- The Opening Print

- Posts

- (Free) 'Thin to Win' Is Today's Theme

(Free) 'Thin to Win' Is Today's Theme

The Fed's foot is off the gas?

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

If you look at a wider timeframe chart of the S&P, it's clear that the ES is going to run into some big resistance above the 4230 level. This doesn't mean that there won't be another push on the upside, but I think it’s critical this week to remember the Pitbull's trading rule that says: “The S&P tends to rally early in the week and early in the day during a bear market.”

As for the Fed, we had too many speakers last week and they left us with mixed messages. However, Chair Powell laid a more direct tone with investors. As reported by Fortune:

“Having come this far, we can afford to look at the data and the evolving outlook and make careful assessments,” Powell said, referring to the Fed’s 10 straight rate hikes, which have elevated its key short-term rate from near zero a year ago to about 5.1%, its highest level in 16 years.

That said, I think the Fed will remain data dependent. I don't see anything getting any cheaper at the grocery store or at the gas pump, but it looks like they will let the rate hikes work through the system.

Does it mean the ES is going to come crashing back down? No, but I think there is a pull back / selloff coming.

Our Lean

This is Danny Riley’s personal trading plan for the day.

To get this delivered daily, please consider upgrading to a paid membership.

MiM and Daily Recap

The ES made a Globex high at 4227.75 and opened Friday's regular session at 4219.75. After the open, the ES made an early high at 4125.75 and sold off down to 4191.50 at 11:39 and traded back up to 4110 11:57. After the uptick, the ES sold off down to a 4193.25 'double bottom' at 12:35, rallied back up to 4209 at 1:09 and sold black off down to 4193 at 2:18.

From there, it traded back up to 4205.75 at 3:05 as the early imbalance showed $755 million to sell. The ES traded 4205.50 as the final 3:50 cash imbalance showed $2.25 billion to sell, traded up to 4208.50 and then traded 4205 on the 4:00 cash close. After 4:00, the ES down-ticked a bit and settled at 4198.25 on the 5:00 futures close, down 13.75 points or -0.33% on the day. The NQ settled at 13,841, down 53 points or -0.38%, the YM closed down 163 points or -0.48% and the RTY settled at 1,775.80, down 15.3 points or -0.85% on the day.

In the end, Friday's gap up open led to an all-day down-tick until the late day gamma squeeze going into the close. In terms of the ES’s overall tone, it traded on the weak side. In terms of ES’s overall trade, volume was steady all day at 1.6 million contracts traded.

MIM has definitely turned south lately.

Technical Edge

NYSE Breadth: 38% Upside Volume

Advance/Decline: 40% Advance

VIX: ~$17

There are not a lot of setups jumping out to me at this moment, so we’ll continue to massage the stocks we’ve got left and focus on the indices now that Opex is out of the way.

Some oddities across the board. 10-year yields are at 10-week highs, AAPL, NVDA, AMD, META and the SMH ETF are down 1%, yet the S&P and Nasdaq are flat. That’s as of 8 a.m. or so, but interesting that the market is ignoring that weakness for now.

SPY

There’s so much talk about the debt ceiling and “sell in May,” etc. I think we just go day by day and week by week. The SPY gyrated around the Q1 high on Friday. Let’s see if that is an active pivot today.

The $414 to $416 area was stiff resistance for a month. Below Friday's low of $417.35 and failure to regain it could put that zone back in play. See that it holds this area as support if we dip that far.

SPY Daily

Pivot: $418

Upside Levels: $421.22 (gap fill), $425-26

Downside Levels: $414 to $416

ES

To receive access to the ES, SPX, NQ, QQQ, DXY and today’s individual stocks, please consider upgrading to a paid membership.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B. Now Add META and AVGO.

premium only

premium only

Go-To Watchlist

[premium only]

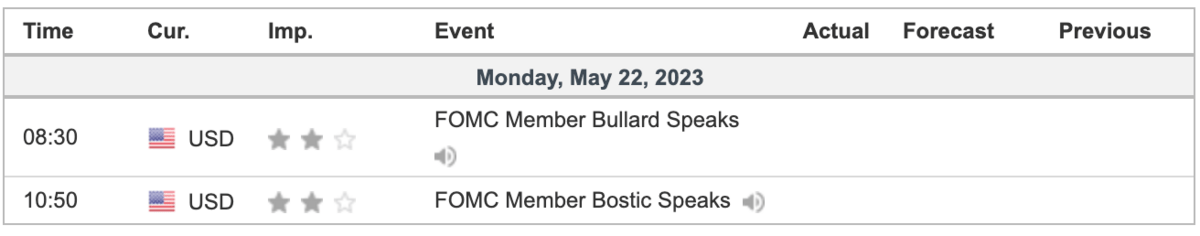

Economic Calendar

Just a couple of Fed heads…