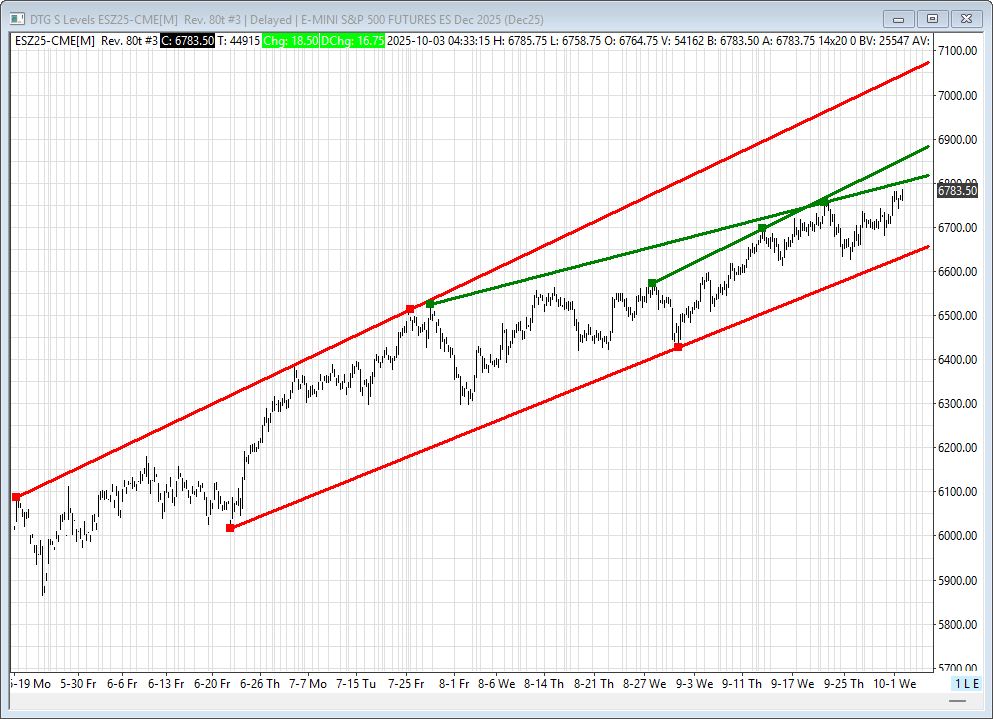

What did the ES do yesterday? It made another new high on Globex at 6782.75, traded 6757.00 on the 9:30 regular session open, sold off down to 6741.50 at 11:35, rallied up to the 6776 area at 1130, and then started to drift lower down to the 6762 area. It traded back up to the 6768 level at 3:00 and traded 6764 at 3:45.

The ES traded 6765 as the 3:50 cash imbalance showed $1.1 billion to sell, traded 6766.75 on the 4:00 cash close, and settled at 6765 on the 5:00 futures close, up 5.25 points or +0.08%. It's been up 9 of the last 12 sessions and up 5 in a row.

The NQ settled at 25,110, +97.75 points or +0.39%, and has been up 8 of the last 11 sessions, or up 5 in a row. The ES and NQ posted new highs, while the YM posted a one-week high. Again, the strength in chipmakers and AI-infrastructure stocks supported gains in the broader market.

Gold dropped 1%, and Bitcoin popped above $120,000.

In the end, it's been up, up, and away. In terms of the ES’s overall tone, it remains a buy-the-pullbacks market. In terms of the ES’s overall trade, volume was on par with Wednesday's volume at 1.182 million contracts traded.

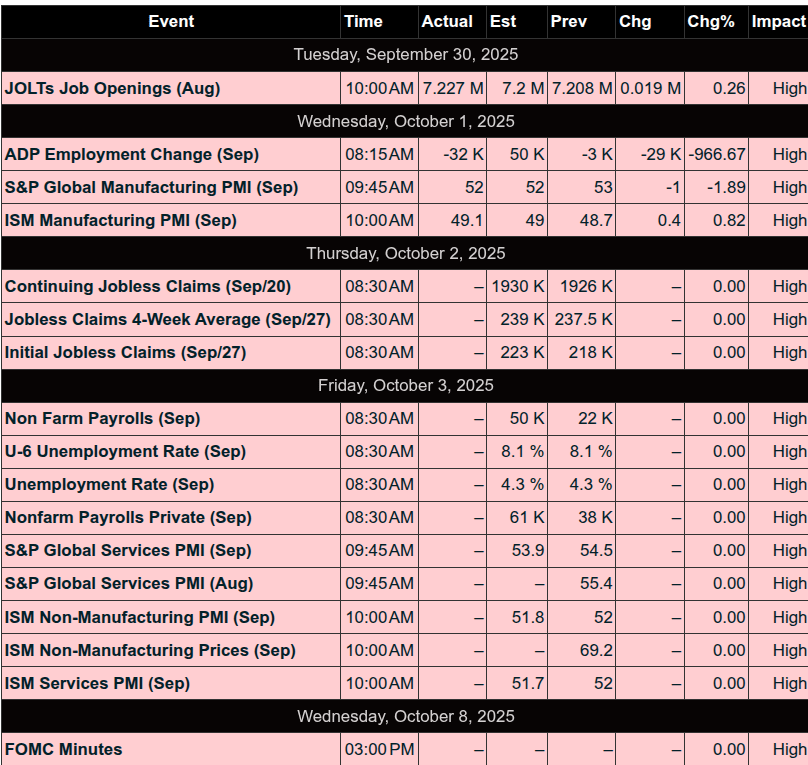

What Was On Tap

All of today's data has been delayed, as has the Fed speak.

6:05 AM: New York Fed President John Williams speech

8:30: September Jobs report

9:30: Federal Reserve Governor Stephen Miran TV appearance

10:00: ISM

1:30: Dallas Fed President Lorie Logan speech

1:40: Federal Reserve Vice Chair Philip Jefferson speech

3:30: Federal Reserve Governor Stephen Miran TV appearance

Our View

The Senate will revote on stopgap funding measures that have previously failed, and if by the end of the day the vote is not resolved, the shutdown will have lasted longer than the previous seven shutdowns. But so far, it doesn’t seem to matter, as the major indexes have now hit 70 closing records this year—including 30 each for the NQ and ES.

Our Lean

I don't know how this is going to play out, but with all the economic reports and Fed speak canceled—and it being the "spooky" month of October—the markets may get the jitters. Prediction markets suggest bettors think the shutdown will last until at least the end of next week, which would delay key economic data such as the monthly jobs report.

Our lean: Had the jobs number gone off as planned, I wanted to buy a lower open and hold for the Week 1 options expo, but like I said, this is spooky. My advice: trade less, pick your spots better.

We’ve never offered a deal like this before, and it includes all our tools, including the Imbalance Meter.

Guest Posts:

|

Get instant access to our partners’ real-time market data and insights not available anywhere else. Here is last night's Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

Founder's Note:

Futures are 20bps higher, with no major data on tap for today as the Shutdown continues.

There is a bunch of positive gamma layered overhead from 6,740 to 6,775 which sets this area up as and overhead "sticky zone" for today. Support is at 6,700, and our risk-off level remains <6,680.

Adding to support for today is short-dated vol, which is quite low and likely suppressed by typical Friday/weekend IV contraction.

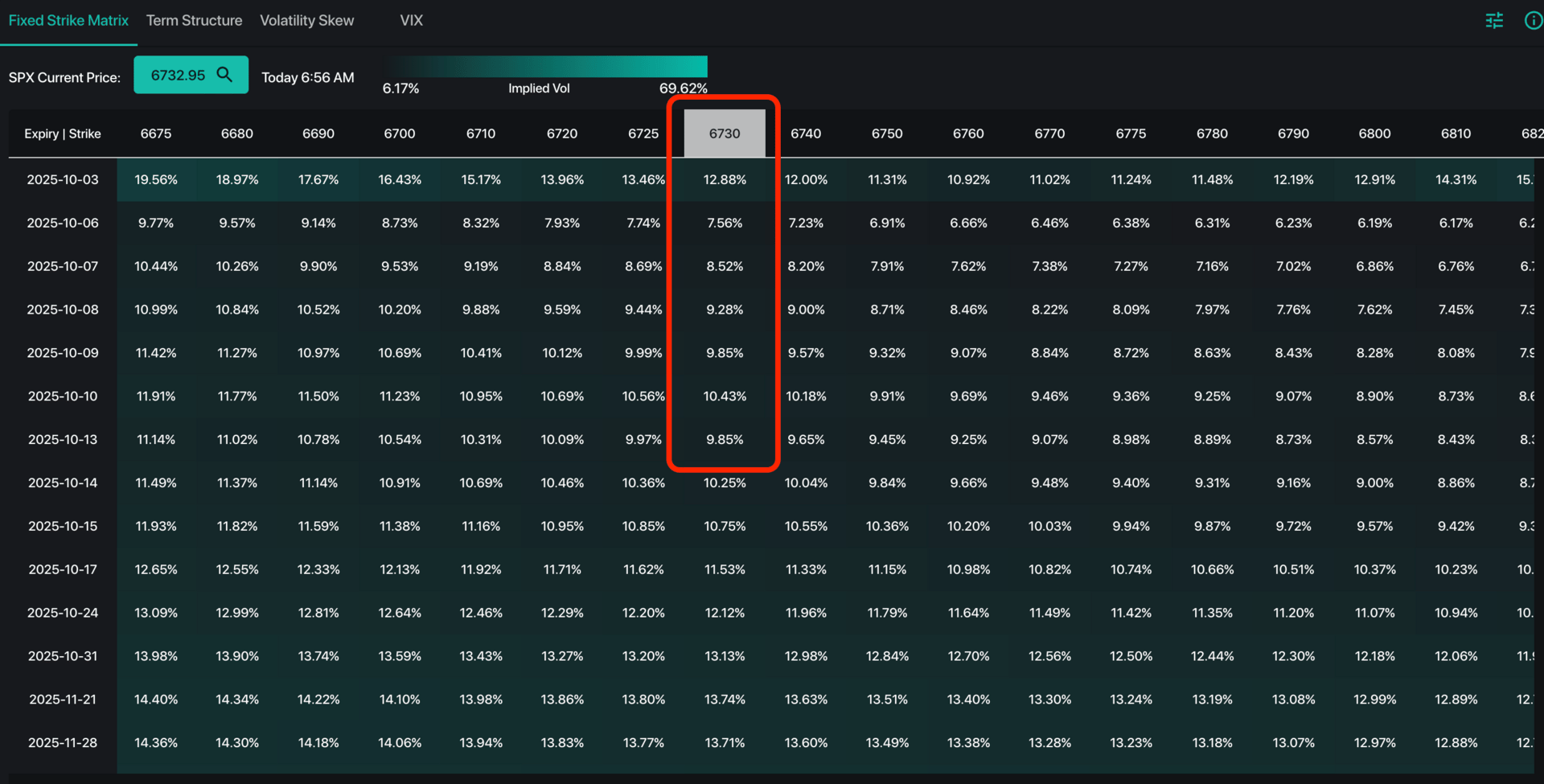

Below is SPX IV, and we see that while VIX remains >16, short dated SPX vols are in the gutter at <10%. Its possible the Shutdown keeps a bid into >1-month vol/VIX, but what seems clearest here is that there is just a IV kink at October OPEX (IV is < before OPEX and > after).

On the OPEX point if we had to bet on when the dynamics highlighted yesterday break (i.e. COR1M is in the danger one) break, we'd think "no later than Oct OPEX".

Lastly, aside from the stock space are a few interesting ETF/sector plays. First, URA is flagging as both rich calls and high IV. We don't know much about this sector or play, but its reading as quite crowded.

The other crowded trade has been GLD/SLV, with only SLV now having relatively high IV's. GLD has slipped down in the rankings. While these are only rankings, its interesting to see both of these names shift to the left of the plot, suggesting call IV's are retracting vs puts. Both GLD and SLV are just a fraction from fresh long term highs. This almost suggests a wearing off of over overbought conditions...

Lastly are bond ETF's which have IV ranks of nearly zero, with huge call IV's. Everyone expects upside in this space - and we're not here to suggest you fade that idea but the rich relative call IV may setup a few interesting trade structures.

©2025 TenTen Capital LLC DBA SpotGamma

Get instant access to our partners real-time market data and insights not available anywhere else. Here is last night Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

MiM and Daily Recap

The overnight Globex session opened at 6757.00 and pushed higher in the early hours, climbing steadily to reach 6771.75 by 21:50. That move represented a 24.75‑point rally (+0.37%) from the open. Sellers emerged shortly after, pressing the contract down to 6763.75 at 23:30 before a modest bounce carried ES to 6770.00 at 01:10. A deeper pullback unfolded into the overnight low at 6750.75 by 02:50, marking a 30‑point decline (-0.44%) off the earlier high. The contract recovered again, advancing to 6775.00 at 04:20 before slipping to 6765.50 at 05:30. The last Globex push carried futures back up to 6782.75, setting up strong for the cash open. Globex closed at 6779.25, up 22.25 points (+0.33%) from its open and 18.75 from its prior settle.

The regular session began at 6779.00, slightly above the overnight midpoint, but quickly sold off. By 11:35, ES printed a sharp low at 6741.50, down 37.5 points (-0.55%) from the open and establishing the day’s cash-session trough. From there, buyers staged a broad recovery, lifting futures to 6771.50 at 14:30. The rest of the afternoon was a tight 7-point chop of lower highs and finished the regular session at 6766.75, down 12.25 points (-0.18%) from the open but up 6.25 points (+0.09%) from the prior cash close.

In the brief cleanup session, ES oscillated narrowly, hitting 6769.00 at 16:10 before easing to a close of 6765.00, slipping 1.75 points (-0.03%). The full session settled at 6765.00, up 8.00 points (+0.12%) from the prior full-session close. Total volume reached 1.13 million contracts, with 951,000 of those changing hands during regular hours.

Market tone leaned indecisive. The overnight bid carried momentum early, but the regular session reversed that strength, testing the downside before retracing most of the move. The intraday recovery was notable but failed to sustain new highs, with sellers reappearing late into the afternoon.

The Market-on-Close imbalance showed -$1.171 billion to sell, with 60.9% of imbalance dollars favoring the sell side and 53.9% of symbols leaning negative, just shy of the extreme threshold. Sector flows highlighted significant weakness in Technology (-70.5%), Consumer Cyclical (-79.9%), and Communication Services (-89.7%), while defensive sectors such as Utilities (+62.9%) and Healthcare (+53.8%) provided relative strength.

Overall, the ES extended its streak of holding higher ground relative to prior closes but ended the day with a soft regular-session tone. The late imbalance pressure weighed on the afternoon recovery, leaving the index to settle just above flat on a full-session basis. Traders will be watching whether sellers can build on the late-session fade or if buyers again defend support into next week’s trade.

BTS Trading Levels - (Premium Only)

Technical Edge

Fair Values for October 3, 2025

SP: 47.99

NQ: 207.26

Dow: 258.22

Daily Breadth Data 📊

For Thursday, October 2, 2025

NYSE Breadth: 47% Upside Volume

Nasdaq Breadth: 72% Upside Volume

Total Breadth: 69% Upside Volume

NYSE Advance/Decline: 49% Advance

Nasdaq Advance/Decline: 58% Advance

Total Advance/Decline: 54% Advance

NYSE New Highs/New Lows: 129 / 41

Nasdaq New Highs/New Lows: 407 / 98

NYSE TRIN: 0.96

Nasdaq TRIN: 0.53

Weekly Breadth Data 📈

Week Ending Friday, September 26, 2025

NYSE Breadth: 50% Upside Volume

Nasdaq Breadth: 54% Upside Volume

Total Breadth: 53% Upside Volume

NYSE Advance/Decline: 39% Advance

Nasdaq Advance/Decline: 40% Advance

Total Advance/Decline: 40% Advance

NYSE New Highs/New Lows: 312 / 107

Nasdaq New Highs/New Lows: 692 / 209

NYSE TRIN: 0.61

Nasdaq TRIN: 0.56

Calendars

Economic Calendar Today

This Week’s High Importance

Earnings:

Trading Room News:

Polaris Trading Group Summary - Thursday, October 2, 2025

Thursday opened with a continuation of Wednesday’s strength but quickly shifted tone. PTGDavid warned early via DTS that “momentum may spill-over before the next decline develops” — and that’s precisely what unfolded. What started as a potential continuation day turned into a clear Cycle Day 1 (CD1) Decline, which the room adapted to with precision.

Key Trades & Positive Setups

Early Short Bias Recognition

David set the tone early with LIS at 6755, and as price failed to reclaim it consistently, the room leaned short. His call: "Yesterday was LONG...Today IS SHORT" provided critical directional clarity.NQ Open Range Short

Executed effectively with Target 2 fulfilled and stop trail in place, showcasing strong rhythm trading in a declining environment.CD1 Range Target Hit and Reclaimed

David marked 6743.43 as the CD1 average decline level. Price nailed it, bounced, and offered a clean +10 handle reversal trade — “ULTRA PRECISE LEVELS,” as David highlighted. These projected levels continue to deliver high-quality opportunities.Afternoon Reversal off D-Level

A bounce from the D-level and CD1 range low projection created a reversal setup for those nimble enough to shift gears. Bruce pointed out the 12:40/6754 discount opportunity (though missed by many), but it marked the structural shift.

Lessons & Takeaways

Trade Today’s Rhythms, Not Yesterday’s

David emphasized the importance of recognizing environment shifts. Several members initially hesitated to short, still anchored to Wednesday’s bullish action. The shift from trend-up to trend-down needed clear mental adjustment.First Pullback is the Best Pullback

David reminded the room that first pullbacks after trend shifts offer the best quality trades. Later pullbacks may look technically similar, but quality and context differ—a valuable nuance for entry selection.Stay in Alignment

Manny stressed alignment over prediction, avoiding the temptation to "buy the low" in a declining tape. His insight: “Predicting is natural, but we have to work to curb those instincts.”Avoid FOMO and Overtrading

Bruce, Roy, and others openly discussed missed trades and poor entries, fostering real-time learning. David’s coaching around discount quality and Roy’s back-and-forth about MA shifts and CCI reads showed the value of collaborative learning.

Challenges

Late-Entry Longs Struggled

Traders trying to catch reversals or buy dips without confirmation (like Roy’s long attempt around 14:48) faced losses. David explained that discounts late in the move tend to fail, reinforcing the importance of context and sequence.MOC Sell Pressure

A $1.1B MOC sell imbalance capped the day, confirming broader sell pressure and aligning with the CD1 narrative. Bruce summed it up: “You’re no fun,” in response to the bearish close.

Room Vibe & Extras

Strong camaraderie and humor as always — sombreros, Panch Villa jokes, and sunrise photos kept the mood light.

Members like Manny and Raja brought depth with order flow, FVG (Fair Value Gap) analysis, and mental discipline shares.

David's afternoon session and deeper coaching added value — including some classic humor, like invoking Carnac the Magnificent as his secret trading weapon.

Closing Thought

Thursday was a masterclass in adapting to shifting structure. While Wednesday rewarded bullish trend followers, today rewarded disciplined shorts who respected the cycle, structure, and PTG playbook.

"Trust your plan. Stay in alignment. Trade what’s in front of you." – PTGDavid

DTG Room Preview – Friday, October 3, 2025

Global Markets: US futures rise after record Thursday closes, boosted by optimism in AI. Major Japanese firms (Hitachi, Fujitsu, Nvidia) unveiled a global AI infrastructure plan, starting in Japan.

Government Shutdown: No end in sight. The September jobs report is likely delayed, with the BLS down to one active staffer. Political standoff continues over healthcare funding.

Fed Watch: The Fed remains focused on labor market softness as a key rate cut driver. Fed speakers: Logan (1:30pm ET) and Jefferson (1:40pm ET) today.

Gold vs. AI Trade: While AI dominates headlines, gold mining stocks lead with a 135% YTD gain, far outperforming semiconductors (+40%). Gold index trades at a more attractive 13x forward P/E.

Venture Capital: AI is the clear VC favorite in 2025, pulling $192.7B YTD. Total VC funding at $366.8B, with $250.2B flowing into US firms.

Key Data Today:

S&P Global Services PMI – 9:45am ET

ISM Services PMI – 10:00am ET

S&P 500 & ES Futures: Volatility eased; 5-day ADR at 54.25 pts. ES holds short-term uptrend with potential resistance at 6804/09, 6869/74, and 7071/76. Support eyed at 6645/50. No significant overnight whale activity.

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!!

Follow @MrTopStep on Twitter and please share if you find our work valuable!