- The Opening Print

- Posts

- ES Grinds Higher: Sixth Straight Gain and Record Close

ES Grinds Higher: Sixth Straight Gain and Record Close

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Current

HSI -0.15%

CAC +1.57%

DAX +1.37%

FTSE +0.74

Yesterday ESU

Open 6429.00

High 6457.75

Low 6408.75

Close 6422.75

Volume 955k

Yesterday's trade was all part of the pop up to 6457.75 on Globex, a sell off before the open and then a push up to the 6434.25, a pull back to 6415.00 in very slow motion, After the low the ES rallied back up to 6420 level and then sold off again down to 6411.00 late, short covered and then caught a bid late as the imbalance showed $1.1bil to buy and traded 6426 going into and after the cash close.

In the end, Monday's slow chop was the kick off to the rest of the week. In terms of the ES's overall tone, the ES and NQ were firm but there seemed to be a lot of little rotations going black and forth between the two of them. In terms of the ESs overall trade, volume was slightly higher at 955k contracts traded.

The ES has closed higher 6 days in a row and both made the 15th record all time high and close and all time high in 2025. What we are seeing is a melt up and while I have voiced my concern about the weak seasonal statistics I also understand that the ES and NQ are in an uptrend and that fighting the current 'patterns' does not work. Helping this idea are the earnings and tariff deal announcements.

MiM and Daily Recap

Intraday Recap:

The overnight Globex session began with strength, pushing ES up to a high of 6455.00 at 18:00. However, the early optimism faded quickly, as prices pulled back to 6442.75 by 18:30. The market then attempted a recovery into 19:40, reaching a lower high of 6452.50 before slipping again to 6445.75 at 20:10. Another brief rally into 20:55 produced a modest high of 6451.25, followed by another pullback to 6448.00 at 21:05.

From there, ES reversed upward into 22:35 with a high of 6453.75, only to give back ground to 6450.25 at 23:25. A stronger push followed in the early morning hours, hitting the overnight session high of 6456.50 at 00:40. But weakness emerged once again, and ES declined steadily over the next few hours, hitting a low of 6444.25 at 03:45 and then a slightly lower low of 6433.50 at 06:50. A rebound to 6440.25 at 08:50 capped the Globex rally attempts before ES sold off into the 9:30 open, reaching a low of 6424.25 at 09:00.

The regular session opened at 6429.00 and immediately pressed lower, finding an early low of 6424.25 by 09:40. A rally attempt lifted ES to 6434.25 at 10:15, but it failed to hold, with the market sinking to a deeper low of 6416.50 by 11:00. A bounce into 12:20 carried ES to 6430.25 before another sharp drop carved out the session low of 6408.75 at 14:05. From there, a rebound to 6416.50 occurred at 14:50, which again failed to gather momentum, leading to a brief low of 6410.50 at 15:05. In the final hour, ES firmed up into the close, climbing to 6426.50 before settling the cash session at 6423.00, down 6.00 points or -0.09% from the open.

For the full day, ES closed at 6424.50, down 25.50 points or -0.40% from the open but just 2.75 from the previous day's settlement. Volume totaled 914,269 contracts, with 727,586 traded during the regular session, displaying the summertime slump.

Market Tone & Notable Factors:

The tone of the session leaned bearish as lower highs and lower lows characterized both the Globex and regular sessions. Buyers were unable to sustain rallies beyond short-term bounces, and selling pressure persisted into the afternoon before a modest closing recovery.

The Market-on-Close (MOC) data showed a not-insignificant imbalance of $1.546B to buy at 15:54, though it did not breach the 66% symbol imbalance threshold, registering 55.2% to the buy side. While the dollar imbalance was notable, the symbol distribution lacked strong conviction and failed to spark a significant price reaction into the close.

In summary, the market appeared to be in digestion mode following recent strength, with sellers controlling the pace throughout most of the day. The modest MOC buy interest offered late-session support but was insufficient to shift the broader tone. Heading into the next session, traders will watch for continuation of the lower-high pattern or signs of stabilization above 6420.

Technical Edge

Fair Values for July 29, 2025:

SP: 31.86

NQ: 135.46

Dow: 163.6

Daily Market Recap 📊

For Monday, July 28, 2025

• NYSE Breadth: 30.52% Upside Volume

• Nasdaq Breadth: 34.94% Upside Volume

• Total Breadth: 34.54% Upside Volume

• NYSE Advance/Decline: 35.03% Advance

• Nasdaq Advance/Decline: 40.93% Advance

• Total Advance/Decline: 38.71% Advance

• NYSE New Highs/New Lows: 82 / 16

• Nasdaq New Highs/New Lows: 220 / 70

• NYSE TRIN: 1.27

• Nasdaq TRIN: 1.28

Weekly Breadth Data 📈

For Week Ending Friday, July 25, 2025

• NYSE Breadth: 57.69% Upside Volume

• Nasdaq Breadth: 65.26% Upside Volume

• Total Breadth: 62.87% Upside Volume

• NYSE Advance/Decline: 66.26% Advance

• Nasdaq Advance/Decline: 61.40% Advance

• Total Advance/Decline: 63.19% Advance

• NYSE New Highs/New Lows: 273 / 62

• Nasdaq New Highs/New Lows: 609 / 157

• NYSE TRIN: 1.40

• Nasdaq TRIN: 0.83

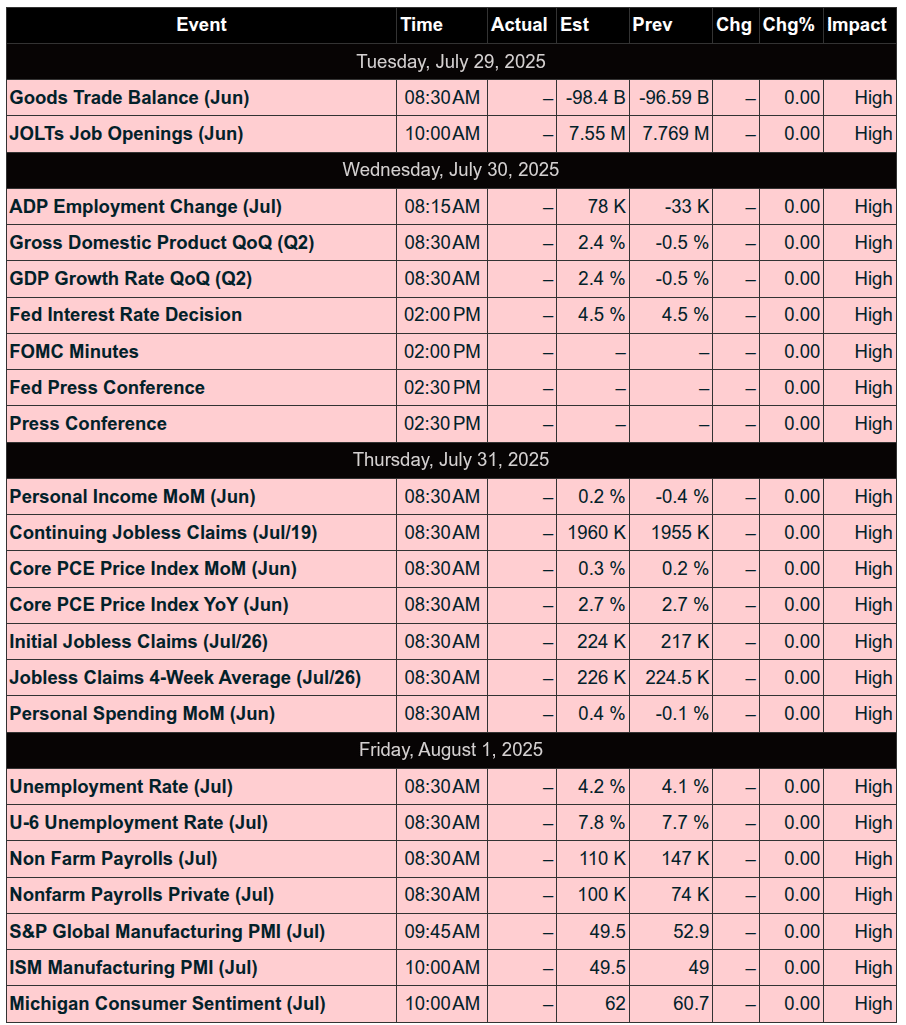

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, July 28, 2025

Overview:

The trading day began with indecision and mixed signals, evolving into a classic Cycle Day 1 Normal Decline. Early trade setups struggled, but the day offered a structured move lower followed by a late-session recovery driven by a significant buy imbalance.

Key Developments:

Pre-market commentary noted a sell-side lean based on overnight structure.

Gap fills were achieved in both ES and NQ early on.

Initial Open Range trade calls were long across ES, NQ, and CL.

A correction followed, with clarification that ES was actually an Open Range short.

All Open Range longs were eventually stopped out, as the market reversed lower.

The "Line in the Sand" at 6425 held significance throughout the day, acting as a key pivot level.

Sellers maintained control through the morning and early afternoon, fulfilling the DTS bear target of 6415.

Price action remained responsive to levels, particularly around 6415–6405, demonstrating clean structural respect.

Afternoon updates highlighted the importance of value levels around 6410 and the need for bulls to reclaim 6415.

A $1.2 billion Market on Close (MOC) buy imbalance provided a late push higher.

Bulls successfully reclaimed the 6415 level and finished strong into the close with buy programs supporting the move.

Lessons and Takeaways:

Early hesitation and failed long setups reinforced the importance of adapting quickly to new information.

Bear targets from the Daily Trade Strategy briefing were fulfilled cleanly, providing structured opportunities for short setups.

Remaining patient during indecisive price action and waiting for clear directional structure proved valuable.

The late-session MOC-driven rally emphasized the importance of staying aware of institutional flows into the close.

Market Context:

Price action aligned with expectations for Cycle Day 1 with a normal decline.

Traders were reminded of the importance of maintaining mental and financial discipline during quiet or confusing sessions.

The upcoming FOMC event mid-week is expected to influence rhythm and volatility in the days ahead.

Discovery Trading Group Room Preview – Tuesday, July 29, 2025

Trade Focus Shifts to China: Following the US/EU trade deal, attention now centers on US/China negotiations ahead of the August 12 deadline. Key issues include semiconductors, rare earths, fentanyl, and energy imports. Market watchers are eyeing the potential for a Trump-Xi meeting.

Geopolitical Tensions: Taiwan's President canceled a planned US visit to avoid jeopardizing ongoing US-China trade talks.

Smartphone Manufacturing Shift: India now leads as the top US smartphone supplier (44%), surpassing China (down to ~25%) and Vietnam.

Auto Tariffs & Prices: US car prices are rising amid tariffs on Japan/EU and shifts to SUVs/trucks. New vehicle averages hit $49K, up 63% over a decade.

Gold Outlook: Fidelity and Goldman Sachs suggest gold could hit $4,000/oz in 2026, citing Fed rate cuts, dollar weakness, and geopolitical risk.

Earnings Watch: Key premarket reports from MRK, BA, PG, PYPL, UPS, UNH, and others. Post-close reports from BKNG, MDLZ, SBUX, and Visa.

Economic Data: Today’s key releases include JOLTS, CB Consumer Confidence (10:00 ET), Goods Trade Balance, Wholesale Inventories (8:30 ET), and HPI (9:00 ET).

Market Technicals: ES dipped back inside its prior uptrend, with resistance at 6434/37s and 6508/11s, and support at 6195/00s, 6143/48s, and 5695/00s. Volatility remains low with muted overnight volume.