- The Opening Print

- Posts

- ES Grinds Higher as Dips Keep Getting Bought—Paul Tudor Jones Warns of a Blow-Off Top

ES Grinds Higher as Dips Keep Getting Bought—Paul Tudor Jones Warns of a Blow-Off Top

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

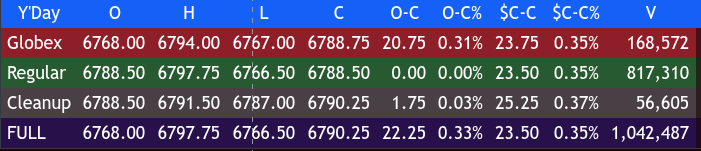

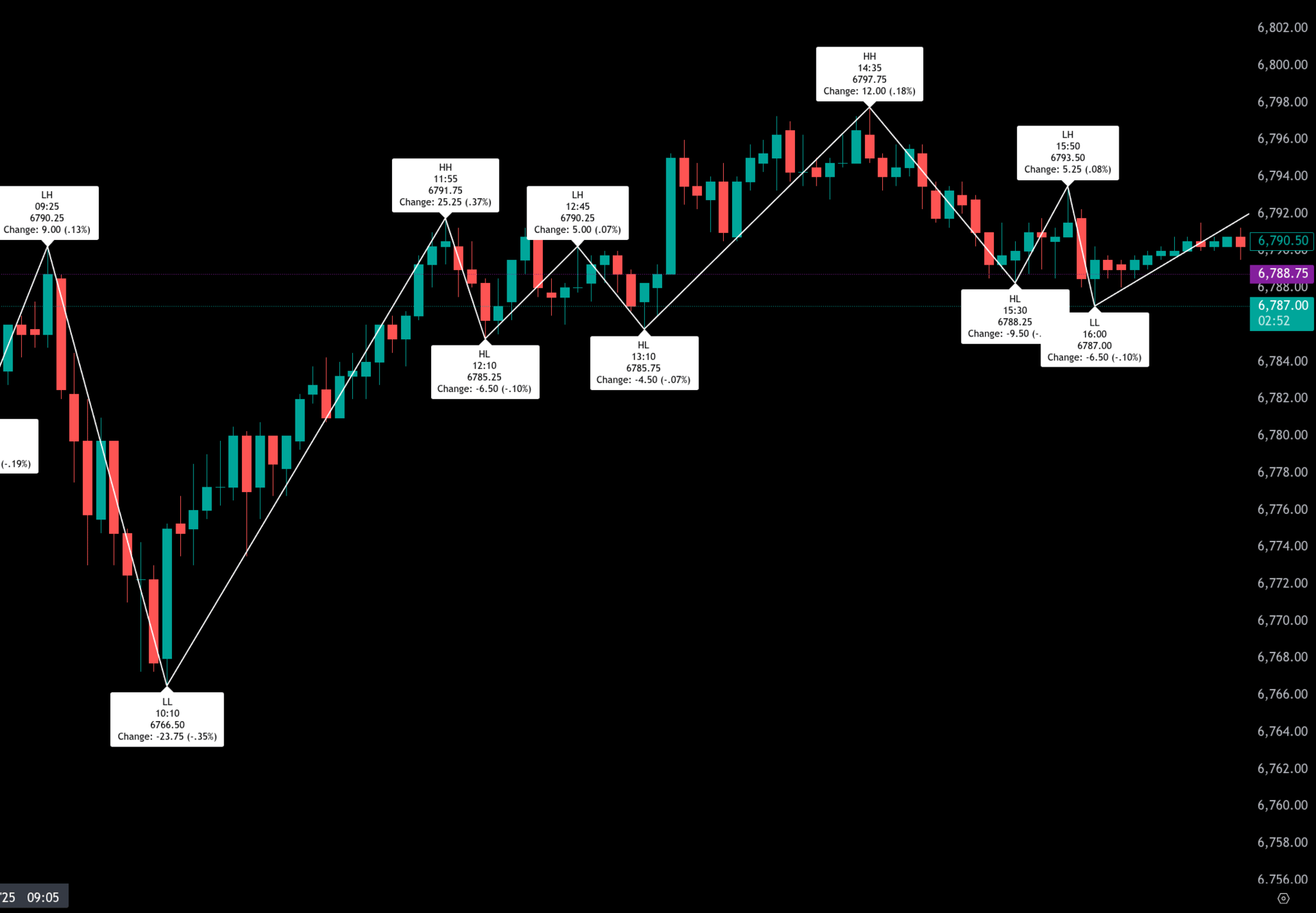

The ES traded up to 6794.25 on Globex, traded 6788.50 on the 9:30 futures open, and promptly sold off down to 6766.25 at 10:10. It then rallied up to 6797.50 at 2:40. There were some small pullbacks, but almost every one led to a new high.

After a pullback down to 6788.00 at 3:30, the ES rallied back up to 6793.75 at 3:45, traded 6788 as the 3:50 cash imbalance showed small to sell, pulled back to 6787.00 at 3:54, and traded 6788.50 on the 4:00 cash close and settled at 6790.25

In the end, the government shutdown and the lack of data have caused a cloud of uncertainty in the markets.

In terms of the ES’s overall tone, all the little dips were getting bought. In terms of the ES’s overall trade, volume was just over 1M contracts

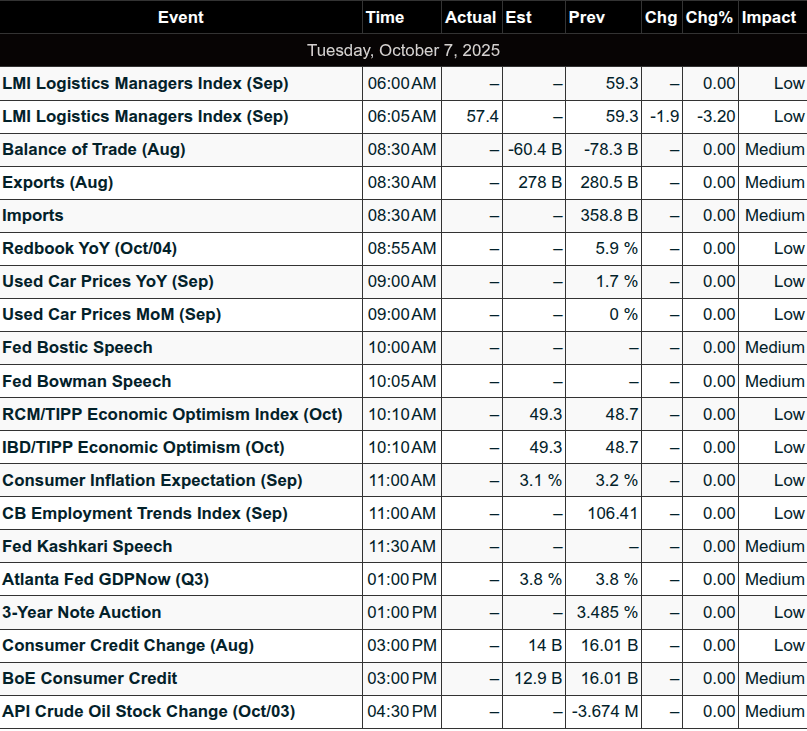

Today, there are no economic reports, but there are five Fed speakers:

10:00 AM – Atlanta Fed President Raphael Bostic

10:05 AM – Federal Reserve Vice Chair for Supervision Michelle Bowman (welcoming remarks)

10:45 AM – Federal Reserve Governor Stephen Miran

11:30 AM – Minneapolis Fed President Neel Kashkari

4:05 PM – Federal Reserve Governor Stephen Miran

In yesterday's OP, I listed all the big names calling for a market "crash", and one of them was billionaire investor Paul Tudor Jones. But yesterday, Jones was on CNBC saying that the S&P has the ingredients in place for a massive rally before a ‘blow-off’ top to the bull market.

Jones discussed the current stock market, drawing parallels to the 1999 dot-com bubble by noting similarities in explosive tech stock rallies and speculative behavior. He stated, "History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999."

He believes the ingredients are in place for a massive rally leading to a "blow-off top" in the bull market, saying, "My guess is that I think all the ingredients are in place for some kind of a blow-off," while also expressing caution about speculative concerns in the AI sector, such as "circular deals or vendor financing" reminiscent of past bubbles.

Jones highlighted key differences from 1999, including the U.S. now being in a Fed easing cycle amid a 6% budget deficit, unlike the rate hikes and surplus back then, describing this fiscal-monetary mix as "a brew that we haven't seen since, I guess, the postwar period, early '50s."

He explained the dynamics of late-stage bull markets, where the greatest price appreciations occur in the final 12 months before the top, warning, "You have to get on and off the train pretty quick... if you do play it, you have to have really happy feet, because there will be a really, really bad end to it."

Jones doesn't see an immediate end to the bull market, noting it still has room to run but will require a "speculative frenzy... more retail buying... more recruitment from a variety of others" to drive prices higher. To capitalize on the potential rally and fear of missing out, he recommended owning gold, cryptocurrencies, and Nasdaq tech stocks through year-end.

I think we all know in the back of our minds that Paul is right. Essentially, he's saying: higher for now, but the rally isn't going to last much longer.

And that brings me to the point: one of the hardest trades to make is picking tops. So far, all the talking heads have been wrong. And for me, it's simple—I'm not here to fight City Hall. As long as the S&P is going up, I'm going for the ride, and I'll worry about the "crash" when it comes.

Our View

One of the things about the small investor is we don't have the luxury of being wrong the way a lot of the big-time investors do. The U.S. economy is walking a tightrope—trying to keep inflation from rising while lowering rates. I know they say lowering rates will bring prices down, but I don't think lowering 0.25 bps did anything, and I don't think the next time the Fed lowers another 0.25 bps it's going to do much either.

Yesterday, Bank of America strategists raised alarms about the gold market as prices near $4,000 per ounce, with technical strategist Paul Ciana warning of elevated correction risks due to uptrend exhaustion signals, like overbought conditions, stretched charts (gold trading 20% above its 200-day moving average, nearing historical peaks at 25%), waning positive divergence, and momentum-driven buying overshadowing fundamentals amid macroeconomic and geopolitical stresses.

He draws parallels to past booms like 2020 and 2011, suggesting a potential sharp reversal if sentiment or policy shifts, and cautions that a relevant peak may be imminent—though further upside could still occur over the next two years.

In contrast, BofA's commodity research team, led by Michael Widmer, views the surge as anticipated, given inflation remains above 2% and the Fed is easing. They note that gold has never declined in such environments since 2001, implying it's not yet at its limits.

My question is: are all these banks and talking heads just talking their books? Are they wishing the markets lower—or do they really see something coming?

MiM and Daily Recap

ES Futures Recap - Monday

The S&P 500 futures (ESZ25) started the week with a mild upward bias, building on recent strength but struggling to maintain momentum through the regular session. The overnight Globex session opened at 6768.00 and traded quietly early before lifting to 6787.50 at 12:43 AM. After a brief dip to 6771.75 at 3:30 AM, buyers regained control, driving ES up to a new overnight high of 6793.75 by 6:40 AM. A shallow pullback to 6781.50 at 7:18 AM set up one final push to 6794.00 at 7:56 AM, just ahead of the New York open.

The regular session opened steady at 6788.50 and quickly tested resistance at 6790.25 before sellers took charge. ES fell to its morning low of 6766.50 by 10:10 AM, marking a 23.75-point slide (-0.35%) from the premarket high. Buyers responded with a midday recovery that carried the contract to 6791.75 at 11:55 AM and then 6797.75 at 2:35 PM, the day’s regular-session high. The afternoon, however, was marked by a slow fade: ES slipped back to 6788.25 at 3:30 PM, tested 6787.00 into the 4:00 PM cash close, and finished the cleanup session at 6790.25, up 22.25 points or +0.33% on the day. Total combined volume across sessions was moderate at 1.04 million contracts.

The overall market tone leaned neutral to slightly bullish. Early momentum from Globex carried into the open, but the failure to hold gains above 6795 showed a reluctance to chase highs ahead of midweek catalysts. The day’s cash-to-cash gain stood at +23.50 points (+0.35%), keeping the uptrend intact but with signs of short-term exhaustion.

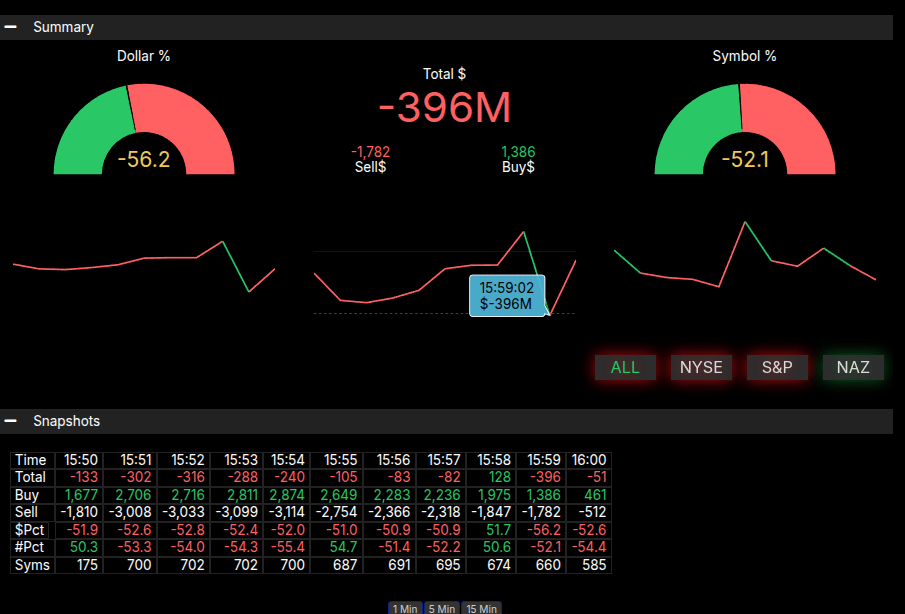

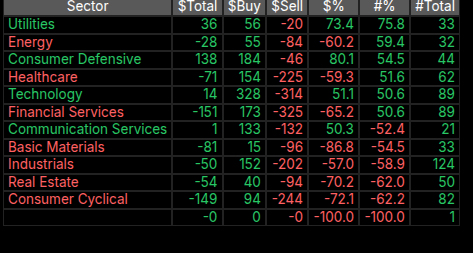

Market-on-Close (MOC) data showed a mild downside bias with a total imbalance of –$396 million to sell, registering a –56% dollar tilt and –52% symbol bias—well short of an extreme. Selling pressure was concentrated in Financials (–$151M), Consumer Cyclicals (–$149M), and Healthcare (–$71M), while Utilities stood out as the only strong buy group (+$36M, +75%). AMD led individual buy imbalances with +$86M, while notable sell programs hit FICO (–$56M), MDT (–$55M), and NEM (–$48M). The late-session weakness coincided with these imbalances but was contained, leaving ES near the upper end of its range to start Tuesday’s trade with a cautiously positive bias.

Technical Edge

Fair Values for October 7, 2025:

SP: 47.53

NQ: 203.42

Dow: 260.4

Daily Market Recap 📊

For Monday, October 6, 2025

• NYSE Breadth: 50.65% Upside Volume

• Nasdaq Breadth: 70.15% Upside Volume

• Total Breadth: 68.15% Upside Volume

• NYSE Advance/Decline: 46.05% Advance

• Nasdaq Advance/Decline: 55.95% Advance

• Total Advance/Decline: 52.29% Advance

• NYSE New Highs/New Lows: 187 / 35

• Nasdaq New Highs/New Lows: 495 / 78

• NYSE TRIN: 0.82

• Nasdaq TRIN: 0.54

Weekly Breadth Data 📈

For Week Ending Friday, October 3, 2025

• NYSE Breadth: 54.96% Upside Volume

• Nasdaq Breadth: 62.72% Upside Volume

• Total Breadth: 59.82% Upside Volume

• NYSE Advance/Decline: 55.86% Advance

• Nasdaq Advance/Decline: 60.43% Advance

• Total Advance/Decline: 58.75% Advance

• NYSE New Highs/New Lows: 315 / 91

• Nasdaq New Highs/New Lows: 748 / 238

• NYSE TRIN: 0.99

• Nasdaq TRIN: 0.88

Calendars

Economic Calendar

Today

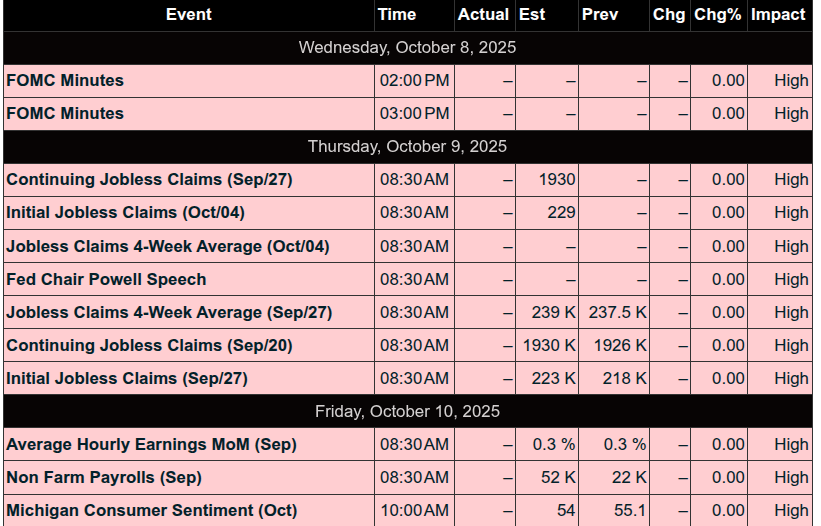

Important Upcoming

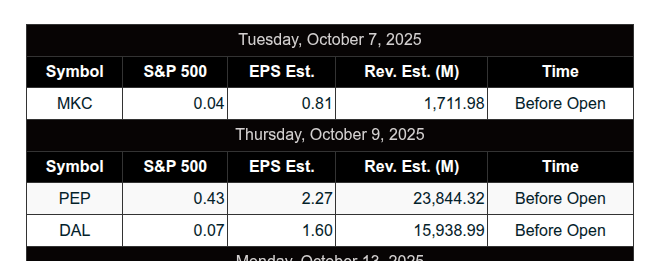

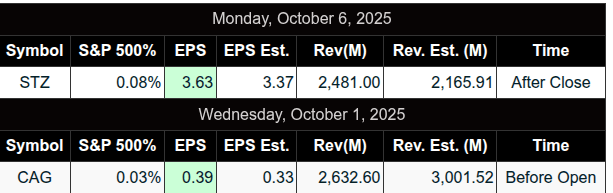

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, October 6, 2025

Monday’s session played out as a Cycle Day 3, with bullish momentum carrying over from the overnight session. PTGDavid guided the room with discipline, emphasizing the importance of sticking to the plan, trading only high-quality setups, and managing risk with hard stops. The day featured multiple solid opportunities, particularly in Crude Oil and NQ, and provided some key learning moments around trade management and continuation strategies.

Positive Trades & Execution Highlights

Overnight Target Zone (6780–85) was fulfilled before RTH, setting the tone for bullish control.

CL (Crude Oil) Open Range Long:

Called and executed by PTGDavid.

Played out perfectly, hitting two upper targets with a trailing stop, as shown in his posted screenshot.

Strong model example of using OR setups effectively.

Lesson: Respect structure; timing and execution at key zones (OR + scaling) works well.

Discount Scale-In (1:26 PM)

David confirmed a discount scale near the session highs as bulls continued pressing.

Price tagged 6794, followed by a push to 6800, showcasing strong continuation.

The “2 pm Shake n Bake” marked another leg up.

Dip n Rip (3:45 PM)

A classic late-day push after a dip, demonstrating the strength of bulls on Cycle Day 3.

Lessons & Key Takeaways

Trade Location Matters:

Roy and David discussed the value of the 89 EMA and VWAP/VPOC for optimal entries.

Roy noted missing the earlier short from 84.00, highlighting the importance of being ready and alert for textbook setups.Continuation Trades are Challenging:

Roy expressed difficulty with continuation setups. David affirmed that managing open trades via scaling and trailing stops (e.g., stop at entry) is a risk-free way to stay in while letting trades work.Scenario Planning (Mindset Tip):

David shared a quote:

“A scenario is not a prediction... it maps out the future of your actions. Decide in advance, ‘If this happens, I’ll do that.’”

— Emphasizing discipline and preparation over prediction.PKB Discussion:

Traders exchanged thoughts on using Prior Known Bar (PKB) setups, with David confirming it's a valid strategy. Peter shared insight from traders using Asia/London highs/lows as PKB triggers.

Community Engagement & Education

Good participation across the board:

Roy, Bruce, Manny, PeterN, and others contributed to discussions on trade logic, setups, and execution.Manny provided intraday timing guides.

PeterN discussed trade theory and audio feedback, adding value to both content and tech.

Several traders reported watching training videos over the weekend (e.g., CCI review by Roy), underscoring the PTG room's educational culture.

Market Close Notes

Final push into 6800 confirmed bullish dominance.

MOC Sell was reported at $338M, which David jokingly referred to as "Mice Nutz" — indicating minimal significance.

Summary

Monday was a bullish continuation day with textbook fulfillment of overnight targets and multiple successful setups, especially in Crude Oil and NQ discount entries. PTGDavid reinforced core principles: trade with the dominant force, use hard stops, and stick to the plan. Traders in the room demonstrated growing skill and commitment, while also navigating the psychological and technical nuances of active intraday trading.

Discovery Trading Group Room Preview – Tuesday, October 7, 2025

AI Trade Mania: AMD surged 24% (+$63B in market cap) following a major deal with OpenAI. Stocks mentioned at OpenAI's dev conference saw sympathy moves: Figma +7.4%, HubSpot +2.6%, Salesforce +2.3%, while Expedia and TripAdvisor both briefly jumped over 7%.

OpenAI Capacity Concerns: OpenAI’s computing deal commitments now exceed $1 trillion, raising doubts about their ability to deliver.

Strategic Minerals Push: The Trump admin is ramping up critical mineral investments to counter China. Key moves:

Reversal of Biden-era decision, reviving Amber Road in Alaska’s mineral-rich Brooks Range.

U.S. takes a 10% stake (plus 7.5% warrants) in Trilogy Metals (TMQ), whose shares surged 150%.

Follows recent U.S. stakes in Lithium Americas (LAC) and MP Materials (MP).

Tariff Impact: World Bank cuts South Asia’s 2025 growth forecast from 6.6% to 5.8%, citing aggressive 50% U.S. tariffs on India (aimed at curbing Russian oil trade).

Earnings Watch: McCormick (MKC) reports premarket.

Economic Calendar: Consumer Credit due at 3:00pm ET.

Volatility & Market Levels:

ES 5-day ADR down to 42.75 points – compression likely to break to the downside.

Whale flows favor short bias into the U.S. open on notable overnight volume.

ES remains capped below short-term uptrend channel top (6818/23s). Key levels:

Resistance: 6818/23s, 6895/00s, 7097/02s

Support: 6668/73s