- The Opening Print

- Posts

- Eyes on CPI: After PPI, the Next Domino Before Triple Witching

Eyes on CPI: After PPI, the Next Domino Before Triple Witching

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

As you know, I’ve been thinking the fix was in ever since September 2, when the big $6.55 billion buy imbalance showed up on the close. Since then, the ES has closed higher 5 out of the last 6 sessions, While I was writing the Opening Print and reading over several bank PPI and CPI estimates calling for higher inflation, I started thinking: the banks are usually wrong when they all say the same thing. And sure enough, the ES popped up to 6565.25 on Globex after the PPI number unexpectedly decreased by -0.1% in August, contrasting with economists' forecasts for a 0.3% increase.

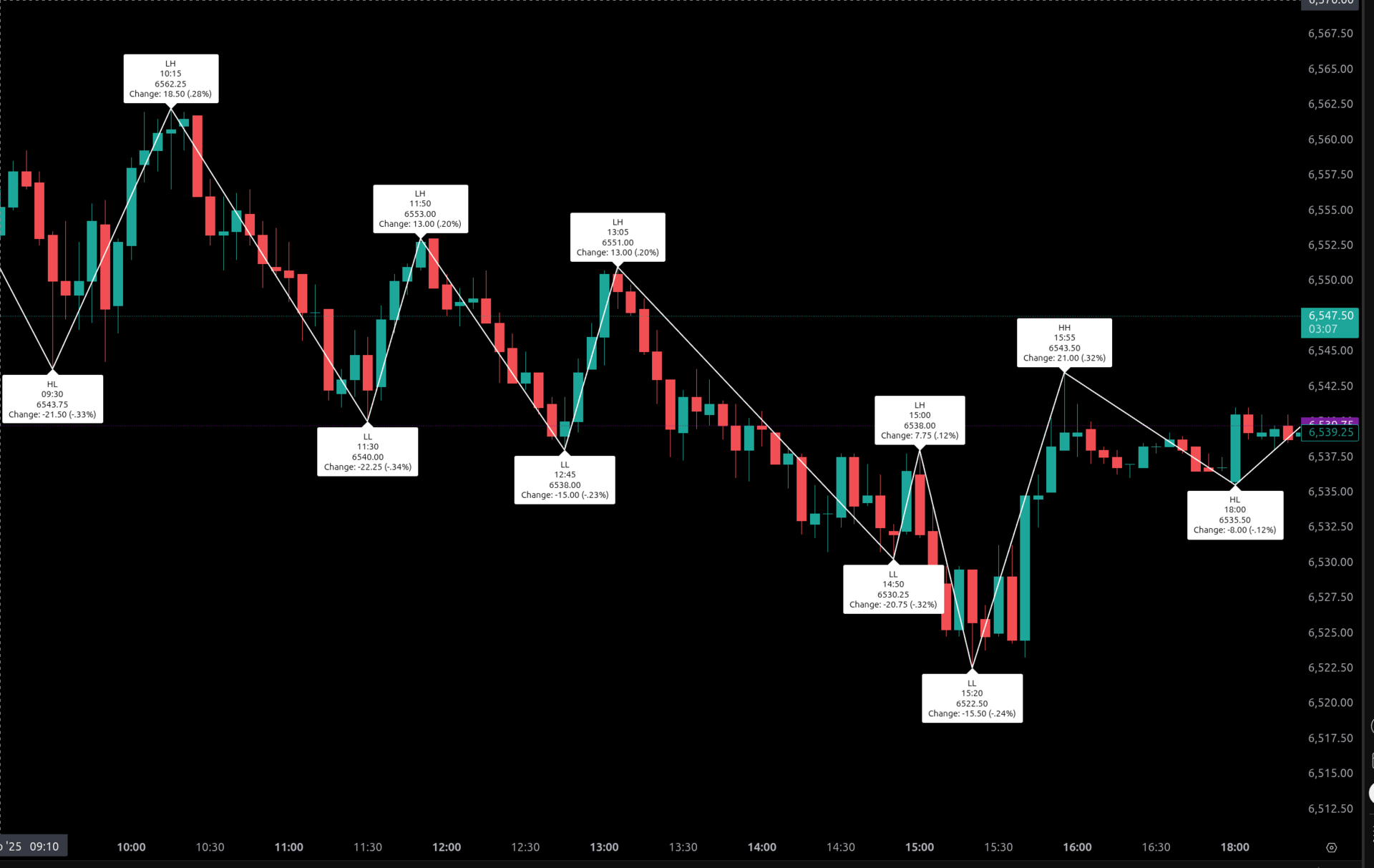

After the open, the ES pretty much did what we thought it would do. It opened high, sold off as expected, rallied up to a lower high at 6562.25 at 10:15, and then sold off down to a 6540.00 double bottom. It rallied up to 6553.00 just before 12:00, then sold off to a new daily low at 6538.00, rallied to another lower high at 6551.25 at 1:03, and then sold off to 6530.50 at 2:22. It rallied up to the 6538 level and then sold off to new lows at 6522.50 after the Charlie Kirk assassination took place.

After the low, the ES rallied to the 6532 level, slid back down to a higher low at 6525.50, and that’s when the ES started climbing again. It traded 6548.50 as the 3:50 cash imbalance showed $2 billion to buy, $2.4 billion, traded 6539.25 on the 4:00 cash close, traded 6543, pulled back to the 6535 area, and settled at 6536.75 on the 5:00 futures close, up 18 points or +0.28% on the day.

In the end, PPI was a sell-the-news event. In terms of the ES’s overall tone, the big gap-up used up the early buying power, and then the late headlines added to the weakness. In terms of the ES’s overall trade, volume was higher at 1.33 million contracts traded. Oracle gained 35%, the 10-yr note yield fell -6 bps to 4.03%, Bitcoin futures (BTU25) traded up to 114,925.00, and gold closed unchanged at 3,668.60.

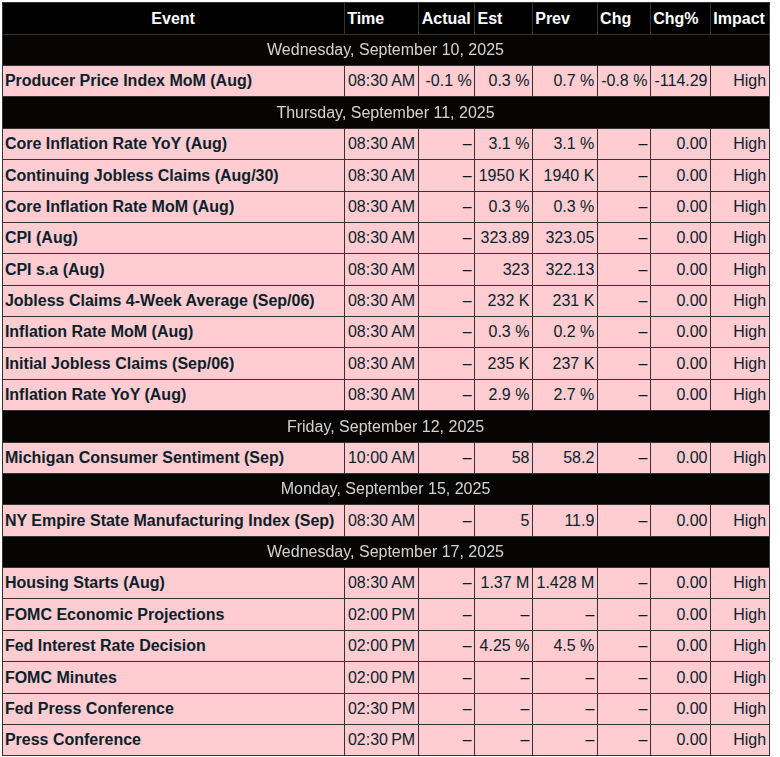

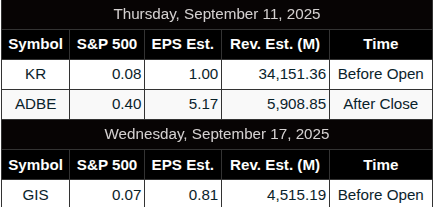

Today, CPI and Initial Jobless Claims are released at 8:30 AM, and the Monthly Federal Budget number is due at 2:00 PM, along with earnings from Adobe and Kroger. One of the things I haven’t covered is all the stock buybacks and the S&P quarterly rebalance that adds, removes, or reweights. After Sept. 22, Robinhood, AppLovin, and Emcor will be components of the S&P 500 index funds. We used to call these "switches," which can cause short-term price adjustments or an uptick in volatility.

Our View

Everything is screwed up. I knew PPI was yesterday and CPI is today, but I started talking about looking for the PitBull’s Thursday low before the Friday Week 2 options expiration. Either way, there’s so much shit being thrown at the wall, it's hard to keep up. It’s boom, boom, boom—every day. And now you have Trump blasting Powell, saying “Just out: No Inflation!!!” and again urging the Fed Chairman to slash rates.

I think we all know there’s a rate cut coming next week, but what will a 1/4-point cut actually do for the economy? Other than what JPMorgan says—a sell-the-news event going into the September Triple Witching.

MiM and Daily Recap

Intraday Recap

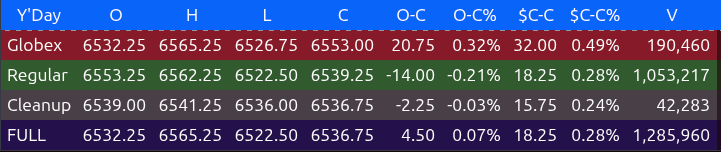

The overnight Globex session began with ES opening at 6532.25 and quickly building momentum. By 18:10 ET, futures reached 6537.75 before pulling back to a low of 6527.25 at 19:30, marking a 10.50‑point decline. Buyers regained control steadily into the night, lifting prices to 6543.75 at 03:40 for a modest 17‑point gain. The subsequent dip found support at 6529.50 near 05:10, followed by a sharp rally that peaked at 6565.25 by 08:30, the overnight high. This 35.75‑point surge (+0.55%) set the tone heading into the regular session. Globex settled at 6553.00, up 20.75 points or +0.32%.

The regular cash session opened at 6553.25 and initially climbed to 6562.25 by 10:15, setting the session high before rolling over. Sellers pushed ES to 6540.00 at 11:30, down 22.25 points from the session high. A midday bounce lifted the contract to 6553.00 at 11:50, but resistance capped further gains. Another leg lower carried prices to 6538.00 at 12:45 and then to 6530.25 at 14:30, marking a fresh intraday low. From there, ES staged a sharp reversal, spiking to 6545.00 at 15:55, briefly reclaiming positive territory. However, the late push faded into the close, and ES settled at 6539.25, down 14.00 points (-0.21%) from the open but still up 18.25 points (+0.28%) from the prior day’s settlement.

During the cleanup session, futures opened at 6539.00 and traded as high as 6541.25 before slipping to 6536.00. The session ended at 6536.75, down 2.25 points (-0.03%). For the full day, ES finished with a modest 4.50‑point gain (+0.07%), closing at 6536.75. Volume was concentrated in the regular session at just over 1.05 million contracts, with total daily volume at 1.28 million.

Market tone tilted cautious despite early overnight strength. The Globex ramp reflected carryover momentum, but sellers controlled most of the regular session until a late rebound attempt near 16:00. The broader picture shows consolidation after the recent multi‑session run‑up, with the intraday swings highlighting indecision.

The Market‑on‑Close imbalance data revealed a substantial $1.916 billion to buy, with 68.9% of dollar flow skewed to the buy side. Notably, Apple (+$323M), Amazon (+$157M), Tesla (+$141M), and Bank of America (+$136M) were among the largest buy imbalances, while Netflix (-$39M), Uber (-$34M), and AXON (-$24M) led the sell side. Sector flows showed Energy as the only group with 100% buy bias, while Financials (-63.6%), Healthcare (-59.5%), and Utilities (-74.2%) leaned heavily toward sell imbalances. The late imbalance support helped ES recover from its afternoon lows, though the close still finished just below the mid‑session range.

Overall sentiment remains neutral‑to‑slightly positive, with buyers defending dips but unable to extend rallies convincingly. The heavy MOC buy imbalance underscores institutional support into the close, suggesting underlying demand even amid intraday weakness. Heading into the next session, the market appears to be in digestion mode, awaiting fresh catalysts while holding above key prior settlement levels.

Dan @ GTC Traders

PPI August 2025: Headline Misses ... But Inflation Persists

In a few moments, Inflation Metrics for the Consumer will be released.

But I thought this morning it might be a good idea to point out a few key points from yesterday’s August Producer Price Index (PPI) report.

The headline numbers read that final demand edged down 0.1 percent month-over-month ... far below expectations of a 0.2 percent rise. On an annual basis, it climbed 2.6 percent, a slowdown from July's 2.7 percent. At first glance, this might suggest inflation is easing.

But the headline is not the full report. In my experience? 99.9% of the individuals you meet will not dig into a report. They simply accept whatever the headline tells them the report says.

Dig deeper, and the data begins to tell a far more expansive story than a simple headline. Inflation remains embedded ... with signs of acceleration in key areas.

Remember, the headline final demand PPI measures prices sellers receive for goods, services, and construction, essentially output prices. It's not a direct gauge of input costs, those "upstream" pressures that often foreshadow consumer inflation. For that, look to intermediate demand indexes ... which track prices for inputs at various production stages.

Stage 4 intermediate demand offers a clear view, prices for inputs into products nearly ready for final sale. In August, this index rose 0.5 percent month-over-month, pushing the 12-month advance to 3.1 percent. That's the highest annual increase since March 2023 ... or pre-pandemic, November 2018. Such acceleration in late-stage inputs signals building cost pressures, ones that could soon filter into consumer prices if not checked.

Breaking down the headline: The 0.1 percent decline was driven by services, which fell 0.2 percent ... the largest drop since April. Trade services margins tumbled 1.7 percent, led by machinery and vehicle wholesaling (-3.9 percent). But goods told a firmer tale. Final demand goods inched up 0.1 percent, the fourth straight advance. Core goods (less foods and energy) rose 0.3 percent, steady pressure. Nondurable core goods jumped 0.5 percent month-over-month ... think tobacco products (+2.3 percent) and processed poultry.

Elsewhere in intermediate demand, processed goods rose 0.4 percent, the fifth consecutive increase, with a 2.6 percent annual gain ... the largest since January 2023. Aluminum mill shapes surged 5.5 percent, diesel fuel and electric power also climbed. Unprocessed goods dipped 1.1 percent, but that's volatile ... and the 12-month rise was 3.0 percent.

A brief summary:

Core final demand (less foods, energy, trade): +0.3 percent MoM, +2.8 percent YoY ... the biggest annual jump since March.

Stage 4 inputs: +3.1 percent YoY, accelerating.

Goods components: Firm ... with nondurables leading.

We've warned before: Inflation is structural, rooted in labor constraints, supply bottlenecks, and policy rigidities. The Fed's rate cuts risk reigniting it ... especially with core measures firm. Will high prices finally crimp demand enough for a slowdown? Time will tell, but these data suggest the battle isn't won.

Until next time, stay safe ... and trade well.

Technical Edge

Fair Values for September 11, 2025

S&P: 5.4

NQ: 24.79

Dow: 29.92

Daily Breadth Data 📊

For Wednesday, September 10, 2025

• NYSE Breadth: 44% Upside Volume

• Nasdaq Breadth: 59% Upside Volume

• Total Breadth: 58% Upside Volume

• NYSE Advance/Decline: 52% Advance

• Nasdaq Advance/Decline: 47% Advance

• Total Advance/Decline: 49% Advance

• NYSE New Highs/New Lows: 148 / 35

• Nasdaq New Highs/New Lows: 364 / 81

• NYSE TRIN: 1.25

• Nasdaq TRIN: 0.59

Weekly Breadth Data 📈

For the Week Ending Friday, September 5, 2025

• NYSE Breadth: 52% Upside Volume

• Nasdaq Breadth: 58% Upside Volume

• Total Breadth: 55% Upside Volume

• NYSE Advance/Decline: 60% Advance

• Nasdaq Advance/Decline: 51% Advance

• Total Advance/Decline: 54% Advance

• NYSE New Highs/New Lows: 274 / 49

• Nasdaq New Highs/New Lows: 442 / 264

• NYSE TRIN: 1.35

• Nasdaq TRIN: 0.76

S&P 500/NQ 100 BTS Trading Levels (Premium Only)

Calendars

Economic Calendar Today

This Week’s High Importance

Earnings:

Released

Trading Room News:

Polaris Trading Group Summary: Wednesday, September 10, 2025

Cycle Day 3 brought strong bullish continuation early, with a clean and effective execution of the 3-Day Cycle play, leading to a highly productive trading session for PTG members. The day was marked by a mix of disciplined setups, clean technical triggers, and excellent follow-through on both long and short opportunities.

Morning Session Highlights

Early Bullish Momentum:

The initial upside targets (6535–6540) were already fulfilled pre-RTH, signaling strong carryover strength from overnight trading.Manny's Break/Retest Long triggered early:

Entry: 6530–6532

Target Zone Hit: 6538–6546

Manny held a long from 6532, though he missed an ES setup at the Globex open due to not being at his desk.

PPI Data (8:30 AM):

Stronger-than-expected numbers fueled further bullish sentiment:PPI MoM: -0.1% vs. 0.3% expected

Core PPI also beat expectations

Result: 3-Day Cycle Targets of 6555 and 6563 were achieved shortly after.

David called it “another fantastic 3 Day Cycle sequence.”

Educational Nuggets & Insights

Manny on Trading Mindset & Market Structure:

Emphasized the difficulty and respect futures demand.

Warned against overtrading: “Your probability of success declines with every additional trade.”

Great quote: “The number one job of any trader isn’t to trade. It’s to understand and respect that futures markets weren’t built for day traders.”

Precision of Algos & FIBs:

Several members remarked how precisely price responded to 1:1s and FIB clusters.

Manny pointed out a potential breakout above 6550 with GEX positioning as a catalyst, which played out nicely into a +5 move.

Midday – Bearish Shift & Consolidation

As the Initial Balance (10:30 ET) was marked, David noted a bearish shift in market structure.

Price retraced and filled the Gap to 6536.25, with bears taking short-term control.

Members discussed setups around a potential long from ~6500s, but it failed to hold as expected due to lunchtime chop.

Afternoon Session – Full Circle & Downside Completion

The "clock" cycle continued to play a role, with Manny calling a low pivot into 2:30 PM.

David returned from break noting that bears had control and that the Gap Fill was completed.

Notably:

Open Range Short play on NQ came full circle as all lower targets were hit.

David emphasized that the 3-Day Cycle targets marked the top — even posting a chart calling it “Pure VooDoo.”

End of Day – MOC Action & VWAP Close

MOC Buy Imbalance: Initially $2.4B, but paired down to $900M, eventually cleaning up into the close.

Price returned to VWAP zone into the bell.

Key Takeaways & Lessons Learned

3-Day Cycle strategy once again delivered strong, reliable results.

Patience and discipline in trade selection were rewarded.

Fib zones and breakout levels were respected by price action.

Manny’s macro-level insights were a reminder of the professionalism and mindset required to trade futures.

Afternoon reversal reminded traders of the importance of adjusting bias as new data (IB break, gap fill, etc.) emerges.

Positive Trades Emphasized

Break/Retest Long from 6532 — Executed cleanly early.

Breakout above 6550 into 6560s — GEX-flavored squeeze.

NQ Open Range Short — Full downside target completion.

DTG Room Preview – Thursday, September 11, 2025

Oracle Lifts AI Hopes: Oracle (ORCL) delivered a blowout revenue forecast driven by major AI cloud deals, including a $300B agreement with OpenAI. This pushed the S&P 500 and Nasdaq to fresh all-time highs.

Inflation Data: PPI surprised to the downside, showing a YoY increase of 2.6% vs. 3.3% expected. CPI data at 8:30am ET is the final major input before next week’s Fed meeting.

Fed & Politics: Fed Governor Lisa Cook will participate in next week’s rate decision after a judge blocked her removal. Trump’s nominee Miran cleared the Senate Banking Committee. Political drama continues around inflation policy and global trade tensions.

Geopolitical Moves: Trump urges the EU to join the U.S. in imposing 100% tariffs on China and India to pressure Putin. NATO tensions are up after Poland shot down Russian drones.

Earnings & Data Watch: Kroger (KR) reports premarket, Adobe (ADBE) after the bell. Market eyes CPI and jobless claims at 8:30am ET, and the Federal Budget Balance at 2:00pm.

Market Levels & Volatility: ES holds mid-channel in uptrend, eyeing CPI reaction. Watch TL resistance at 6730/35, 6756/61 and support at 6430/35, 6404/09, 5868/73. 5-day ADR sits at 55.75 points. No whale bias overnight due to light volume.