- The Opening Print

- Posts

- ES Hits Wall as Economic Reality Sinks In

ES Hits Wall as Economic Reality Sinks In

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Market Recap

Globex Low: 6295.00

Day Session Open: 6311.00

High: 6311.50

Low: 6239.50

3:50 Imbalance MOC Buy: $2.6 billion

4:00 Cash Close: 6263.50

5:00 Close: 6263.25, down 1.69%

Volume: 2.2 million

Eeee... The ES sold off down to 6295.00 on Globex, down 1.2%, and the NQ traded all the way down to 23,031.50, down 1.33%. I think it works like this: when the S&P and Nasdaq looked their worst on April 7, everyone was bailing. After an 80-session rally and gains of 1638.50 points, everyone was scratching their heads in disbelief at how far the markets have rallied.

The ES traded 6311.00 on the 9:30 ET open of the regular session, traded 6311.50, and sold off 72 points down to 6239.50. After the low, the ES had a few decent short-covering rallies that failed. The ES traded 6280.25 as the 3:50 imbalance showed $2.6 billion to buy, traded 6263.50 on the 4:00 cash close, and settled at 6263.25, down 107.75 points or -1.69%, the largest daily drop since May 21, 2025.

JOBS Catastrophe

In the end, the brutal jobs report showed only 73k jobs in July, which was well below most economists' expectations of 100K. Even more shocking were the massive downward revisions over the past two months. The economy added just 14,000 jobs in June, after the number was initially reported as 147,000. Only 19,000 jobs were added in May after initially being reported as 144,000. The combined revisions showed 258,000 fewer jobs in the economy, and the report from the Bureau of Labor Statistics suggested the economy and labor market are much weaker than previously thought, raising questions about whether the president’s tariff regime is keeping businesses from hiring.

So what does Trump do? He fired BLS commissioner Erika McEntarfer, accusing her without evidence. I think we all knew there were going to be side effects from Trump's tariffs, and it's evident that it's holding back businesses from hiring.

The three-month average of approximately 35,000 jobs is the lowest since early 2020, during the initial economic fallout from the COVID-19 pandemic, when job growth plummeted to near-zero or negative levels due to widespread lockdowns. Prior to 2020, similar low job growth was observed during the 2008–2009 financial crisis, with monthly job gains averaging around 30,000–50,000 in late 2008 and early 2009, and negative growth in some months.

Do tariffs actually work? I guess, but a 2019 study by the National Bureau of Economic Research found that US consumers bore over 90% of the cost of tariffs on Chinese goods, with prices for goods like washing machines rising by about $86 per unit. When China retaliated with counter-tariffs, they hit US agricultural exports hard, costing farmers an estimated $16 billion in 2018–2019. And that doesn’t count the cost of disrupting the supply chains.

I have always said my main concerns are treasury yields and the dollar. After a five-day rally, the dollar (DXY) fell to 98.6941, marking a 1.27% decline from the previous session. The EUR/USD exchange rate rose to 1.1590, up 1.48% from the prior session. On a slightly more positive note, bond prices soared. The yield on the 10-year note dropped 13 basis points to 4.236%, while the 30-year bond yield pulled back 4.8 basis points to 4.837%. This pushed up the odds of a September rate cut: according to the CME's Fed-funds futures, there is a 66.8% probability. Morningstar says the bond market now sees roughly 80% odds of a September cut, and Barron's reported odds soared past 80%.

In the end, it seems like the S&P and Nasdaq hit a brick wall, with the end of July and the beginning of August seeing unseasonably negative stats colliding with extremely overbought conditions and shocking jobs data. In terms of the ES's and NQ's overall tone, it was all sell programs and sell stops. In terms of the ES's overall trade, volume was high, but not for the size of the range, with 2.2 million contracts traded.

The week ahead has only eight economic reports, two Fed speakers, and 122 companies in the S&P reporting earnings. Palantir (PLTR) and Axon (AXON) report after market close on Monday, August 4th, with calls at 5 PM ET. Tuesday, August 5th is busy: Caterpillar (CAT) and Bayer (BAYRY) report before the open; AMD, Astera Labs (ALAB), Pfizer (PFE), and Amgen (AMGN) all report after the close. SiTime (SITM) reports after the close on Wednesday, August 6th, at 5 PM ET. Finally, Thursday, August 7th, sees Eli Lilly (LLY) and Gilead Sciences (GILD) reporting before the open (8:30 AM ET calls), while Ligand Pharmaceuticals (LGND) reports after the close.

Guest Post - SpotGamma:

Get instant access to our partners’ real-time market data and insights not available anywhere else. Here is last night's Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

You’re Invited — SHARPEN YOUR SKILLS: TRACE |

Why do some moves stall out, while others accelerate? Why does the market close on a trendline some days, but other times, spike or crash at the end of the day? TRACE unveils hidden buying and selling pressure so you can spot support, resistance, and volatility for the S&P 500 each day – empowering you to optimize your entries and exits. Join us for a free webinar on Wednesday, August 6, at 12 PM ET, for a deep dive into: |

Gamma — Spot where market makers will hedge, which can either accelerate or reduce volatility

Delta Pressure — See how intraday shifts in market maker positioning affect buying & selling pressure

Charm Pressure — Explore how time influences positioning and can trigger unexpected price moves and pins

GEX-by Strike Bars — Visualize open interest and 0DTE exposure to identify where gamma will create intraday support & resistance

From "Zombie Market" to Vol Awakening

What a difference a week makes. The S&P 500 went from consistently hitting all-time highs with 6,450 touched on Wednesday to close Friday down 1.6% to 6,238.

This dramatic shift from "zombie market" to spiking realized volatility exemplifies the need for protective puts and/or VIX calls as insurance, as we highlighted in the daily pre-market Founder’s Notes throughout last week. Insurance like this grows increasingly important as markets pivot from complacency to concern

On Wednesday evening both META and MSFT delivered blowout earnings, initially suggesting the bull run would continue. However, the real damage arrived Friday when disappointing NFP data combined with ongoing tariff headline risks pushed the market below the critical 6,300 pivot level.

This awakened volatility from the summer slumber, as the VIX surged from 15 to 20 by week's end. Our Volatility Dashboard had been highlighting the unusually low IV and the risk of this exact scenario for weeks: with 1-month realized vol compressed to just ~6%, any catalyst could trigger a sharp vol expansion.

Single Stock Moves: The Healthcare Highlights |

This past week saw UNH drop to a 5-year low. However, the stock showed an unusual upside skew premium despite being driven to recent lows – an anomaly where call options 100 points out-of-the-money were trading with very sizeable premiums of 63 cents above at-the-money options.

|

This positioning created a prime selling opportunity as the market was pricing in an absurd rally scenario – making these overpriced calls attractive candidates for premium selling strategies when skew premiums become excessive relative to realistic expectations.

|

Next Week's Outlook: Navigating the New Regime |

The question we now face: Is this a mild correction allowing vols to reset a bit and call skews to cool, or is this the start of something more severe? Our positional analysis suggests the former, since we don't see the massive imbalances that characterized the July & August 2024 selloff. The upcoming calendar brings lighter fundamental headlines with 11% of S&P 500 market cap reporting earnings, but several key events still bear watching: |

Earnings from Energy, Healthcare, and Utilities sectors

CPI (8/12)

The market's zombie phase appears to be ending, replaced by more traditional price discovery. For active traders, this environment offers significantly more opportunities than the recent low-volatility grind – the key is having the right tools to navigate the increased volatility.

We encourage all traders to stay informed with the latest options analysis, and remember: in volatile markets, having the right data and tools makes all the difference.

MiM and Daily Recap

Intraday Recap:

Friday's session opened with a continuation of overnight weakness. The ES began the Globex session at 6359.50, falling swiftly to a low of 6346.25 by 20:15. A modest bounce led to a lower high at 6372.50 at 23:30, before sellers regained control. The market resumed its slide, reaching 6295.00 at 06:45, marking a total loss of 64.50 points from the overnight high.

Heading into the regular session, the ES opened at 6311.00, went up half a point and fell, plunging to 6243.75 by 10:00, down 87.25 points (-1.38%) from the pre-market morning high.

A volatile rebound carried prices up to 6288.00 at 10:30 before another leg down found a higher low at 6260.50 by 11:25. From there, a midday rally peaked at 6297.00 by 12:05, gaining 36.50 points from the morning low.

The afternoon action saw a series of lower highs and higher lows. Another retracement took prices to 6239.50 at 14:05, establishing the low of the day, before a push to 6278.00 at 14:45. This move stalled, and a sequence of tightening swings followed, with a lower high at 6280.25 at 15:50 and the final low of the session printed at 6251.25 at 18:00.

The regular session closed at 6263.50, down 47.50 points from the open and down 107.50 points (-1.69%) from the prior cash close. The full session settled at 6263.25, reflecting a 96.25-point loss (-1.51%) from the previous day. Total volume was elevated, with 2.2 million contracts traded.

Market Tone & Notable Factors:

Friday's tone was decisively bearish, marked by persistent selling pressure across both sessions and failed intraday rallies. Sellers controlled the tape from the outset, with lower highs capping each recovery attempt and deep pullbacks establishing lower lows throughout the day.

Volume was notably strong, particularly in the cash session, where over 1.75 million contracts exchanged hands, signaling active institutional participation. The broad-based nature of the selling and rejection of bounce attempts reinforced the risk-off sentiment.

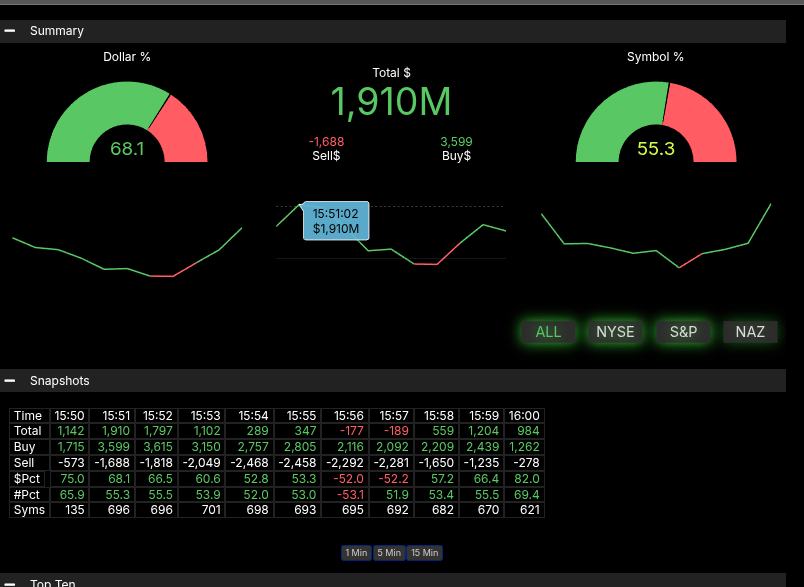

Market-on-Close (MOC) imbalance data showed a strong buy imbalance of $1.91 billion, with 68.1% of the notional flow on the buy side. However, the symbol imbalance ended at just 55.3%, failing to cross the 66% threshold for a notable skew. The MOC appeared to help stabilize prices slightly into the 4:00 PM close, but was not strong enough to trigger a sustained reversal.

In summary, the ES closed out the week with a sharp pullback, reversing gains from earlier sessions and resetting short-term bullish momentum. The heavy selling, coupled with failed bounce attempts, leaves a cautious tone heading into the new week.

Technical Edge

Fair Values for August 4, 2025:

SP: 27.6

NQ: 118.24

Dow: 125.23

Daily Breadth Data 📊

For Friday, August 1

NYSE Breadth: 27% Upside Volume

Nasdaq Breadth: 36% Upside Volume

Total Breadth: 35% Upside Volume

NYSE Advance/Decline: 30% Advance

Nasdaq Advance/Decline: 26% Advance

Total Advance/Decline: 28% Advance

NYSE New Highs/New Lows: 35 / 96

Nasdaq New Highs/New Lows: 50 / 229

NYSE TRIN: 1.15

Nasdaq TRIN: 0.66

Weekly Breadth Data 📈

For Week Ending August 1

NYSE Breadth: 32% Upside Volume

Nasdaq Breadth: 37% Upside Volume

Total Breadth: 35% Upside Volume

NYSE Advance/Decline: 31% Advance

Nasdaq Advance/Decline: 21% Advance

Total Advance/Decline: 25% Advance

NYSE New Highs/New Lows: 217 / 133

Nasdaq New Highs/New Lows: 438 / 322

NYSE TRIN: 0.95

Nasdaq TRIN: 0.46

Calendars

Today’s Economic Calendar

This Week’s Important Economic Events

Today’s Earnings

Recent Earnings

Room Summaries:

Polaris Trading Group Summary - Friday, August 1, 2025

The session was characterized by volatility and bearish sentiment initially due to weaker-than-expected Nonfarm Payrolls data and downward revisions to previous months. This triggered increased expectations of a Federal Reserve rate cut in September, spurring notable intraday price movements.

Key Events and Sentiment:

Pre-Market: Overnight selling exceeded lower targets, tagging 6295. The key level identified for bulls was 6330 to neutralize bearish momentum.

Economic Data Impact:

Nonfarm Payrolls were significantly weaker (73K vs. expected 104K), with substantial downward revisions to prior months.

The ISM Manufacturing PMI also came in below expectations (48.0 vs. 49.5), adding further bearish pressure.

Traders reacted to the news by pricing in a higher likelihood (75%) of a Fed easing in September.

Trades and Strategies:

PTGDavid highlighted the importance of "POWER OF ALIGNMENT" in trades, emphasizing discipline, clear entries, and capital preservation, particularly important on volatile Fridays.

A strong example provided was the "A4 short," demonstrating an ideal execution of a planned trade setup.

Traders emphasized "one and done" trades as optimal, avoiding overtrading after capturing the initial high-probability setups.

Manny reported executing a planned short around the 6294 level successfully later in the session.

Technical Insights:

Key levels noted were 6265 (previous quarter’s high), identified as critical for the weekly close.

Fibonacci retracements were actively discussed, emphasizing clarity in measurement points for accurate trade entries and exits.

The 89 EMA trading rules chart was shared again for educational reinforcement, indicating disciplined adherence to technical tools.

Lessons Learned & Positive Highlights:

Importance of maintaining discipline ("Don't hesitate on entries") especially during volatile news events.

Avoidance of forced trades was consistently emphasized by members who missed initial moves but wisely chose to stay patient rather than chase the market.

Effective utilization of alignment strategy and Fibonacci retracements for entry precision.

Final Market Observations:

The market experienced a "Normal Cycle Day 2" (Balancing/Consolidation/Stabilization) after heightened volatility earlier.

Late session strength with a $2.6 billion MOC BUY imbalance indicated bullish interest into the close, stabilizing earlier bearish momentum.

Overall Impression:

The session underscored the necessity of discipline, clarity in trade setups, and effective execution. Positive trades hinged on pre-planned setups with patience and avoidance of reactive trading under stress. The day's volatility offered valuable lessons in trading discipline, strategic patience, and technical alignment.

Key takeaway: Adherence to clear trading rules and setups, capital preservation, and discipline were repeatedly affirmed as essential practices.