- The Opening Print

- Posts

- CPI Pops the Tape, but Nobody’s Buying It — Witching Day’s Got Teeth

CPI Pops the Tape, but Nobody’s Buying It — Witching Day’s Got Teeth

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

While the ES and NQ reacted positively to the cooler-than-expected CPI data, the number may not have changed the Fed's rate cut path very much. Thomas Lee, the head of investment strategy at SoFi, said, “The equity market seems to be responding to the CPI report in a positive way, but the trouble is that nobody trusts the data right now.”

I think that’s a fair assessment of the public’s view and tends to cast a shadow of doubt on all the economic reports that have—and will be—released after the government shutdown.

Our Lean

There is going to be a lot of noise this morning between the BoJ raising rates, the pending economic reports (mainly the PCE number), and the December Quadruple Witching. Everything points to increased volatility.

I did catch a few good longs yesterday, but I wasn’t impressed with the late weakness going into the close. I think there will be resistance between the 6850 to 6875 levels, with support at the 6778 to 6765 levels. If that doesn’t hold, we could see a deeper pullback toward the 6700 level.

Our lean: In most cases, the quarterly expirations tend to be busy in the first hour and a half and the last hour, with big volume prints on the opens and closes. While I still think there will be an upside push that starts on December 24, I also can’t rule out some further drops before then.

Guest Posts:

|

Get instant access to our partners’ real-time market data and insights not available anywhere else. Here is last night's Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

Founder's Note:

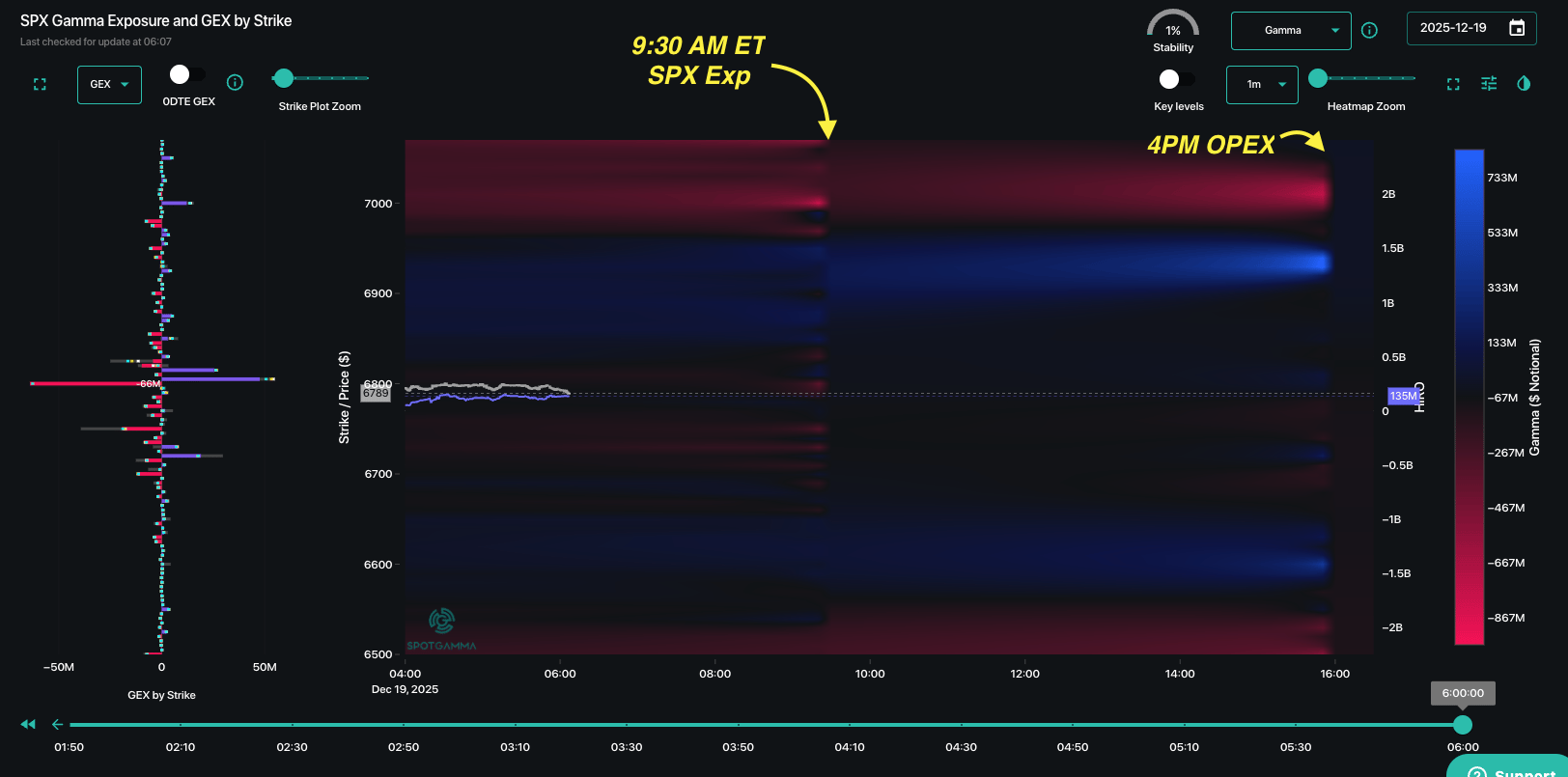

Futures are +20bps ahead of the largest OPEX ever. At 9:30 AM ET we see ~$1.8tn delta notional of SPX expire, and at 4pm another ~$500bn of ETF's & single stocks expire. While calls outweigh puts, we don't detect extreme imbalances in positioning which could be relieved post-OPEX. You will likely see some "$9 TRILLION" figure in the news, that 9 trillion assumes every contract expiring is worth 100 shares of stock. This delta method is more reasonable in our opinion, as it uses delta to equate actual share notional value.

News of OpenAI seeking sovereign wealth funds has tech firming up a bit.

For the record: today's 0DTE straddle is $40/58 bps. We've not seen an intraday move of less that 58 handles in the SPX for 7 straight sessions. We're a bit less excited about buying this seemingly cheap 0DTE straddle into OPEX (discussed below), but that does not mean we don't see it as cheap given the vol thats been realized over the past week. 5-day realized vol is 12%, which is pricing in 75bps of daily movement on a close to close basis, the intraday swings have been much larger (often >1%).

Here is what the impact is for the SPX. In TRACE you see a line at 9:30 AM, which is the big AM expiration. That exp appears to remove 6,700-6,800 negative gamma, and seems to clean up the structure for the remainder of the day (i.e. we are wary of a bit less vol). Also note the 0DTE strikes around 6,805 appear to go away with that AM exp.

Here is the bigger picture: 6,800 remains the pivot. We lean neutral to short <6,800, and want to lean long >6,800. If SPX is <6,800 after Xmas then we would lean more short vs neutral.

As a baseline, we have viewed, and continue to view the expiration through Xmas week as bullish/supportive. Post FOMC to VIX expiration the equity market moved -2% - we'd label this as somewhat muted relative some sharp downside move in top AI related names (ie ORCL -15%, AVGO -20%, etc). We can make the case that the sleepy volatility through this 2% decline is being aided by the holiday period, as well as the big JPM call that suppresses vol. After Christmas, the long vol "decay tax" is gone, and that could open up put buying. If that were to happen, negative gamma increases as likely does dealer short vega exposure (i.e. things get jumpy). Thus the darker red post-Xmas on our chart <6,800.

We have/had been of the view that traders should watch the "OPEXmas" right tail move up into the 7k strike, and while 7k is a topping area and feels less likely, we do view a close above 6,800 as a reason to increase upside exposure into next week. After next week, we no longer have a reason to be constructively bullish - thus the lighter green post-Xmas.

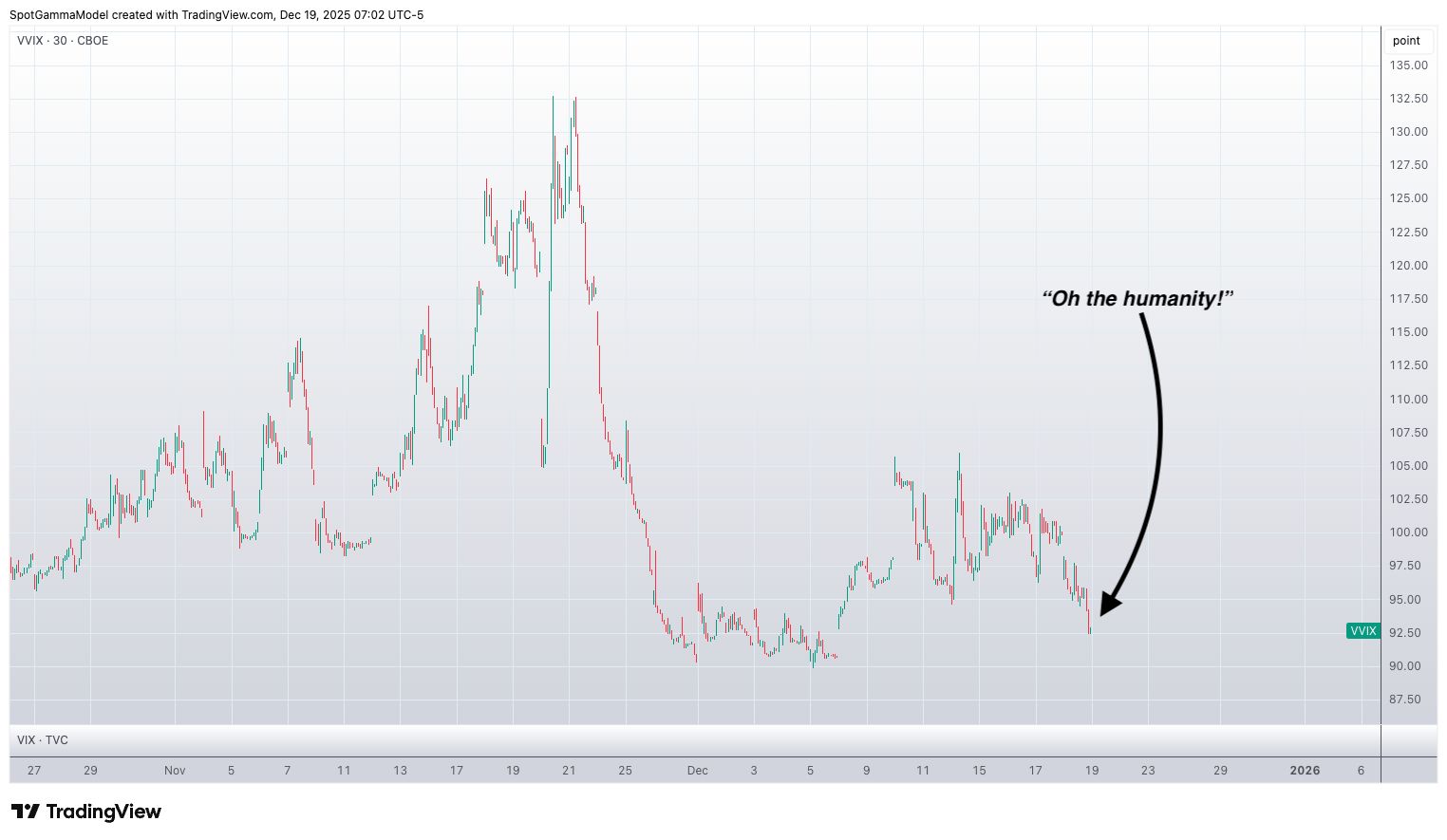

Let's substantiate the "sleep vol" claim. We've been chronicling the way-too-low 0DTE pricing every day for the last week, so we will zoom out a bit in exp time. Below is today's SPX term structure (teal) vs mid November. Mid November saw a nearly identical SPX drawdown of ~2% from the same ~6,900 high. However, the ATM IV's were in the 16-17%'s vs the 11-12% that we have now.

Further to the point of vol, basic evidence is via the VVIX. Post VIX exp there is no bid to upside VIX calls. So, again, if traders are looking for more downside, they are not doing it via puts/VIX calls. That is important from both a sentiment perspective, but positionally as the lack of downside protection reduces dealer hedging obligations. The argument has been made that this lack of vol risk premium creates a lack of vanna-induced bounce, which is true. I counter that with flagging the oversold nature of many top tech stocks, and their fuel for a dead-cat bounce.

The scary part for bulls here is if that vol goes bid, then stocks have very little support below. Again, we suspect that if that were to happen, it would be post-Xmas.

©2025 TenTen Capital LLC DBA SpotGamma©2025 TenTen Capital LLC DBA SpotGamma

Get instant access to our partners real-time market data and insights not available anywhere else. Here is last night Founder’s note getting you ready for today’s market and explaining the constraints in yesterday’s market. - MrTopStep

Market Recap

There’s an old saying that no one promised us a rose garden — and apparently, that goes for trading the stock market, too.

After a $5 billion MOC sell on Wednesday’s close, the ES did what I thought it would: it rallied up to 6841.25 on Globex. But the fun didn’t start until the delayed Consumer Price Index (CPI) report came out, showing annual inflation at 2.7% vs. the 3.1% economists expected.

After the 8:30 release, the ES traded up to 6837.75 at 8:45, pulled back, and traded 6840.50 at 9:25. It opened Thursday’s regular session at 6839.75, up 0.92%. After the open, the ES rallied to 6850.25, sold off down to 6820.50 at 9:45 — and that’s when the buy programs kicked in, pushing the ES up to 6872.00.

From there, the ES sold off to 6811.75 at 12:25, rallied back to 6860.75, then sold off again to 6816.25. It made a lower high at 6850.00 at 3:45 and traded 6847.50 as the 3:50 cash imbalance showed $1.3 billion to sell. The ES immediately started selling off, trading 6828.50 on the 4:00 cash close and settling at 6822.75, up 51.50 points or 0.76% from the previous day’s session close.

The NQ settled at 25,261.75, up 363 points or +1.46% on the day.

In the end, the ES staged a big rally — but there were also some big drops. In terms of the ES’s overall tone, the rally broke a 4-day losing streak. In terms of overall trade, 365k ESZ contracts traded, and 1.97 million ESH contracts traded, for a total volume of 2.34 million contracts.

On Tap

US Core PCE Price Index and Personal Income at 8:30

Consumer Sentiment and Existing Home Sales at 10:00

Bank of Japan (BoJ) interest rate decision last night; official press conference to follow at 1:30 AM ET Friday

Today’s $6.6 Trillion December Expiration

@AlmanacTrader

According to the Stock Trader’s Almanac, the December Quad Witching has the S&P up 26 of the last 42 occasions — but down 7 of the last 9.

@HandelStats

December OPEX Day Performance — ES Futures (Since 2008)

This study examines December options expiration (OPEX) Fridays using E-mini S&P 500 (ES) futures data, measured close-to-close going back to 2008.

Key Results (17 observations):

Up days: 6

Down days: 11

Unchanged: 0

Probability breakdown:

Up: 35.29%

Down: 64.71%

Unchanged: 0.00%

Average performance:

Net average move: -0.34%

Average up day: +0.64%

Average down day: -0.87%

What stands out:

December OPEX in ES futures has shown a persistent downside bias. While upside outcomes do occur, they’ve been less frequent and smaller in magnitude than downside moves. Nearly two-thirds of December OPEX sessions closed lower, and the average down move exceeded the average up move.

This pattern is consistent with common OPEX-related structural flows, including:

Dealer hedging adjustments into expiration

Gamma decay and strike pinning breakdowns

Reduced intraday support as liquidity thins

Bottom line:

Historically, December OPEX Friday in ES has favored downside outcomes, both in frequency and magnitude. While not predictive on its own, it provides valuable context when aligned with trend, volatility regime, and higher-time-frame structure.

MiM

Market-On-Close Recap

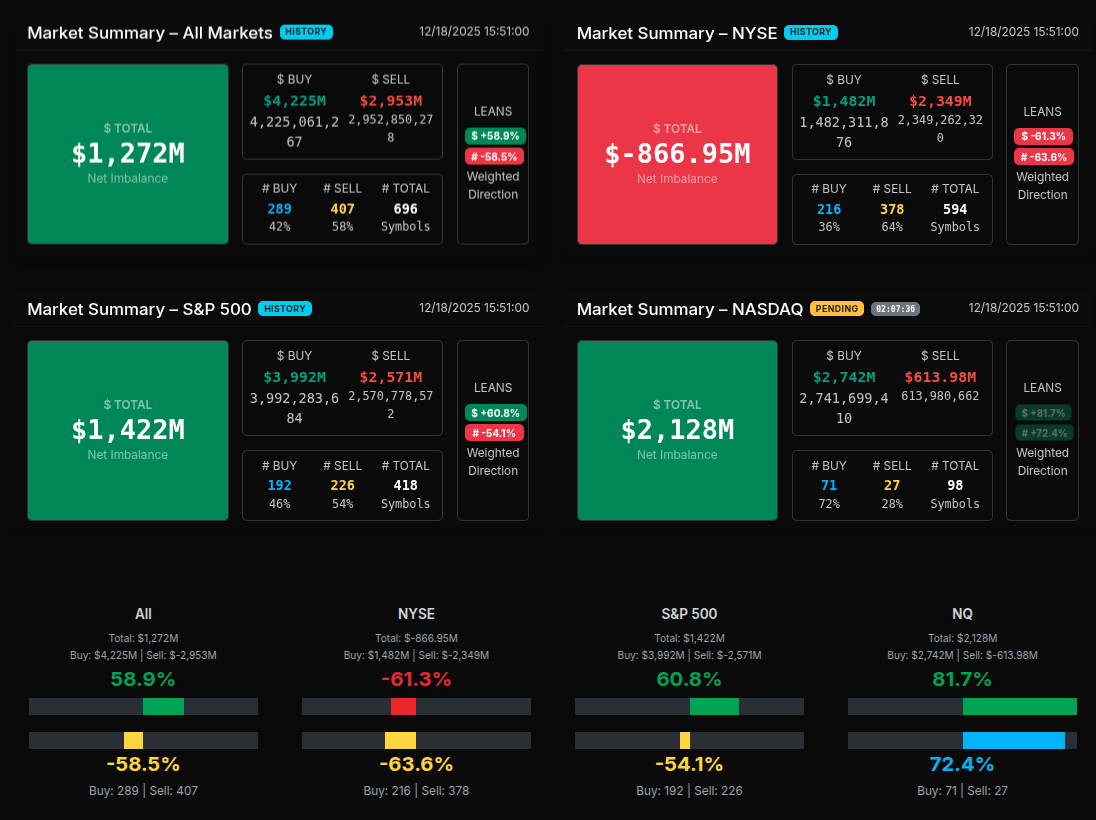

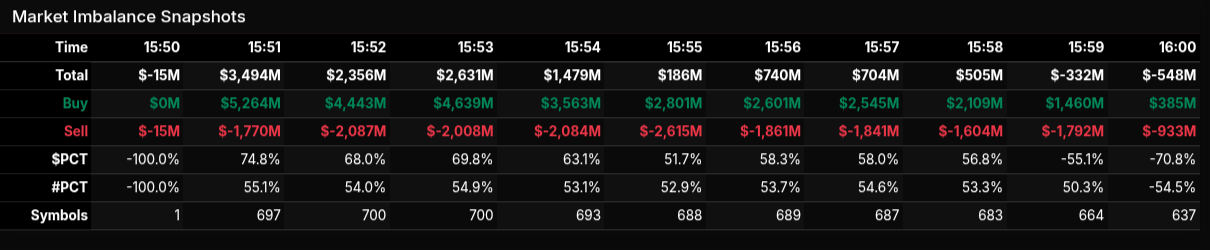

The Market-on-Close auction opened with a firm buy-side tone and steadily built into a sizable imbalance as the clock moved past 15:51. Early snapshots showed total imbalances climbing from roughly $1.35B to over $2.5B by 15:54, driven by consistent increases in buy dollars even as sell pressure remained elevated. The $PCT readings above 66% during this window signaled more wholesale-style buying rather than simple rotation, particularly notable at 15:54 when buy participation peaked and market intent was clearly directional.

That tone shifted sharply at 15:55–15:56. Total imbalance collapsed and flipped negative, with sell dollars overwhelming the tape and $PCT plunging below -58%. This transition marked a clear handoff from aggressive buyers to dominant sellers, not a smooth rotation. The struggle between buyers and sellers became evident as symbol counts remained elevated, but net pressure reversed, suggesting institutions were unloading into late liquidity rather than simply rebalancing.

Sector flows reinforced this narrative. Technology and Communication Services carried the buy-side leadership, with Technology posting over $1.2B in total imbalance and a +77% lean, while Communication Services showed a +94% skew. Healthcare and Basic Materials also leaned decisively higher, both above +68%, pointing to targeted accumulation. On the other side, Consumer Cyclical, Financial Services, Industrials, and Consumer Defensive all posted deep negative leans below -53%, signaling broad distribution rather than isolated selling.

At the symbol level, mega-cap tech dominated the buy tape. AVGO, AAPL, NVDA, MSFT, and META all showed large paired dollar flows, confirming institutional participation. Semiconductors were particularly active, reinforcing the strength seen in the Technology sector. Meanwhile, consumer names such as AMZN, CVNA, and HD appeared amid selling pressure, aligning with the weakness in Consumer Cyclical.

Into 16:00, the imbalance rebounded modestly back to a positive $522M, suggesting late offsetting flows rather than a renewed trend. Overall, the MOC told a story of early wholesale buying, a sharp seller-driven reversal, and a late attempt to stabilize—classic auction dynamics highlighting real two-

BTS Trading Levels - (Premium Only)

ES Levels

The bull/bear line for the ES is at 6827.00. This remains the key pivot for intraday bias. Holding above this level keeps the tone constructive despite the sharp overnight selloff.

ES is currently trading near 6839.50 in Globex. Above the bull/bear line, buyers can work against nearby resistance levels, but price acceptance is still needed after the fast liquidation.

On the upside, initial resistance comes in at 6872.00, followed by the upper range target at 6886.50. A stronger push higher would open the door toward 6942.50, though that would likely require sustained strength back above the upper range.

On the downside, support sits at 6830.50 and then 6792.00. Below that, look for support at 6767.50, the lower range target. A failure to hold this zone targets the lower stretch target at 6711.50.

Overall, the ES remains range-bound but fragile. Above 6827.00, dip buyers have a case. Below it, sellers regain control with downside risk toward the lower range target.

NQ Levels

The bull/bear line for the NQ is at 25,219.75. This is the key pivot for today and defines intraday bias.

NQ is currently trading near 25,322.25, holding above the bull/bear line after a sharp selloff and bounce. As long as price holds above 25,219.75, the tone stabilizes and favors rotation higher rather than continuation lower.

The upper range target sits at 25,540.25. Initial resistance comes in at 25,391.00 and then 25,401.00. A sustained push above these levels opens the door for a test of 25,540.25. Above that, upside momentum could extend toward 25,841.75.

On the downside, first support is at 25,261.75, followed by the bull/bear line at 25,219.75. A failure back below this level puts pressure back on the tape, targeting 24,983.50 and then 24,899.25, which is the lower range target for today. A break below 24,899.25 risks continuation toward 24,597.75.

Overall, NQ is attempting to base above 25,219.75 after heavy liquidation. Holding above this level keeps the market in balance with upside potential toward the upper range target, while acceptance back below it shifts control back to sellers.

Technical Edge

Fair Values for December 19, 2025

SP: 53

NQ: 227.08

Dow: 327.14

Daily Breadth Data 📊

For Thursday, December 18, 2025

• NYSE Breadth: 53.5% Upside Volume

• Nasdaq Breadth: 58.9% Upside Volume

• Total Breadth: 88.8% Upside Volume

• NYSE Advance/Decline: 60.8% Advance

• Nasdaq Advance/Decline: 59.4% Advance

• Total Advance/Decline: 63.6% Advance

• NYSE New Highs/New Lows: 100 / 38

• Nasdaq New Highs/New Lows: 128 / 234

• NYSE TRIN: 1.26

• Nasdaq TRIN: 1.07

Weekly Breadth Data 📈

Week Ending Friday, December 12, 2025

• NYSE Breadth: 53.5% Upside Volume

• Nasdaq Breadth: 51.7% Upside Volume

• Total Breadth: 51.8% Upside Volume

• NYSE Advance/Decline: 54.9% Advance

• Nasdaq Advance/Decline: 48.1% Advance

• Total Advance/Decline: 49.6% Advance

• NYSE New Highs/New Lows: 344 / 76

• Nasdaq New Highs/New Lows: 616 / 306

• NYSE TRIN: 1.05

• Nasdaq TRIN: 0.89

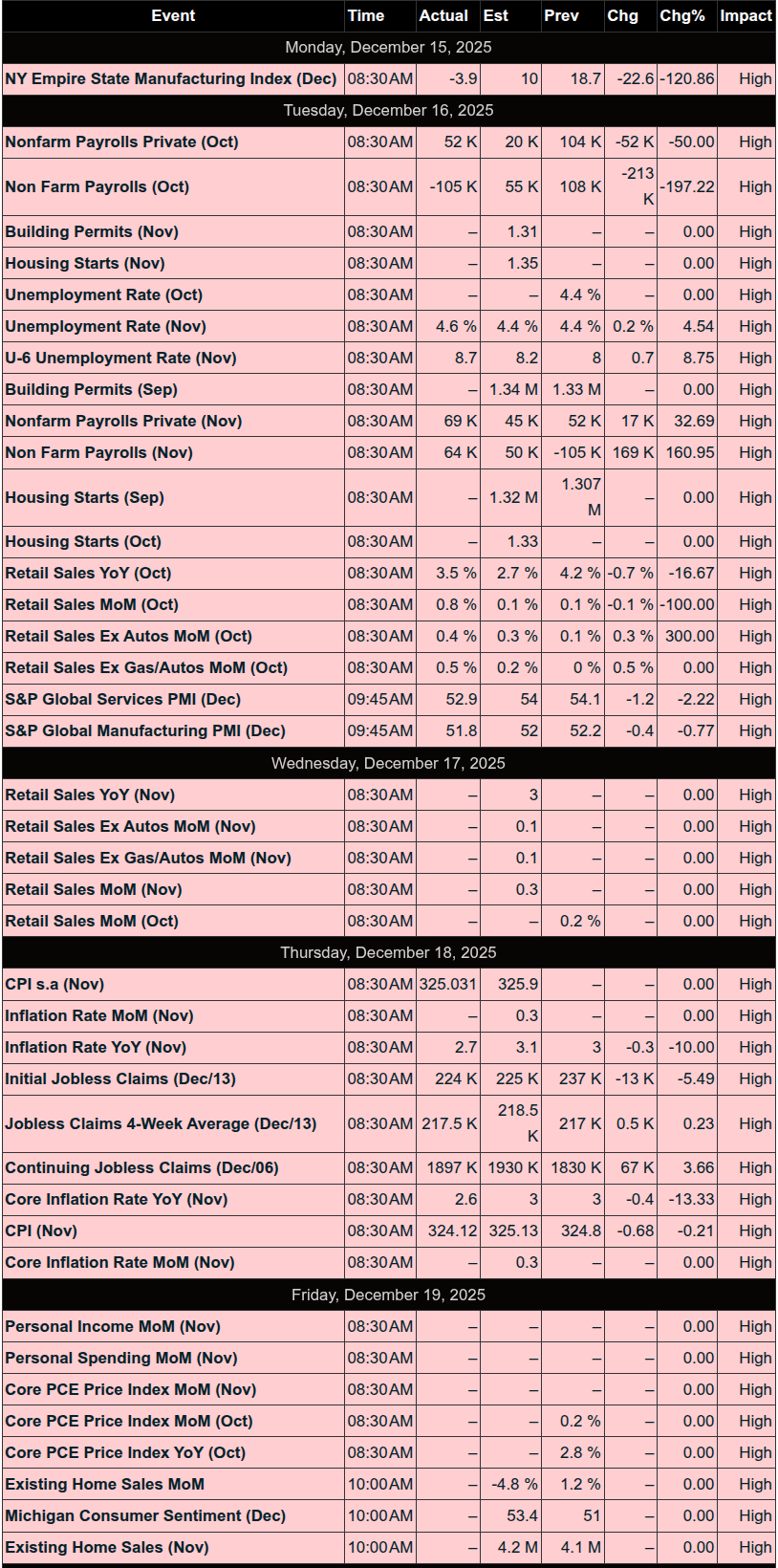

Calendars

Economic Calendar Today

This Week’s High Importance

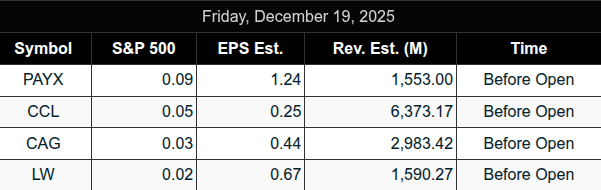

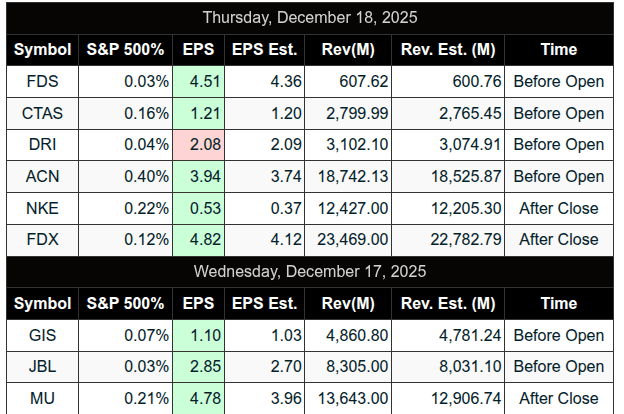

Earnings:

Trading Room News:

Polaris Trading Group Summary - For Thursday, December 18, 2025

Thursday was a strong bullish trend day, driven by a significant CPI data miss to the downside. The PTG trading room, led by David Dube (PTGDavid), executed several key setups from the Daily Trade Strategy (DTS). Multiple upside targets were fulfilled with precision, and the room saw active participation, solid trade management, and smart recognition of market structure shifts throughout the day.

Key Highlights and Positive Trades

CPI data came in well below expectations:

Headline CPI YoY: 2.7% vs 3.1% forecast

Core CPI YoY: 2.6% vs 3.0% forecast

This triggered strong bullish momentum and increased odds of Fed rate cuts.

David confirmed the DTS Bull Scenario was fulfilled shortly after the CPI release. Price held above the key 6795 area, confirming long continuation setups.

The continuation long from 6799–6803 (ES) triggered cleanly and offered excellent follow-through. Price pushed through multiple DTS targets.

Key measured move targets were achieved:

CD2 Target: 6840.98

CD3 3-Day Rally Target: 6871.18

These levels were nailed nearly to the tick, reflecting the strength and clarity of the trend.

Several room members reported positive trades:

Manny captured +30 points, exiting around the 6834 area.

PeterN executed a successful options swing trade, buying the previous day’s close and selling the open.

Other traders acknowledged the smooth continuation trade early in the session.

Futures setups in CL and NQ also performed:

CL Open Range Long hit Target 1, with a trailing stop to protect gains.

NQ Open Range Short hit Target 1 before a breakeven stop exit—well-managed risk.

Lessons and Market Observations

The DTS levels were highly effective, especially the continuation long area, which lined up with price action and market internals after the CPI release.

Awareness of Cycle Day behavior was critical. CD2 lived up to its reputation with volatility and range expansion early, followed by consolidation later.

After the major morning targets were hit, price entered a consolidation "sandbox" between 6860–6870. David identified this as Wyckoff-style distribution, which helped members shift expectations and avoid overtrading.

Late in the session, traders observed the common post-target slowdown, with Ram noting a “slow motion” feel after the morning move. David confirmed that this is typical behavior.

Community Atmosphere

The room stayed engaged and light-hearted. David referred to the day’s action as “Wild Ryde Clyde 2.0,” and there was joking around ICT-style methods and terminology.

Members shared observations, confirmations of levels, and recognition of the market environment. Participation remained strong through both the trend and consolidation phases.

End-of-Day Notes

A $1.3 billion MOC buy imbalance was noted, but the market still followed through with a sell-the-close pattern, as David called out “right on cue.”

Traders were reminded of the upcoming $6 trillion options expiration (quad witching) on Friday, which could bring more volatility and larger order flow shifts.

Summary

Thursday’s session was a clean, disciplined bullish trend day led by macro catalysts and well-aligned technical levels. The DTS levels performed precisely, major range targets were hit, and the room demonstrated strong trade planning and execution. It was a day that reinforced the power of preparation and awareness of market structure.

Looking ahead to today's massive OpEx, traders are expecting increased volatility and potential continuation of range expansion.

DTG Room Preview – Friday, December 19, 2025

Inflation Uncertainty: November CPI showed cooling inflation at 2.7%, but missing October data and questionable rent figures (a third of the index) are casting doubt. Black Friday discounts may have also skewed results.

Oil Prices Drop: Despite global tensions, WTI crude is down 2% this week (~$56/barrel), lowest since May. Oil is off ~20% YTD due to oversupply and weak demand.

Trade Developments: US-Canada to review USMCA in mid-January. $2.7B in Canadian exports cross daily, with 2026 re-negotiation looming.

BOJ Shifts Gears: Japan raises rates to 1995 highs, signaling a change in global carry trade dynamics and a continued tightening path.

TikTok Deal Finalized: Oracle-led US consortium to acquire TikTok US operations by Jan 22, 2026. ORCL up 5%+ premarket.

Premarket Earnings: Carnival (CCL), Paychex (PAYX) on deck.

Key Economic Events: Existing Home Sales, UoM Sentiment & Inflation Expectations @ 10am ET; NY Fed’s Williams speaks @ 8:30am ET.

Market Action: ES holding below 50-day MA (6848.50); resistance at 6819/14s & 7066/71s. Support at 6728/23s. Bulls need a close above 50-day MA to break short-term downtrend. Volatility elevated; 5-day avg range at 92 pts. No whale bias detected overnight.

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!!

Follow @MrTopStep on Twitter and please share if you find our work valuable!