- The Opening Print

- Posts

- ES Grinds to 29th Record High

ES Grinds to 29th Record High

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

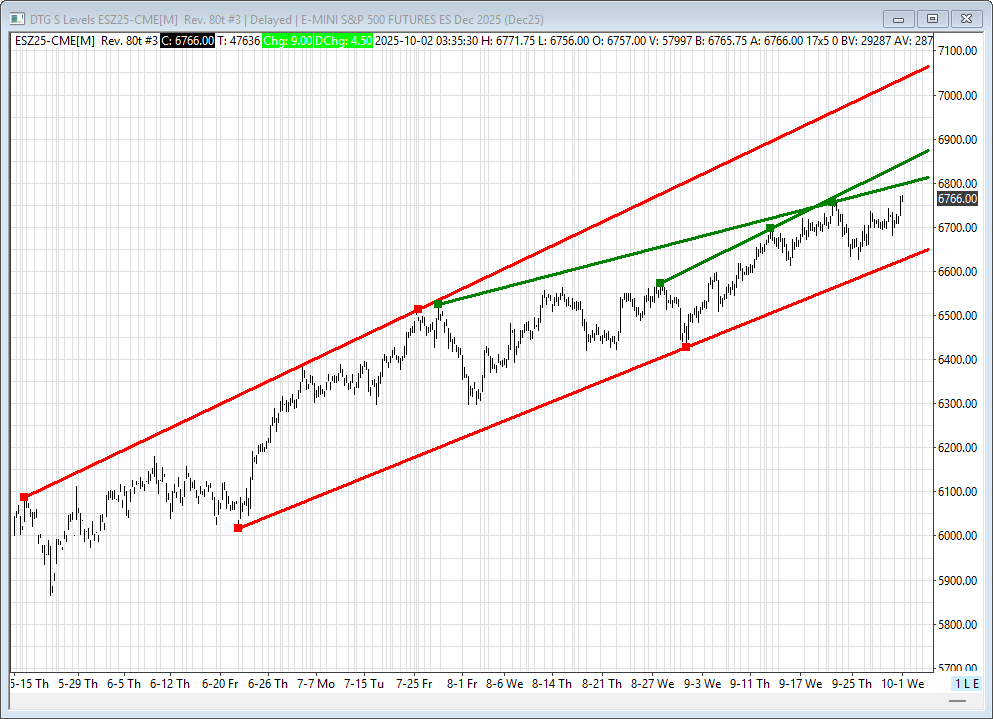

The US government shutdown pushed the ES down to 6680.00 on Globex, with 222K ES traded. It opened the regular session at 6706.75, dropped to 6705.75, and, over the next 3 1/2 minutes, traded up to 6723.00, then up to 6726.50 at 9:35, and eventually reached 6729.00. This type of price action continued all day—it was one small pullback after another as the ES ratcheted higher.

At 2:36, the ES traded up to a new contract high, surpassing the prior all-time contract high at 6757.50 and running all the way up to 6768.50 at 3:45. It traded 6765.25 as the 3:50 imbalance showed $900 million to buy and printed 6767.00 on the 4:00 cash close.

In the end, it’s like I posted on Twitter: the public is always pushed into believing “how bad things are going to get,” and they end up offside. The ES and NQ did the exact opposite—they skyrocketed. In terms of the ES’s overall tone, the NQ led the way higher.

In terms of the ES’s overall trade, volume was lower at 1.2 million contracts traded.

You know how I say we live in an ever-changing world? Well, the government shutdown pushed the YM to its second straight record and its 9th record high in 2025, closing up +0.40%, falling just shy of a new all-time high. The ES hit its 29th record high for the year.

I know from running my own stats that a prolonged government closure could have a negative effect on the stock market and push consumer prices higher—but you know what? When the smoke clears, the S&P is going to rally again. It’s not going to stop. Sure, we could see some sideways-to-down price action in October, but November has always been a good month. And December? December is historically up about +1.5% on average.

I’m just like everyone else; my head is spinning with all the crap going on. All you have to do is look at gold: it traded up to $3,900 and is still going up. It hasn’t had any major correction because the gold market is too ‘bid’ to go down very much. It really seems like the old saying “don’t fight the Fed” is the theme.

Our View

The new highs and the level of complacency are at all-time highs. The government shutdown and the unexpected ADP jobs report showing the labor market lost 32,000 jobs didn’t dent the rally at all.

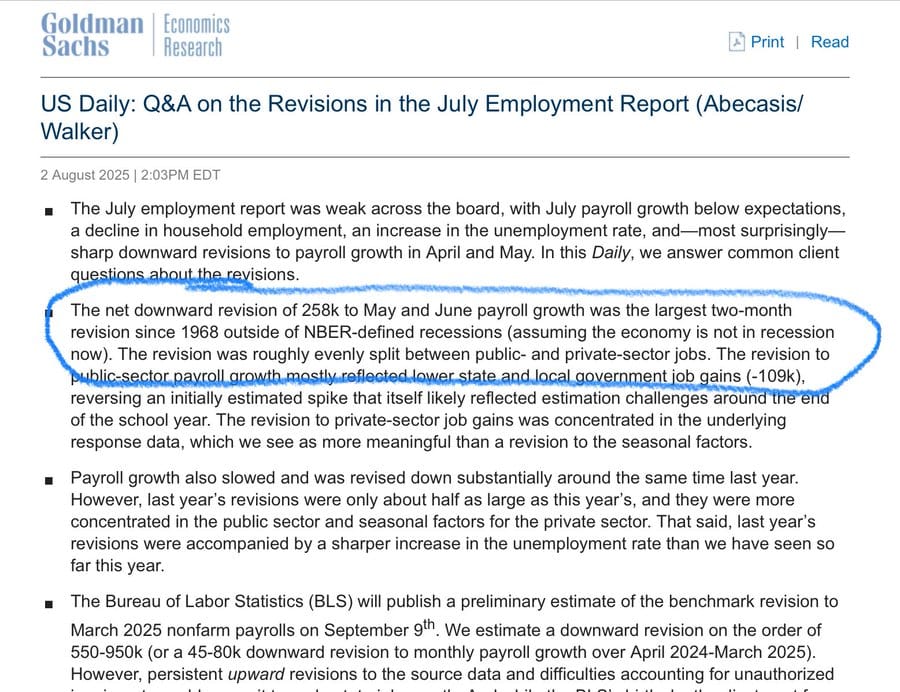

I don’t know how all the data works, but it looks like the job market is in trouble. Economists at Goldman Sachs noted that recent revisions to job reports represent the most substantial adjustments in 57 years, excluding recessionary periods. Their analysis showed a net downward revision of 258,000 jobs for May and June payrolls, marking the largest two-month adjustment since 1968. This revision affects both public and private sector jobs.

Goldman has also cautioned clients that further significant revisions are likely in upcoming reports. These could potentially lower monthly job growth projections from 145,000 to somewhere between 65,000 and 100,000 between April 2024 and March 2025.

I don’t know, but this makes sense to me; it’s all part of an economic shift that continues to fester.

MiM and Daily Recap

Intraday Recap

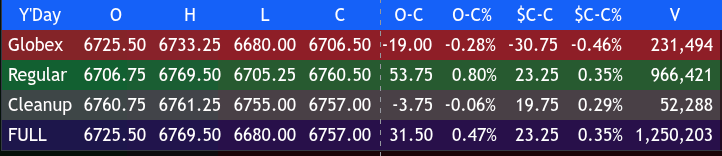

The overnight Globex session opened at 6725.50 and faded as sellers stepped in, driving the ES lower through the evening. A modest rebound at 23:40 lifted prices to 6710.75, but this lower high gave way to renewed selling pressure. By 02:50, futures had fallen to 6680.00, marking the overnight low and a 53.25-point reversal from the initial high. A recovery attempt took ES back to 6706.00 at 05:20, but momentum stalled, and the market entered the cash open just off its overnight recovery highs. The Globex session closed at 6706.50, down 19.00 points or 0.28% from its open and off 30.75 points or 0.46% from the prior cash close.

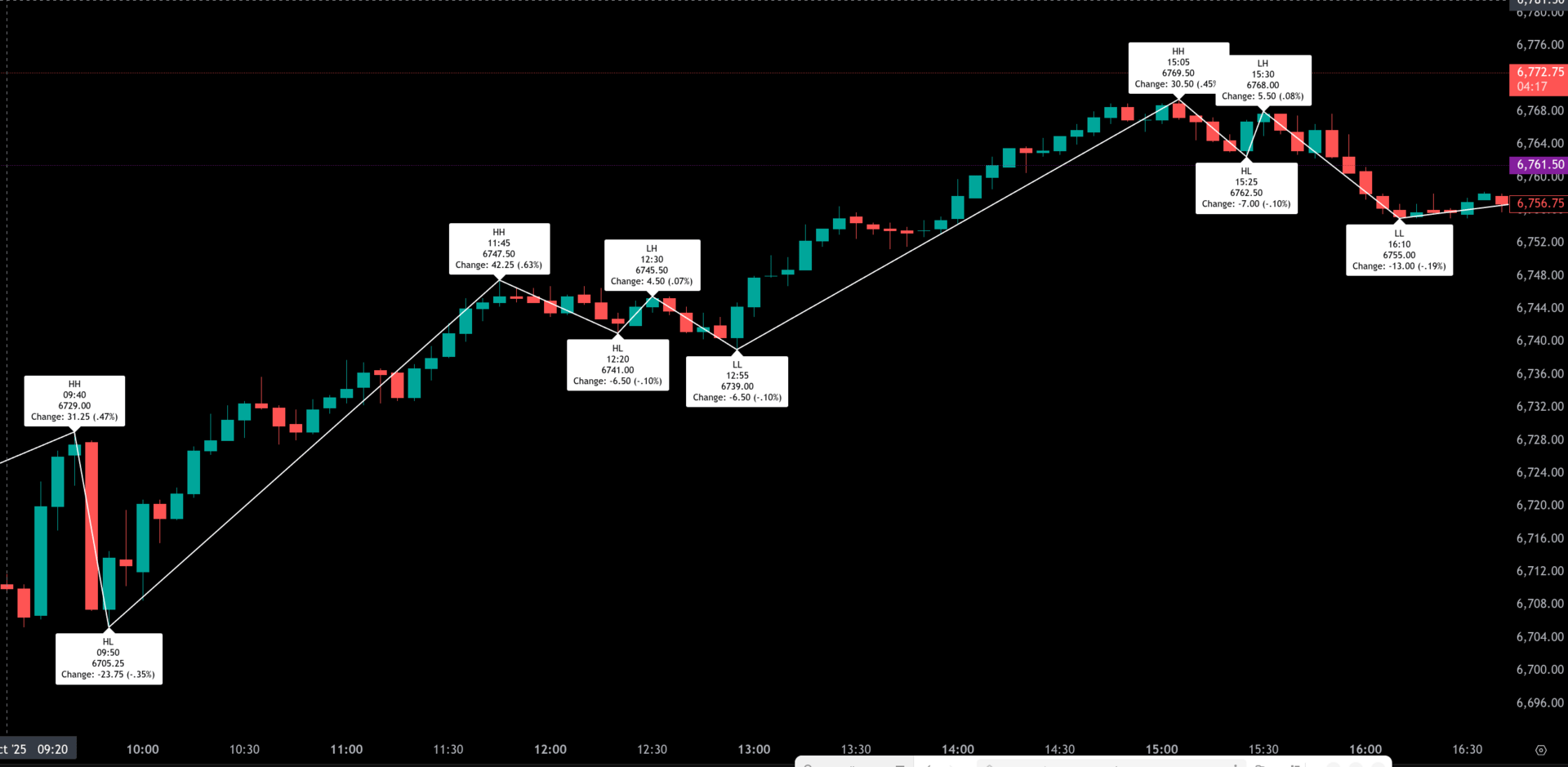

The regular session opened at 6706.75 and quickly advanced to 6729.00 at 09:40, a 22.25-point pop from the open. A brief pullback to 6705.25 at 09:50 set the stage for a powerful rally and marked the low of the day. Buyers carried the ES to 6747.50 by 11:45, extending the run 42.25 points from the morning low. After a mild midday consolidation, the futures dipped to 6739.00 at 12:55 but found support and pushed to the day’s high of 6769.50 at 15:05, a 64.25-point gain from the morning low. Into the closing hour, ES slipped to 6755.00 at 16:10 and settled the regular session at 6760.50, up 53.75 points or 0.80% on the day.

The cleanup session was quiet, with trade limited between 6761.25 and 6755.00 before settling at 6757.00, down 3.75 points or 0.06% from the cleanup open. Volume for the full day reached 1,250,203 contracts, with nearly 970,000 traded during the regular session. Overall, the ES gained 31.50 points or 0.47% on the full session, finishing at 6757.00. From cash close to cash close, the contract was higher by 23.25 points or 0.35%.

Market tone was constructive after the early overnight weakness. The ability to recover from the 6680.00 overnight low and sustain upward momentum through the cash session demonstrated underlying demand. Buyers remained in control for most of the day, with higher lows and higher highs reinforcing the bullish structure.

MOC imbalance data showed a strong buy skew, with $1.435 billion in total imbalances and 75.1% of dollar flow to the buy side. However, symbol participation was more balanced at 52.8%. Technology led the charge, with heavy buy programs in Microsoft ($461M), Nvidia ($194M), and Meta ($191M), among others. By sector, Technology and Healthcare dominated the positive flow, while Industrials and Financial Services showed notable selling pressure. The imbalance supported the late afternoon rally, helping prices hold firm into the close despite some profit-taking.

In sum, the ES finished higher on the day with buyers overcoming early overnight weakness and pushing the market into new regular session highs. Strong technology-led MOC buy programs underpinned the bullish close. Attention now turns to whether the momentum can carry into the next session as the market navigates record-high territory with macro uncertainties still looming.

Dan @ GTC Traders

DIAGEO (DEO) … The Biggest Loser

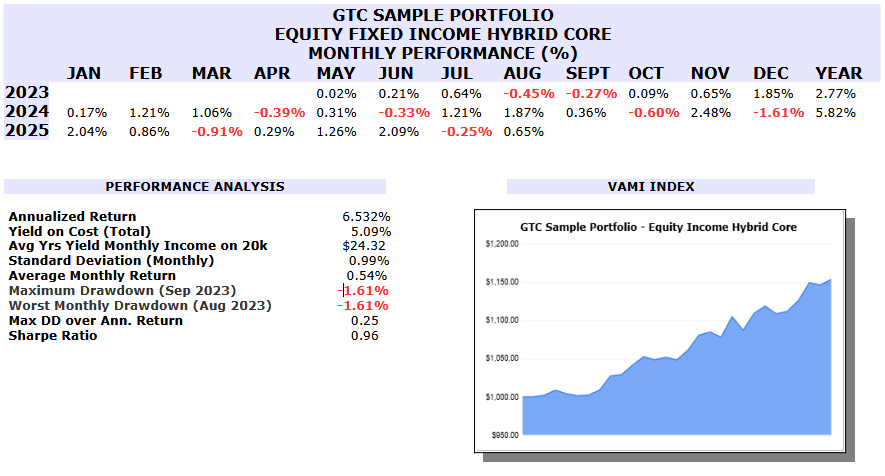

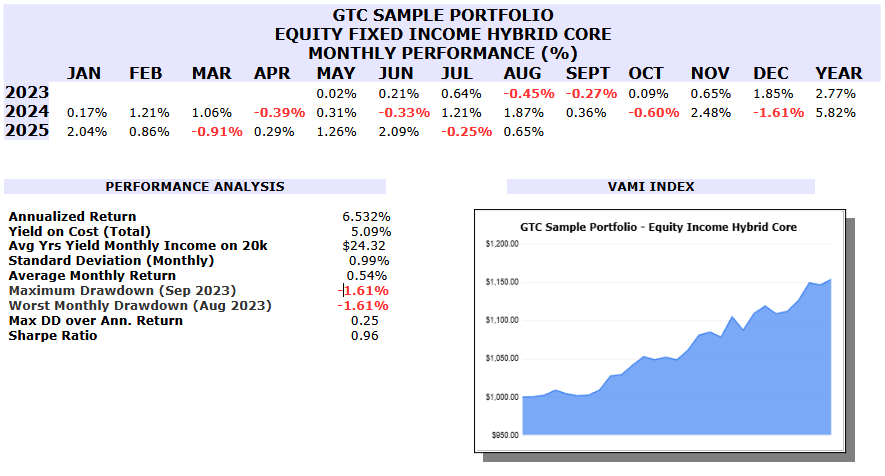

One of the strats that we demonstrate in our GTC Sample Portfolio, is an “Equity Fixed Income Hybrid Core” model. It demonstrates a model for building up an account whose objective is to eventually provide regular income and yield, using Equity instruments.

And we have to say, for a Fixed Income account? It has been doing very well.

If we take out the hedges, do not include the dividends, distributions or cash instruments … each piece contributing to the overall whole continues to hit brand new highs …

/

And again, this is a Fixed Income account. That is not even the primary objective.

Or, we can look at the monthly grid of performance, up to last month …

Despite all of the above, it does suffer one problem.

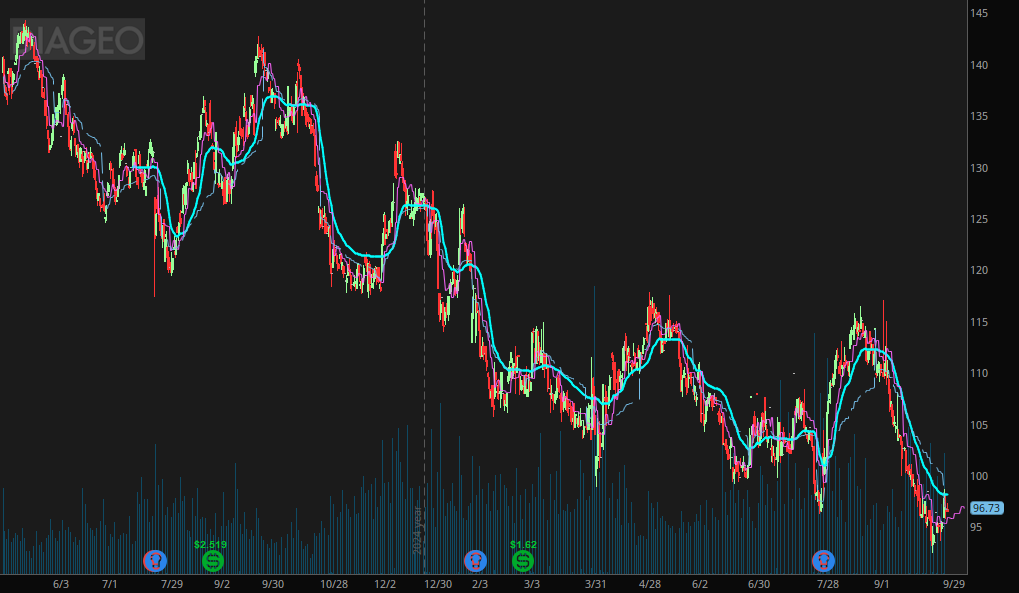

One of those equity pieces? Is DIAGEO, PLC (DEO)

We could talk on and on about all of the reasons for this slide in the share price. A confluence of weaker sales, rising costs, and growing uncertainty around its outlook. We could discuss sharp demand declines in Latin America and the Caribbean due to macroeconomic stress and “down-trading” by consumers toward cheaper alternatives. Margin pressure from inflation, adverse FX and tariff concerns.

And to be sure, we have to do something about this particular piece. If we sell it? We have to find a replacement that provides for the account, what DIAGEO (DEO) was intended to provide. If we keep it? We still need to develop a line in the sand, wherein we admit we can’t take any more pain with what has become … this particular value trap.

But that’s all besides the point we really wanted to make, at least … today ...

The point that we wanted to make, is that we have the time to decide.

When you properly construct a basket of assets … if something goes wrong with one of those assets? Such an account can continue to gain in both value, yield and income … week after week ...month after month …

So, as far as what we will do? We’ll decide that in the future. But keep in mind that when you know how to construct a basket of assets, that skill alone provides you tremendous downside protection and risk mitigation for when something inevitably goes wrong.

Until next time, stay safe and trade well ...

Technical Edge

Fair Values for October 2, 2025

S&P: 49.44

NQ: 211.93

Dow: 270.05

Daily Breadth Data 📊

For Wednesday, October 1, 2025

• NYSE Breadth: 56% Upside Volume

• Nasdaq Breadth: 59% Upside Volume

• Total Breadth: 59% Upside Volume

• NYSE Advance/Decline: 59% Advance

• Nasdaq Advance/Decline: 57% Advance

• Total Advance/Decline: 57% Advance

• NYSE New Highs/New Lows: 160 / 39

• Nasdaq New Highs/New Lows: 316 / 100

• NYSE TRIN: 0.98

• Nasdaq TRIN: 0.90

Weekly Breadth Data 📈

For the Week Ending Friday, September 26, 2025

• NYSE Breadth: 50% Upside Volume

• Nasdaq Breadth: 54% Upside Volume

• Total Breadth: 53% Upside Volume

• NYSE Advance/Decline: 39% Advance

• Nasdaq Advance/Decline: 40% Advance

• Total Advance/Decline: 40% Advance

• NYSE New Highs/New Lows: 312 / 107

• Nasdaq New Highs/New Lows: 692 / 209

• NYSE TRIN: 0.61

• Nasdaq TRIN: 0.56

S&P 500/NQ 100 BTS Trading Levels (Premium Only)

Calendars

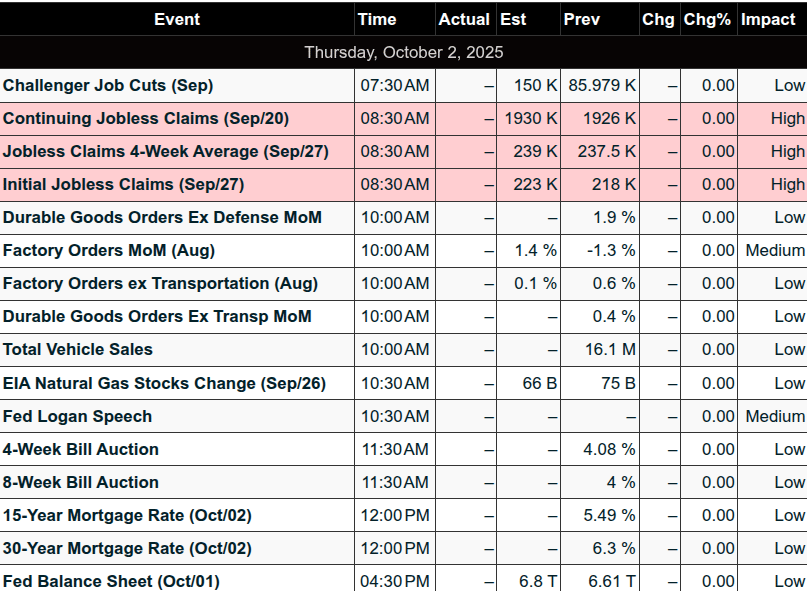

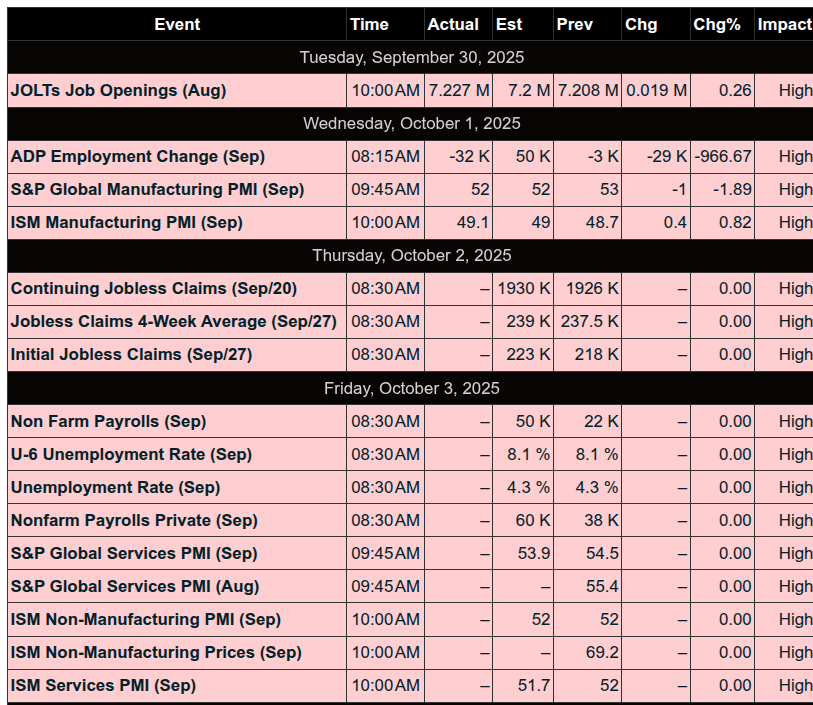

Economic Calendar Today

This Week’s High Importance

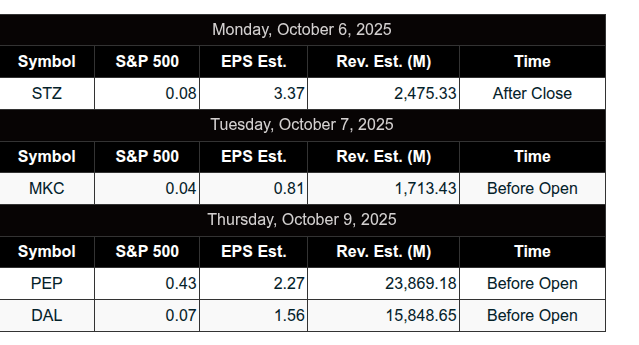

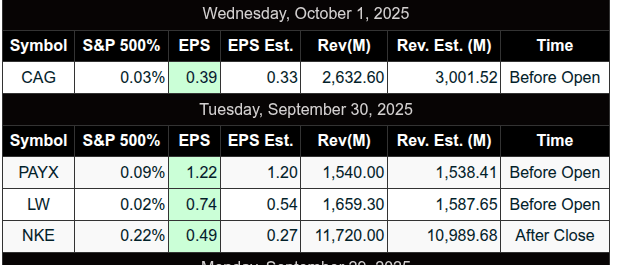

Earnings:

Released

Trading Room News:

Polaris Trading Group Summary: Wednesday, October 1, 2025

Yesterday was a textbook bullish trend day, with PTGDavid and the room clearly identifying and leaning into long setups supported by structure, moving averages (notably the 89 EMA), and flow. Despite early volatility, the market delivered consistent upside, rewarding disciplined execution and adherence to the bullish narrative.

Key Highlights & Positive Trades

Early Long Lean & Wild Card Day:

David labeled the session a Cycle Day 3 Wildcard, noting that core targets had already been met. Despite this, the day turned into a strong bullish trend with the Line in the Sand at 6725 holding as a key support.Support Zone Holds:

Early support at 6700–6705 held firm, setting the stage for a strong directional move. Several room members, including Manny, referenced long setups triggering around these levels pre-RTH.Bullish Structure Maintained:

PTGDavid consistently reinforced the long bias, especially with price sustaining above 6725. The market rallied through targets of 6735–6740, then 6766+, with anchored VWAPs and the 89 EMA providing structural support.NQ Target Achieved:

David called out the NQ target of 24915, which was tagged cleanly, validating his bullish scenario.A10 Long Rip:

In the afternoon, an A10 long setup provided another strong entry opportunity, with PTGDavid and Manny both noting the continuation and lack of selling pressure.Cycle Timing Tracked Well:

Manny outlined the S1H Cycle Day:10:30 High

12:30 Low

2:30 High

This cycle played out cleanly, allowing traders to anticipate the afternoon ramp.

Lessons & Takeaways

Don't Fight Structure:

A key message from David: “I do not understand the need to be playing short-side when all metrics support longs.” Despite some room members attempting shorts (e.g., Roy), they were quickly reminded by price action and commentary that today was not the day for contrarian plays.Discipline over FOMO:

Both David and Manny reflected on past mistakes related to FOMO, revenge trading, and greed. Manny shared personal insights into the mental traps traders fall into when they miss a move or chase losses.Green Light, Red Light System:

Bruce shared a simple but powerful tool—color-coded stickies to keep aligned with the market bias. A practical tip for staying mentally grounded.Follow the 89 EMA:

The 89 EMA was the "train track" yesterday—structure was clearly long and price rode that EMA throughout. The room theme “Riding the 89 Train” encapsulated this perfectly.Market on Close (MOC) Activity:

Big money inflows continued with $1.8B in MOC buy imbalance by the close. David reminded the room: “Does anyone really think they were going to let this collapse today?”

Challenges Noted

Shorts That Didn’t Work:

Several traders tried to fade strength, often at poor locations.

Roy shared a CCI cross short that failed.

Bruce noted frustration with bottom-tick stops, reinforcing the need for better timing and context-based entries.

Room Vibes

Members shared sunrise photos, gardening updates, and personal reflections—keeping the atmosphere supportive and grounded despite a fast-moving market.

Clear camaraderie and real-time sharing of setups (Manny’s pre-RTH alerts were particularly detailed and helpful).

Closing Thought

Wednesday rewarded those who trusted the trend, respected structure, and avoided the temptation to fade strength. As David said: “Bullish Ride to Success.”

Today: Watch how today’s bullish close sets the stage for the next 3 days of the cycle. Stay aligned with structure, trust your plan, and manage risk.

DTG Room Preview – Thursday, October 2, 2025

Markets & Macro:

S&P 500 and Dow closed at record highs; futures drifting near those levels.

Weak ADP data points to a softening labor market, increasing odds of a Fed rate cut.

Inflation remains sticky, but Fed now prioritizing labor data in rate decisions.

Government shutdown likely to delay Friday’s BLS jobs report.

Politics & Policy:

Shutdown expected to extend beyond Friday.

President Trump leveraging shutdown powers to cut programs, targeting Democratic initiatives—dubbed “DOGE 2.0.”

~$18B in NYC infrastructure funding frozen, ~$8B in green energy funding for blue states canceled.

Senator Schumer calls the move “stupid and counterproductive.”

Corporate News:

OpenAI completes $6.6B secondary share sale; new valuation at $500B.

Now the world’s most valuable startup, surpassing SpaceX.

Investors include Thrive Capital, SoftBank, Dragoneer, MGX (Abu Dhabi), and T. Rowe Price.

Economic Calendar:

No major earnings today.

Unemployment Claims (8:30am ET) and Factory Orders (10:00am ET) may not be released due to shutdown.

Fed speakers: Logan (energy conference), Goolsbee (Fox Business @ 2:30pm ET).

Futures & Technicals:

Wednesday volatility uptick: ES 5-day ADR now at 62.25 points.

Whale bias leaning short into U.S. open on light overnight volume.

ES trend levels:

Resistance: 6799/04, 6858/63, 7064/69

Support: 6636/41