- The Opening Print

- Posts

- From Criticism to Converts: How a Resurgent Market is Reshaping Views on Trump

From Criticism to Converts: How a Resurgent Market is Reshaping Views on Trump

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

The ES rallied on Globex overnight Thursday, making new all-time highs at 6357.00 (just above my 6350–6380 level). After being down 18.5%, the ES is now up 7% YTD. The NQ traded all the way up to 23,320.75 since its April 7th low—in just 73 sessions—and is now up 8.1% YTD after being down over 25%.

Back then, everyone was blaming Trump for the selloff. I didn’t think he was 100% to blame. Sure, he rattled the public’s nerves, but Trump had nothing to do with the Fed’s reckless interest rate policies when they lowered rates while inflation was still rising. Especially since they did this as the ES was coming off back-to-back gains of 25% in 2023 and 2024, which saw a combined total of 81 separate new all-time contract highs.

Am I making excuses for Trump? Definitely not. Yields started rising in March 2022, peaked on July 26, 2022, and rate cuts began in September 2024. None of these shenanigans had anything to do with Trump.

There are always reasons for markets to go up or down, but simple economics no longer applies. Despite the weak bond market, rising debt, and higher inflation, the backstop is Trump’s “One Big Beautiful Bill,” which would pump trillions into the U.S. economy.

Back in April, even Trump supporters were turning on him. But now that the S&P has rallied over 25%, it seems all is forgiven. One person who seems to have changed his tune is someone I always listened to when I watched CNBC or Bloomberg: Home Depot co-founder Ken Langone.

Langone had previously criticized Trump’s tariffs, calling them “bullshit” and too aggressive—particularly a 46% tariff on Vietnam and a 34% tariff on China. He said he didn’t understand the formula behind them, felt Trump was poorly advised, and expressed concern that the tariffs could lead to inflation and increase the budget deficit. It wasn’t the first time Langone spoke out against Trump. But last week, during a CNBC interview, he reversed course, saying he is now “sold on Trump” and that “he’s got a good shot at going down in history as one of our best presidents ever.”

This isn’t a new story, but I think there’s been a shift. Some believe Trump will pull off the trade deals and the stock market will keep going up. However, there’s now a new battle brewing—the Epstein files. Elon Musk has started attacking Trump after the famous DOGE shutdown and this week’s revelations about Trump’s involvement.

While it’s not a very many yet, some people are already predicting August could be a down month, with a possible +10% correction. I’m sure there will be more headlines, but I also think it’s a good idea to start shorting the ES because of the Epstein files. Trump may say he OK’d the release of the rest of the files, but who knows if that’s true—or how long it will take.

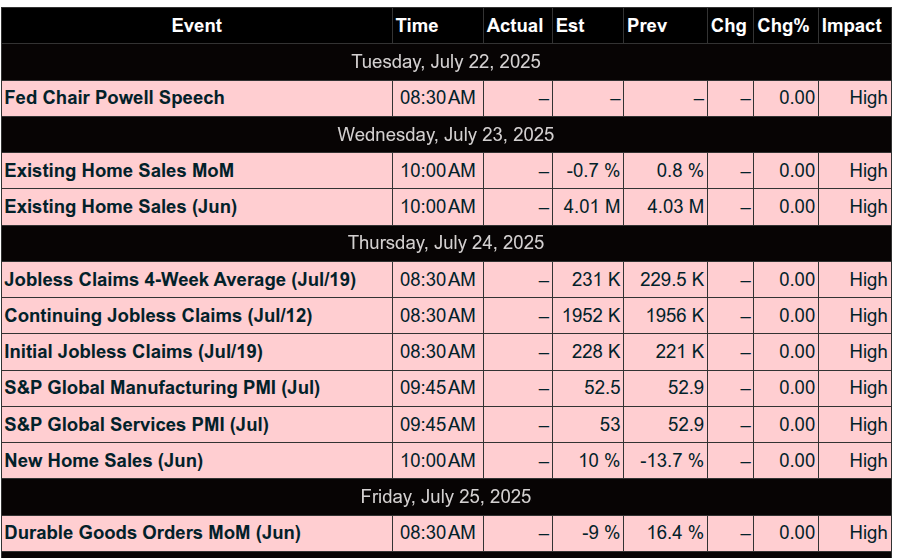

This week has a low level of economic reports. Powell speaks at 8:30 on Wednesday, and 112 companies in the S&P report earnings, including Google, TSLA, IBM, Coca-Cola, and Intel.

The Key Number: 28%

Foreign sales accounted for 28% of S&P 500 companies' $17 trillion of revenue in 2024. The largest regional exposures outside the US were the Asia-Pacific (10%) and Europe (5%). According to Goldman Sachs Research, only one sector of the S&P 500 generates more than half of its revenues overseas: information technology (56%).

The year-to-date weakening of the US dollar has supported the S&P 500 stocks with the highest international sales exposure. They've outperformed their domestic-facing counterparts by 7 percentage points since the start of 2025.

Guest Post:

Today’s post is a link to DLC Risk Management comments on July Markets

Read Here

MiM and Daily Recap

Intraday Recap

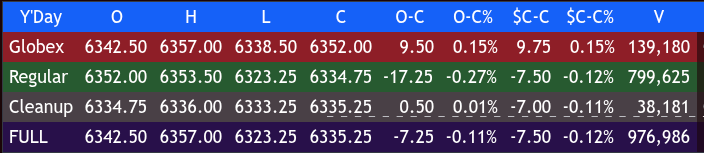

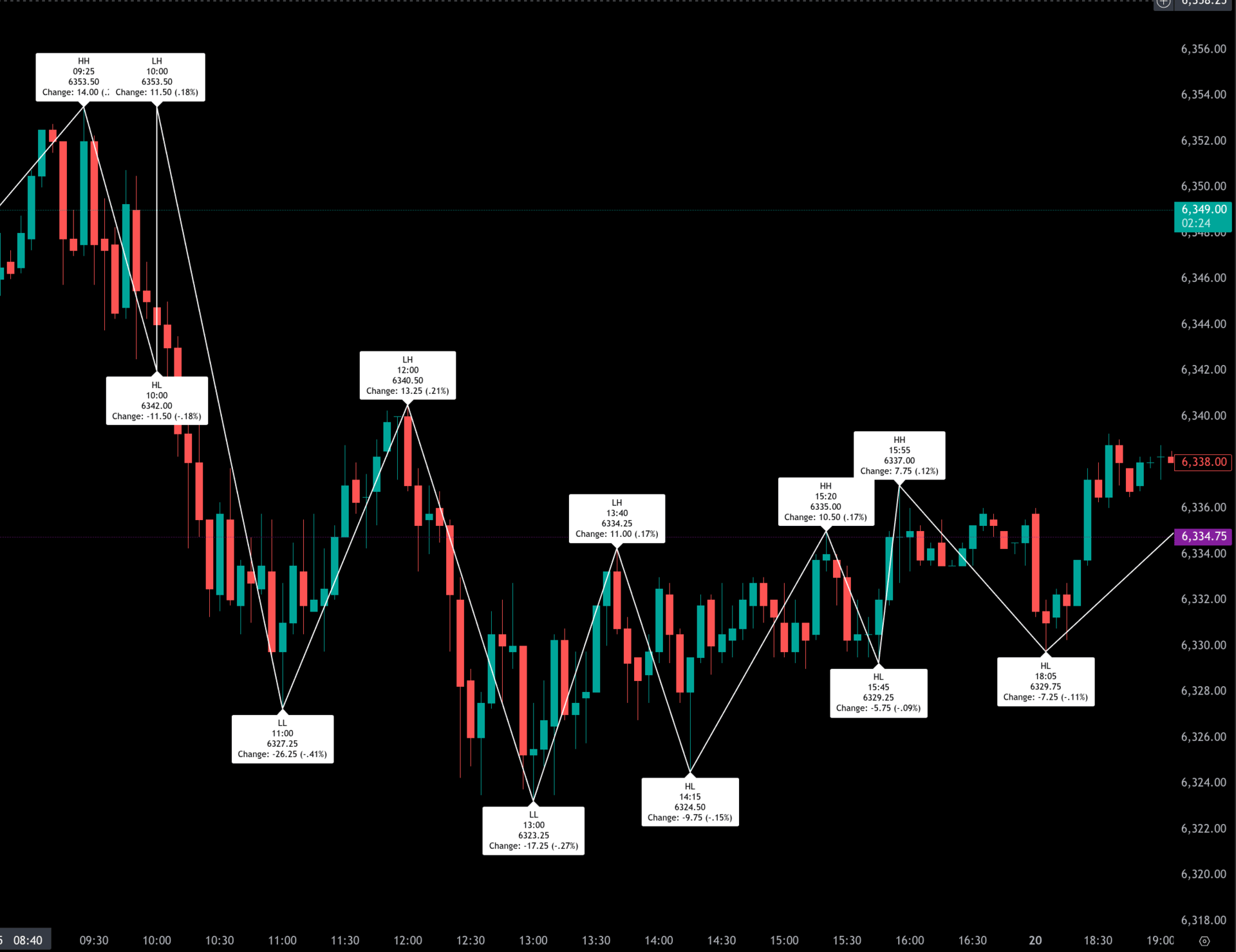

Friday's trade followed a weak-handed overnight session that opened at 6342.50 and reached an early high of 6350.75 by 19:45 ET. After a brief dip to 6344.75 at 22:00, buyers stepped in to lift the ES to an overnight high of 6357.00 at 02:15. From there, the tone shifted bearish. A steady selloff followed, dropping prices to a low of 6339.50 by 07:15, a 17.5-point fade off the peak. A short-lived rally into the cash open brought ES back up to 6353.50 at 09:15 before the downside resumed.

The regular session opened at 6352.00 and immediately failed to hold gains. A reversal off the open drove ES down to 6340.00 at 10:00 as Fed Kugler spoke, then accelerated to a session low of 6327.25 at 11:00. That 24.75-point decline marked the session's sharpest down leg. A sharp midday rally topped out at 6340.50 by 12:00, before rolling over once again. A second low was struck at 13:00 at 6323.25, representing the day's extreme print.

From there, the market stabilized and began a methodical grind upward. A lower high printed at 6335.25 by 13:40, followed by a modest dip and a climb to 6345.00 at 15:20. After a brief pullback to 6335.00 at 15:45, the ES lifted again to 6350.75 at 15:55 before slipping back into the close. The regular session settled at 6334.75, down 17.25 points (-0.27%) from the open and 7.50 points (-0.12%) from the previous day's close. Volume during the regular session was light and totaled 799,625 contracts.

The cleanup session added little, with a narrow range between 6333.25 and 6336.00, closing at 6335.25. Total full session volume came in at 976,986 contracts. The combined session (Globex + Cash + Cleanup) showed a net change of -7.25 points or -0.11%.

Market Tone & Notable Factors

Friday's tone was mixed with a bearish lean. The market failed to hold overnight strength, and multiple attempts to rally during the day were met with sellers, particularly after the morning’s failed bounce above 6350. Despite the pullback, bulls managed to defend 6323.25 on the second test, and the late afternoon produced a resilient if uninspiring grind higher.

Volume came in below average, contributing to the choppiness and lack of trend extension. Globex accounted for just 139,180 contracts, and total volume remained under 1 million.

The MOC imbalance showed a moderate tilt to the buy side with $2.507B notional flowing in, and the dollar percentage at 67.0%. However, the symbol imbalance registered only 59.9%, falling short of the 66% threshold for strong directional bias. The MOC helped lift prices into the 15:55 spike high but wasn’t strong enough to drive a breakout.

Technical Edge

Fair Values for July 21, 2025:

SP: 35.96

NQ: 152.77

Dow: 198.21

Daily Breadth Data 📊

• NYSE Breadth: 46% Upside Volume

• Nasdaq Breadth: 56% Upside Volume

• Total Breadth: 55% Upside Volume

• NYSE Advance/Decline: 41% Advance

• Nasdaq Advance/Decline: 41% Advance

• Total Advance/Decline: 41% Advance

• NYSE New Highs/New Lows: 113 / 33

• Nasdaq New Highs/New Lows: 268 / 60

• NYSE TRIN: 0.81

• Nasdaq TRIN: 0.53

Weekly Breadth Data 📈

• NYSE Breadth: 53% Upside Volume

• Nasdaq Breadth: 64% Upside Volume

• Total Breadth: 60% Upside Volume

• NYSE Advance/Decline: 42% Advance

• Nasdaq Advance/Decline: 54% Advance

• Total Advance/Decline: 49% Advance

• NYSE New Highs/New Lows: 207 / 76

• Nasdaq New Highs/New Lows: 473 / 177

• NYSE TRIN: 0.62

• Nasdaq TRIN: 0.64

Calendars

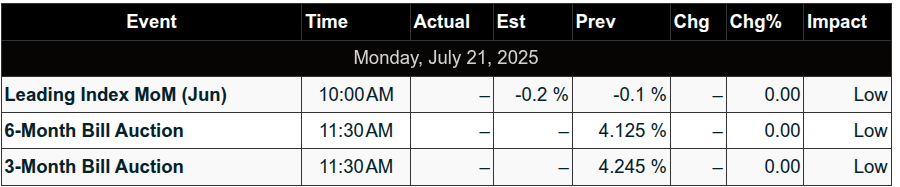

Today’s Economic Calendar

This Week’s Important Economic Events

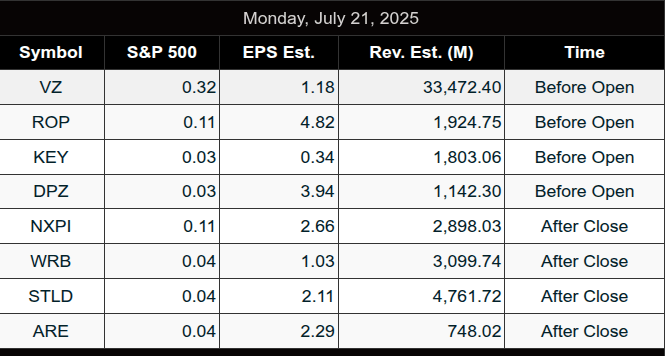

Today’s Earnings

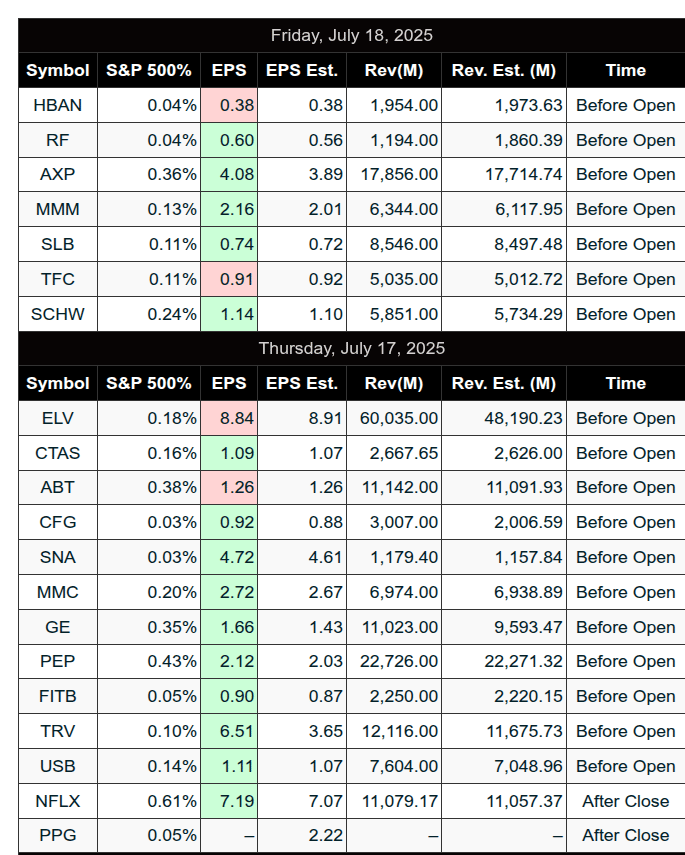

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, July 18, 2025

Overview:

"FRYday" lived up to its name with a sharp, clean trading session that emphasized discipline, scenario-based execution, and precise fulfillment of both bullish and bearish DTS (Daily Trade Strategy) targets. Despite PTGDavid having an early appointment and no pre-market briefing, the room navigated the session with confidence and clarity once he joined post-open.

Key Highlights

DTS briefing provided highly accurate target zones for both NQ and ES.

Early short scenario was in play with Open Range short hitting all downside targets on NQ.

NQ upside target of 23315 also hit precisely as outlined in the DTS briefing.

ES similarly fulfilled both its downside and upside DTS zones with precision.

PTGDavid returned post-open and quickly confirmed short-side alignment, authorizing sell-the-bounce entries.

PeterN shorted the open, took a small loss, but re-entered confidently aiming for CD1 low, demonstrating resilience and strategic thinking.

slatitude39 executed two solid short entries at 38.50 and 6338.50, targeting lower zones (6319, 6315, 6299), following the broader DTS roadmap.

John B managed positions well, closed flat after the morning move, and wrapped up his week on a strong note.

Education and Lessons

David stressed the importance of scenario-based trading, eliminating ambiguity, and reducing overtrading.

Emphasis on defining trades in advance and executing only when setups align with strategy.

Avoiding premature exits was highlighted as critical to maintaining statistical edge.

Repeated references to Yumi's guidance underscored the psychological discipline needed for consistent execution.

Traders were reminded that cutting losses before the actual stop can compromise win rates and risk-reward structure.

Community and Room Dynamics

Room stayed active and engaged throughout despite the late start.

Members shared charts, levels, and setups to support group analysis.

Chart freeze issues were reported and resolved collaboratively.

The day ended with casual banter and light-hearted images, creating a positive close to the week.

Takeaway

Friday’s session was an excellent example of how disciplined trading aligned with a solid plan can yield strong results. The DTS briefing provided actionable structure, and traders who followed the plan and stayed patient were rewarded. The emphasis on capital preservation heading into the weekend served as a final reminder that good trading is about quality, not quantity.