- The Opening Print

- Posts

- Fed’s Playing Hard to Get.

Fed’s Playing Hard to Get.

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

There are three ways to do the Opening Print—small, medium, and large—and today’s falls into the small department.

The E-mini S&P 500 (ES) opened Monday at 6,908.25, up 36.25 points or 0.52%, after trading as high as 6,909.00 overnight and dipping to 6,873.25. Post-open, it briefly touched 6,909.50 before selling off sharply to a session low of 6,849.50 by 10:27 a.m. ET.

A midday rally lifted it to 6,889.75 at 12:24 p.m., only to reverse to 6,874.75 three minutes later. It then recovered to 6,893.00 by 1:12 p.m., pulled back four points, and edged to a new intraday high of 6,893.25 at 1:45 p.m.

The afternoon saw choppy action: a drop to 6,876.50 at 2:40 p.m., a bounce to 6,887.50 by 3:09 p.m., and a final dip to 6,875.75 at 3:36 p.m. amid a $$-heavy sell imbalance at 3:50 p.m with ES sitting at 6,877.75. The cash close came in at 6,885.25, but after-hours saw a slide to 6,880.50 before settling at 6,882.25—up just 8.75 points or 0.13% on the day.

The E-mini Nasdaq-100 (NQ) settled at $26,103.25, up 99.25 or 0.38%. Despite a late recovery, the ES felt dragged by NQ momentum all session, trading in a 60+ point range on lighter volume of 1.3 million contracts, with an underlying tone that lacked conviction heading into Election Day.

Important Earnings, Fed & Economic Calendar: November 4-6:

Day 35 of Government Shutdown

I got out of my longs last night. I'm not down much, but I'm not liking the price action, and I'm not sure if it’s the NY mayoral election or just the same old uncertainties, the tariff economic concerns or the government shutdown. Going into its 35th day, the shutdown is now affecting consumer confidence. Several Democratic Senators are urging President Trump to join the talks to end the impasse, but it doesn’t sound like he’s going to do that.

Today’s 35-day U.S. government shutdown equals the previous record for the longest shutdown in history: the 35 days from December 22, 2018 – January 25, 2019. That partial shutdown stemmed from disputes over border wall funding and affected over 800,000 federal workers, leading to widespread economic disruptions estimated at $11 billion in lost productivity.

I got news for you—this shutdown is going to cost way more than the first one.

Our View

I really think the ES and NQ are going up, but they seem spooked. I didn’t sell the open yesterday, and the ES and NQ went straight down. Yes, they had a good bounce, but they were acting weak last night. Maybe the markets will catch a bid after the election.

Right now, the election odds show Zohran Mamdani is a 95% favorite—if you bet $1,880, you win $100. That is not a good fade. That’s worse than selling the ES down 50 points.

Guest Post: Tom Incorvia - Blue Tree Strategies

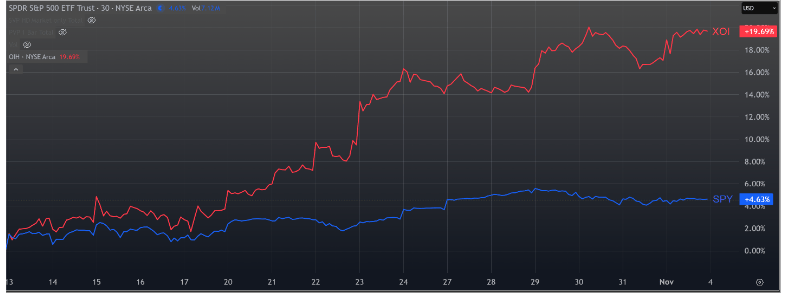

Since the FOMC announcement, the S&P 500 has remained rangebound over the past three sessions, with overlapping value areas reflecting short-term market indecision. This consolidation phase suggests that traders are awaiting a catalyst before committing to directional exposure. During periods of broad-market hesitation, relative strength analysis becomes increasingly important. Notably, the Oil Services (OIH) sub- sector has exhibited strong momentum and sustained buying interest. From the S&P 500’s recent low on October 10, the index has advanced 4.62%, while the oil services sub-sector has outperformed significantly, gaining 19.69% over the same period—demonstrating clear relative strength and heightened demand within the energy complex.

Adopting a top-down approach, I focus on identifying strong stocks within strong sectors that align with broader market momentum—and vice versa. In reviewing several companies within the oil services industry, I identified a number of technical patterns that warrant attention for potential increased demand. That said, as a technical analyst, it’s essential to recognize potential conflicting factors. In this instance, the key risk is the sector’s sensitivity to external influences, particularly policy developments from Washington or production decisions by OPEC.

TechnipFMC is another strong performer within the oil services sector. The merged profile reflects a bullish distribution pattern beginning from the initial breakout. The red line may indicate the potential start of a new upward distribution phase. I am watching for a decisive and energetic breakout to confirm the continuation of this

Tom Incorvia began his career in financial services in 1987 and has amassed over three decades of experience navigating the complexities of the markets. His career spans both the buy-side and sell-side of the trading desks, having served as Vice President of Equity Trading and later as General Partner of a hedge fund. This dual perspective has provided him with a unique and well-rounded understanding of market behavior.

You can purchase Tom’s Course on Volume Profile here.

MiM

Market-on-Close Recap – Monday, November 3, 2025

Monday's MOC session opened balanced but quickly shifted toward persistent selling pressure, ending with a –$1.15 billion net imbalance across all markets. Total buy interest reached $2.67 billion, while sell programs totaled $3.82 billion, resulting in a weighted lean of –58.8%, signaling a strong institutional bias to the sell side. The breakdown showed –$690 million in NYSE names, –$978 million in S&P 500 components, and –$415 million on the NASDAQ.

The imbalance trend through the 15:50–16:00 window confirmed broad liquidation pressure. Early readings around 15:51 ET showed roughly $3.8 billion in sells versus $2.6 billion in buys. A brief mid-session rotation near 15:54 ET lifted totals into positive territory ($+296 million) before sellers reasserted control into the close. By 16:00 ET, total sells settled near $3.8 billion, with only $2.3 billion in buys remaining.

Sector participation reflected a defensive rotation. Basic Materials (+63%) and Healthcare (+55%) finished firmly on the buy side, showing targeted inflows. However, most sectors leaned negative: Communication Services (–87%), Utilities (–77%), and Consumer Defensive (–75%) led the selling with heavy outflows, each indicating wholesale institutional distribution. Technology, while slightly negative at –50.5%, showed signs of rotation rather than full-scale liquidation with 707 buys versus 722 sells.

At the symbol level, selling was concentrated in mega-cap technology and communication names: AAPL (–$190.7M), GOOG (–$62.4M), and META (–$387M) all saw notable sell imbalances. Offsetting this were selective buys in LIN (+$164M) and LLY (+$105M), as well as TSLA (+$81M) in the cyclical group. These mixed signals highlight money rotating from high-momentum growth to more stable value and healthcare exposure.

Overall, Monday’s MOC displayed a broad sell imbalance with selective defensive accumulation—a sign that institutional traders were de-risking portfolios while reallocating into lower-volatility sectors ahead of key macro data later in the week.

Technical Edge

Fair Values for November 3, 2025:

SP: 28.48

NQ: 126.86

Dow: 127.64

Daily Market Recap 📊

For Monday, November 3, 2025

NYSE Breadth: 43% Upside Volume

Nasdaq Breadth: 51% Upside Volume

Total Breadth: 50% Upside Volume

NYSE Advance/Decline: 43% Advance

Nasdaq Advance/Decline: 39% Advance

Total Advance/Decline: 40% Advance

NYSE New Highs/New Lows: 72 / 97

Nasdaq New Highs/New Lows: 162 / 215

NYSE TRIN: 0.91

Nasdaq TRIN: 0.60

Weekly Breadth Data 📈

For Week Ending Friday, October 31, 2025

NYSE Breadth: 46% Upside Volume

Nasdaq Breadth: 55% Upside Volume

Total Breadth: 52% Upside Volume

NYSE Advance/Decline: 32% Advance

Nasdaq Advance/Decline: 35% Advance

Total Advance/Decline: 34% Advance

NYSE New Highs/New Lows: 293 / 181

Nasdaq New Highs/New Lows: 700 / 373

NYSE TRIN: 0.53

Nasdaq TRIN: 0.42

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, November 3, 2025

Monday was a textbook Cycle Day 2 with normal Morning-Afternoon Turnaround Day (MATD) rhythms. The room leaned heavily into gamma-driven trading dynamics, with clean follow-through in the morning and a slower, more indecisive afternoon. There were some well-executed continuation and short setups that paid nicely, especially during the early session. PTGDavid and Manny both emphasized discipline, timing, and adapting to shifting gamma environments.

Key Trades & Wins

Manny’s Continuation Long

Trade Plan: Buy 6890–6900, target 6905–6920–6930

Result: Manny executed this well, taking +5 on one leg and +2 on the remainder

Screenshot provided for education and transparency

Lesson: Patience and managing risk paid off—scaled out before the open to avoid volatility

Resistance Short / Head and Shoulders (HnS) Pattern

Manny noted a micro HnS at the high and tied it into his resistance short zone (6885–6890)

Target hit: 6888, as planned

Takeaway: Great example of using fractals and structure for early confirmation

PTGDavid's Opening Range Strategy

Identified and traded shorts early below the 6875 Line in the Sand

Targeted 6855, 6848, and 6843 CD1 lows – hit progressively as momentum followed through

Stops moved to breakeven, locking in gains

A10 & A4 Structures

A10: Early short followed by NTNT setup confirmation

A4: Long from discount area, confirmed again later in the session

Strategic callouts by David made these actionable for members

Gamma Environment & Market Structure Lessons

Negative Gamma Insight:

Both Manny and David stressed how negative gamma creates cleaner momentum and more second chances

Manny: “Dealers hedge, their flow amplifies moves... cleaner momentum, faster rotations”

David: “Make Negative Gamma Great Again”

Supportive Structure Commentary:

Important structural zones were highlighted:

Line in the Sand at 6875

Volume Triangulation at 6851

Cycle Day Lows at 6843–6848

Backtest support: 6865

These gave traders clear zones for decision-making

Time Cycles Tracked Well:

Manny’s timing guide (10:00–10:45 low, 12:45 high, 2:30 low, 3:30 high) played out accurately

Noted live: “Clock continues to track well” – reinforcing the strength of the intraday cycle framework

Trader Insights & Wisdom

Manny’s Plan-Based Discipline:

Shared the evolution of his trade plans from 2012 to now

“I’m a trainwreck without a plan”

Shared historical screenshots of his planning process—valuable insight for new traders

Gamma Nuance:

Some debate mid-morning about whether gamma had flipped back positive

John B noted 0DTE gamma crossing at 6875, reminding traders to stay adaptive as conditions shift

David on Absorption:

When asked about red histogram with rising price: “Generally I’ll read that as absorption”

Afternoon Session – Slower, But Rhythmic

After the 2 PM “Shake n’ Bake” move back to VWAP, the market dulled out

David noted “Dulls-ville for the afternoon session”

Price closed near mid-VWAP, consistent with CD2 rhythm expectations

MOC: Flat

Summary

A solid Monday in the PTG room. Trade plans were respected, gamma awareness elevated the quality of setups, and timing was in sync with cycle expectations. The room remained cautious and adaptive, particularly in the afternoon when the tape got slow. Manny and David both delivered sharp guidance and actionable insights, helping the room extract value from a structured day.

Key Takeaways

Stick to trade plans, scale out smartly

Gamma awareness is critical—know when it’s helping or hurting

Time-based rhythm provides structure, especially on CD2

Absorption and volume clues provide added edge

On to the rest of the week with clarity and confidence.

Discovery Trading Group Room Preview – Tuesday, November 4, 2025

Macro & Headlines:

Big Tech Pullback: Futures retreat as Big Tech (AMZN, GOOG, META, MSFT) gives back gains from last week’s AI-fueled rally. Amazon hit a record close on its OpenAI partnership; meanwhile, Palantir (PLTR) fell 5% despite strong earnings on valuation concerns.

Key Earnings in Focus: Eyes on AMD, Uber, Spotify, Super Micro (SMCI) today. Notable premarket and postmarket earnings include Pfizer, Marriott, Snap, Lyft, Amgen, Rivian, and more. MCD, HUM, and NVO report Wednesday.

SNAP Cuts Amid Shutdown: White House confirms partial (50%) SNAP benefits during the shutdown. USDA warns delays in adjusting payments could stretch months. ~42M Americans impacted.

China Trade Tensions: China’s US envoy outlines four “red lines” (Taiwan, democracy, political system, development rights), warning the US not to cross them. Meanwhile, China eases chip export curbs crucial to global auto supply.

Quiet Economic Calendar: Fed’s Bowman speaks from Madrid at 6:35am ET.

Market Technicals:

ES Futures: Volatility elevated; ES dipped to 70.25 overnight. Held Monday’s LOD off the inside channel. TL support now at 6719/24; resistance zones to watch: 6851/54, 7038/43, 7064/69.

Whale Bias: Bearish lean into US open amid light large-trader overnight volume.