- The Opening Print

- Posts

- Ending of a Quarter

Ending of a Quarter

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Yesterday’s action in the ES was a tale of two tapes: Globex strength into the early morning gave way to intraday selling pressure, with the regular session carving out a series of lower highs and lower lows. The downside never really cascaded, though, as strong MOC buy imbalances — led by NVDA, AAPL, and AVGO — helped stabilize the market into the close. That tug-of-war left the full session with a modest gain despite the choppy, indecisive tone.

This is the last trading day of the quarter. Expect heavier rebalancing flows, squaring of books, and possible window-dressing moves by funds. The market is torn between persistent buy programs in mega-cap tech and broader sectoral selling, which may keep ranges contained but choppy.

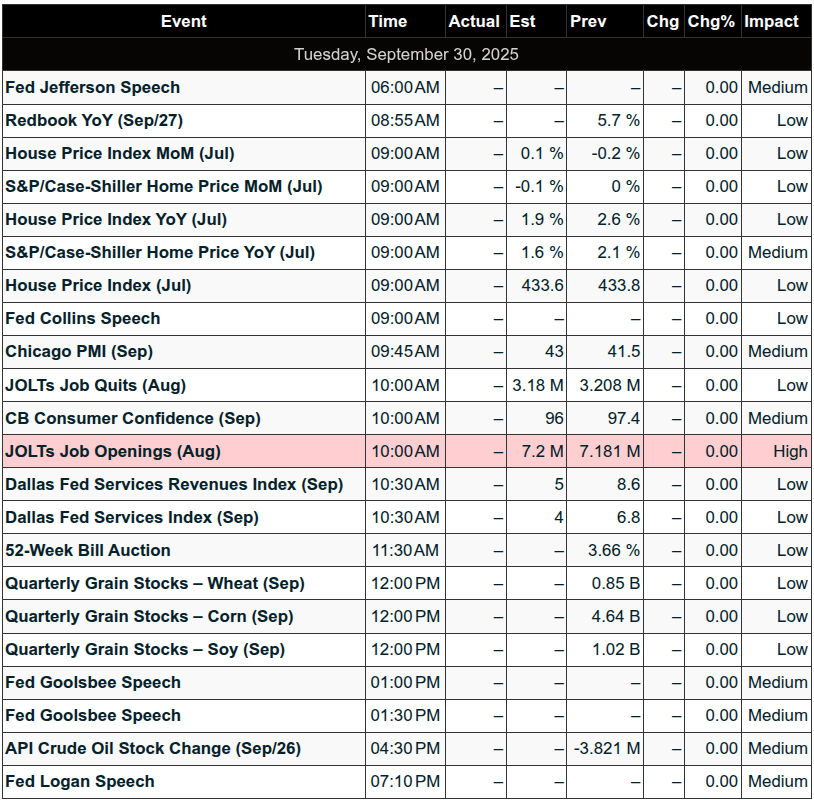

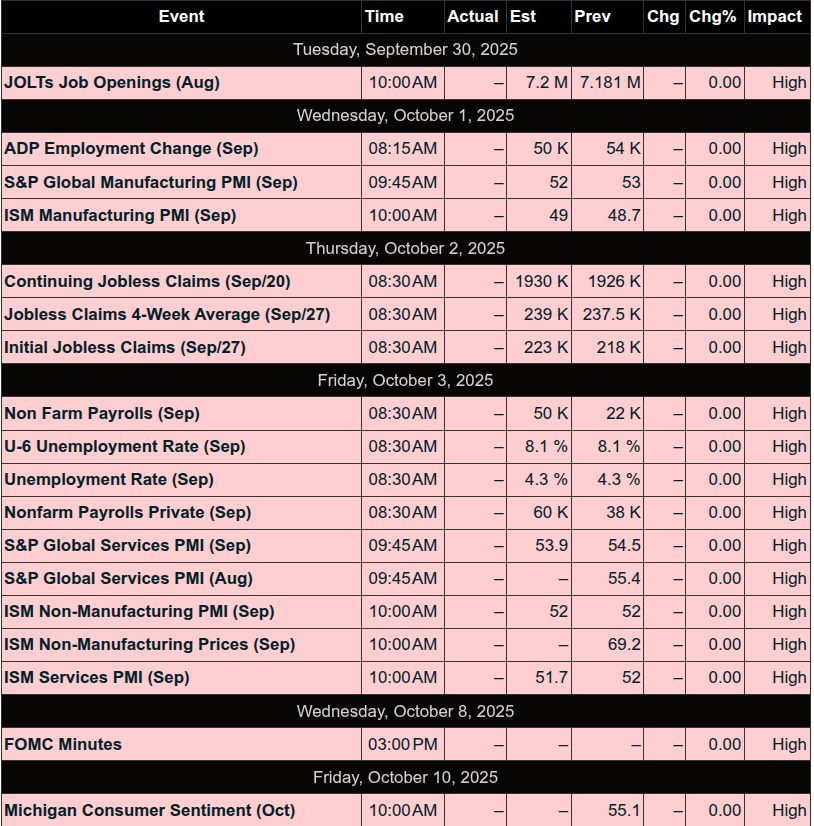

On the economic front, today’s calendar includes the S&P Case-Shiller Home Price Index (9:00 AM ET), Chicago Business Barometer/PMI (9:45 AM ET), and JOLTS + Consumer Confidence (10:00 AM ET) — all of which could stir short-term moves, particularly given the Fed’s focus on labor and consumer data.

MiM and Daily Recap

ES Futures Recap - Monday

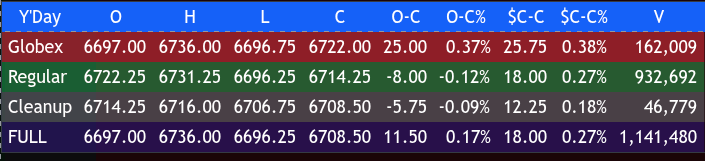

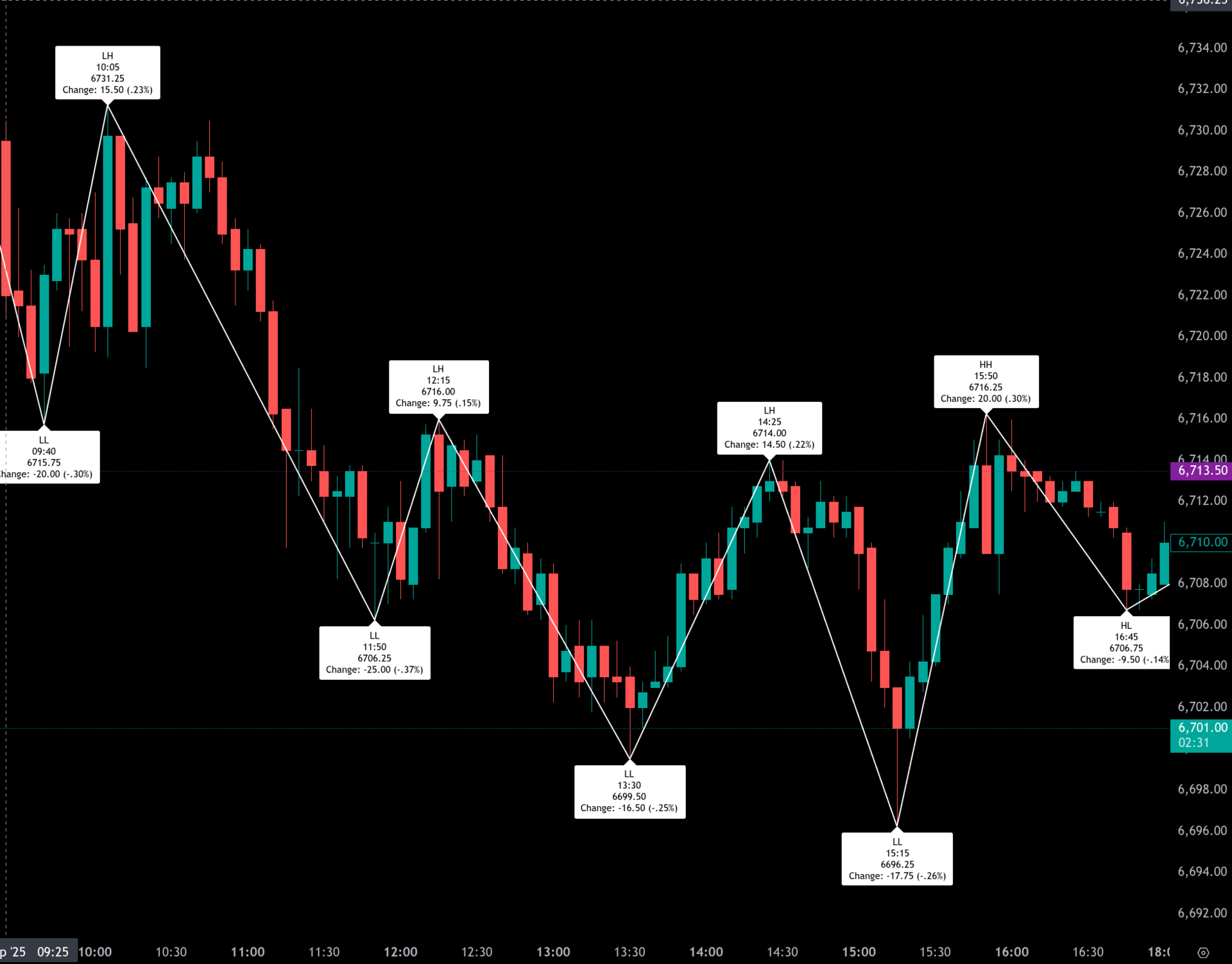

The overnight Globex session opened at 6697.00 and initially pushed higher, finding steady momentum into the early morning. A climb extended into a high of 6736.00 at 6:20 AM, a 39-point rally from the open. From that peak, sellers emerged, sending ES down to 6723.50 by 7:40 AM, a modest 12.50-point pullback. A rebound attempt lifted futures back to 6735.75 at 9:00 AM, but that lower high set up a reversal. Heavy selling drove prices down through the 6722.25 open.

The regular session opened at 6722.25, only slightly above the morning low, and quickly weakened. Selling pressure pushed ES to 6715.75 at 9:40 AM, establishing a new low. A brief bounce to 6731 at 10:05 failed to gain traction, and futures slipped to 6706.25 by 11:50 AM and then further to 6699.50 at 1:30 PM. Another rally attempt reached 6714.00 at 2:25 PM but again faltered, and ES dropped to 6696.25 at 3:15 PM, the session’s intraday low. A late lift carried prices back to 6716.25 at 3:50 PM before softening into the close. The regular session settled at 6714.25, down 8.00 points or -0.12% from its open.

The cleanup session extended the modest weakness. ES slipped to 6706.75 before settling at 6708.50 by 5:00 PM, down 5.75 points (-0.09%) from the cleanup open. For the full session, futures finished with a net gain of 11.50 points (+0.17%), closing at 6708.50, up 18 points (+0.27%) from the prior cash close. Total volume reached 1.14 million contracts, led by 932,000 during regular trading hours.

Market tone carried a choppy, indecisive character. Early Globex strength faded quickly, and the regular session carved a series of lower highs and lower lows, highlighting intraday selling pressure. However, downside follow-through remained limited, keeping the overall structure contained within a relatively narrow band.

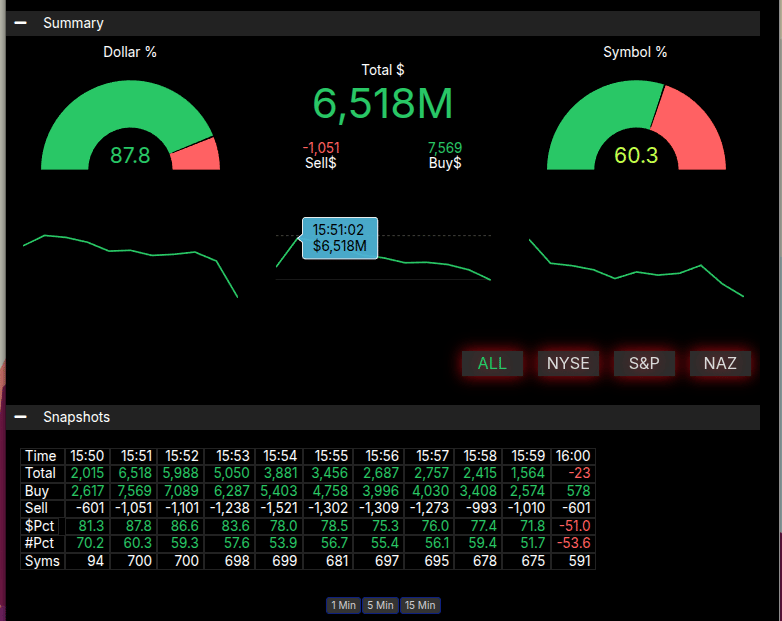

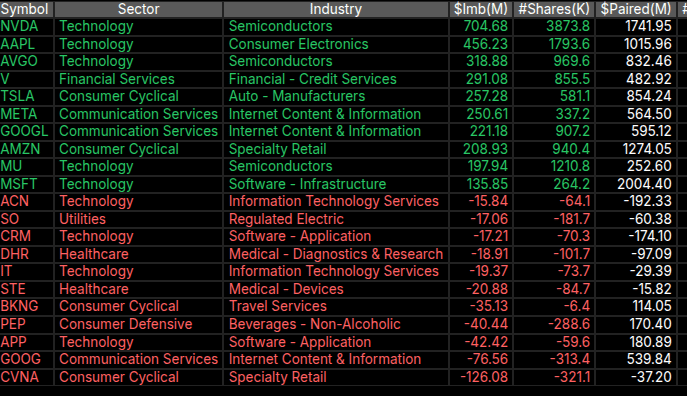

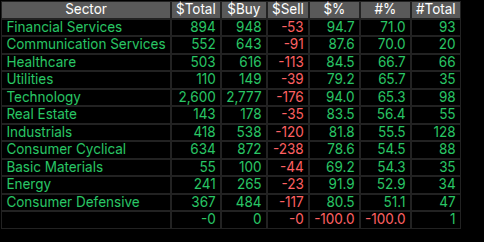

The Market-on-Close data revealed a strong imbalance to buy. At 3:51 PM, total imbalances registered $6.5 billion with 87.8% of the purchase on the buy side. Symbol imbalance measured 60.3%, comfortably above neutral but not extreme. Sector flows were heavily skewed toward technology and financials, with semiconductors in particular showing outsized demand. NVDA led the buy side with a $704 million imbalance, followed by AAPL at $456 million and AVGO at $319 million. Despite this heavy skew toward large-cap tech and financials, selling emerged in consumer cyclicals such as CVNA (-$126 million) and defensives like PEP (-$40 million).

The late-session bid from the imbalance helped stabilize ES into the close, but the overall action underscored mixed sentiment. The bullish imbalance contrasted with the day’s intraday weakness, leaving the tape torn between persistent buy programs in mega-cap tech and broader sectoral selling. In the end, ES managed to notch a small full-session gain, though traders will watch closely to see if the strong imbalance flow carries momentum into the next session or if the lower-high structure continues to weigh.

Technical Edge

Fair Values for September 30, 2025:

SP: 52.58

NQ: 223.59

Dow: 297.41

Daily Market Recap 📊

For Monday, September 29, 2025

• NYSE Breadth: 51.67% Upside Volume

• Nasdaq Breadth: 62.18% Upside Volume

• Total Breadth: 60.91% Upside Volume

• NYSE Advance/Decline: 48.77% Advance

• Nasdaq Advance/Decline: 54.46% Advance

• Total Advance/Decline: 52.34% Advance

• NYSE New Highs/New Lows: 119 / 41

• Nasdaq New Highs/New Lows: 227 / 101

• NYSE TRIN: 0.82

• Nasdaq TRIN: 0.71

Weekly Breadth Data 📈

For Week Ending Friday, September 26, 2025

• NYSE Breadth: 50.16% Upside Volume

• Nasdaq Breadth: 54.27% Upside Volume

• Total Breadth: 52.76% Upside Volume

• NYSE Advance/Decline: 38.79% Advance

• Nasdaq Advance/Decline: 40.16% Advance

• Total Advance/Decline: 39.65% Advance

• NYSE New Highs/New Lows: 312 / 107

• Nasdaq New Highs/New Lows: 692 / 209

• NYSE TRIN: 0.61

• Nasdaq TRIN: 0.56

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, September 29, 2025

Monday was Cycle Day 1 (CD1) and Series Day S3L, which historically implies a rotational, choppy character, especially in the morning session. Manny and PTGDavid guided the room through several key pivot windows using time-based analysis (The Clock) and structure-based trading strategies. Despite some chop, the day provided valuable educational content, several positive trade opportunities, and great insights into systematic discipline and patience.

Key Positive Trades & Setups

Early Long Trade (Manny):

Entry: Back above 6722.25

Exit: +5 @ 6730, then +8 @ 6733

Highlighted early strength in the market and effective use of structure for entry.

Crude Oil Open Range Short (@CL):

PTGDavid: Announced trade and confirmed “All Targets fulfilled” by 9:27 AM – a textbook trade setup executed cleanly.

NQ Open Range Long (10:10 AM):

Screenshot shared by David — bullish structure held up through consolidation within the clock window.

Manny’s Afternoon Trade:

Entry: S6716 during the 11:30 candle, anticipating a low pivot at 12:30

Exit: +5 off a “pseudo A4” at the 2:30 PM pivot high, then +10 more in the afternoon

A strong example of timing trades within clock windows for optimal reward.

Last Hour Low Pivot:

Right on time at 3:20 PM (as forecasted)

Manny: “Trailed out” profitably

David shared that the full CD1 range target (6697–6735) was achieved.

Key Lessons & Educational Highlights

S3 Days Require Patience:

Manny emphasized that S3 days are often best avoided early on due to chop. He reinforced the value of waiting for structure and clock alignment, rather than forcing trades."The Clock" Explained in Detail:

Manny delivered a masterclass on his time-based trading model:Each day (S1–S4) has predictable high/low pivot windows.

Today’s S3L pivot windows (CT):

Low: 10:30

High: 11:20

Low: 12:35

High: 2:30

Final Low: 3:20

These windows played out well, reinforcing the reliability of the clock model.

Trading Boot Camp Discipline:

Manny shared his path to profitability:3-month boot camp (1 contract, 3 trades/day limit)

Rule violations meant restarting the entire process

Took him a full year but was transformative.

Excel Tools & Historical Tracking:

Manny shared screenshots of:

His clock model tracking going back to 2015

His performance tracker spreadsheet

Reinforced the value of journaling and self-review for developing edge.

Wisdom Shared:

"Nothing in trading is perfect, but follow along... eventually you trust it."

“Keep adding tools to your belt. Throw out what doesn’t serve us.”

"The clock is a tool outside of price — and it works."

Notable Mentions

Chief shared a video on how he draws zones – well received by the group.

Many participants engaged actively, with appreciation expressed for the community learning environment.

Manny credited WB (Wyckoff AM Trader) for teaching him the clock model back in 2013/14.

Summary Takeaway

Despite the typical choppiness of an S3L day, PTG members navigated the session with discipline, structure, and time-tested tools. Patience paid off, especially for those who waited for setups to align with the clock model, leading to several profitable trades in the afternoon session. The educational content — particularly around time-based pivots and trading psychology — made this a standout learning day.

Looking Ahead:

Today is expected to be S4H, which historically offers more directional clarity, especially on CD1 — potentially setting the tone for the rest of the week.

Discovery Trading Group Room Preview – Tuesday, September 30, 2025

Government Shutdown Watch

Government shutdown likely at 12:01am ET tonight after failed talks between President Trump and Democratic leadership.

BLS to cease operations if shutdown occurs, potentially impacting future economic data.

Senate has a last-minute vote tentatively scheduled for today.

Tariffs & Trade

President Trump announced:

10% tariff on softwood timber/lumber.

25% tariff on certain upholstered wooden products (effective Oct. 14).

Proposed 100% tariff on foreign films.

Homebuilders warn lumber tariffs could hurt new home/renovation investment.

Canada, already facing 35.2% tariffs, will be significantly impacted.

Corporate & Crypto

Visa (V) to test stablecoin-based cross-border transactions.

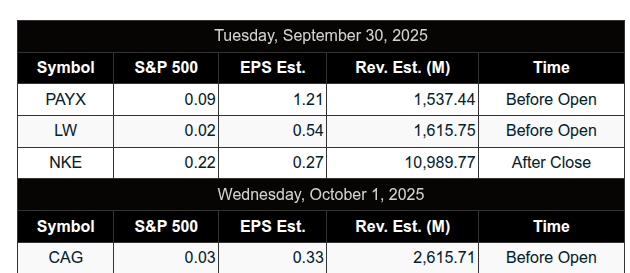

Earnings Today:

Paychex (PAYX) – premarket

Nike (NKE) – after the bell

Economic Data – All Times ET

9:00am – HPI, S&P/CS 20-City HPI

9:45am – Chicago PMI

10:00am – JOLTS Job Openings, CB Consumer Confidence

Fed Speakers

9:00am – Susan Collins (Boston)

1:30pm – Austan Goolsbee (Chicago)

Market Technicals & Volatility

Volatility remains moderate; ES 5-day ADR: 55.25 pts.

Whale bias bullish into US open on strong overnight volume.

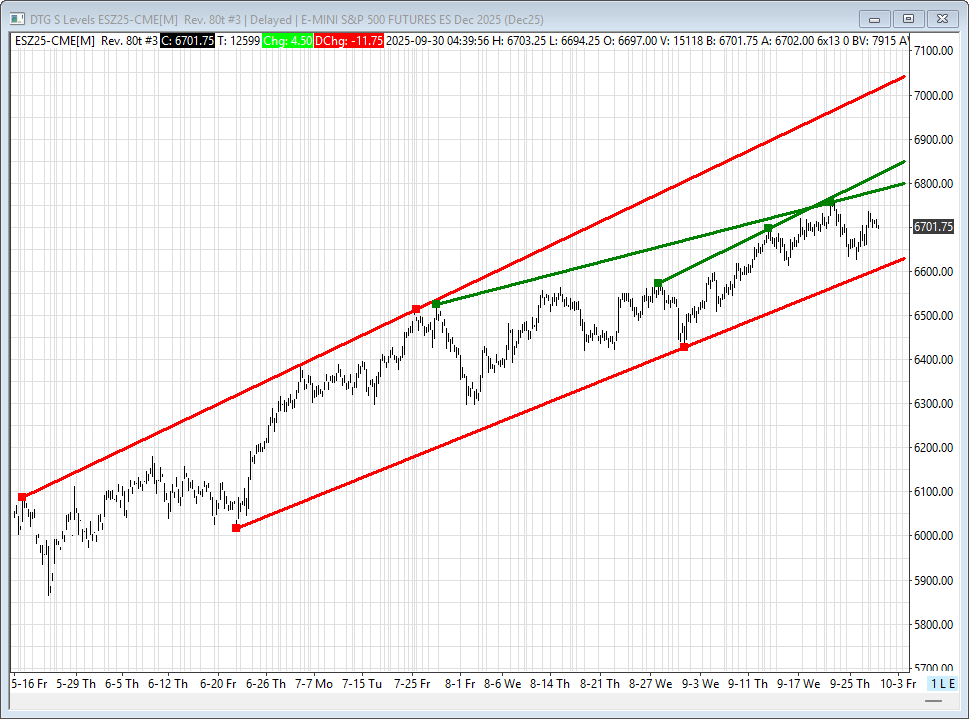

ES trading mid-channel in short-term uptrend.

Trendline Resistance: 6790/95, 6840/45, 7046/51

Trendline Support: 6618/23