- The Opening Print

- Posts

- (Free) Finally a Break Out of the Range. Can The Move Last?

(Free) Finally a Break Out of the Range. Can The Move Last?

Taking a chunk of profit on all of our open trades.

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

@RealTraderDave totally nailed the rally in the ES yesterday in the MrTopStep chat. I was dragging a long NQ from late Tuesday so after the opening drop I added to my NQ position. When they trend like they did yesterday, you just put your stop in and let it run.

As I write, all I can think about is this crazy range trade for most of 2023. The S&P has been (mostly) stuck between 4000 to 4220, but in the shorter term, it’s been stuck between 4120 to 4160 for weeks now. While I recall several periods where the S&P chopped in a narrow range, I don't recall being at the same price for this long. I think this says the public is sitting it out right now and the short-term traders have taken over.

There has been another big shift of money moving out of the US back to Europe, which could be affecting the S&P. It doesn’t help that investors can park their money in interest-bearing investments and/or accounts and get 4% to 5%+ without the headache of equities.

At least for now I do not see a large move coming in either direction, despite making a big upside push yesterday.

Our Lean

This is Danny Riley’s personal trading plan for the day.

To get this delivered daily, please consider upgrading to a paid membership.

MiM and Daily Recap

The ES traded up to 4144.75 on Globex and opened Wednesday's regular session at 4143.50. After the open, the ES printed 4144.25, sold off down to 4125.75 at 10:00 and then rallied back up to 4138.75 at 10:42, pulled back to the VWAP and then ripped up to 4148.25 at 11:18. From there, it dropped down to 4137.75 and then slowly rallied up to 4158.50 at 12:42, then made three separate higher highs at 4163, 4166.50 and 4172.50 at 1:11.

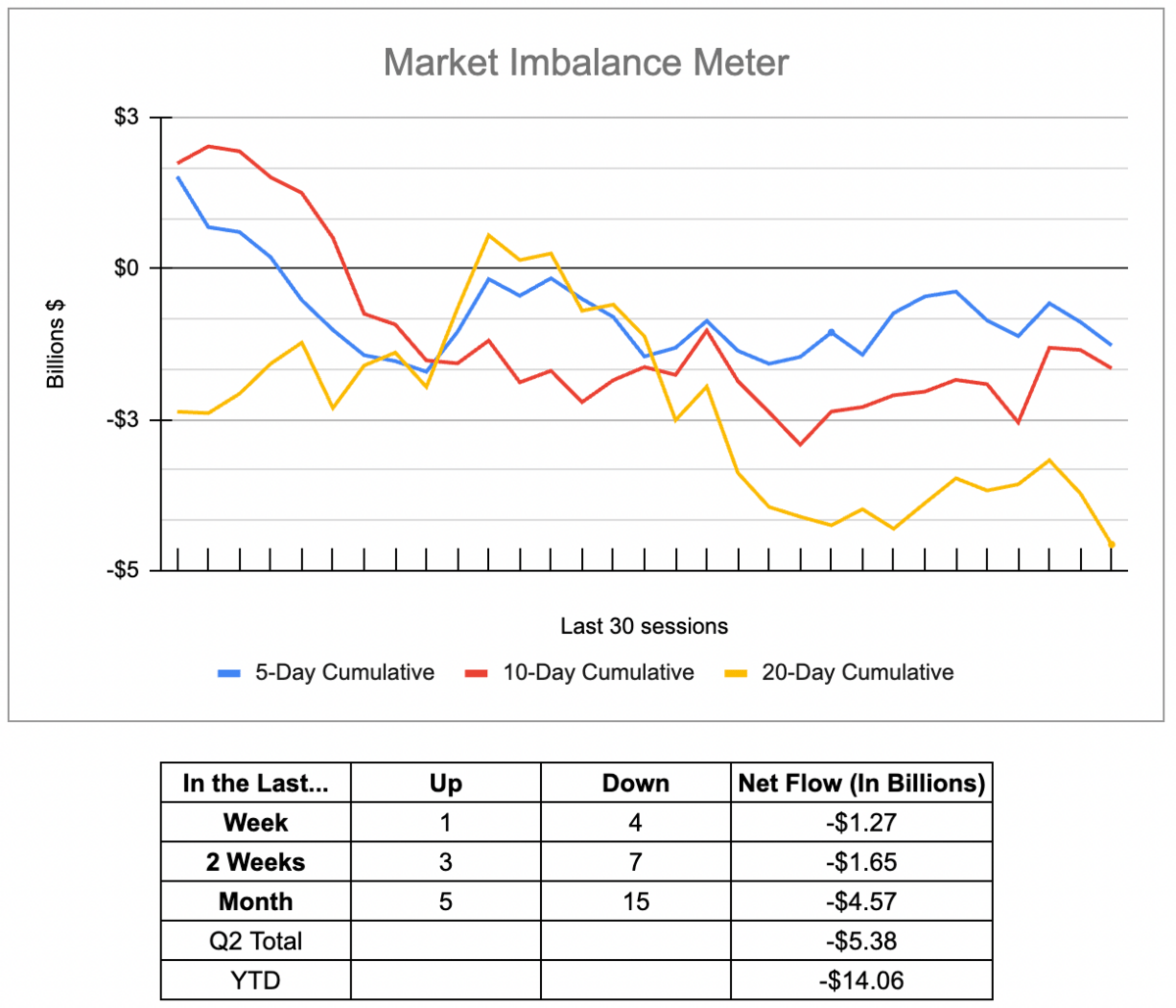

From 11:27, the ES rallied from 4144 to 4175.75 in one hour and 10 minutes and made two more higher highs at 4176.27 and 4179 at 1:58. The ES gradually pulled back to the 4164.75 level as the early imbalance showed $591 million to sell and then rallied up to 4173.75 as the 3:50 cash imbalance showed $360 million to sell. It traded up to 4175.25 at 3:57 and traded 4171.50 on the 4:00 cash close. After 4:00, the ES traded in a narrow range and settled at 4171 on the 5:00 futures close, up 48.50 points or 1.2% on the day.

In the end, the ES the MrTopStep trading rule that “it takes days and weeks to knock the S&P down and only one to bring it back,” was in play. In terms of the ES's overall tone, with the exception of the roughly 20-point drop after the open it was very firm. In terms of the ES's overall trade, volume was higher at 1.5 million contracts traded.

Technical Edge

NYSE Breadth: 81% Upside Volume (!)

Advance/Decline: 78% Advance

VIX: ~$16.75

A nice upside breadth push yesterday as most S&P instruments cleared last week’s high. We will need the SPY and SPX to hold that weekly-up rotation today and will need the ES to go weekly-up in the process (it is during Globex). Otherwise, the range trade may not be finish quite yet.

S&P 500 — ES

4175-ish is still a bit of a hurdle, but if the ES can clear it, ~4200 is the next significant area.

ES Daily

Pivot: ~4175

Upside Levels: 4198-4206, 4220, 4242

Downside levels: 4150, 4120, 4110-12

SPY

To receive access to the SPY, SPX, NQ, QQQ, DXY and today’s individual stocks, please consider upgrading to a paid membership.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B

META — [premium only]

CRM — [premium only]

AVGO — [premium only]

UBER — [premium only]

Go-To Watchlist

Feel free to build your own trades off these relative strength leaders

Relative strength leaders →

[premium only]

Relative weakness leaders →

[premium only]

Economic Calendar