- The Opening Print

- Posts

- Bells, Deals, and New Highs — the Market’s on Trump Juice Again

Bells, Deals, and New Highs — the Market’s on Trump Juice Again

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Hells Bells!!! Trump pulled off a peace deal and a trade deal over the weekend. In Japan, they pulled out the red carpet and struck a trade agreement after Japan agreed to establish a $550 billion investment fund to be invested at Trump's direction. In return, Japan gets lowered tariffs on its exports.

The ES traded up to 6890.00 and opened Monday's session at 6883.00, up 0.81%. After the open, the ES rallied up to the 6888.00 level, sold off down to 6876.50, then rallied up to 6891.00 at 10:06. It sold off to a higher low at the 6880 level, traded up to 6898.75, and then pulled back to another higher low at 6881.25 at 11:10. From there, it rallied up to 6895.00 at 12:55. After the new high, the ES pulled back to 6887.75 at 1:24, rallied to 6896.25 at 1:45, back-and-filled until 2:45 when the ES made a sequence of higher highs up to 6908.75 at 3:48. It traded 6906.00 as the 3:50 imbalance showed $5.2 billion to buy, and hit 6907.50 on the 4:00 cash close. The ES settled at 6915.75 on the 5:00 close, up 88.75 points or +1.30% on the day.

In the end, everything moved in slow motion. The YM, ES, and NQ hit new all-time highs with technology shares leading the way. China’s Shanghai Composite (SHA) surged 1.18% to close at its highest level in over a decade, while Japan's Nikkei (^N225) climbed 1.35%, South Korea's KOSPI (^KS11) advanced 2.00%, and Taiwan's TWII (^TWII) rose 2.13% after the White House said it reached trade agreements or frameworks with Malaysia, Cambodia, Thailand, and Vietnam.

In terms of overall tone, the NQ has been rate-cut-supercharged and has been leading the ES higher for the last three sessions: 10/25 up 0.56%, 10/24 up 0.77%, and 10/27 up 1.3%. Over the same three days, the NQ rose +0.86%, +1.01%, and +1.78% yesterday, totaling a 3.65% gain. Volume in the ES was 1.28 million contracts traded.

Powell’s Days Are Numbered

Trump doesn't forget much, or if he does, he doesn’t want to remember. The Donald is already looking for Fed Chair Jerome Powell’s replacement and is accelerating his search, as Powell’s term expires in May 2026. According to a Wall Street Journal report, Trump could announce his pick by year-end.

The process, led by Treasury Secretary Scott Bessent, has narrowed to five finalists—two current Fed governors and three outsiders—set for second-round interviews next month. After that, Bessent will recommend a shortlist for Trump’s decision.

The slate includes:

Rick Rieder – BlackRock executive, known for market expertise and a less hawkish inflation stance

Christopher Waller – Fed Governor, data-driven supporter of recent rate cuts

Michelle Bowman – Fed Governor, conservative banking regulation expert, aligning with Trump’s views

Kevin Warsh – Former Fed Governor, Powell critic, favors aggressive rate adjustments

Kevin Hassett – Economist, strong Trump ties, favors looser policy despite inflation risks

This fast-tracked timeline aims for pre-exit Senate confirmation amid Trump’s criticisms of Powell’s “high” rates, which he says are hindering growth. However, political picks like Warsh or Hassett could face Democratic pushback—potentially signaling faster rate cuts and increased market volatility.

10/28 Tuesday

96th Anniversary of the 1929 Crash (-23% on Oct 28 & 29)

Day 1 of the Fed Two-Day Meeting

Our View

Below are the YTD returns of the top four Asian, European, US, and emerging markets. Obviously, the selloff in May and April didn’t help the US's returns, but if you start from the April lows, the US indices are really not that far off track.

The other part: after the largest exodus out of the US stock market into Europe, billions have been flowing back in. In the last five months (June–October 2025), foreign investors have net purchased approximately $450 billion in US equities, according to US Treasury TIC data and EPFR fund flow reports. This includes:

$163.1 billion in June (private: $116.5B, official: $46.6B)

$78.8 billion in July (private: $72.4B, official: $6.4B)

~$90 billion in August (based on preliminary TIC trends)

~$118 billion in September–October, amid a surge in foreign-domiciled fund buying (e.g., $58 billion in late September alone)

These flows reflect renewed confidence in US markets post-Fed rate cuts, through September.

Guest Post: Tom Incorvia - Blue Tree Strategies

MiM and Daily Recap

ES Futures Recap - Monday

The ESZ25 futures extended their recent rally in a steady, controlled climb Monday, closing near session highs after a balanced overnight consolidation gave way to persistent daytime strength.

The Globex session opened Sunday evening at 6881.00 and quickly dipped to 6868.50 around 6:15 PM ET, establishing its low early as sellers tested the bottom of Friday’s range. That weakness was met by firm buying interest, sparking a slow and deliberate recovery through the Asian and early European hours. ES printed 6878.75 at 8:20 PM and continued to edge higher overnight, reaching 6887.50 just after midnight. A brief pullback to 6875.50 at 3:40 AM set the stage for the London and early U.S. ramp that carried prices to 6890.00 by 4:00 AM, marking the Globex high. From there, the futures held firm above 6880 for most of the morning, closing the session at 6882.75, up 1.75 points (+0.03%) with a constructive, bid-supported tone. From last week’s close, the Globex was up 55.50 points (0.81%). The overnight pattern showed controlled rotation and solid support interest ahead of the U.S. open, reflecting a market comfortable near recent highs.

The regular session opened at 6883.00 and briefly probed lower, tagging 6877.00 at 9:55 AM. Buyers quickly reclaimed control, lifting the ES to 6892.50 by 10:00 AM, then fading slightly to 6885.75 at 10:55 AM. The late morning and midday trade featured orderly higher lows and consistent buying programs that pushed price to 6895.50 at 12:50 PM. After a shallow pullback to 6887.75 at 1:05 PM, momentum accelerated into the afternoon as buyers pressed into new ground. A powerful push between 1:30 PM and 3:45 PM lifted ES to the session high at 6916.25, where it paused just before the bell. The futures settled the regular session at 6907.50, added 24.50 points (+0.36%) from the open as bulls controlled nearly the entire session. The session maintained the overnight gap and was up 80.25 points (1.2%) from Friday's close.

The cleanup hour added a modest continuation bid, with prices opening at 6907.50 and closing at 6914.00 (+6.50 pts, +0.09%), completing a full-session gain of +80.25 points (+1.18%) from the prior cash close. Volume was light, totalling 875,514 contracts during the day and 1.13 million across all sessions.

Market Tone & Notable Factors

Monday’s tone was decisively bullish but orderly, characterized by constructive pullbacks and persistent intraday buying. Globex provided the foundation with steady accumulation, and the regular session followed through with higher highs and supportive breadth. The push above 6900 carried psychological weight, suggesting renewed momentum after last week’s mild consolidation.

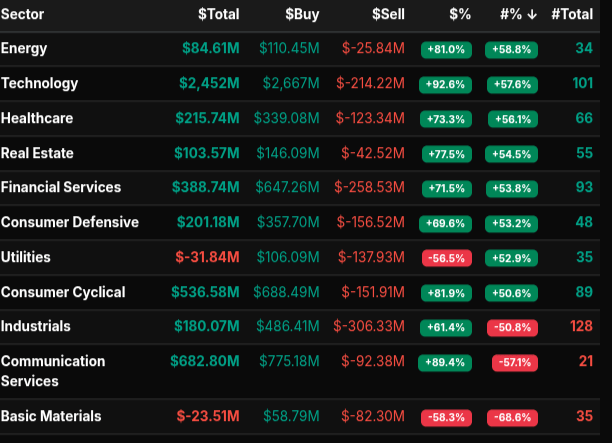

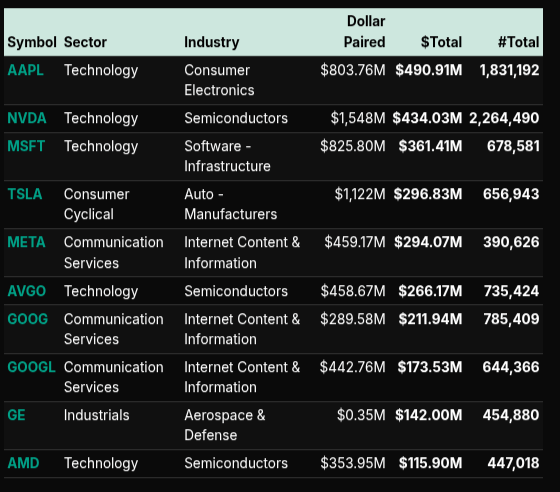

Market-on-Close (MOC) data confirmed strong institutional participation. The 3:51 PM reading showed a $4.79 billion net buy imbalance, with 80% of dollar flow and 52% of symbols leaning to the buy side. The S&P 500 saw 82.1% of its symbols bought, and the Nasdaq 100 an even stronger 90.2%. Leadership came from technology and communication services, led by AAPL (+$490M), NVDA (+$434M), and MSFT (+$361M) buy imbalances. Sector flows reflected aggressive accumulation across tech, financials, and cyclicals, while defensive and utilities sectors faced mild profit-taking.

By the close, the ES ended at 6914.00, up 1.18% from Friday’s settlement. The strong afternoon rally and heavy MOC buying reinforced bullish conviction, leaving buyers in command ahead of Tuesday’s trade and the upcoming Fed rate decision.

Technical Edge

Fair Values for October 28, 2025:

SP: 32.7

NQ: 142.35

Dow: 164.78

Daily Market Recap 📊

For Monday, October 27, 2025

• NYSE Breadth: 60.62% Upside Volume

• Nasdaq Breadth: 69.68% Upside Volume

• Total Breadth: 68.84% Upside Volume

• NYSE Advance/Decline: 56.88% Advance

• Nasdaq Advance/Decline: 54.84% Advance

• Total Advance/Decline: 55.58% Advance

• NYSE New Highs/New Lows: 135 / 24

• Nasdaq New Highs/New Lows: 459 / 79

• NYSE TRIN: 0.72

• Nasdaq TRIN: 0.52

Weekly Breadth Data 📈

For Week Ending Friday, October 24, 2025

• NYSE Breadth: 56.65% Upside Volume

• Nasdaq Breadth: 57.04% Upside Volume

• Total Breadth: 56.91% Upside Volume

• NYSE Advance/Decline: 74.08% Advance

• Nasdaq Advance/Decline: 67.27% Advance

• Total Advance/Decline: 70.62% Advance

• NYSE New Highs/New Lows: 229 / 66

• Nasdaq New Highs/New Lows: 595 / 257

• NYSE TRIN: 2.12

• Nasdaq TRIN: 1.52

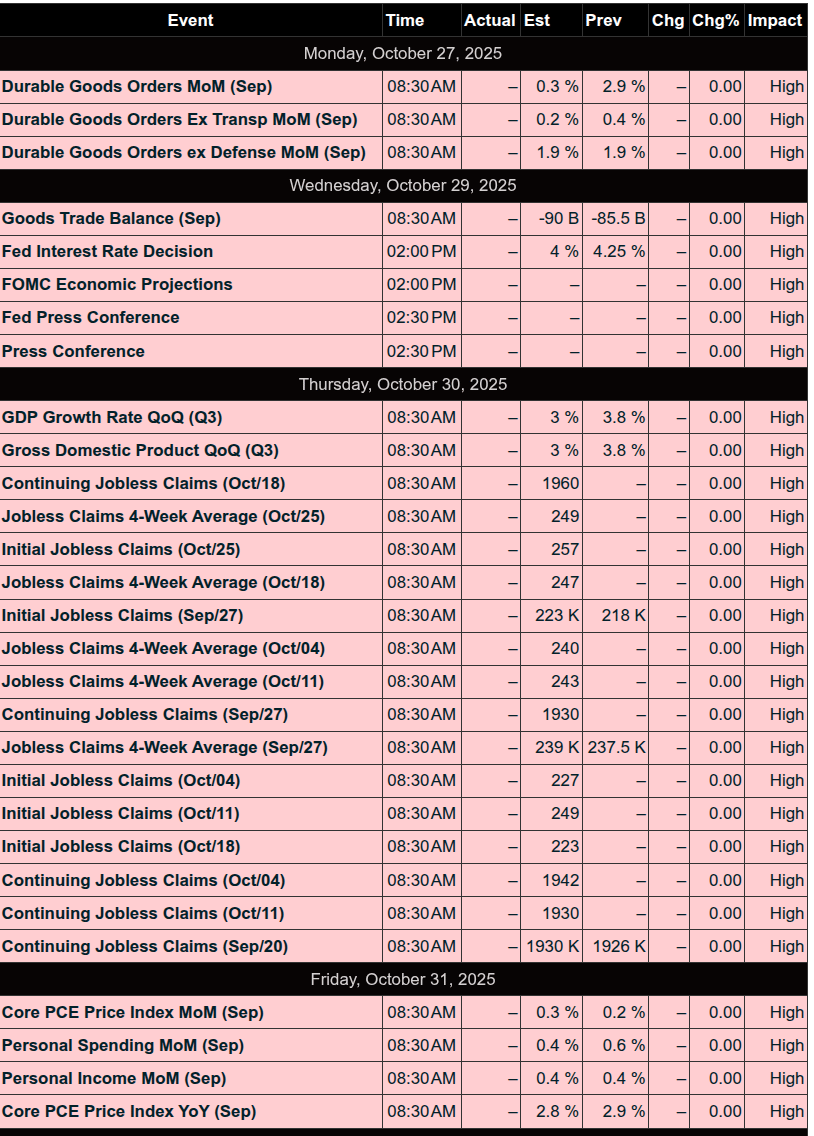

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Trading Room Summaries

Polaris Trading Group Summary - Monday, October 27, 2025

Monday was a bullish grind higher in the ES, driven by favorable macro sentiment and strong buyer participation throughout the session. Despite early chop and some failed short setups, traders who stayed aligned with the long-side bias were rewarded as the market pushed through key levels, culminating in a massive MOC buy imbalance and confirmation of a Super Cycle Day.

Positive Trades & Setups:

PeterN's Early Wins:

PeterN had a strong morning, locking in gains using a 750-tick chart for NQ Opening Range trades and a tight scalp in ES. His use of a narrower ORB timeframe stood out and sparked interest from others in the room. David complimented it not as luck but "solid strategy."Manny’s Long from 6882.25 ES:

This continuation long setup triggered nicely mid-morning and produced a +5 point win as the market pushed toward the magnet level at 6902.25. Manny called the behavior "pretty standard" and gave clear trade structure in advance.David’s A10 Long Setup:

Triggered around 10:20 AM with solid follow-through. First and second scale levels hit soon after, confirming alignment with the day’s directional bias. It reinforced the day's “long lean” mantra.

Lessons & Key Takeaways:

Respect the Cycle Day Structure:

Manny highlighted that the day was Cycle Day 3 (S3H) — often the choppiest day. He reminded the group that it's a good day to “play small ball” or even sit out if conditions become frustrating. Nonetheless, price action exceeded statistical expectations, reclassifying the day as a Super Cycle Day by the close.Failed Shorts:

Both @ES and @NQ Opening Range shorts triggered and were stopped out early.

ES 5-min OR short also failed. Bruce reminded the group, “No matter, on to the next,” a good example of professional mindset.

Liquidity Cues & Timing Guidance:

Manny shared intraday timing windows, helping traders identify potential turning points. Though the morning session had relatively low liquidity (<200k Globex), the eventual ramp aligned with his timing for a late-morning high.Staying Aligned with Market Structure:

David emphasized repeatedly to “stay properly aligned” and maintain a long bias — this was crucial as the market never gave real retracement entries, making it a “one lane highway UP.”

Market Context:

Macro Fuel:

A combination of a US/China deal framework, benign CPI data, and anticipation of FOMC/mag 7 earnings later this week contributed to the bullish lean. Gamma Guys raised the bull/bear pivot to 6800, reinforcing the upside potential.Closing Ramp & Imbalance:

In the final hour, a $5.2 Billion MOC Buy Imbalance hit the tape. David summed it up:“Forever Bid”

“Bulls are Beasts”

“Super Cycle Day”

Summary:

Despite a tricky open and some early failed shorts, yesterday developed into a textbook long-biased trend day. Traders who stayed patient and trusted the long setups like the A10 trigger or 6882.25 continuation were able to catch meaningful upside. The afternoon rally into a large buy imbalance capped off what David called a Super Cycle Day, solidifying the bull's control and ending the final Monday of “Rocktober” with strength.

Key Lesson: Stay aligned with higher-timeframe bias, especially on S3 days where traps are common but structure still rules.

Discovery Trading Group Room Preview – Tuesday, October 28, 2025

Markets surged to record highs Monday on easing US-China trade tensions. Focus now shifts to corporate earnings and tomorrow's Fed decision, where a 25bps rate cut is expected. Attention will be on guidance for a potential December cut.

Key Headlines:

US-China Trade: Trump and Xi to meet Thursday; deal framework reportedly includes rare earths, soybeans, and TikTok US operations.

Amazon Layoffs: Up to 30,000 corporate jobs to be cut, with AI-driven automation cited for future reductions.

Tesla: Musk’s $1T compensation package back in focus; board pushes for approval to retain Musk amid expansion plans.

Trump in Japan: Met new PM Takaichi; vague trade and minerals agreements signed.

Earnings Watch:

Premarket: AMT, AMZN, DHI, GLW, PYPL, RCL, UNH, UPS, SHW, SYY, W, more.

After-hours: BKNG, EA, EIX, MDLZ, OKE, PPG, STX, V, more.

Macro: S&P/CS HPI at 9am ET; Richmond Fed at 10am. Government shutdown continues.

Technical Outlook (ES):

Resistance: 6924/29, 6994/99, 7231/36.

Support: 6744/49, 6651/56.

Whale bias bearish into the open; overnight large trader volume elevated. 5-day ADR at 70.5pts.