- The Opening Print

- Posts

- Da Bears Hit Da Bonds as We Gear Up for Fry-Day

Da Bears Hit Da Bonds as We Gear Up for Fry-Day

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Today is Fry-Day, which means it’s a free-read for everyone. If you’d like to consider upgrading to our premium membership, do so with a free 7-day trial.

Da' Bonds

At one point, I worked in the world's largest futures pit, the CBOT bond pit. If ever there was a smelly futures pit, it was the bond pit, hands down.

There were lots of busy pits that hired big guys, and clerks who were former football and basketball players were hired to protect the order filler when the pit would shift. We had a few big guys in the S&P pit that played football for Indiana State and they towered over most of the locals. I don't know if they made or lost.

But the bond Pit was where Tom Baldwin — who had no floor experience — turned $17,000 into over $150 million. Tom had a knack for knowing when the pit was long or short and he knew how to move the largest futures contract up and down like an accordion. Sometimes when he did this he was losing and getting out, but sometimes he would have 10,000 to 20,000 bonds on and bid the bonds up a half a point. He set off stops and caused massive short squeezes.

At the end of the day, Tom Baldwin was one of, if not the greatest bond futures traders in the world. I remember when I was on the floor, the bonds were trading 86.00 and they ran up tremendously…but that was then and this is now.

I recently had a conversation with my friend Kun from China. He was the person who told me there was a flu floating around in China that was resistant to medications and a few months later COVID-19 shut down the world. When we spoke a few weeks ago, he mentioned the stock market and I talked about how rates were still going higher and he said, that's because China is dumping its positions in the US bond market. That much is true. Japan has also been a smaller buyer.

Now the 10-year yield is at its highest level since October 2017.

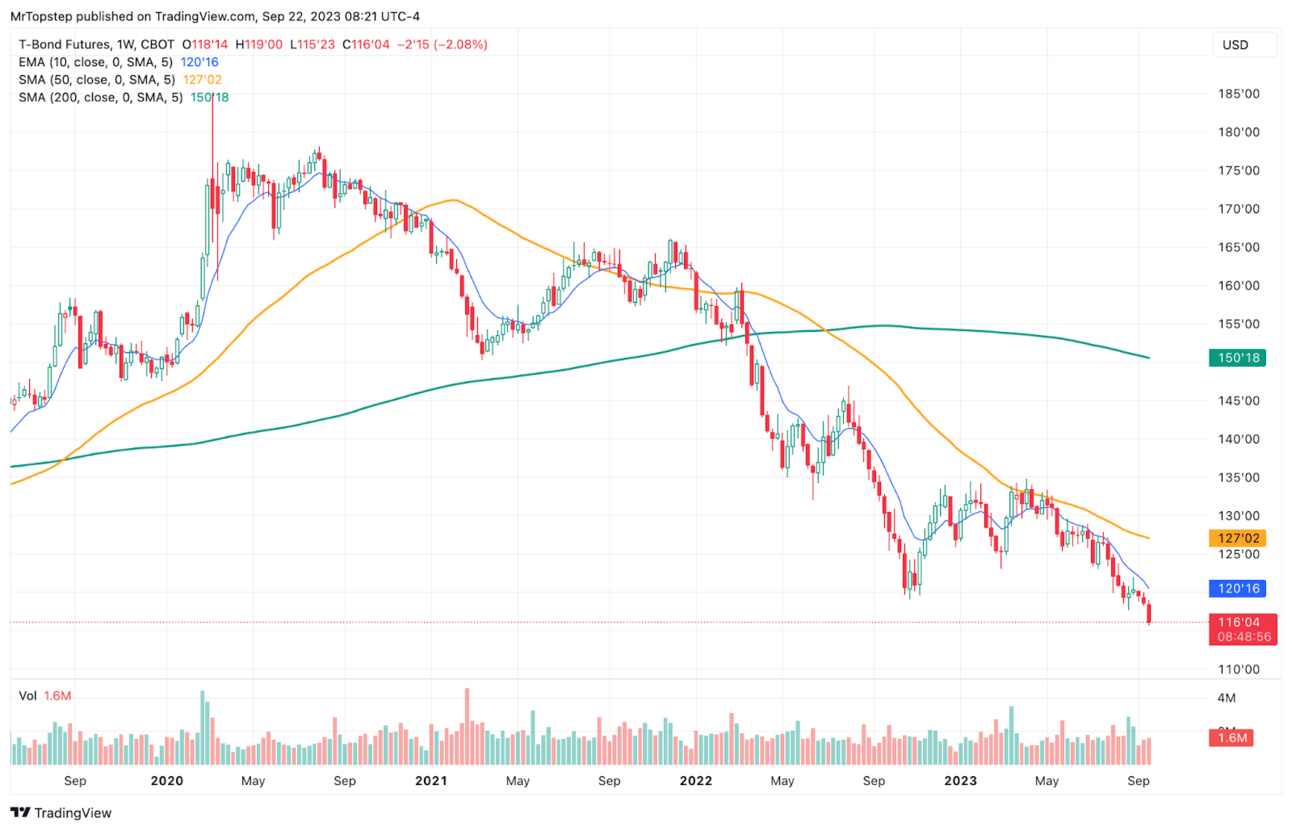

Weekly chart of /ZB

Yesterday the bonds were down 2.20 points or 80 ticks. In April of 2020, the bonds traded up over 190 and yesterday they traded down to 115.29, a ~75-point drop from those highs. For the year, /ZB is down almost 10%. TLT is down about 11.5%.

Clearly, “higher for longer” is a lot more serious than most people think. @HandelStats said last night that he has a 111.00 downside price objective and said, “hey, it's only ~4 points away.”

As I have always said, I’m not an economist, but I think there is a November rate hike coming and possibly more hikes in 2024. Higher bond and oil prices are one of the worst economic cocktails out there and guess what? China is far from done.

Our View

I have adapted many of the PitBull’s trading rules. There used to be one called Mutual Fund Monday where you get long on the close on Friday and hold into Monday and for years that was a winning trade. Now the rule is the markets tend to rally early in the day and early in the week.

I told the PitBull there is a new rule and it's called the 3-Day Rule. The 3-day rule is actually a 3-day trading week where you avoid the low-volume trading days of Monday and Tuesday and start trading Wednesday for the Thursday/Friday uptick in volume and the option expiration.

I am not actually saying not to trade early in the week; what I’m saying is most of the action comes later in the week and you can see it by the larger ranges and higher volumes.

Separately, the outflows have been cranking up. Yesterday’s MIM (the data of which is always outlined in the recap) showed $4.5 billion for sale yesterday. Further, BofA Global equity funds had outflows of $16.9 billion in the week through Sept. 20. US stock funds led the exodus, while in Europe, redemptions reached 28 weeks.

Global bond funds have a 26th straight week of inflows at $2.5 billion, while $4.3 billion leaves cash funds.

Our Lean

The ES and NQ acted very weak on Thursday, with both going out near the lows. I know everyone is talking ES 4300, but I'm not sure we just go straight down like we did the last few days.

My lean is to buy the early weakness — especially if overnight inventory is 100% short — and sell the rips keeping in mind that the ES has sold off 138 points in 26 hours.

Do I like the markets? Not necessarily. Do I think they can rally? Yes.

The 50% retracement — the “half-back” — from the current low to the Fed-day high is at 4437, while the 50% retrace of yesterday’s range is at 4406. Bulls want to hold ~4369 on the downside and get back up through 4400 to sustain some sort of larger bounce.

Remember, today is FRYday, so expect the unexpected.

MiM and Daily Recap

ES recap 15-min

The ES traded down to 4403.25 on Globex and opened Thursday's regular session at 4415.75. After the open, the ES rallied up to 4428.50 and then sold off down to a 4398.75 double bottom low and then rallied back up to the VWAP at 4414.75 at 10:22. From there, the ES sold off to 4403.25, rallied up to two lower highs at 4412.50 and 4413.50 at 10:42, dropped down to 4402 and then sold off to 4392.50 at 12:11. After the low, the ES back-and-filled in a 4 to 8-point range until 1:17, then rallied up to 4407.75 at 2:38.

The ES sold back down to a new low at 4376.00 at 3:33 as the early MIM showed $536 million to sell and traded 4378.00 as the 3:50 cash imbalance showed $4.45 billion to sell. From there, it traded down to 4371.75 at 3:59 and traded 4373.50 on the 4:00 cash close. After 4:00, the ES sold off down to 4366.50 and settled at 4369.00 on the 5:00 futures close, down 75.75 points or 1.70% on the day. The NQ settled at 14849.75, down 287 points or 1.90%.

In the end, it seems like it's not just the threat of higher rates that is the only thing spooking the markets right now…everything from crude oil to all the global strife. In terms of the ES's overall tone, every rally was sold. In terms of the ES's overall trade, volume was higher: 360k traded on Globex and 1.546 million traded on the day session for a total of 1.90 million contracts traded.

Technical Edge

NYSE Breadth: 10% Upside Volume (!!)

Nasdaq Breadth: 33% Upside Volume

Advance/Decline: 14% Advance

VIX: ~$17 (one-month high)

ES

Can bulls regain 4400 and the August low? That’s the big question to unlock more upside.

ES Daily

Upside Levels: 4400-06, 4416, 4430-37

Downside levels: 4369, 4340

CL

Maybe bulls are getting sick of looking at oil, but I doubt it! Back up over $91 and perhaps new highs for the move are back on the table.

CL Daily

Short-Term Support: ~$88

Longer-Term Upside Levels: $92.50, $94, $9

Economic Calendar